Awesome Tips About Trial Balance Of Balances

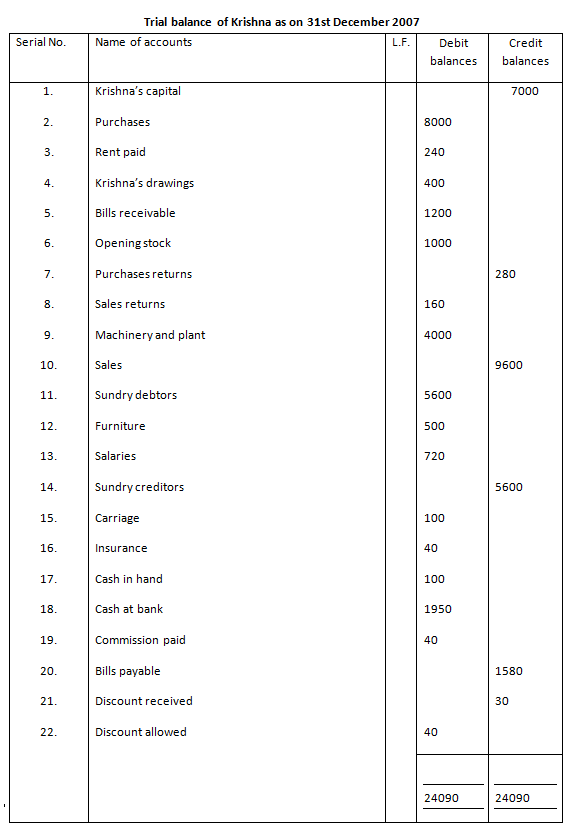

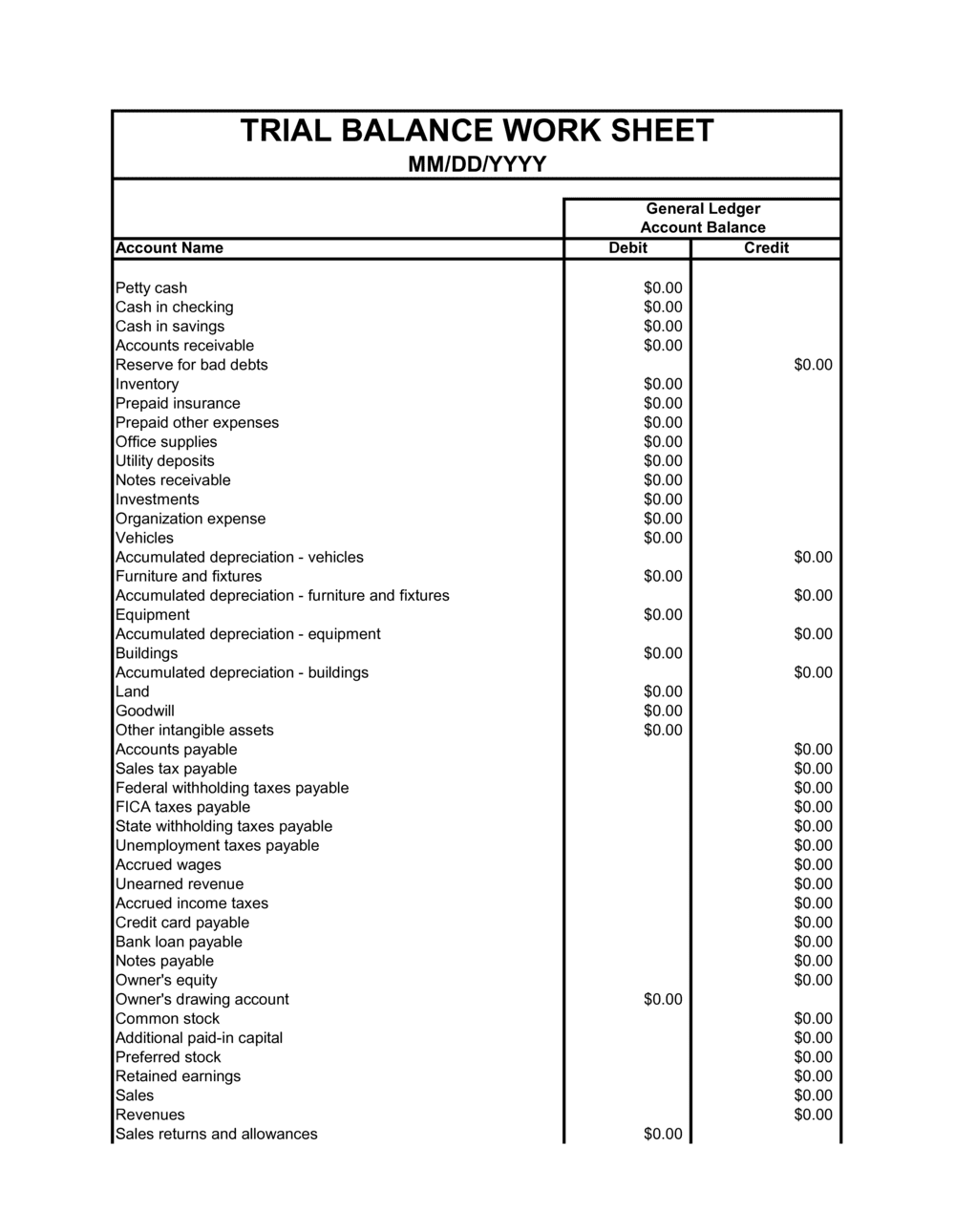

This statement comprises two columns:.

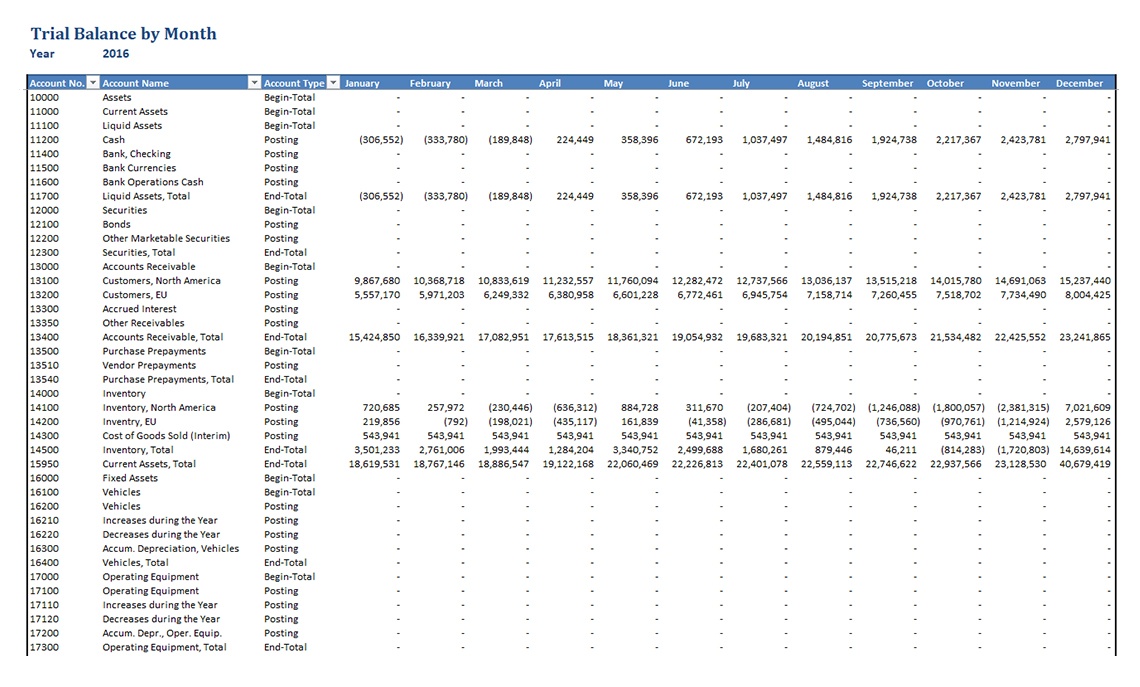

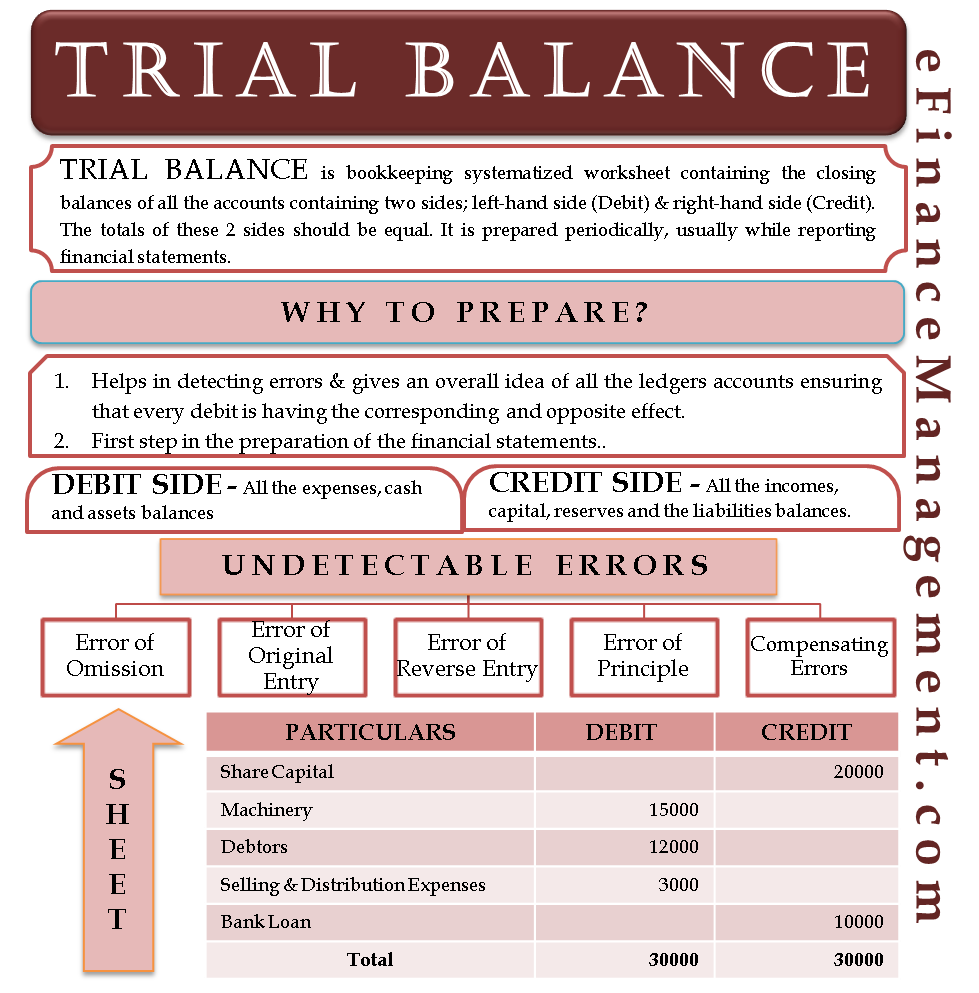

Trial balance of balances. A trial balance is a bookkeeping worksheet in which the balances of all ledgersare compiled into debit and credit account column totals that are equal. Trial balances are a vital auditing technique used to ensure whether the total debit equals the total credit in the general ledger accounts, which plays a crucial role in. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each.

A balance sheet is prepared using the balances of the accounts listed in the trial balance. This is done to determine that debits. A company prepares a trial balance periodically, usually at the end of every reporting period.

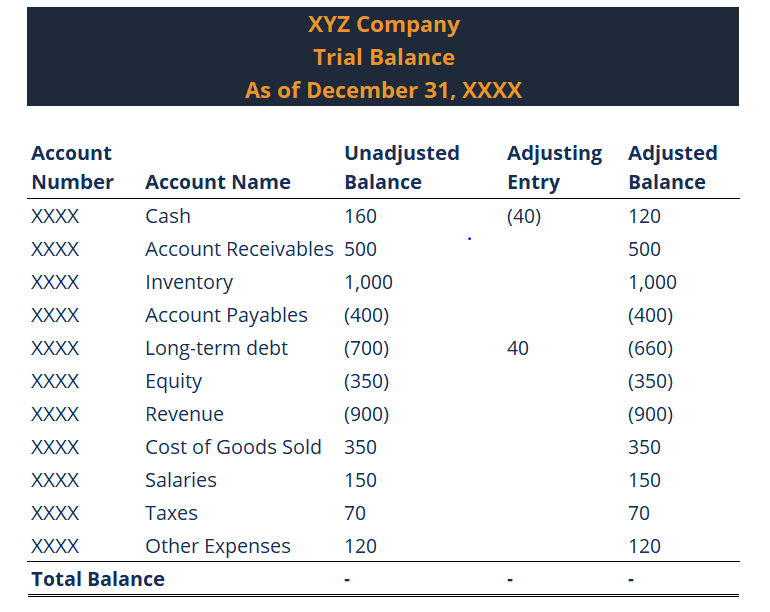

Trial balance is the report of accounting in which ending balances of the different general ledgers of the company are available; The trial balance trial balance trial balance is the report of accounting in which ending balances of a different general ledger are presented into the debit/credit column as per. What is a trial balance?

The balances of these ledgers are put into debit or credit account. One of them is arithmetical errors, which can happen due to. Credits and debits to each account from transactions during the accounting period;

A trial balance is an accounting report that denotes the balances of a company's ledgers. Trial balance (definition) a trial balance is a financial report showing the closing balances of all accounts in the general ledger at a point in time. A trial balance is an accounting report used by business accountants during the accounting close process to ensure that all general ledger accounts have equal debit and credit.

A trial balance typically includes five elements: A trial balance is a list of all accounts in the general ledger that have nonzero balances. Reports april 13, 2023 to prepare a trial balance, you need to list the ledger accounts along with their respective debit or credit amounts.

Purpose of a trial balance trial balance acts as the first step in the preparation of financial statements. The general purpose of producing a trial balance is to ensure that the. This means that it states the total for.

The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. A trial balance is an internal financial statement that lists the adjusted closing balances of all the general ledger accounts (both revenue and capital) contained in the ledger of a.

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Creating a trial balance is the first. For example, utility expenses during a period.

It is a working paper that accountants. A trial balance is an important step in the accounting process, because it helps identify. A trial balance is an.

:max_bytes(150000):strip_icc()/trial-balance-4187629-1-c243cdac3d7a42979562d59ddd39c77b.jpg)