Ideal Info About Prepaid Expenses Financial Statement

What are prepaid expenses?

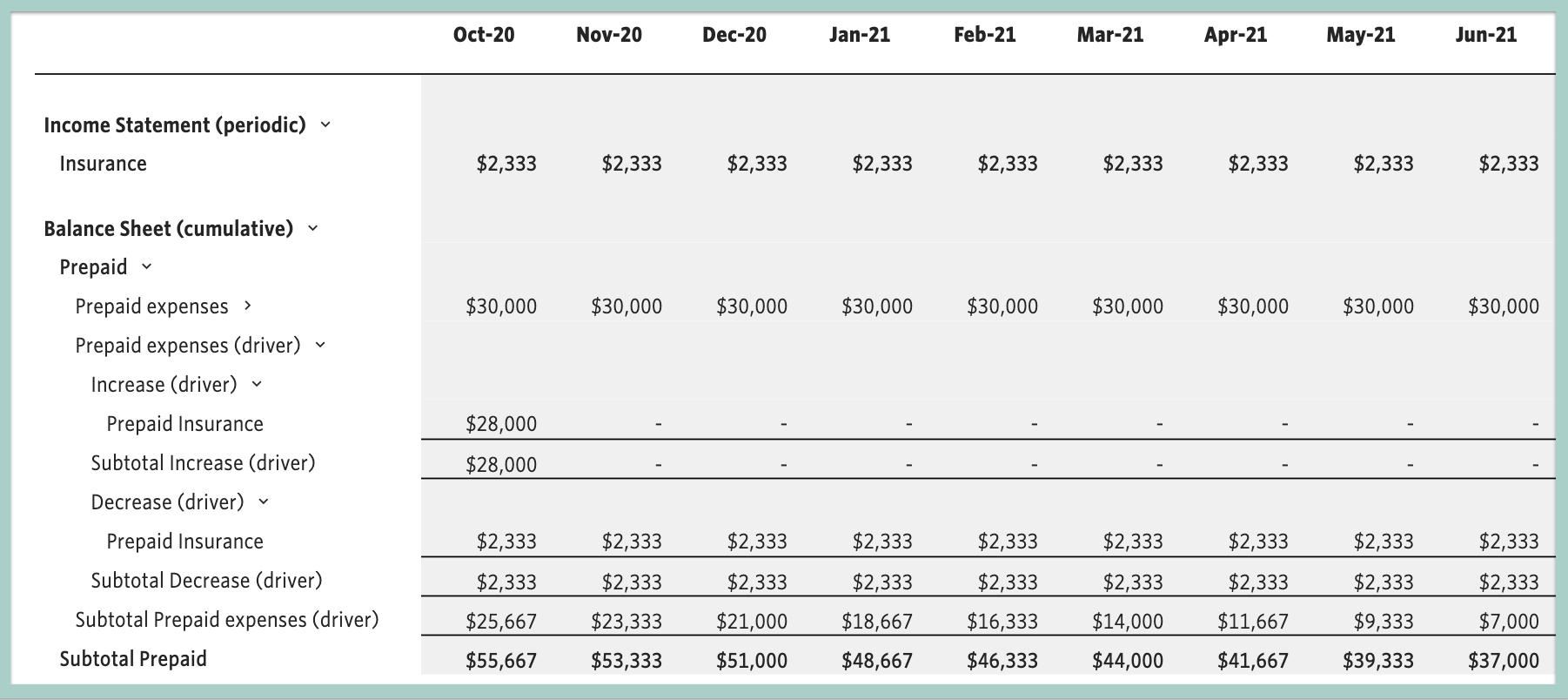

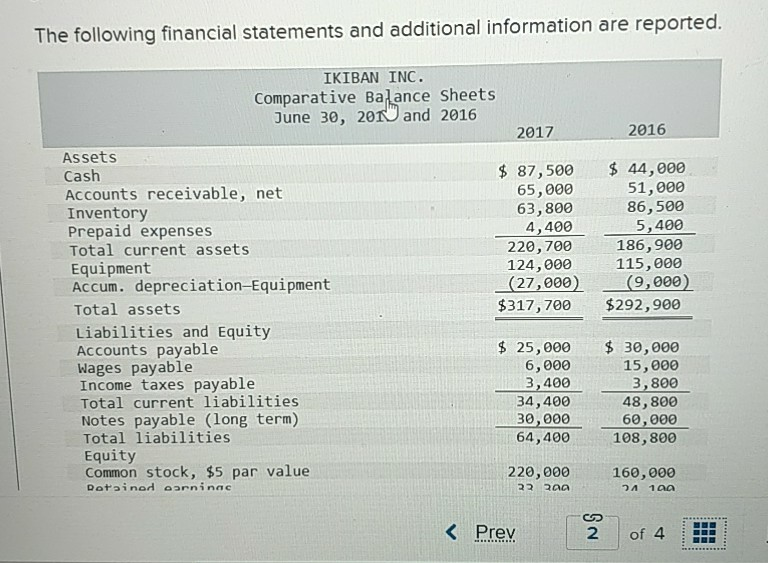

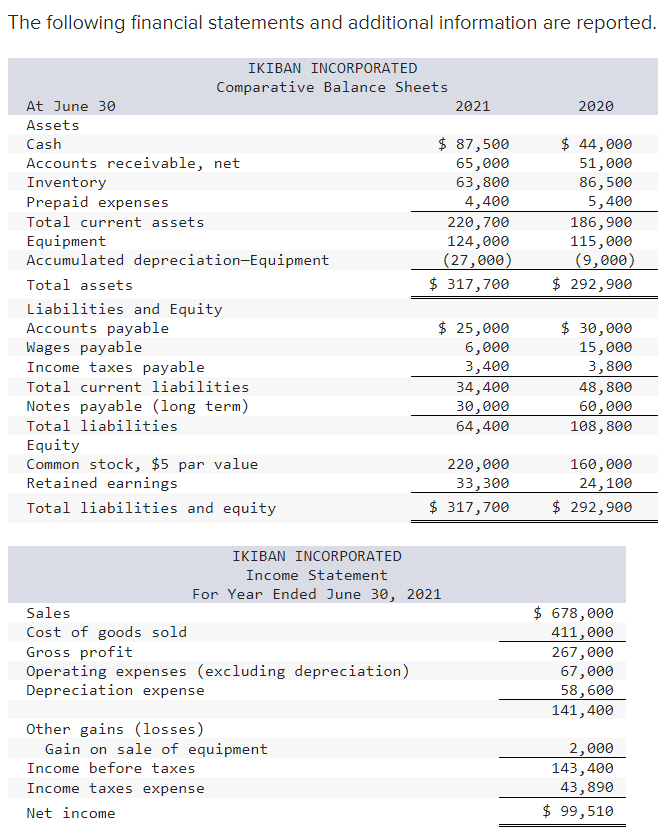

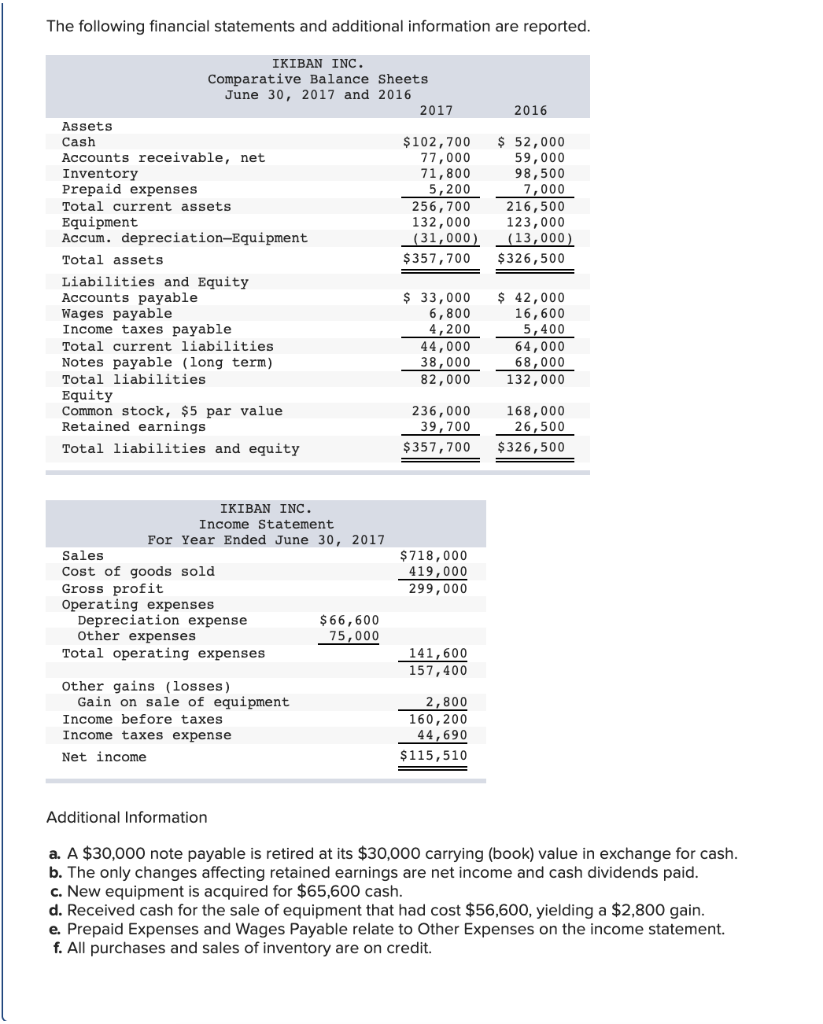

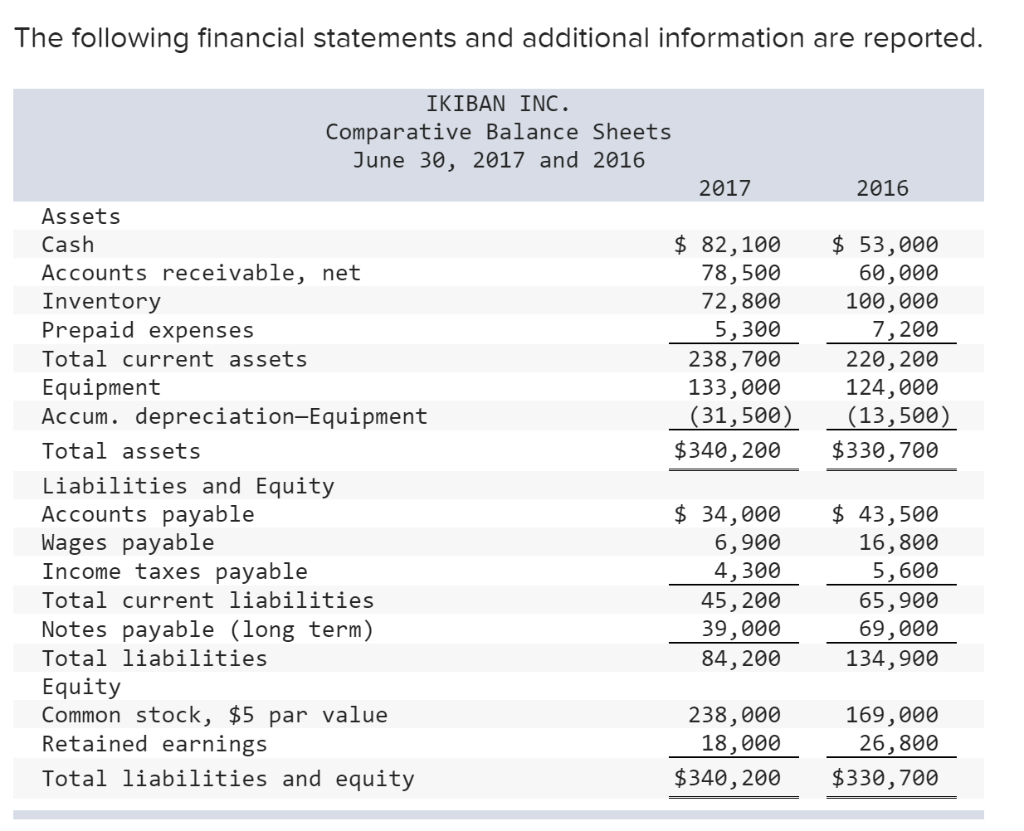

Prepaid expenses financial statement. With the $5,300 increase in prepaid expenses and other information in the example, we can prepare a schedule of cash flows from operating activities under the. Thus, prepaid expenses aren’t recognized on the income statement when paid, because they have. The initial journal entry for a prepaid expense does not affect a company’s financial statements.

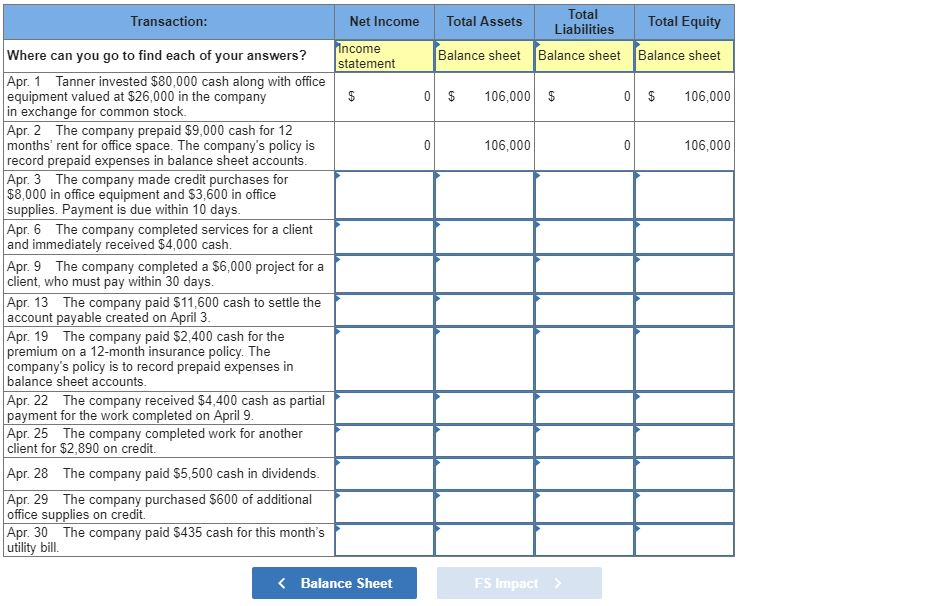

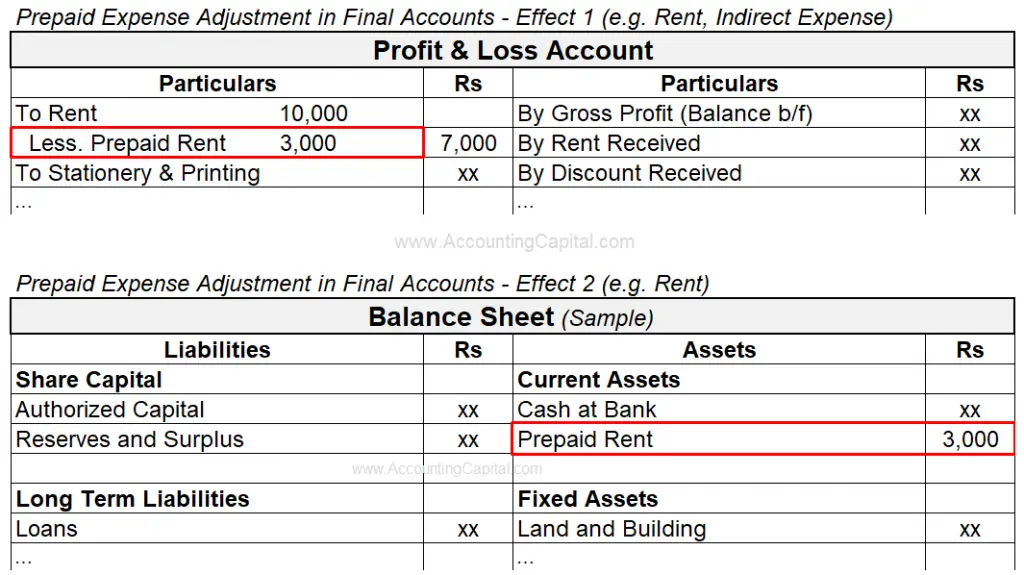

Where are prepaid expenses recorded in the financial statement? Definition unexpired or prepaid expenses are the expenses for which payments have been made, but full benefits or services have yet to. Effect of prepaid expenses on financial statements.

Prepaid expenses = prepaid expenses % of opex × operating expenses however, if the connection between upfront payments and operating expenses (sg&a). What is the effect of prepaid expenses on financial statements? Logging your prepaid expenses correctly into your balance sheet is crucial for tracking costs and maintaining accurate financial records.

Financial statement accuracy: Prepaid expenses, or prepaid assets as they are commonly referred to in general accounting, are recognized on the balance sheet as an asset. Prepaid expenses must be initially noted down as a type of asset on the firm’s balance sheet.

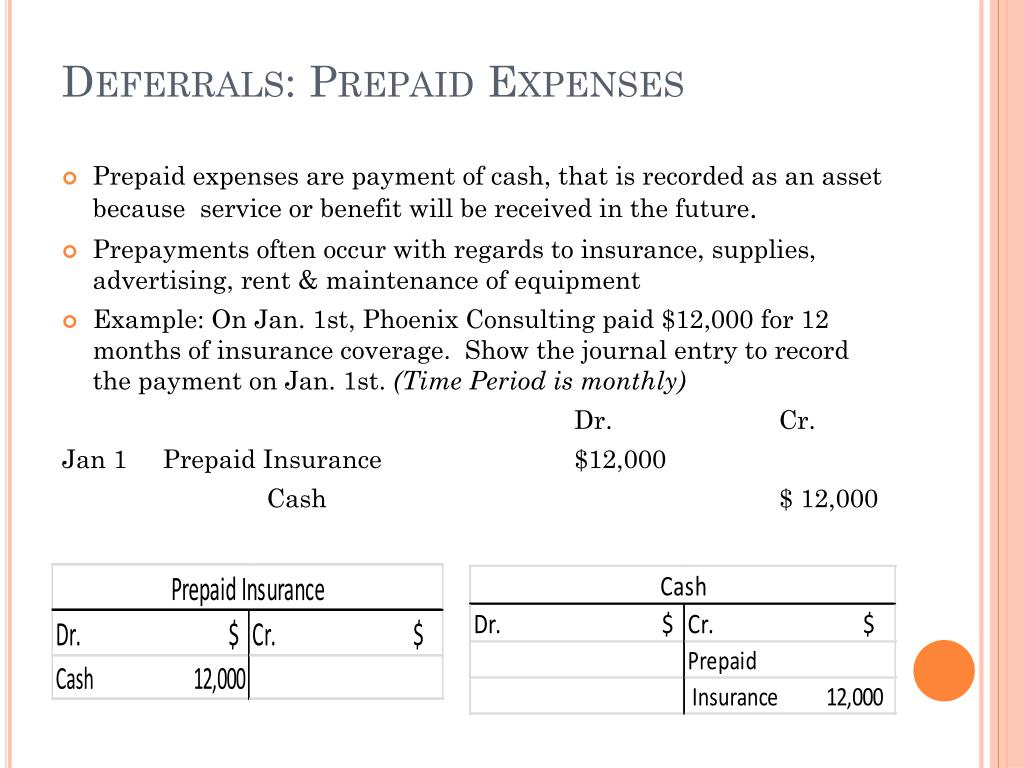

Examples of prepaid expenses include insurance, rent, leases, interest, and taxes. As explained above, the prepaid expense initial entry does not affect the financial. That is, expenses should be recorded when incurred.

Their primary purpose is to allocate. Prepaid rent will increase, while cash will. In the company’s balance sheet, the prepaid expenses are.

Prepaid expenses aren’t included in the income statement per. As noted above, prepaid expenses are payments made for goods and services that a company intends to pay for in advance but will incur sometime in the future. A prepaid expense refers to an advance payment made for goods or services that will be consumed or utilized in the future.

In essence, it represents a. The recording of prepaid expenses in the financial statements is as follows: Prepaid expenses, or prepaid assets as they are commonly referred to in general accounting, are recognized on the balance sheet as.

Effect of prepaid expenses on financial statements the initial entry to record a prepaid expense only affects the balance sheet. Prepaid expenses are a type of financial arrangement in accounting where a company pays for goods or services in. A prepaid expense is a payment made in advance for goods or services that will be received in the future.

These payments are recorded as assets on the balance.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-03-8b430eba78534c66be0eb416932fe80e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-04-59546336082445fa8db2dd9bbfcf58cb.jpg)

![[Solved] The following financial statements and ad SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2021/02/60225803e72ed_1612863490510.jpg)