Fun Info About Rent Payable In Balance Sheet

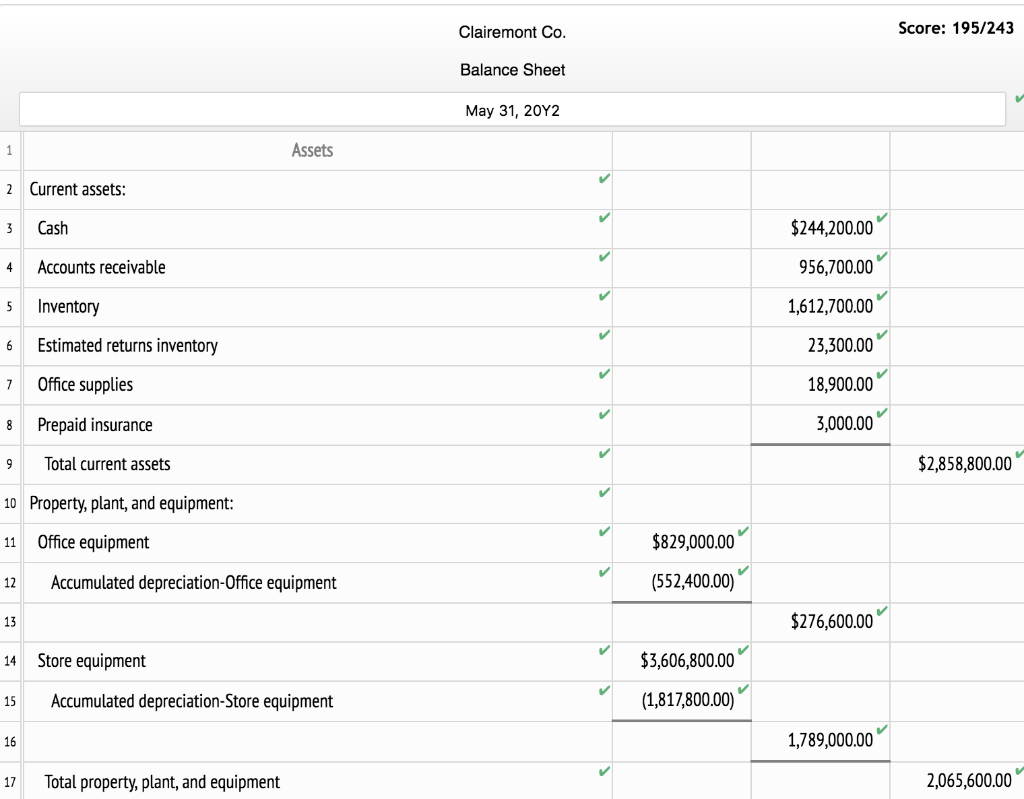

Owner's equity which is on the right side of the accounting.

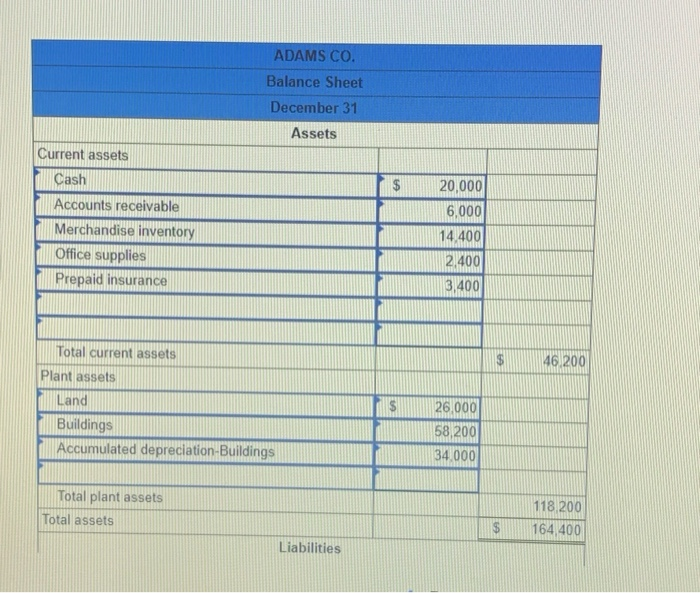

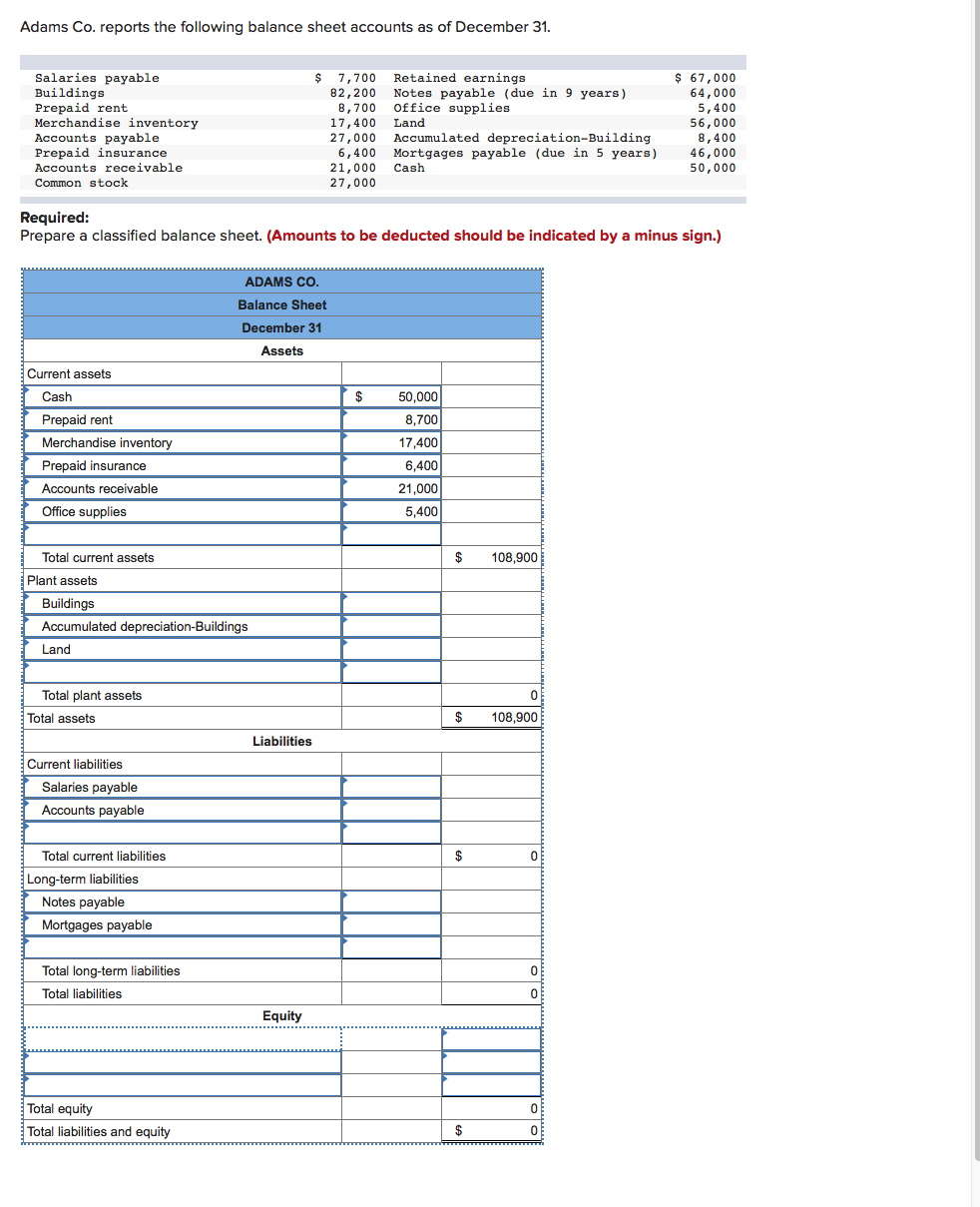

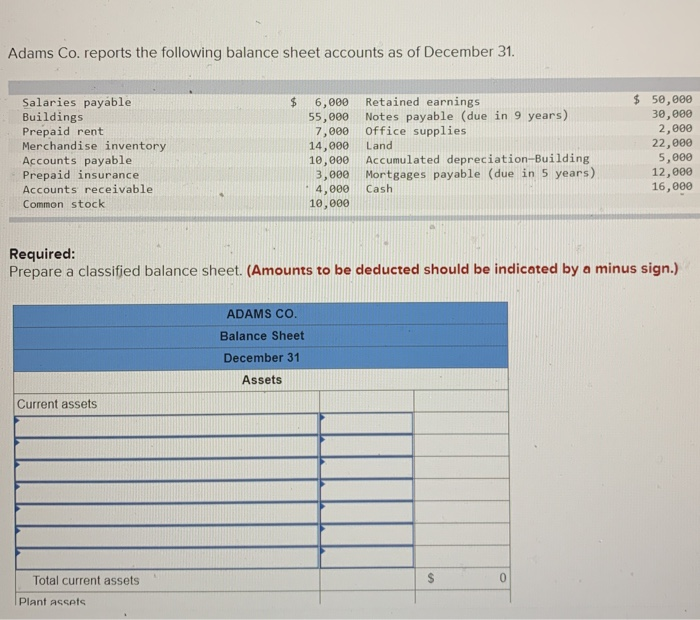

Rent payable in balance sheet. When the company settles rent with landlord,. Rent would be considered an expense if you are the tenant. Calculate the total payments step 2:

It will present as current liabilities on the balance sheet. Rent is typically categorized as an operating expense and does not appear on the balance sheet. Prepaid rent is rent paid in advance of the rental period.

Rent paid will be debited with corresponding credit. It summarizes the financial position of the company after a certain period of time. Example of rent receivable and.

Each of these balance sheet components can tell a story. In general, a balance sheet. How do you include rent on a balance sheet?

Rent expense during the period of time that the space was occupied but was not paid, and a current liability rent. Rent payable that is recorded under current liability in the balance sheet. The pre paid rent account is a balance sheet account shown under the heading of current assets.

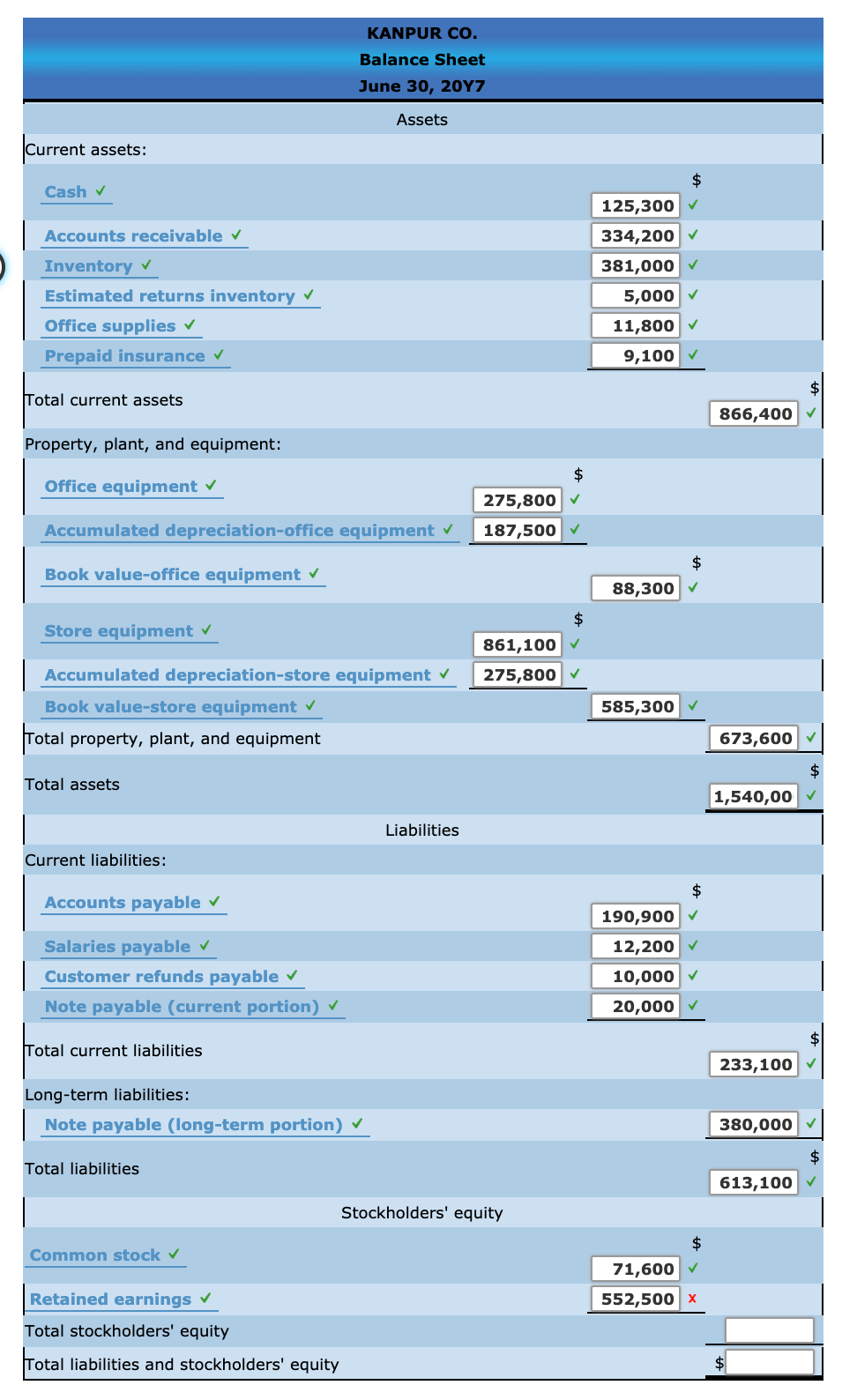

What is the difference between the accounts rent receivable and rent revenue? On december 31, 2020, hannifin must report in its balance sheet the rent payable of $2,500 as current liability. Payment of rent received (in cash/cheque) is treated with a couple of steps as shown below;

Under the accrual method of accounting the tenant should report: This journal entry is made to eliminate the rent payable on the balance sheet that we have recorded in the prior period. In this regard, if the tenant entity has not already paid the rental amount to the property owner, it must accrue the rent expense by means of debiting rent expense account and.

Instead, it is recorded on the income statement,. Rent payable is a liability account in the general ledger of the tenant which reports the amount of rent owed as the date of the balance sheet. Under accrual concept, an entity must recognize a rent expense in each period in which it has occupied the rented property.

Rent expense (and any other expense) will reduce a company's owner's equity (or stockholders' equity). Rent expense on the balance sheet 6. If you are the landlord, rent would be considered income.

In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and. Rent payable is the present obligation that company has toward the landlord. Rent receivable is the title of the balance sheet asset account which.