Real Tips About 26as Form Means

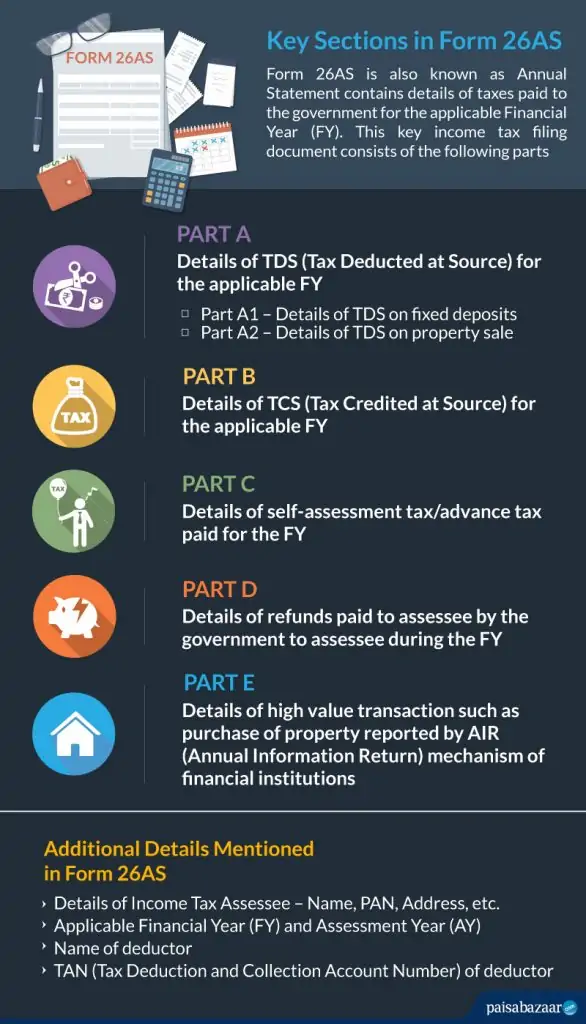

Form 26as is a statement which is maintained by the department of income tax on an annual basis.

26as form means. Form 26as is a consolidated annual statement maintained by the income tax department. 26as full form is annual information statement (ais). It shows the details of tax deducted at source, tax.

Form 26as is commonly known as a tax credit form as it provides consolidated details of all the tax credits that can be claimed by an assessee during a. Form 26as is a statement that shows the below information: It contains the tax credit information of each taxpayer against his pan.

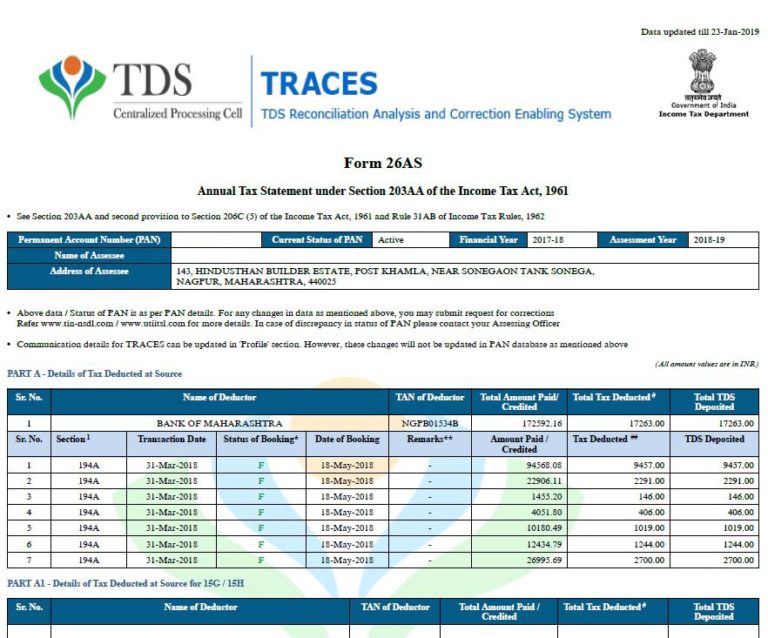

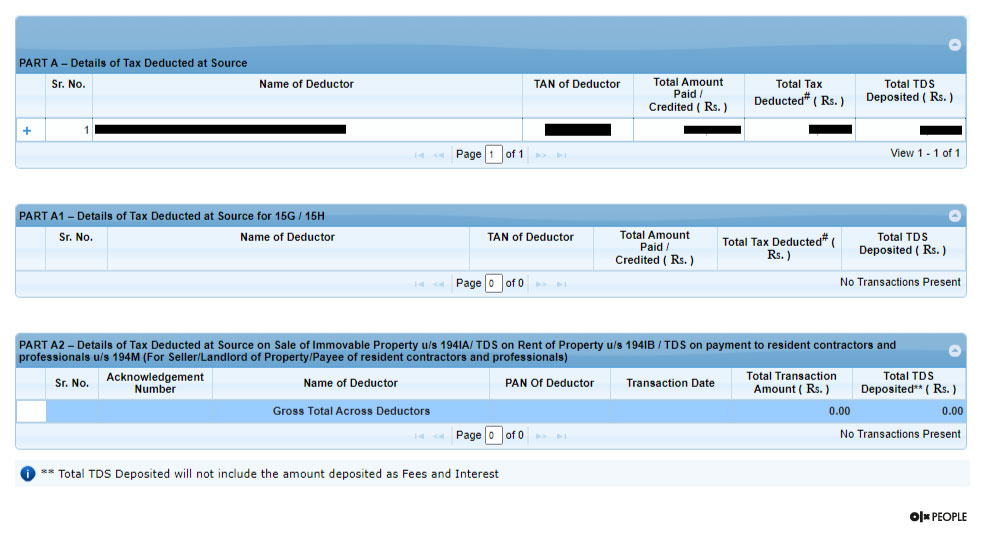

This would include tax deducted from various sources. Form 26 as contains the details of the tax credit in an account. Form 26as is a statement that provides details of any amount deducted as tds or tcs from various sources of income of a taxpayer.

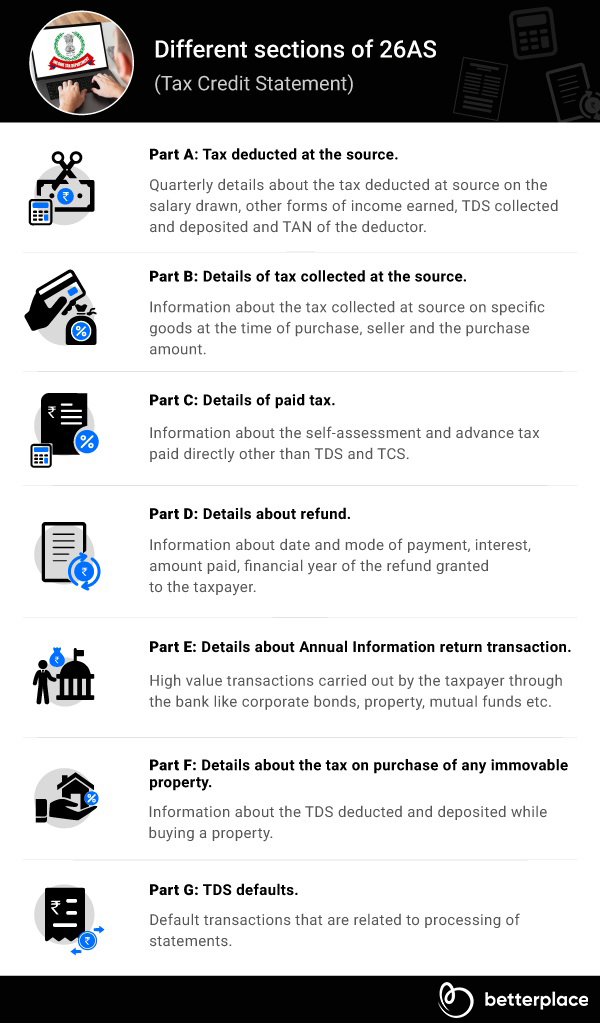

All the details of collected tax by the person who is collecting. The tax credit statement (form 26as) is an annual statement that consolidates information about tds, advance tax paid by the assessees, and tcs. Form 26as is a crucial tax document.

Form 26as means a tax credit statement and is an important document for taxpayers. Form 26as is a statement providing information on any amount deducted as tds or tcs from different income sources of a taxpayer. Tax deducted on your income by all the tax deductors 2.

Form 26as includes the information on all the deducted tax on the income of deducted. Form 26as is a consolidated tax statement that contains details of tax deducted at source (tds), tax collected at source (tcs), advance tax, and. Form 26as is a consolidated annual tax statement that shows the details of tax deducted at source, tax collected at source, advance tax paid by the assessee along.

By means of this document, it is ensured that accurate taxes have been deducted from a person’s income and deposited into the government’s account. What is form 26as? Click on the link view tax credit (form 26as) at the bottom of the.