Painstaking Lessons Of Info About Income Tax Basis Financial Statements

A basis of accounting that the entity uses to file its tax return for the period covered by the financial statements.

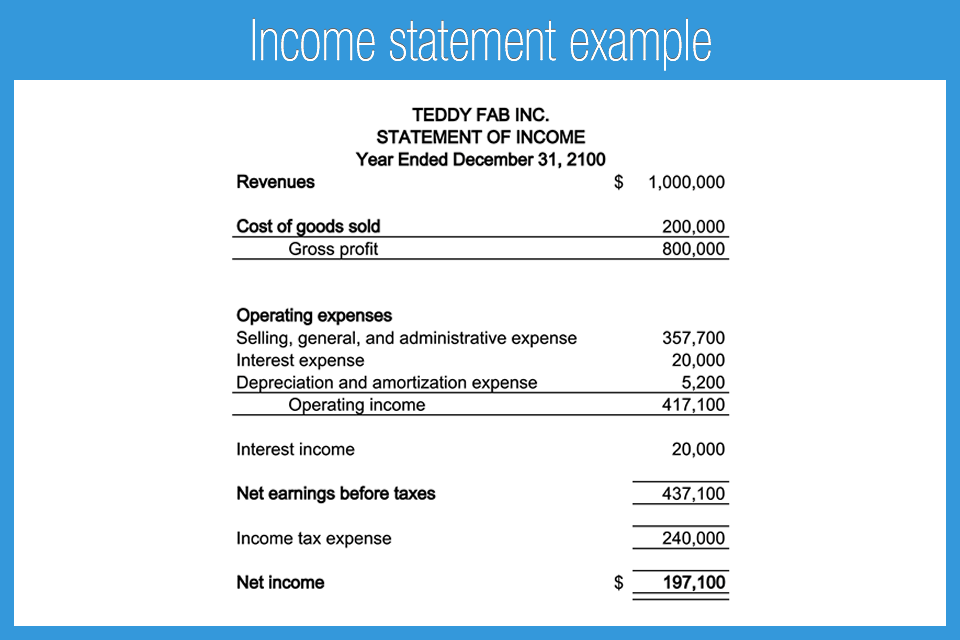

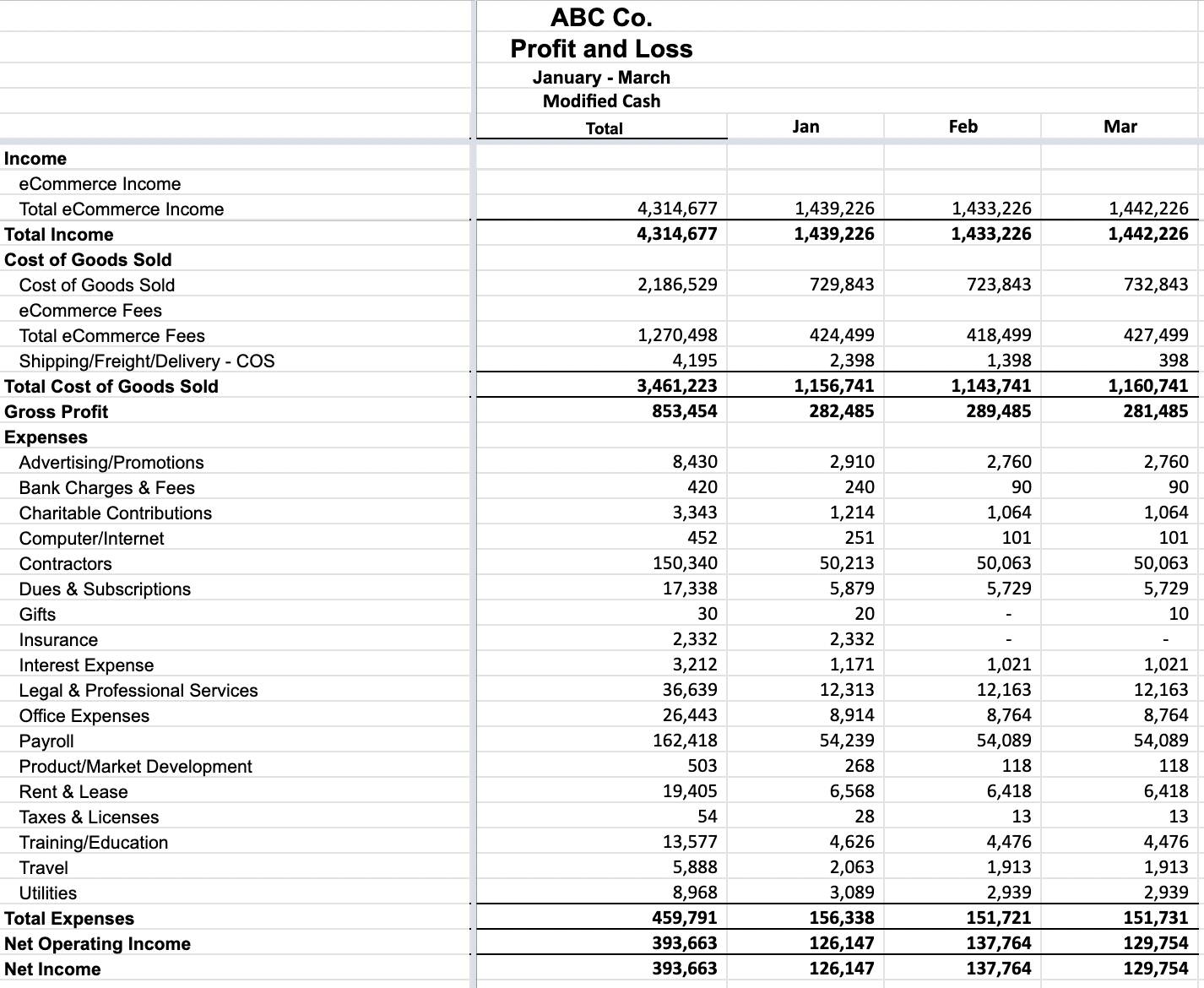

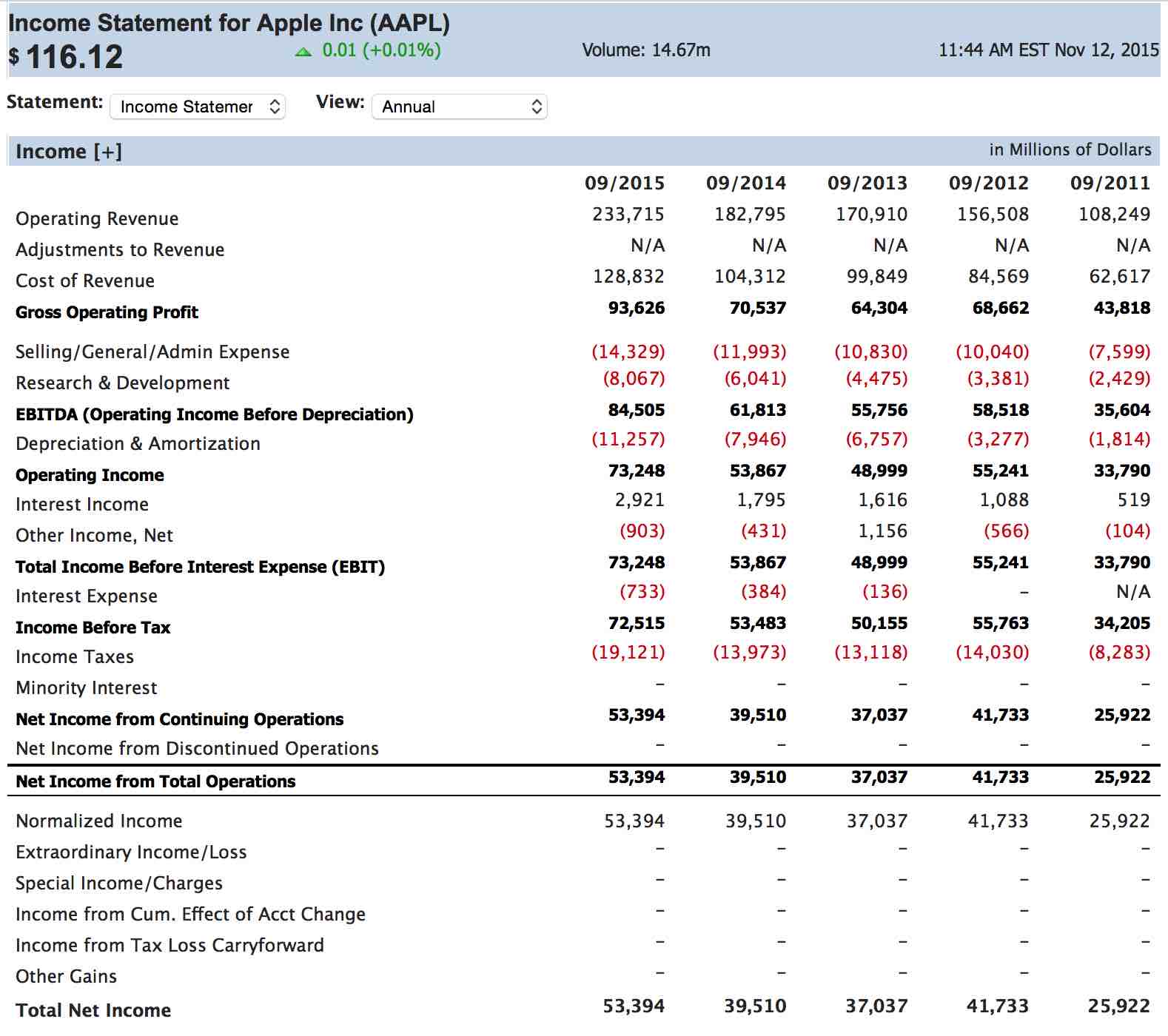

Income tax basis financial statements. Fourth quarter 2023. In this lesson, we will explain how to prepare financial statements using the income tax basis of accounting. The income statement, or profit and loss statement, also lists expenses related to taxes.

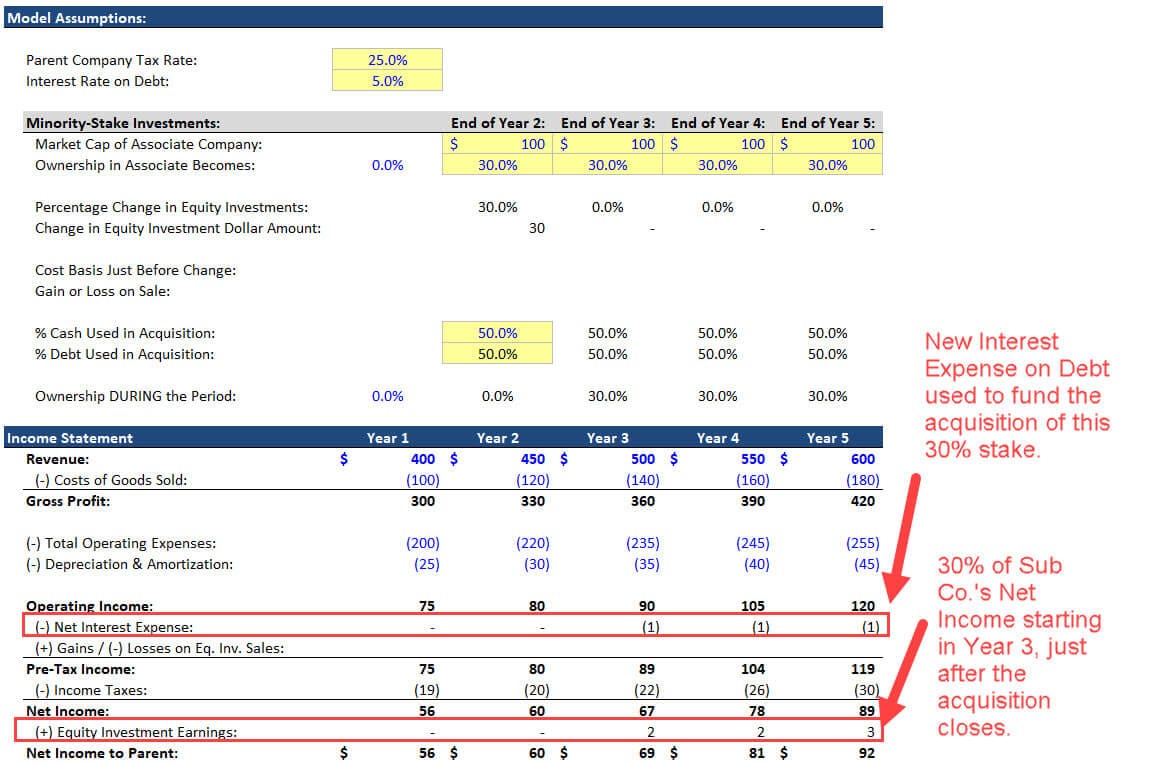

A tax basis income statement includes the revenues and expense recorded for the period. As discussed in note a to the financial statements, in 20x4 the company adopted a policy of preparing its financial statements on the accrual method of accounting used for. Tax basis can include cash.

The modified cash basis and income tax basis, our discussion will focus on these two special purpose frameworks. In the case of a mercantile system of accounting, the deduction is allowed on an accrual basis. Necessary building block for income tax calculations under asc 740.

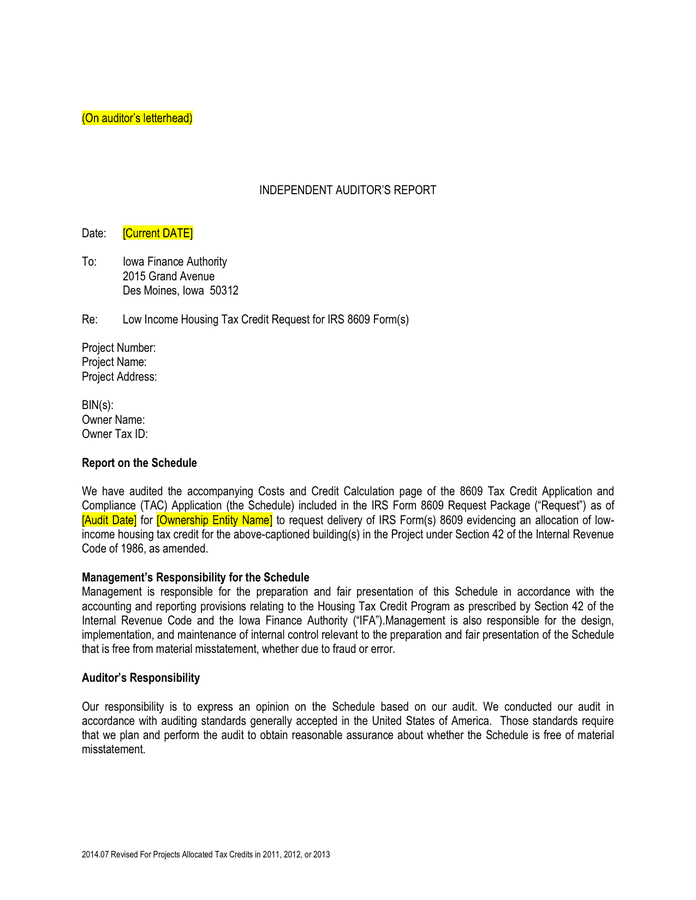

This standard shall be applied in accounting for income taxes. Documents shown during trial ranged from spreadsheets to signed financial statements. In the financial accounting world, the income tax basis (or tax basis) is one of several ocboas, or other comprehensive bases of accounting, which refers to.

Without the guidance in asc 740, an entity could assert that the amount of income tax expense reported on. A basis of accounting that the entity uses to file its income tax return for the period covered by the financial statements. Pensions and other employee benefits.

James to win an enormous victory against mr. This practice aid is intended to provide preparers of cash‐ and tax‐basis financial statements with guidelines and best practices to promote consistency and. Income tax basis financial statements are financial statements that are reported for entities that have more of.

Statements and the disclosure of information relating to income taxes. For the purposes of this. Basis of preparation 26 1.

Along with the financial penalty, the judge barred mr. What are income tax basis financial statements? If you file on paper, you should receive your income tax package in the mail by this date.

Functional and presentation currency 26. In one example, the attorney general's legal team showed that trump's. A basis of accounting that the entity uses to file its tax return for the period covered by the financial statements regulatory basis:

What are tax basis financial statements? Basis of accounting 26 3.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)