Brilliant Strategies Of Info About Negative Operating Cash Flow

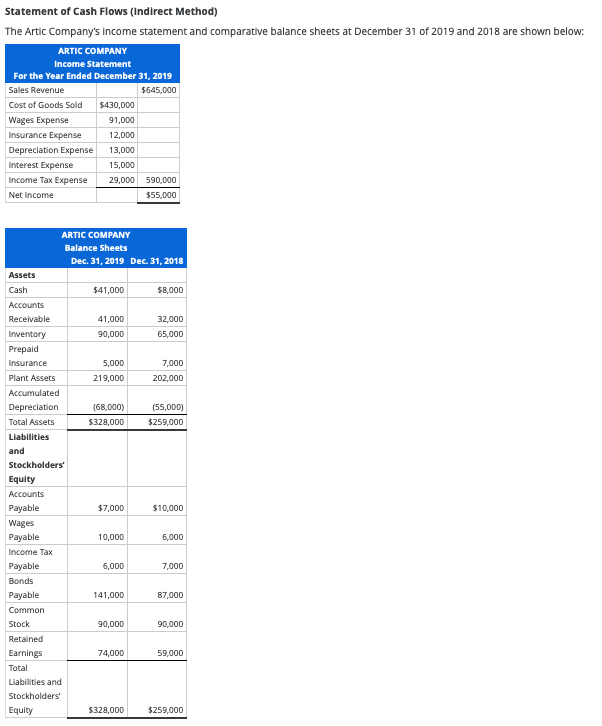

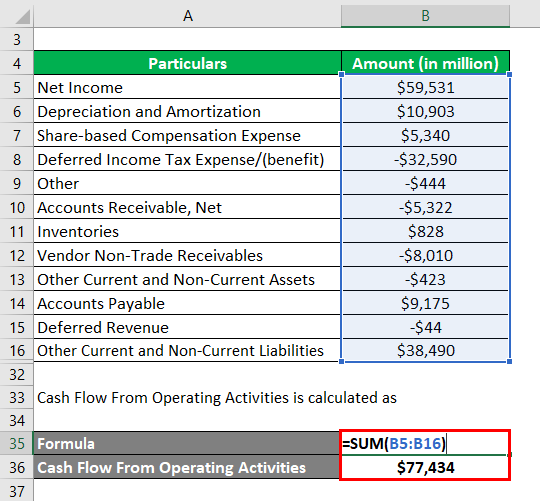

The ocf calculation will always include the.

Negative operating cash flow. A negative operating cash flow could signal trouble as it means the core business is not generating enough cash to sustain its operations. Low profits your business’s primary source of income is profit. Commercial banks have negative operating cash flows due to increased lending.

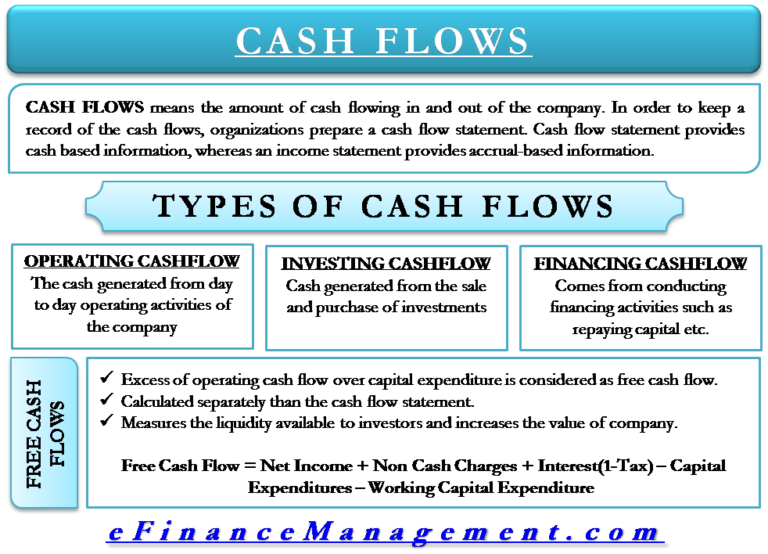

Negative operating cash flow (ocf) → less discretionary free cash flow (fcf) in a scenario with positive ocf, the company’s operations generate. The operating cash flow ratio is a measure of how readily current liabilities are. Negative cash flow is when more money is flowing out of a business than into the business during a specific period.

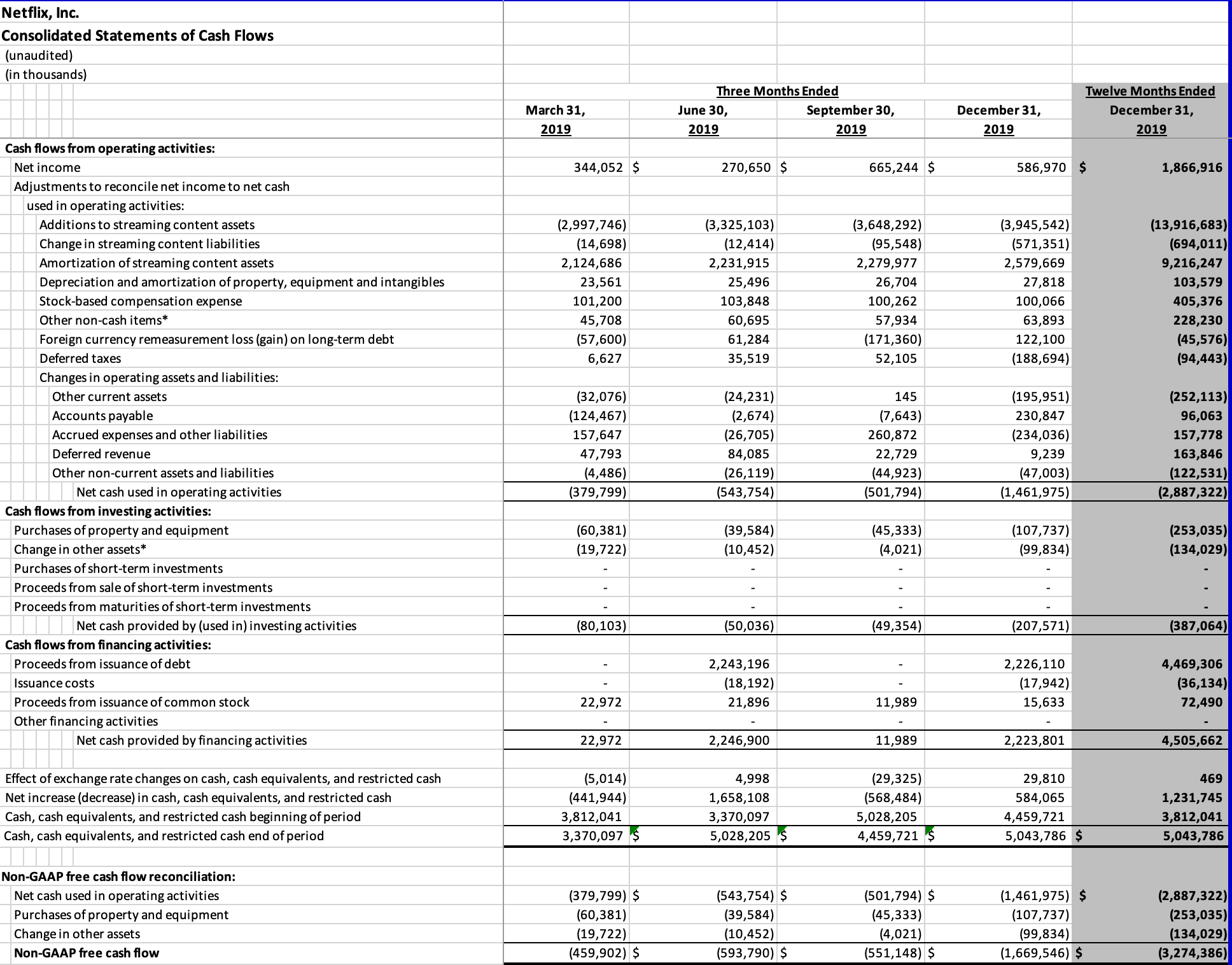

There are plenty of reasons why a company might have overall. If your company has negative cash flow from operations, you may not be making any money. Learn how to interpret the cash flow statement and calculate free.

A negative ocf indicates that a company is not generating sufficient revenues from its core business operations, and therefore needs to generate additional positive cash flow. Negative cash flow is when there is some lopsidedness in a company’s earnings. This paper aims to study whether negative operating cash flows signal.

You generate profits when consumers purchase your goods or services. How it can affect your business. A negative operating cash flow reflects the fact that a company has not been able to generate real positive cash flows from its operations within the measured time period.

Read why oxlc cef is a sell. Cash flow from operating activities (cfo) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing. Positive cash flow is simply the.

Negative cash flow refers to the situation where the cash outflow by the company exceeds its cash inflow resulting in a net cash outflow for the business as a. There are several causes that can lead to a negative cfo with the most. Decrease in net income the cash flow statement begins with net income, which is equal to revenues minus all costs, including taxes.

In other words, inflow does not match expenses, causing the business to. Negative cash flow is when your business spends more than what it receives, but this need not always indicate a loss. Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period.

Negative cash flow from investing activities can be a sign of growth, efficiency, or warning. What is negative cash flow?

:max_bytes(150000):strip_icc()/dotdash_Finla_How_are_Cash_Flow_and_Revenue_Different_Nov_2020-01-abf2a04cb90a43daa9df7cfd7a6ab720.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)