Awesome Tips About Shareholders Account In Balance Sheet

The shareholder current account is essentially a loan from a shareholder.

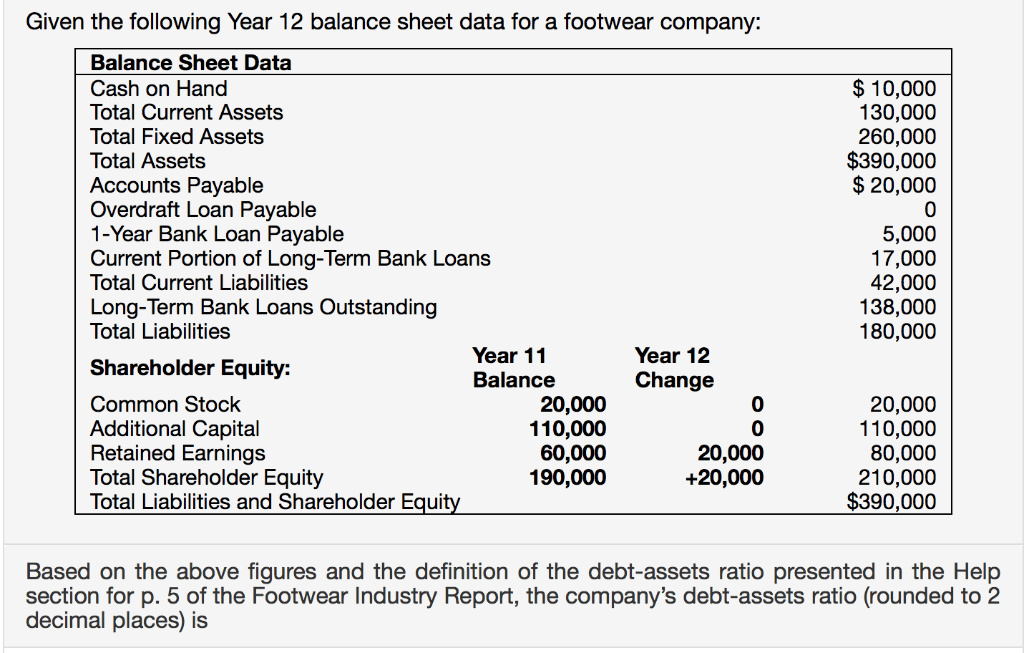

Shareholders account in balance sheet. Assets = liabilities + shareholders’ equity. It is also called the ‘shareholders equity’ or the ‘net worth’. What is a shareholder current account?

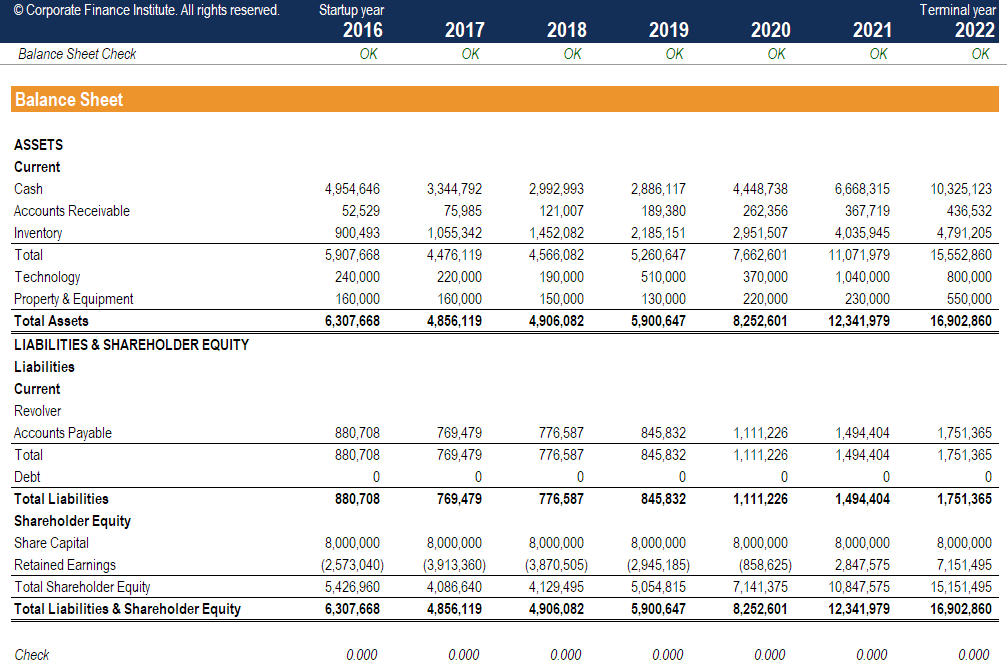

There’s also an example towards the end, so you can see how it all falls into place. In 2023, we increased our lending to customers by. The shareholders’ equity is the money left if a corporation sells all of its assets and pays all its debts.

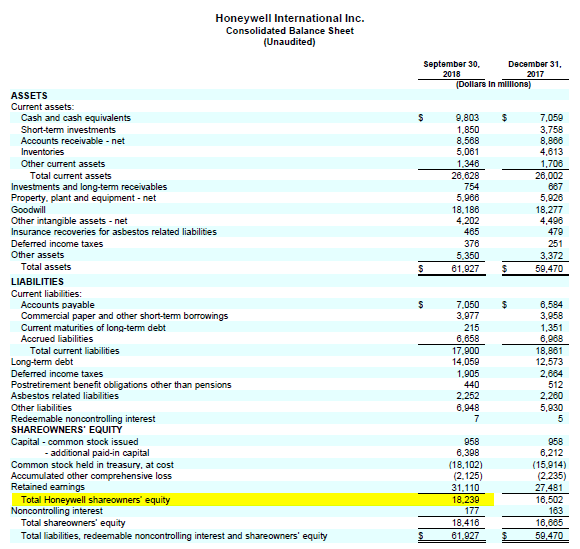

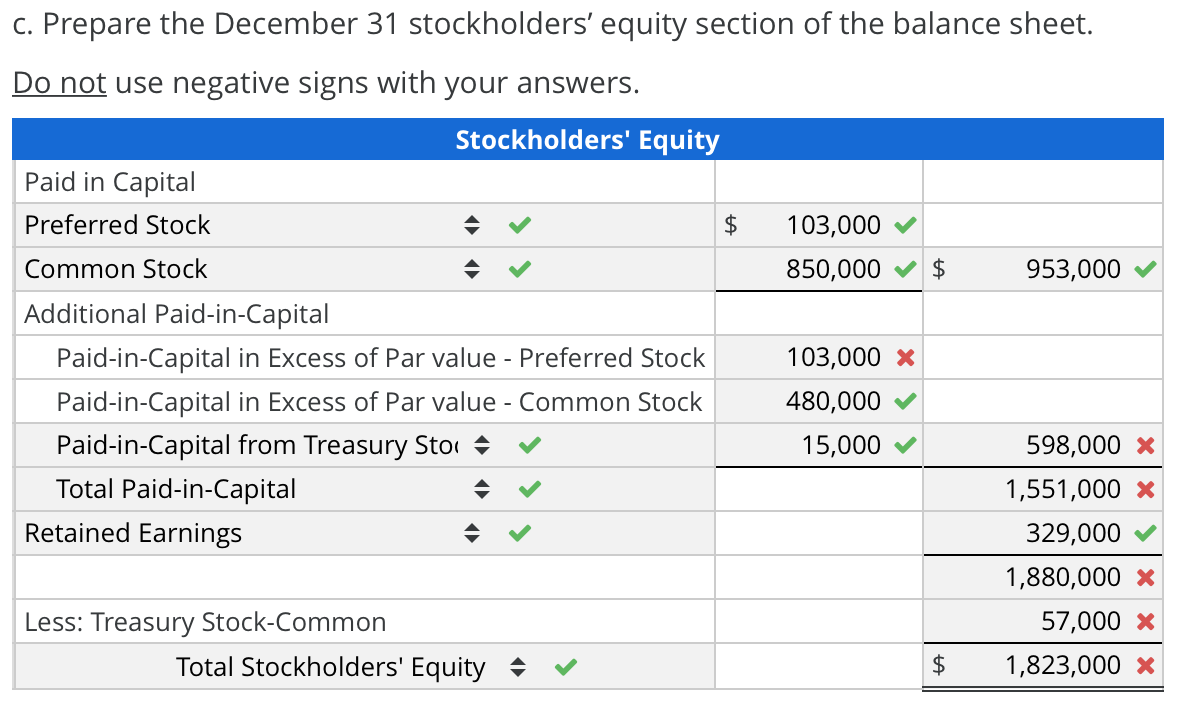

The shareholders’ equity portion of the balance sheet shows the initial amount of money invested in the business. The video explains we have 3 sections in stockholder’s equity: The company stockholders’ equity also known as shareholders’ equity is an account contained in the balance sheet.

Comes from the statement of retained earnings financial statement. When the shareholder pays back the loan, cash is increased and due from shareholder is decreased or set to zero, depending on the amount of money paid back. Some shareholders take drawings regularly and this works precisely the.

Part of the roe ratio is the stockholders' equity, which is the total amount of a company's total assets and liabilities that appear on its balance sheet. This figure is included in the company’s balance sheet and also the equity statement. The credit balance is represented as a liabilty in the balance sheet as the company owes the shareholder that money.

It expresses the amount the owner or owners of a company has invested in the business over time. The balance sheet provides a snapshot of a company’s financial position at a specific moment in time, while the sse looks at a period of time and examines the sources and uses of capital. Stockholders equity (also known as shareholders equity) is an account on a company’s balance sheet that consists of share capital plus retained earnings.

22 feb, 2024, 08:00 et. It also represents the residual value of assets minus liabilities. The sse also includes changes to equity during a period of.

In this article, you will get to understand the components of stockholder’s equity in the balance sheet, its calculation, and how. As fixed assets age, they begin to lose their value. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity.

The balance sheet where assets, liabilities and shareholders’ funds are disclosed then will also always be in balance (the resources or assets in the top part of the balance sheet will always be equal to the sources of funding namely the sum of liabilities and shareholders’ equity in the bottom part of the balance sheet). The diagram below shows examples of how the shareholder current account can increase and decrease. Take the sum of all assets in the balance sheet and deduct the value of all liabilities.

The balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes assets, liabilities, and shareholders’ equity. Representing this in the form of an equation : If the statement of shareholder equity increases, the activities the business is pursuing to boost income pay off.

:max_bytes(150000):strip_icc()/ScreenShot2021-05-03at11.03.30AM-985f846f70e347c69f0f288359e7beed.png)

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)