Simple Tips About Statement Of Comprehensive Income Format

This module focuses on the general requirements for the presentation of the statement of comprehensive income and the income statement in accordance with section 5 statement of comprehensive income and income statement.

Statement of comprehensive income format. Comprehensive income is the variation in the value of a company's net assets from. Comprehensive income is often listed on the financial statements to include all other revenues, expenses, gains, and losses that affected stockholder’s equity account during a period. A closer look on comprehensive income and its various categories

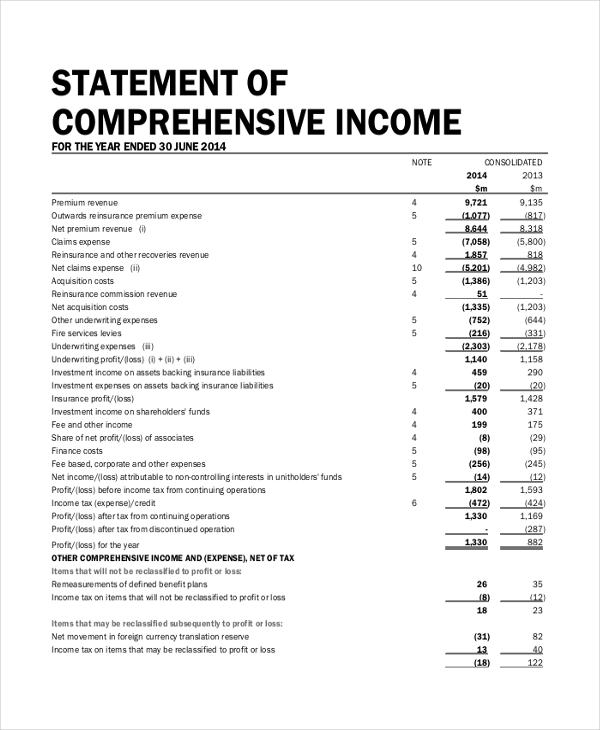

*every financial statement should inform the reader that the notes are an integral part of the financial statements and should be read for important information. Net income and comprehensive income. The statement of comprehensive income is made up of two parts:

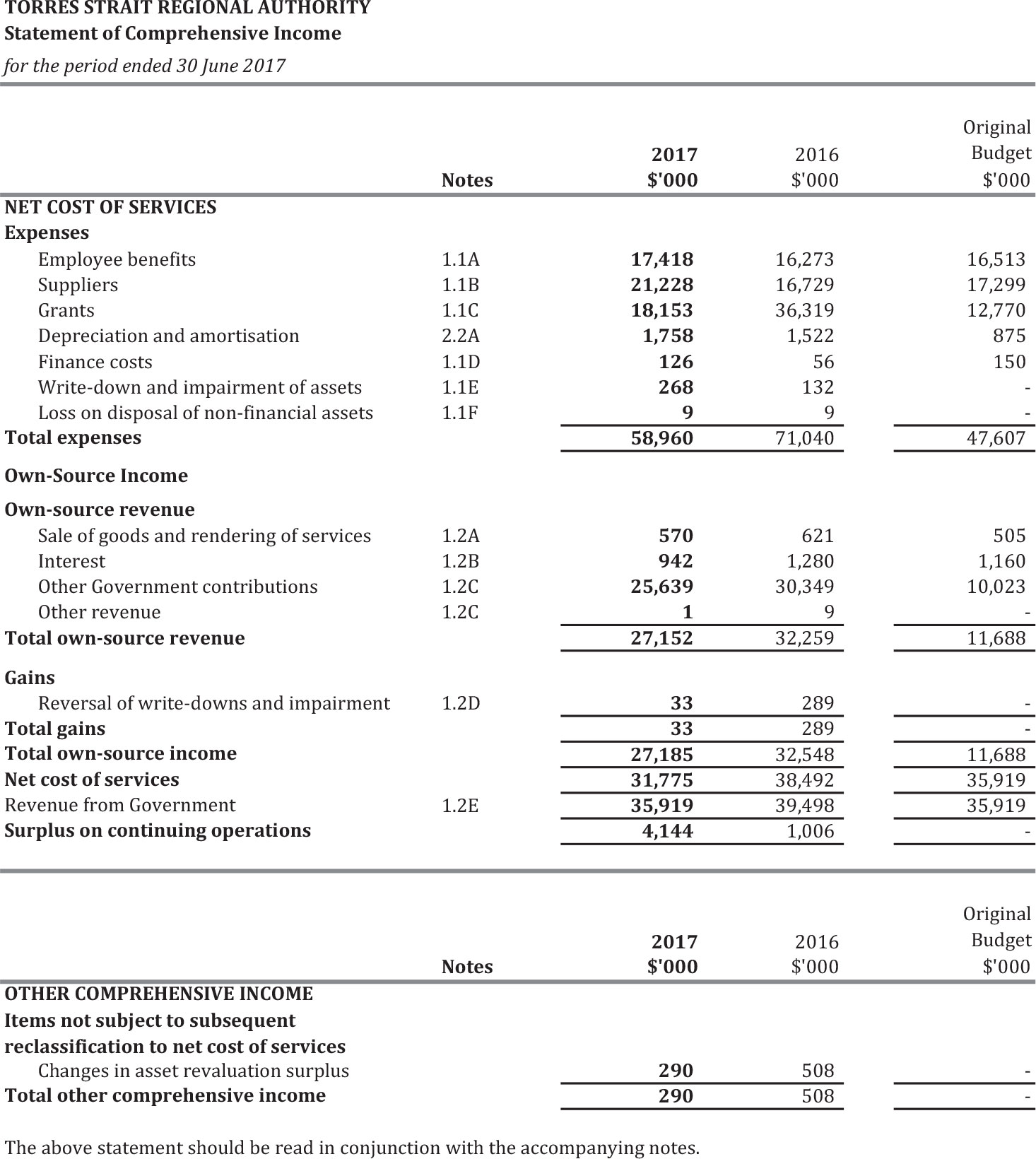

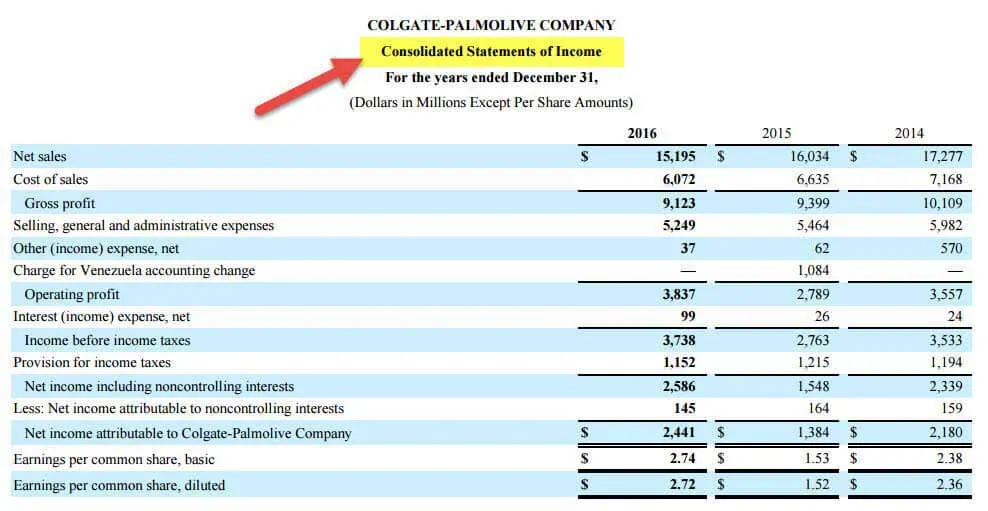

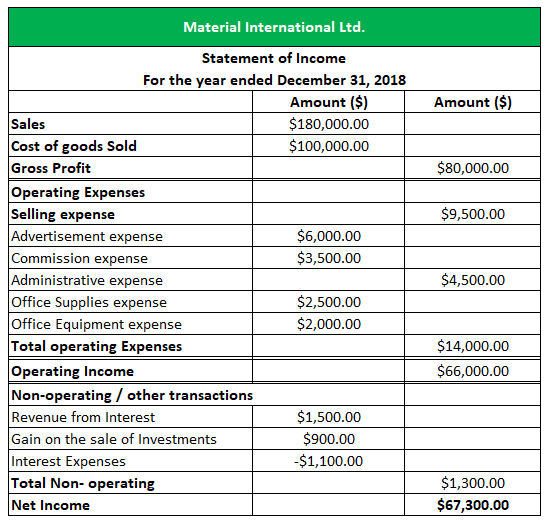

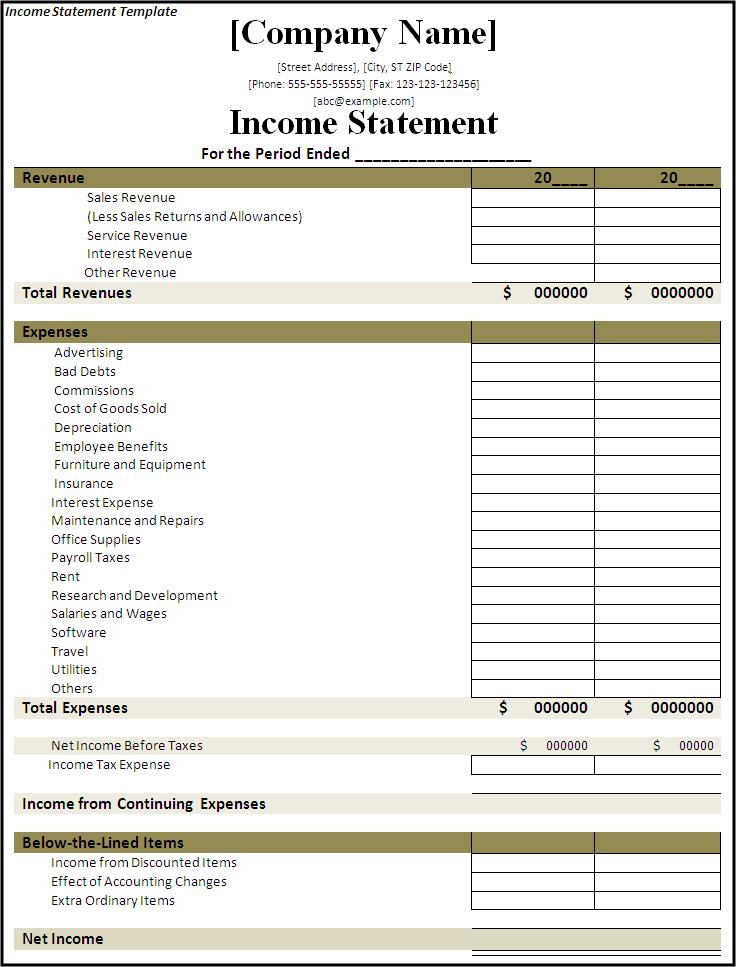

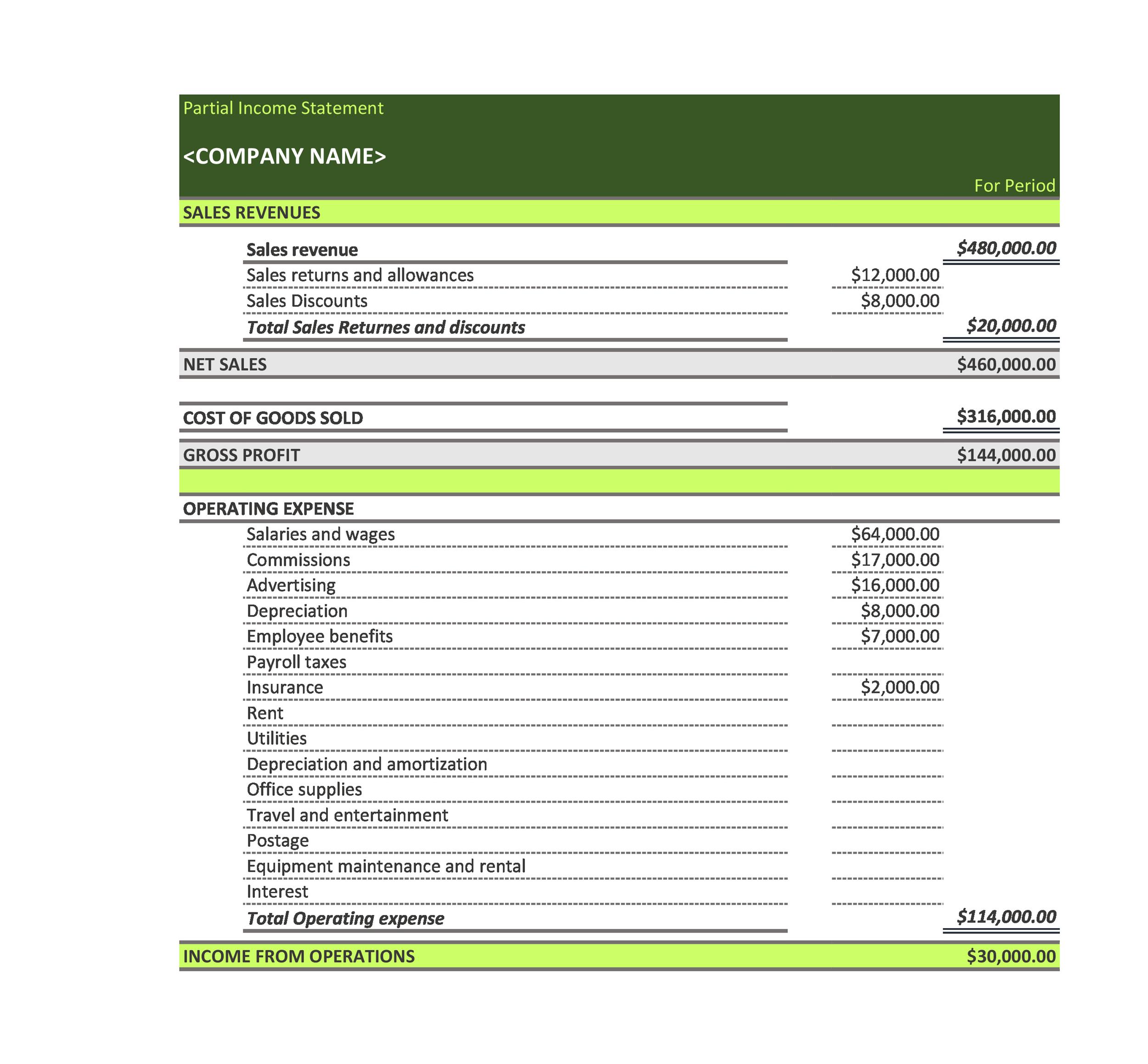

The following shows the format of the statement of comprehensive income: Organising the statement of profit 106 or loss by function of expenses appendix b: The statement of comprehensive income reports the change in net equity of a business enterprise over a given period.

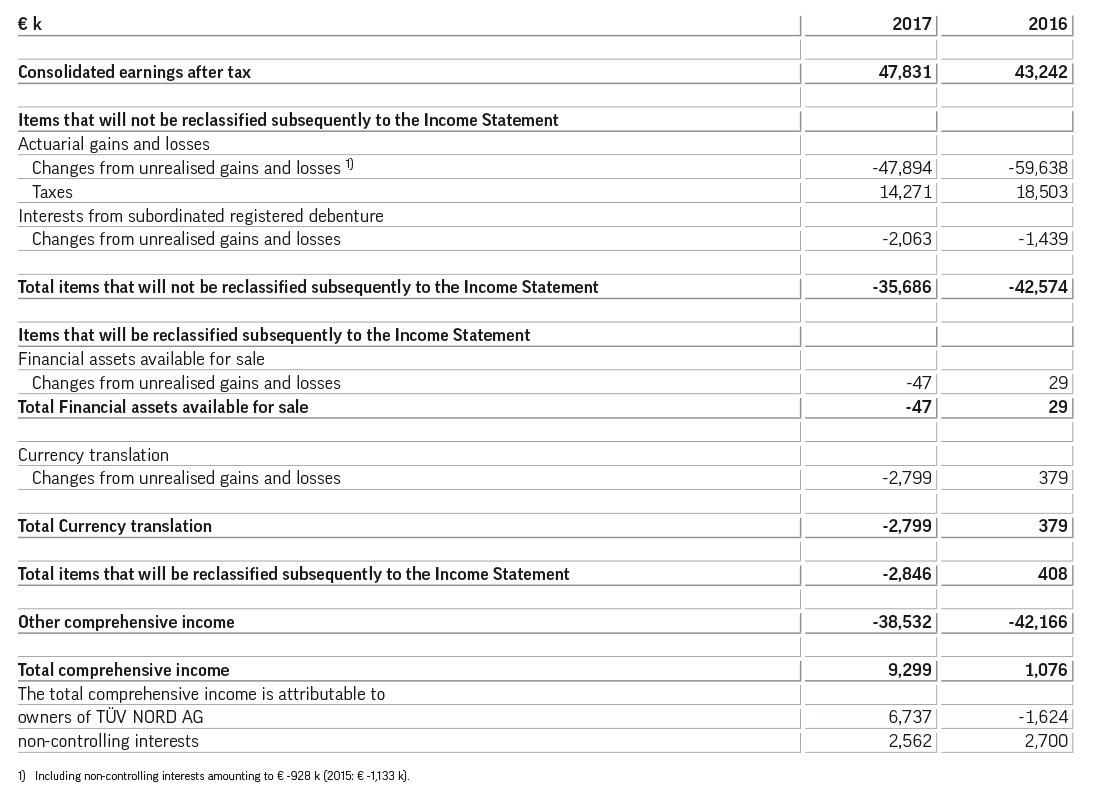

Net income, and other comprehensive income, which incorporates the items excluded from the income statement. Statement of comprehensive income 108 presented in a single statement appendix c: What is other comprehensive income?

In other words, it adds additional detail to the balance sheet’s equity section to show what events changed the. Effective dates of new ifrs standards 110. It introduces the subject and reproduces the official

Two statements would be prepared for ifrs companies that prefer to separate net income from comprehensive income. Comprehensive income may be presented in a single statement or in two consecutive statements. Statement of comprehensive income refers to the statement which contains the details of the revenue, income, expenses, or loss of the company that is not realized when a company prepares the financial statements of the accounting period, and the same is presented after net income on the company’s income statement.

A second statement, called the statement of comprehensive income, would start with net income and include any other comprehensive income (oci) items. The statement of retained earnings includes two key parts: Appendices to the ifrs example consolidated 105 financial statements.

Updated july 13, 2023 reviewed by melody bell fact checked by marcus reeves what is comprehensive income?