One Of The Best Info About Trial Balance Of Totals

The announcement came one day after a new york judge ordered trump and the trump organization to pay over $355 million as part of a civil fraud case.

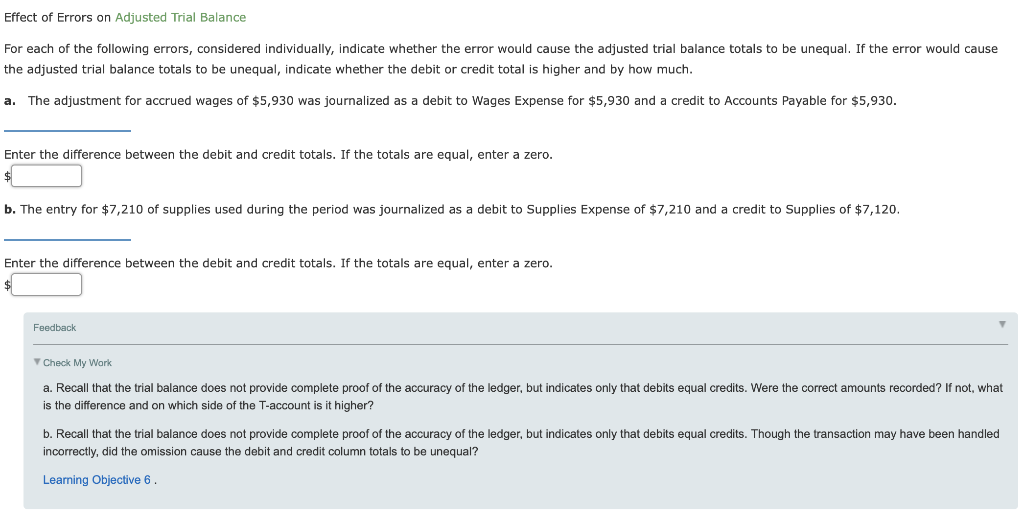

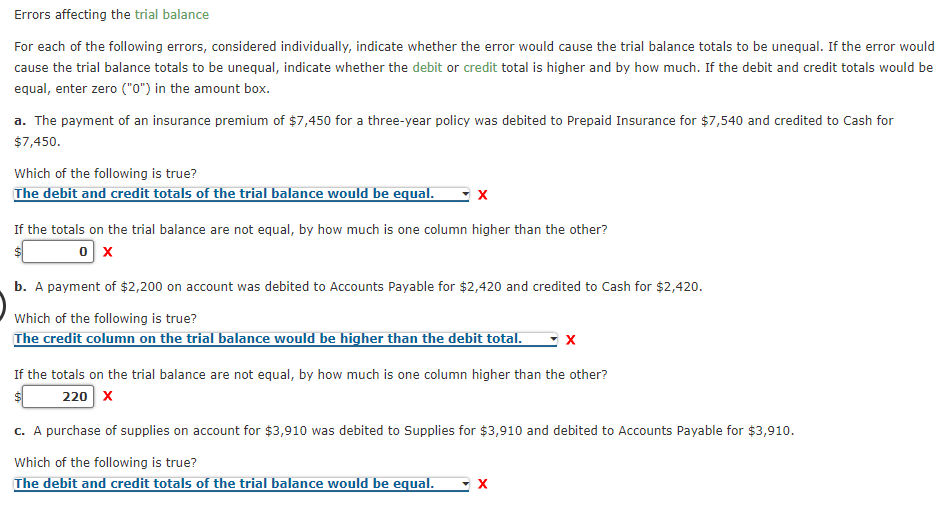

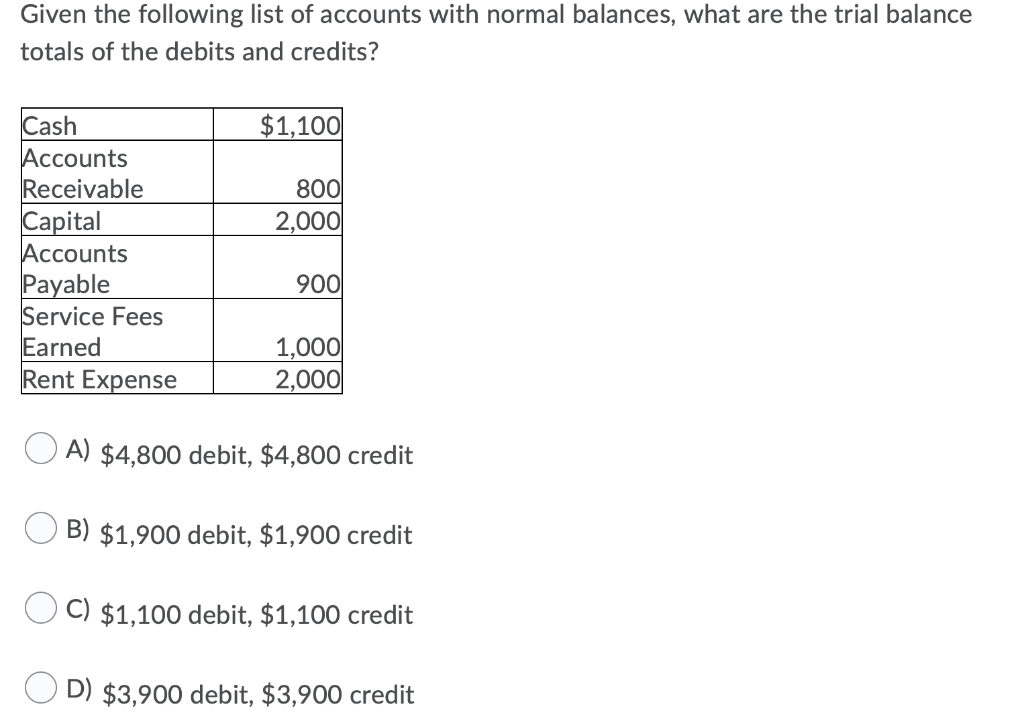

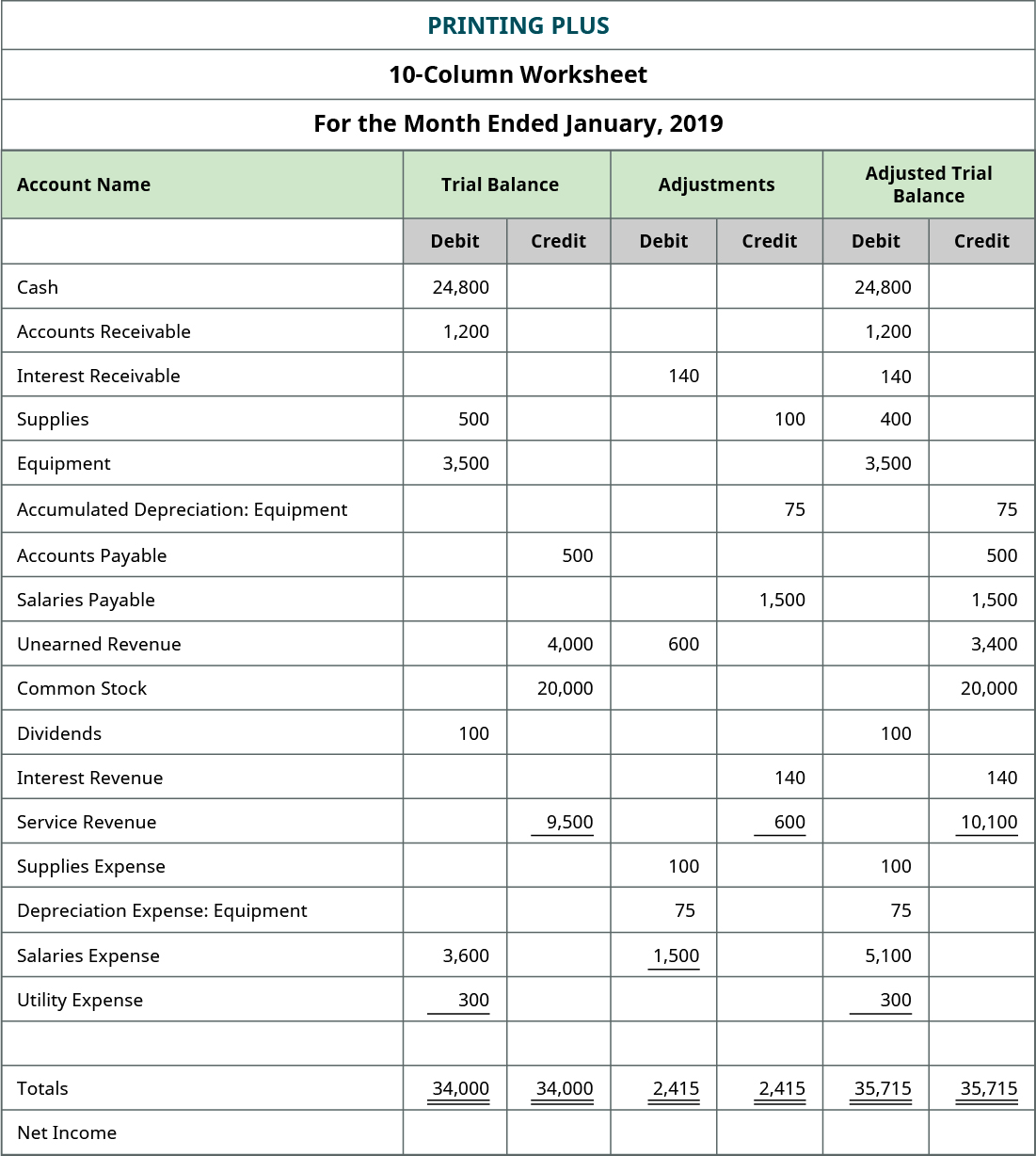

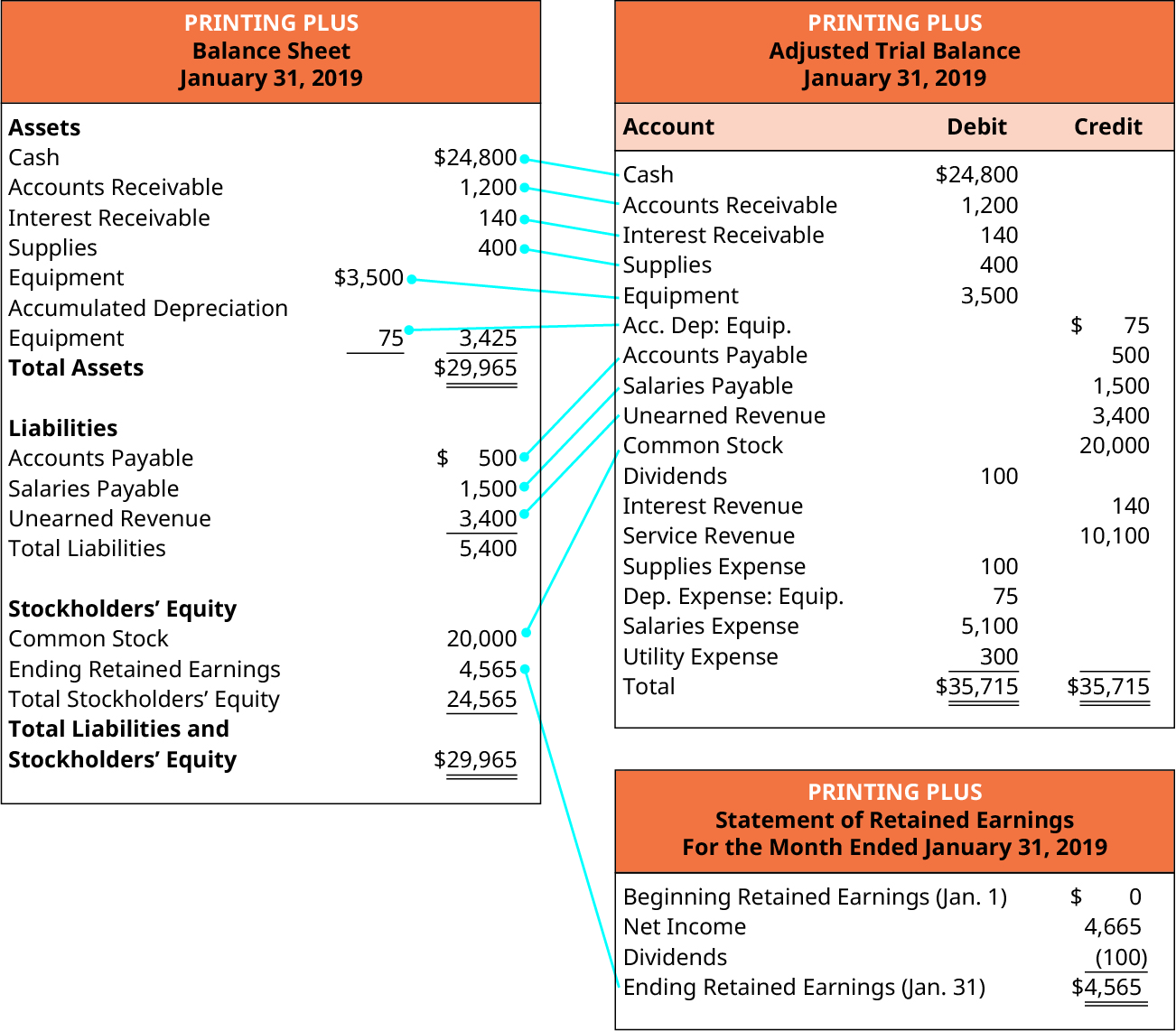

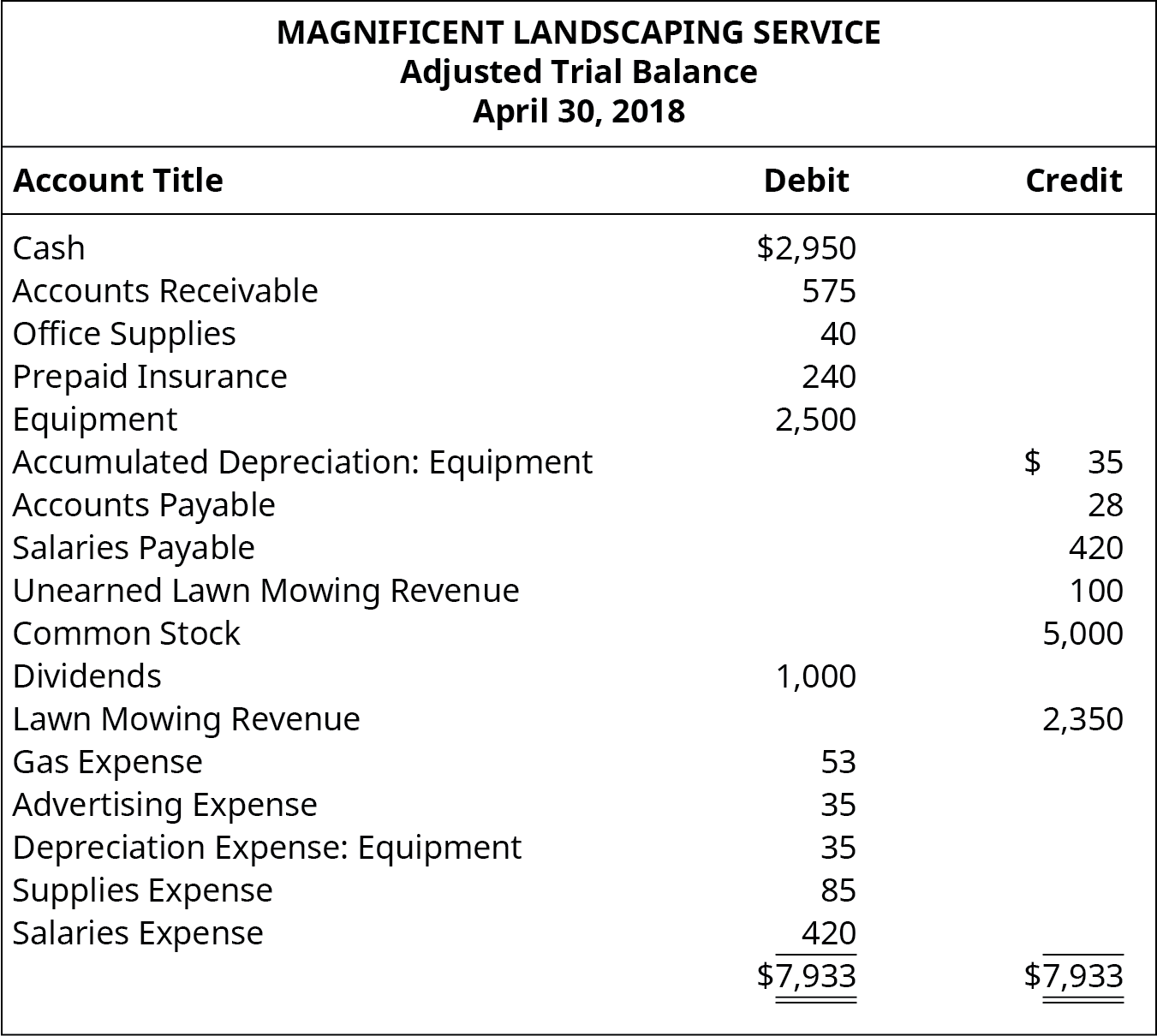

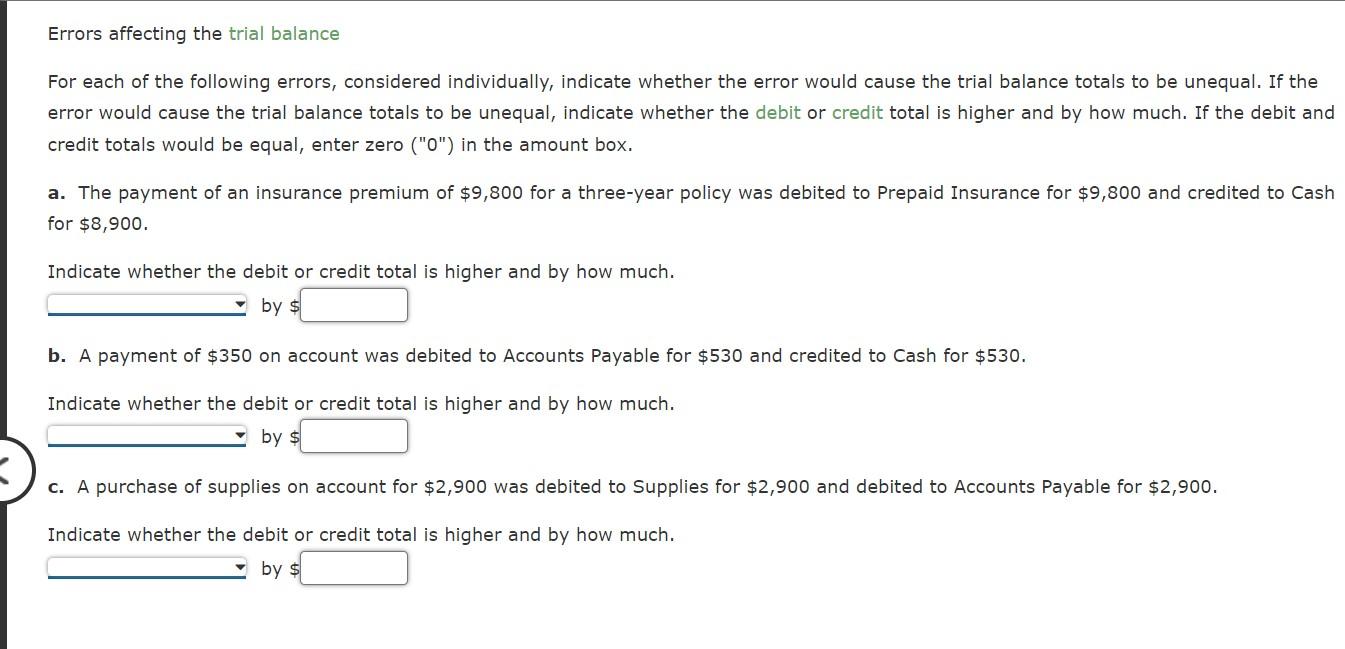

Trial balance of totals. The balance method of preparing trial balance is more popular compared to its alternatives. A trial balance is a statement that shows the total debit and total credit balances of accounts. Trial balance totals may agree in spite of errors.

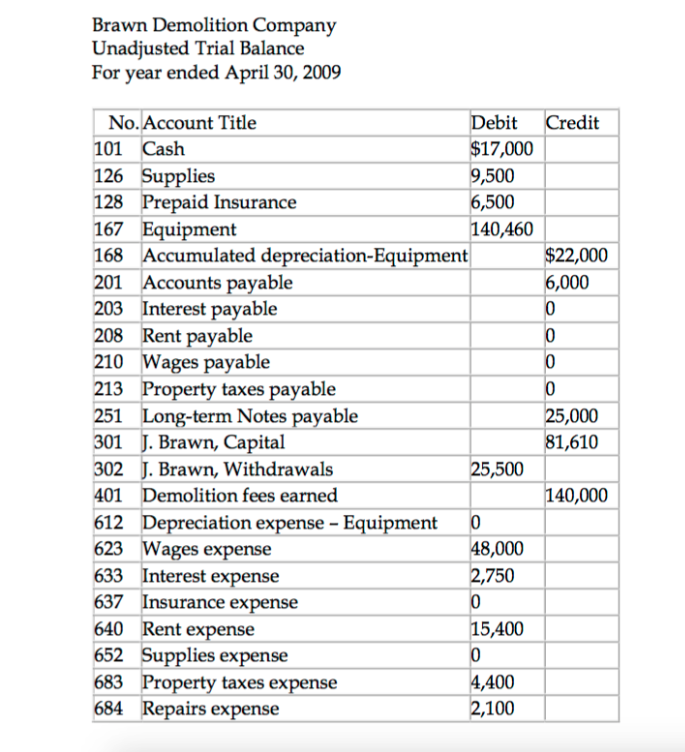

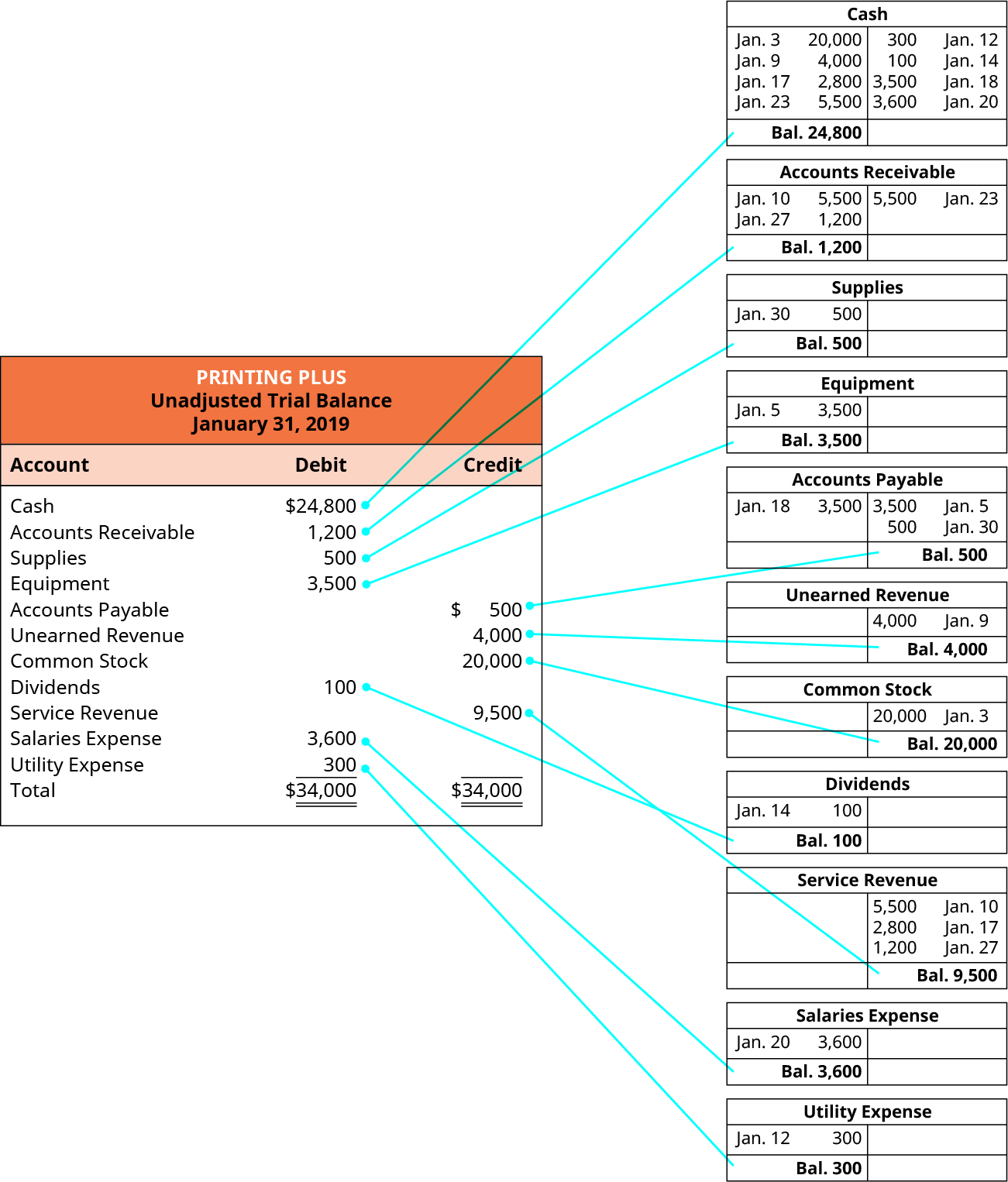

The general purpose of producing a trial balance is to ensure that the. The trial balance is an accounting report that lists the ending balance in each general ledger account. Once the debit and credit column totals match, the prepared trial balance serves as a solid foundation for the subsequent steps in the accounting cycle.

Each account should include an account number, description of the account, and its final debit/credit balance. A company prepares a trial balance periodically, usually at the end of every reporting period. What is a trial balance?

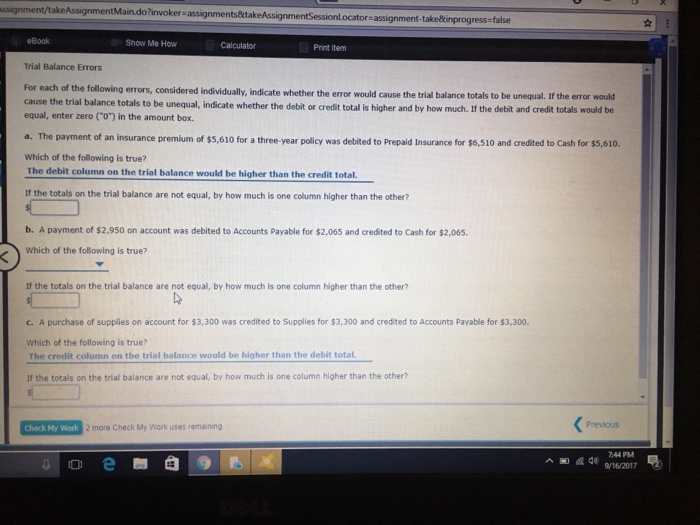

5 limitations of trial balance. The total of debit amounts shall be equal to the credit amounts. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company.

Trial balances are a vital auditing technique used to ensure whether the total debit equals the total credit in the general ledger accounts, which plays a crucial role in. A trial balance is a bookkeeping worksheet in which the balances of all ledgersare compiled into debit and credit account column totals that are equal. Trial balance only confirms that the total of all debit balances match the total of all credit balances.

The unadjusted trial balance is the preliminary trial balance report or document that lists all ending balances or totals of accounts to determine if total debits and credit balances. A trial balance includes a list of all general ledger account totals. A trial balance is an internal financial statement that lists the adjusted closing balances of all the general ledger accounts (both revenue and capital) contained in the ledger of a.

For example, utility expenses during a period. 6.2 posting to the wrong side of. At the bottom of the trial balance report document, the debit and credit column totals are presented.

The total of the accounts on the debit and credit side is referred to as the trial balance. To calculate the trial balance, first determine the balance of each general ledger account. A trial balance is a listing of the ledger accounts and their debit or credit balances to determine.

The balance method is typically. 6 errors disclosed by trial balance. Trial balance is the report of accounting in which ending balances of a different general ledger of the company are and is presented into the debit/credit column as per their.

This means that it states the total. This statement comprises two columns:. The total of the debit column and credit column should agree.

:max_bytes(150000):strip_icc()/trial-balance-4187629-1-c243cdac3d7a42979562d59ddd39c77b.jpg)

![[ANSWERED] Effect of Errors on Adjusted Trial Balance For... Math](https://media.kunduz.com/media/sug-question/raw/84357597-1657470989.6186373.jpeg?h=512)