Exemplary Tips About Consolidated In Accounting

While preparing the consolidated statement, a uniform accounting policy accounting policy accounting policies refer to the framework or procedure followed by the management for bookkeeping and preparation of the financial statements.

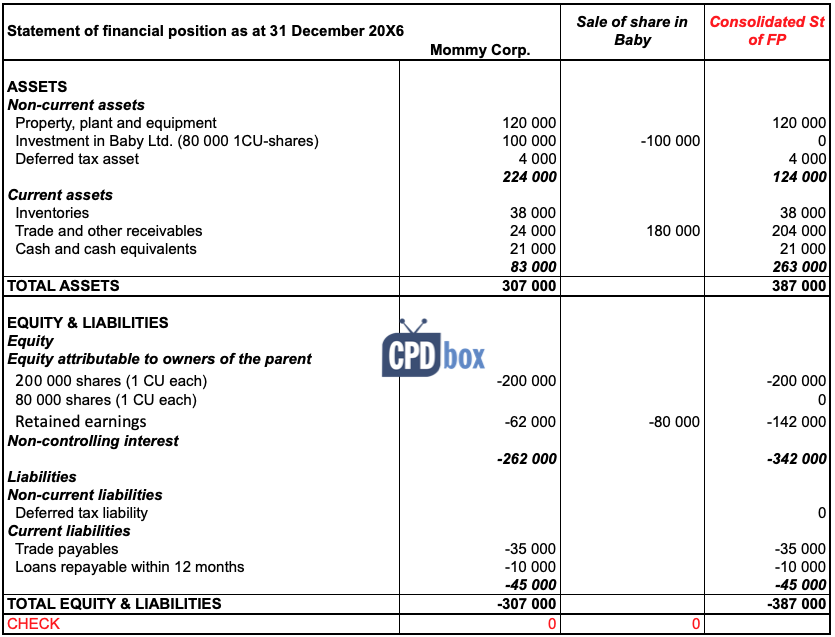

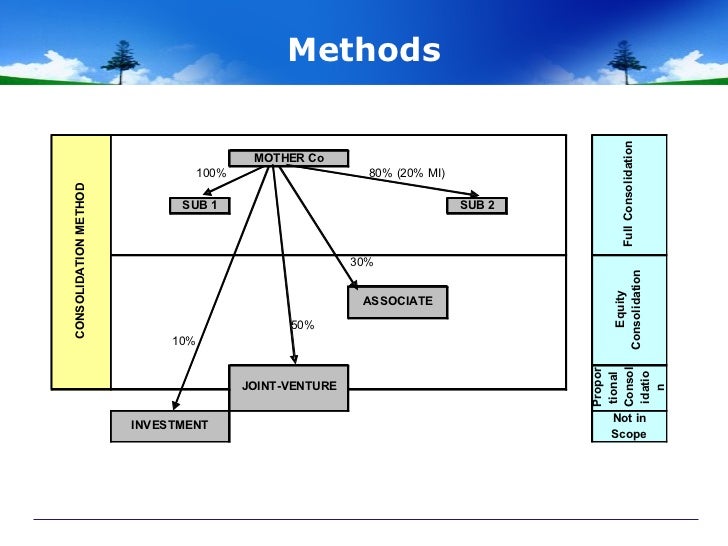

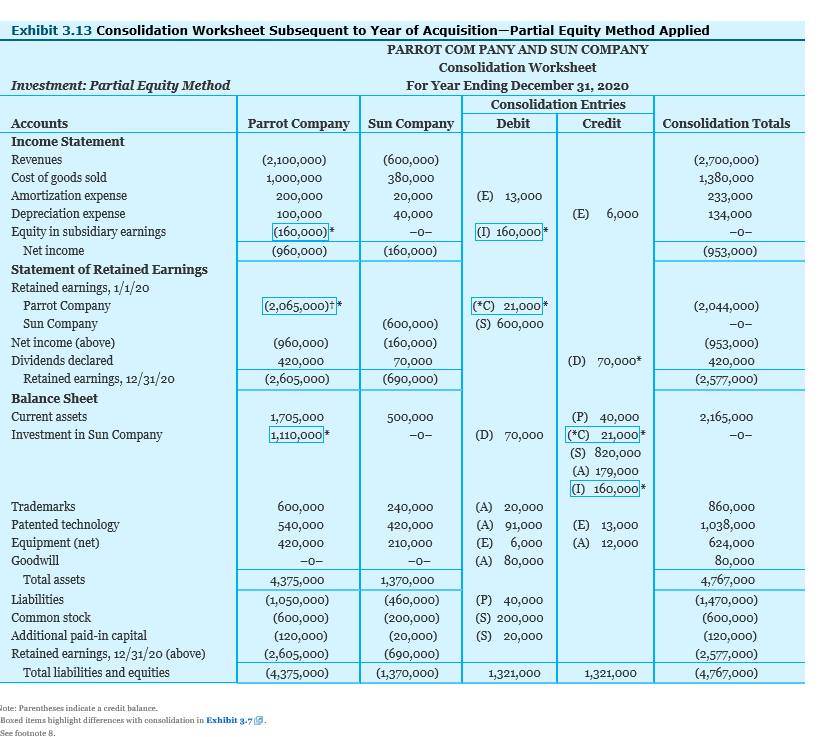

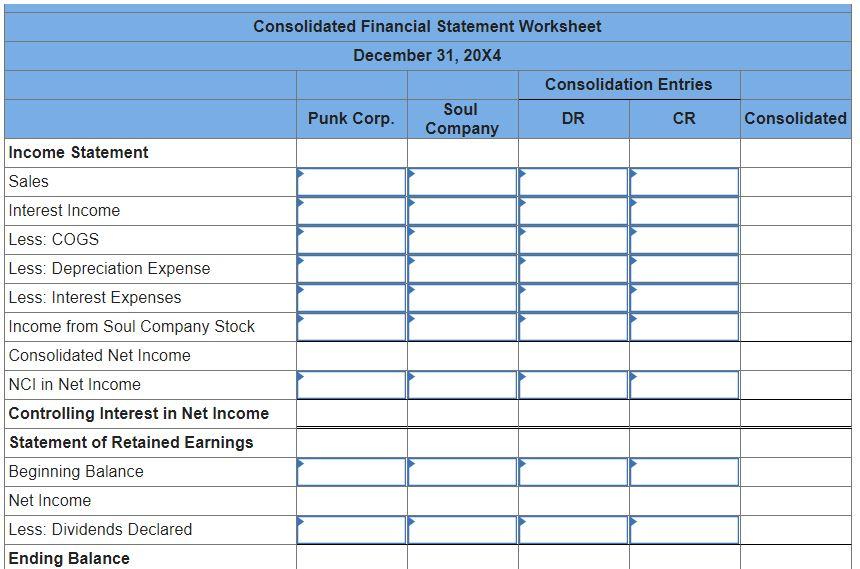

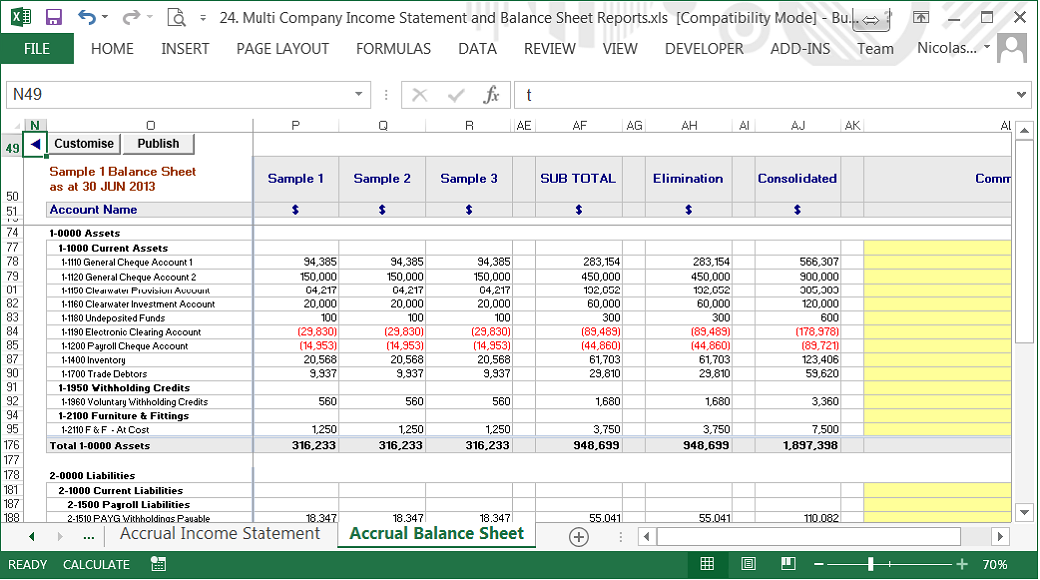

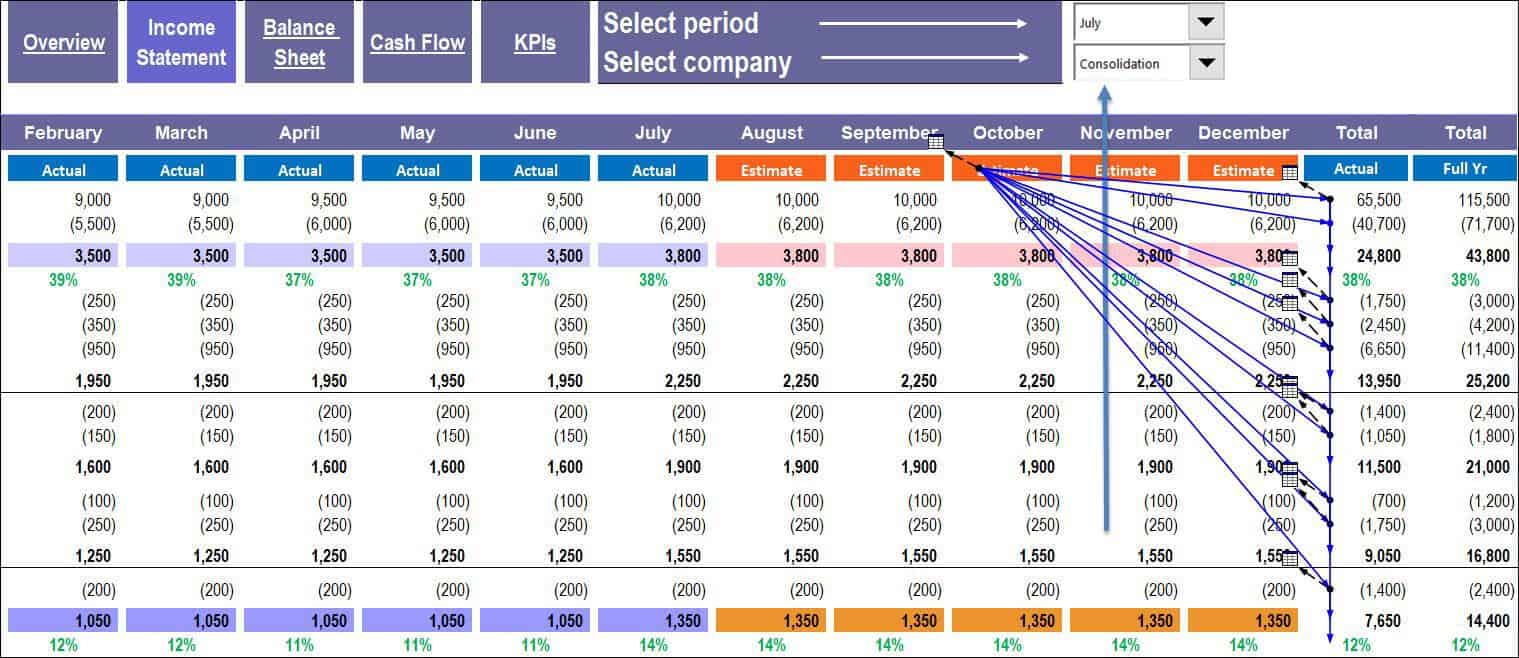

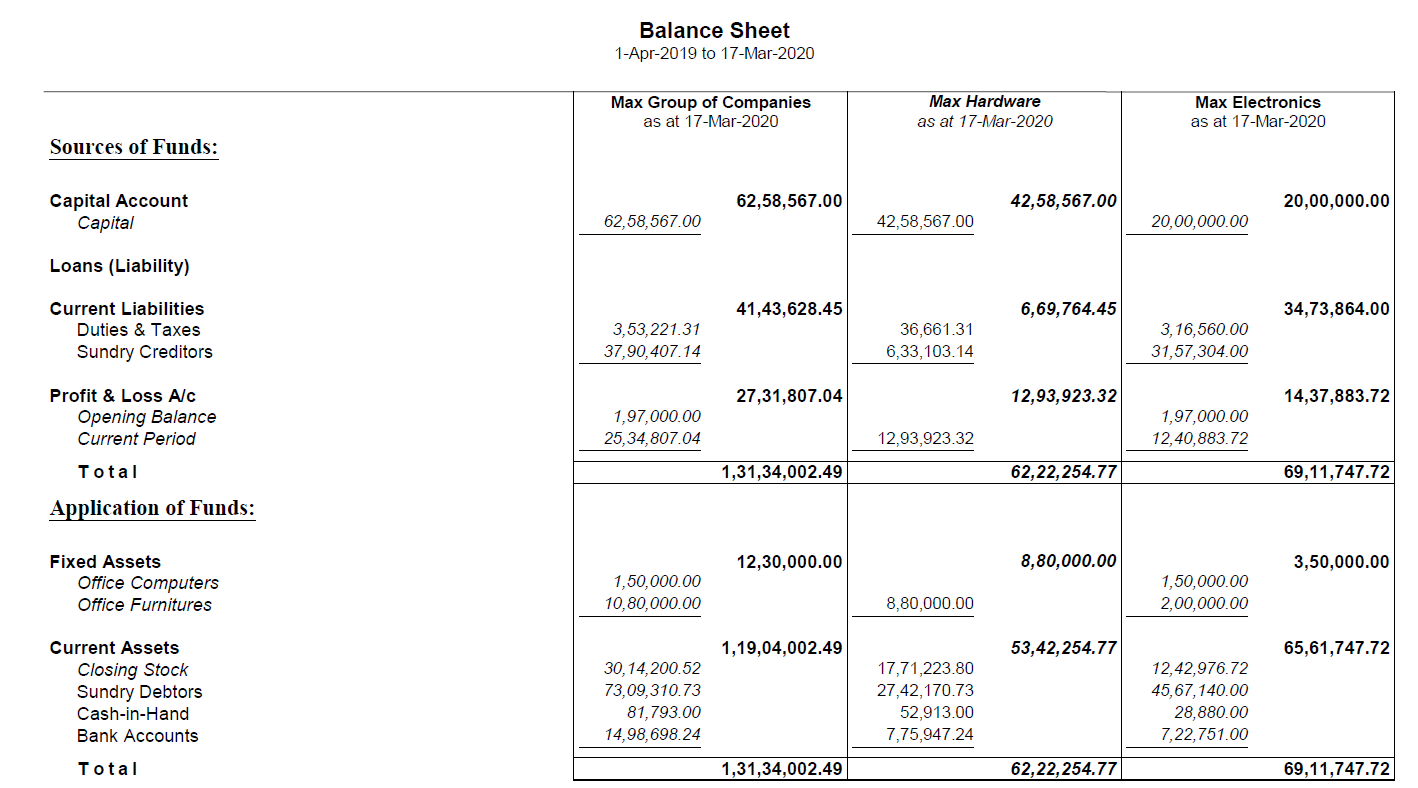

Consolidated in accounting. Consolidation process in accounting. The consolidation of financial statements integrates and combines all of a company's financial accounting functions to create statements that show results in standard balance sheet, income. Consolidated financial statements present assets, liabilities, equity, income, expenses, and cash flows of a parent entity and its subsidiaries as if they were a single economic entity.

It involves accounting methods and practices determined at the corporate level. This process typically includes consolidating balance sheets, income statements, cash flow statements, and statements of changes in equity. The terms ‘group’, ‘parent’, and ‘subsidiary’ are used in this context to refer to the.

Consolidation is the bringing together of all financial statements of affiliated companies within a group. The consolidation process involves several steps to ensure accurate and meaningful financial reporting. The accounting and reporting policies of ifc conform with accounting principles generally accepted in the united states of america (u.s.

In the opinion of management, the condensed consolidated financial statements reflect all adjustments necessary for the fair presentation of ifc’s financial position and results of operations. Retention of the specialized accounting policy in consolidation is permitted in such cases. What is consolidation accounting?

This november 2023 edition incorporates updated guidance. Consolidation accounting is a method of accounting used when a parent company owns subsidiaries (from 20% to upward of 50 %). Let's take a closer look at the typical steps involved:

Control requires exposure or rights to variable returns and the ability to affect those returns through power over an investee. The proportional consolidation method of accounting lists the assets and liabilities in proportion to the percentage of participation of the parent. A consolidated financial statement ( cfs) is the financial statement of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent company and its subsidiaries are presented as those of a single economic entity , according to international accounting standard 27 consolidated and separate financial stateme.

It is important in order to present the overall financial situation of the group in a transparent way. The objective of consolidated financial statements is to present the results of the group in line with its economic substance, which is that of a single reporting entity. Companies often use consolidation to increase efficiency and profitability while reducing costs.

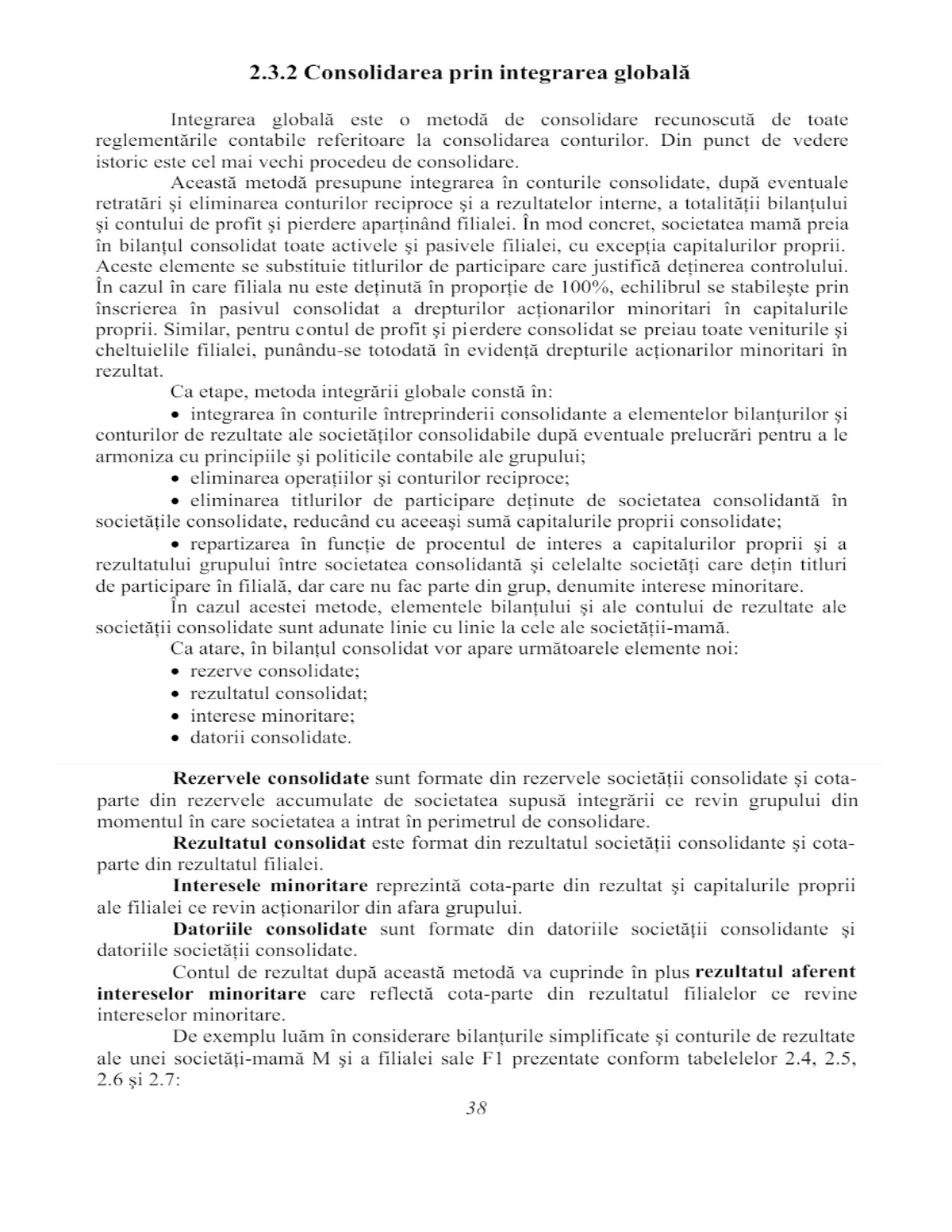

More details on these changes are presented in interim management report and unaudited consolidated financial statements of grigeo ab covering 12 months of 2023 (see attachments). These statements are prepared in accordance with ifrs 10. The diagram below shows an example of a typical group structure:

Ifrs 10 was issued in may 2011 and applies to annual. Consolidation is the process of combining multiple entities or assets into one. This edition of on the radar covers differences between the two models and considers questions to ask when determining which to use for identifying a controlling financial interest.

George town, grand cayman, cayman islands, feb. Ifrs 10 outlines the requirements for the preparation and presentation of consolidated financial statements, requiring entities to consolidate entities it controls. About contact handbooks | november 2023 insight download now ‹ › nick burgmeier partner, dept.

![International perspectives on_consolidated_accounting [PDF Document]](https://static.fdocuments.net/img/1200x630/reader025/reader/2021050312/554913fbb4c90565458c1163/r-1.jpg?t=1621784469)

:max_bytes(150000):strip_icc()/Consolidatedfinancialstatement_final-1a46c53d5f0d4eca864b30adfe22b048.png)