Beautiful Tips About Detailed Cash Flow Statement Format

Download accounts payable template excel | smartsheet this accounts payable template tracks suppliers, order numbers, and amounts due to help you manage payments and due dates.

Detailed cash flow statement format. It is one of the three primary financial statements used to assess a company's financial health, alongside the income statement and balance sheet. A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period. Following are the basic steps to proceed with a cash flow statement:

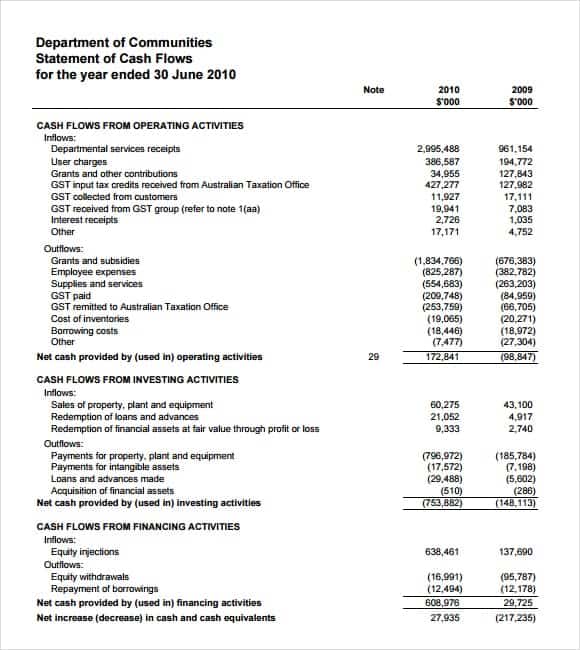

Operating activities investing activities financing activities operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses. What is the statement of cash flows direct method? The cfs measures how well a.

Cash flow statements are used to assess the liquidity, solvency, and. Deduct all outbound cash flows via operating, investing, and financing activities. The cash flow statement is required for a complete set of financial statements.

Write the opening balance of cash and bank for the year. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. The cash flow statement is typically broken into three sections:

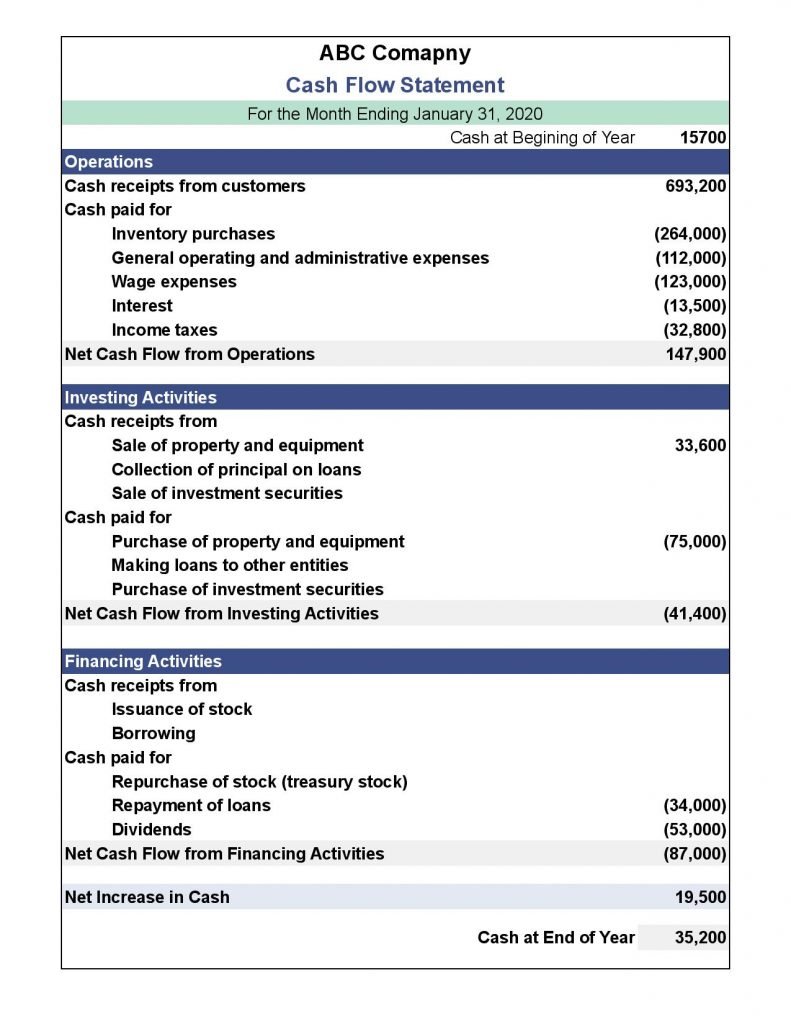

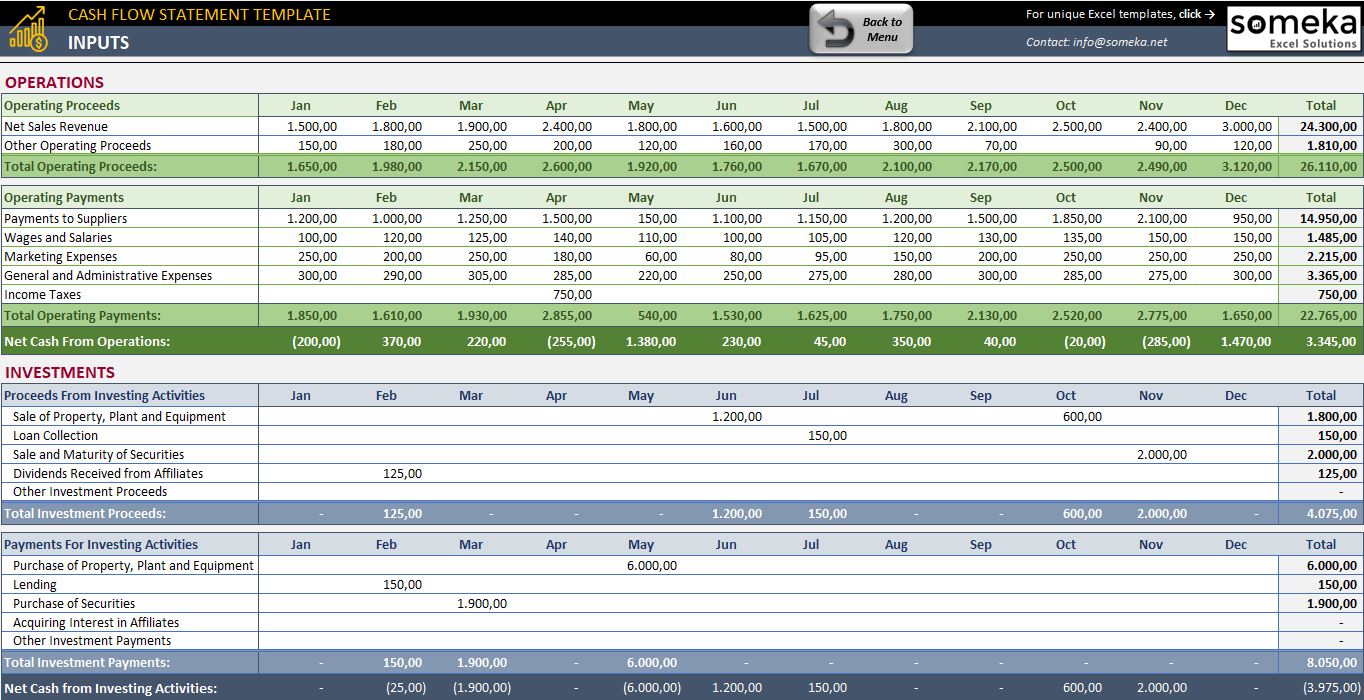

Cash flow statement format. Using these procedures, you can easily create a cash flow statement format using the. We will use these names interchangeably throughout our explanation, practice quiz, and other materials.

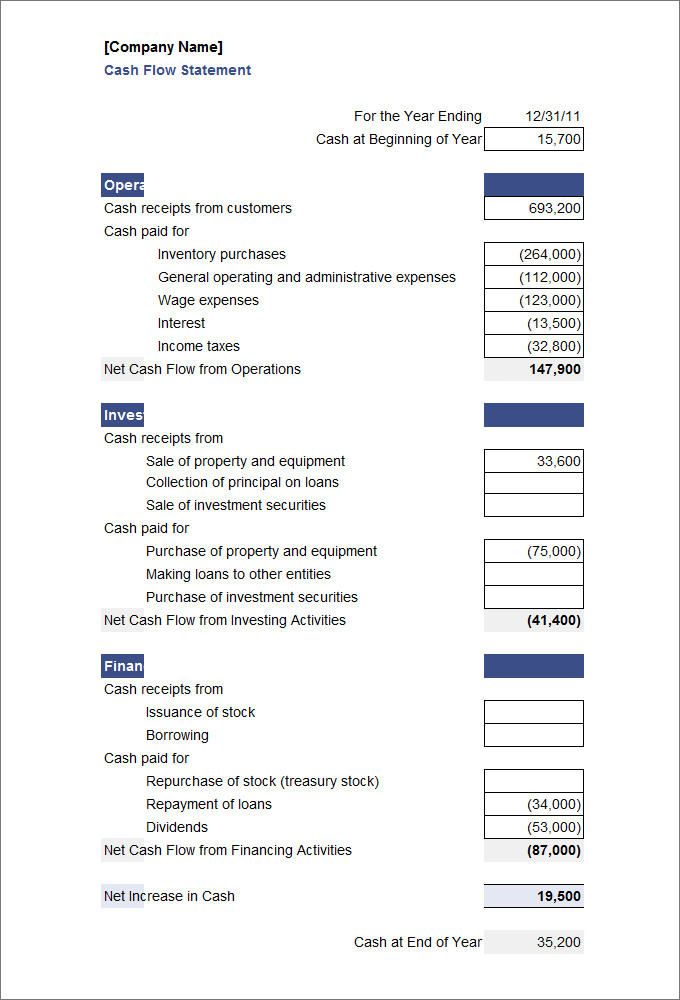

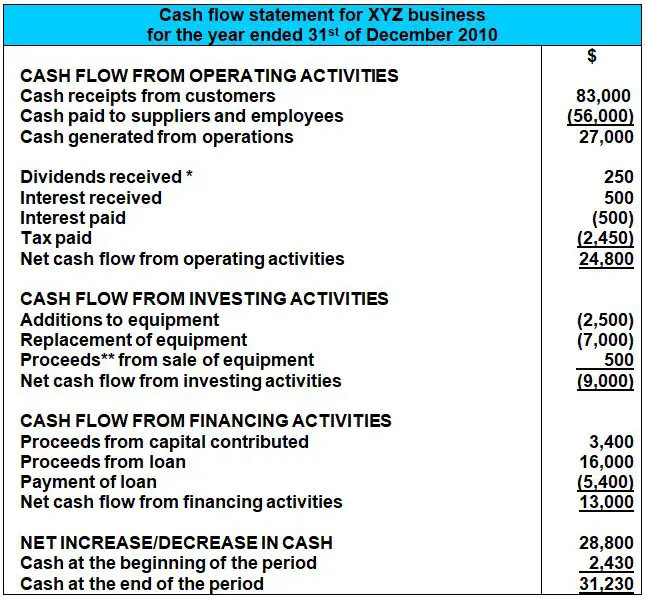

The cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments during the period by source. This value can be found on the income statement of the same accounting period. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business.

A cash flow statement is prepared to enlist the detailed cash flow of a company for a specific period. Please see our separate tutorial on the indirect cash flow statement method for the format and explanations on how to put this together. The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf.

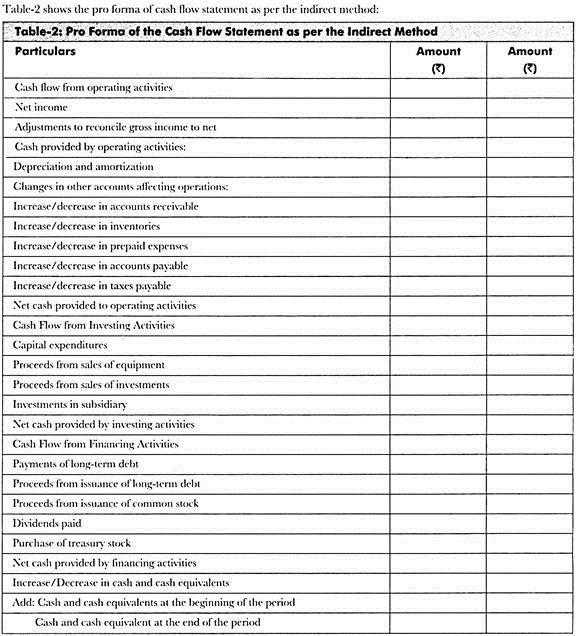

The following are the different formats of the cash flow statement used by small, medium, and large businesses alike. The cash flow statement format is shown in the below table. A statement of cash flows is a financial statement which summarizes cash transactions of a business during a given accounting period and classifies them under three heads, namely, cash flows from operating, investing and financing activities.

Add all the annual cash inflow from operating, investing, and financing activities. Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. All the transactions and information related to these three activities are summed up to prepare cash flow statement format.

Cash flow statement format (direct method) okay, so before anything else, here's the format of the cash flow statement itself (see further below for explanations): How to prepare a cash flow statement? The cash flow statement format inverts that monthly outlay, revealing available funds rather than total expenditures.