The Secret Of Info About Cash Collected On Accounts Receivable Balance Sheet

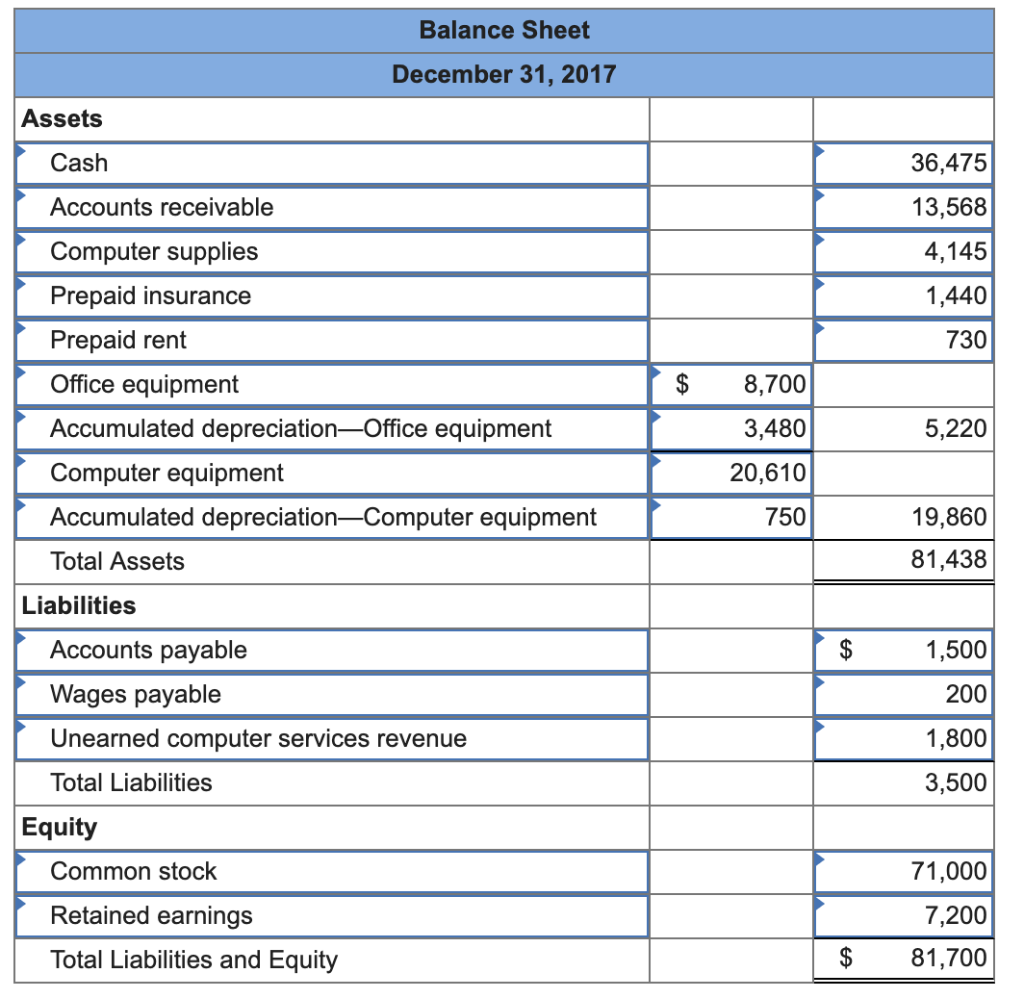

This is an asset because, at some point, the money will arrive in the form of cash.

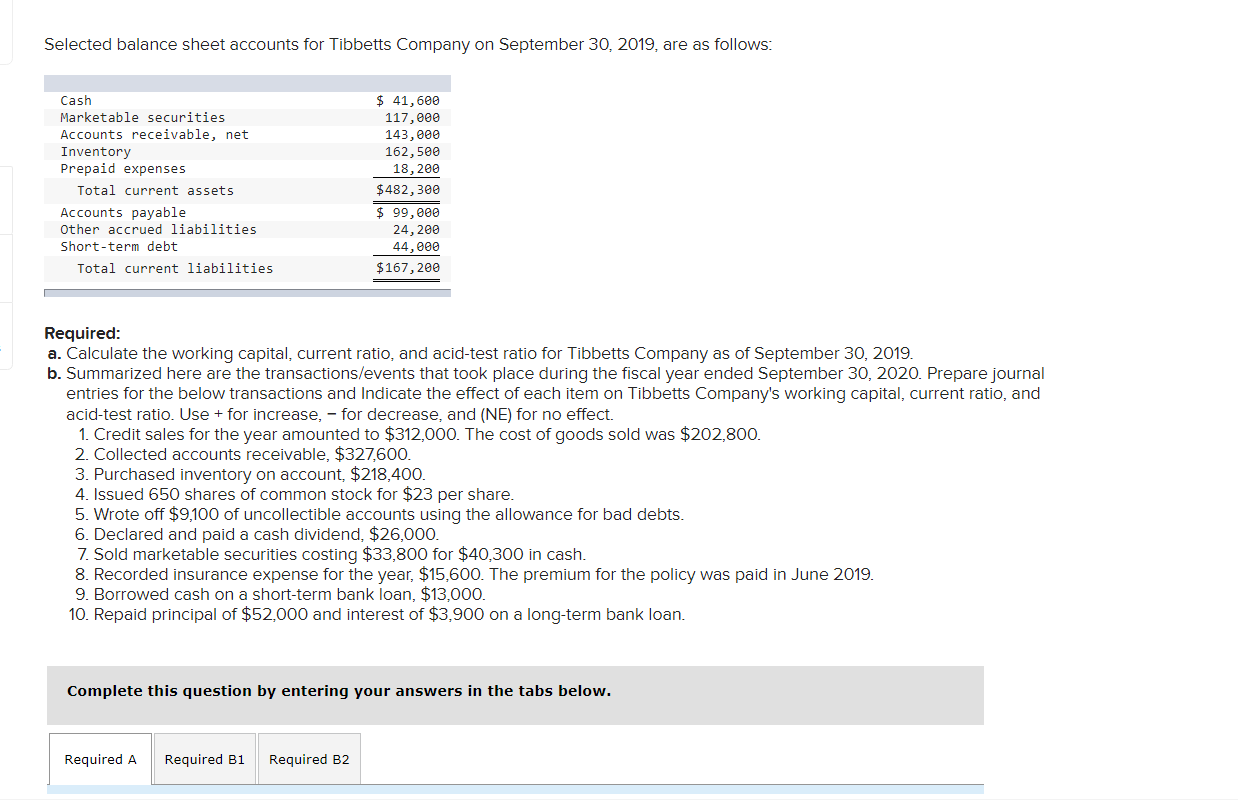

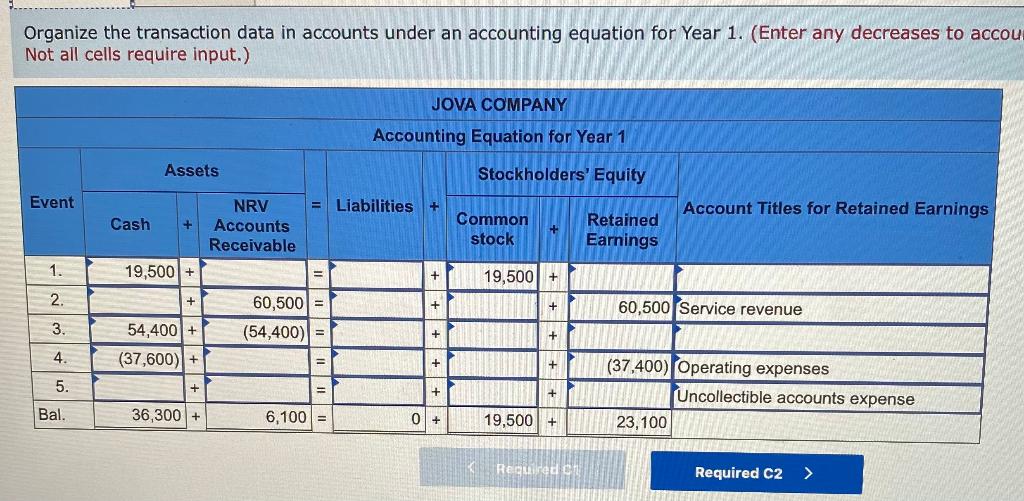

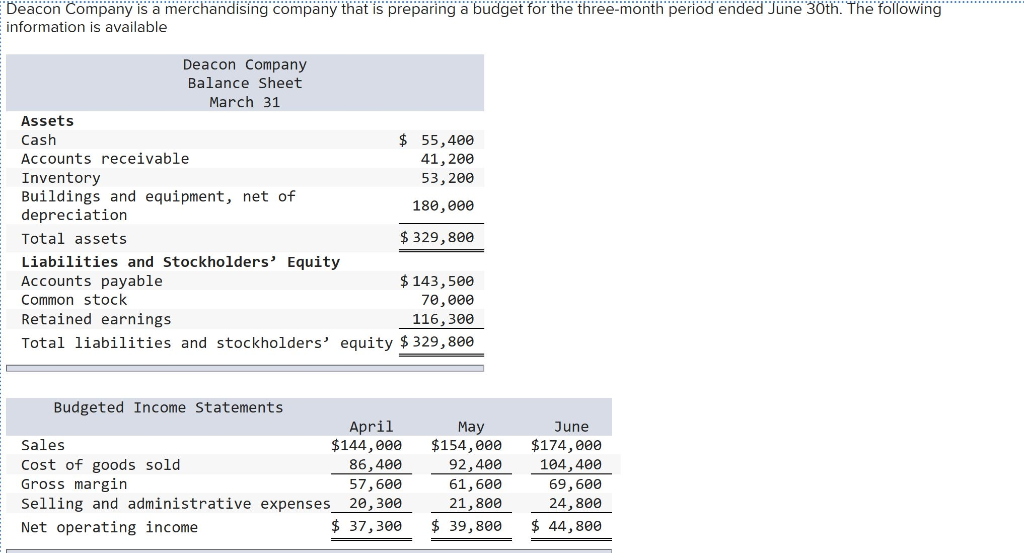

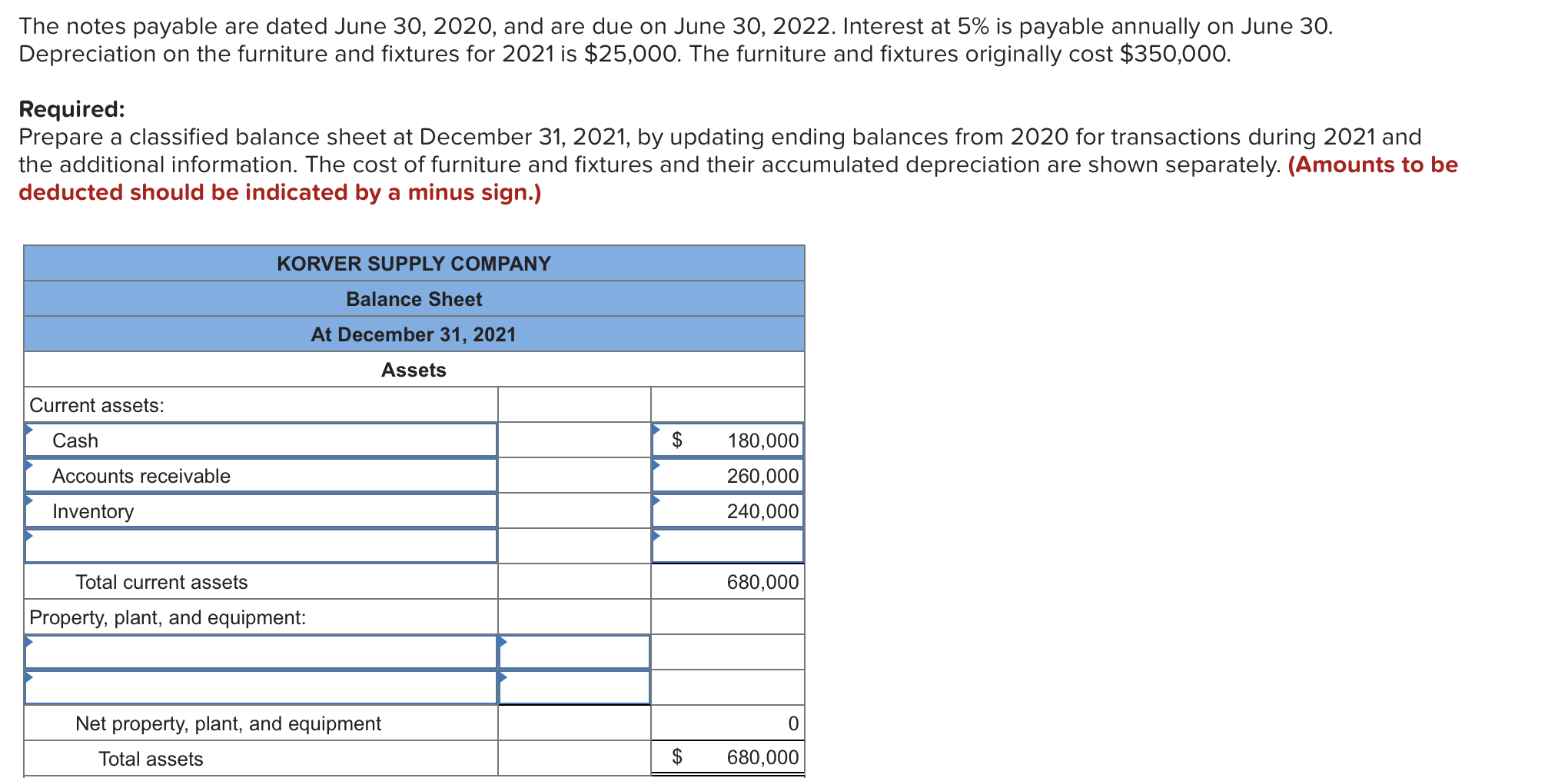

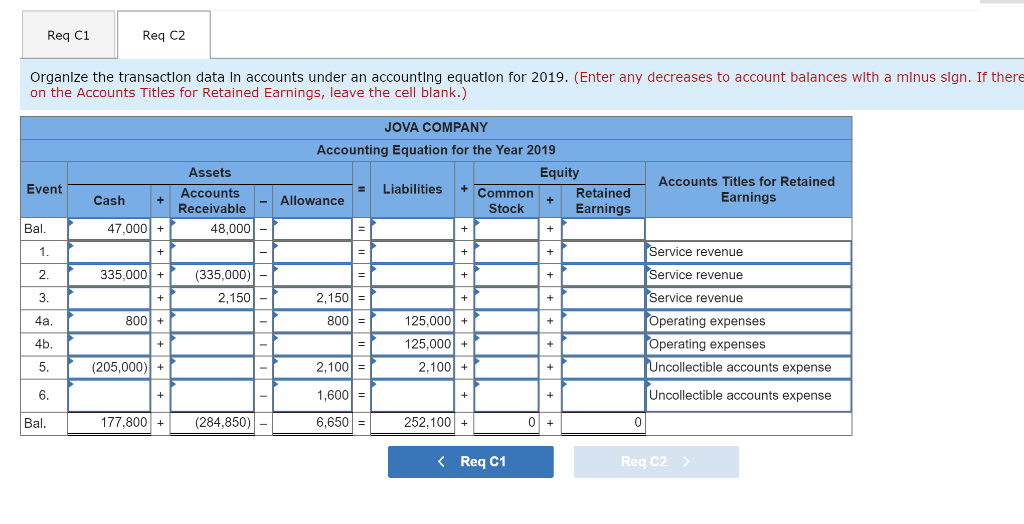

Cash collected on accounts receivable balance sheet. The cash collection formula is a calculation companies use to estimate the amount of cash they expect to collect from customers within a certain period. For companies who sell much of their product on credit, accounts receivable can be a significant amount on the balance sheet. Decrease assets and decrease liabilities.

When cash is collected on accounts receivable, it leads to a decrease in the accounts receivable balance on the balance sheet. Under the cash basis of accounting , transactions are only recorded when there is a related change in cash. You may also hear this called payment collections.

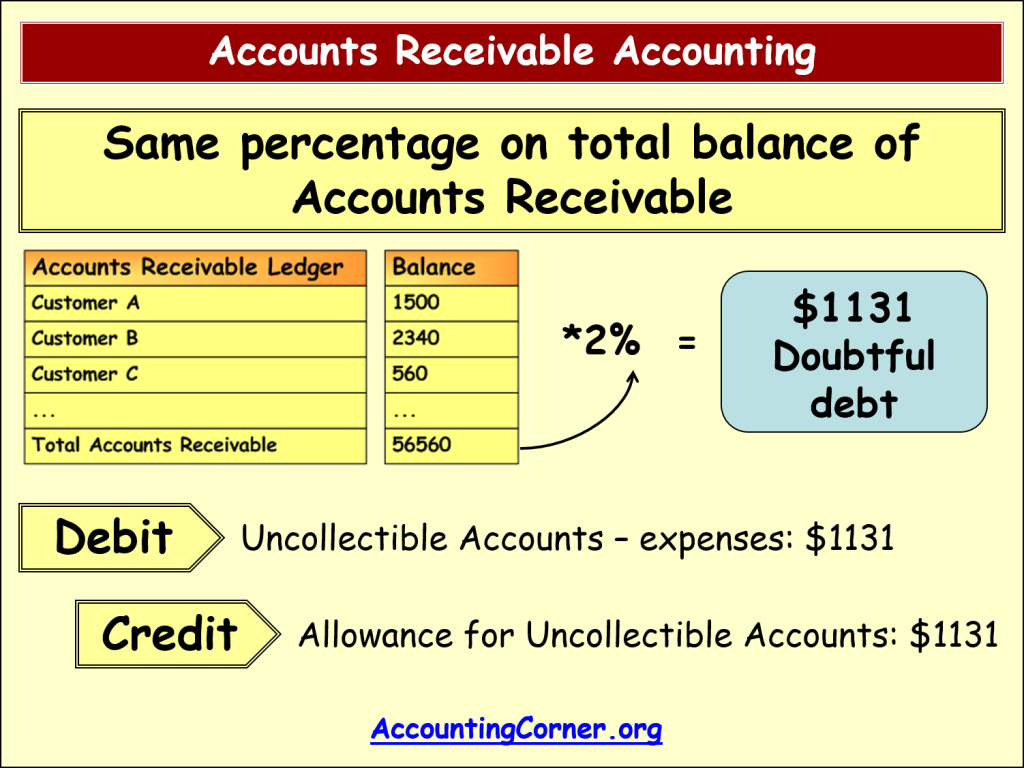

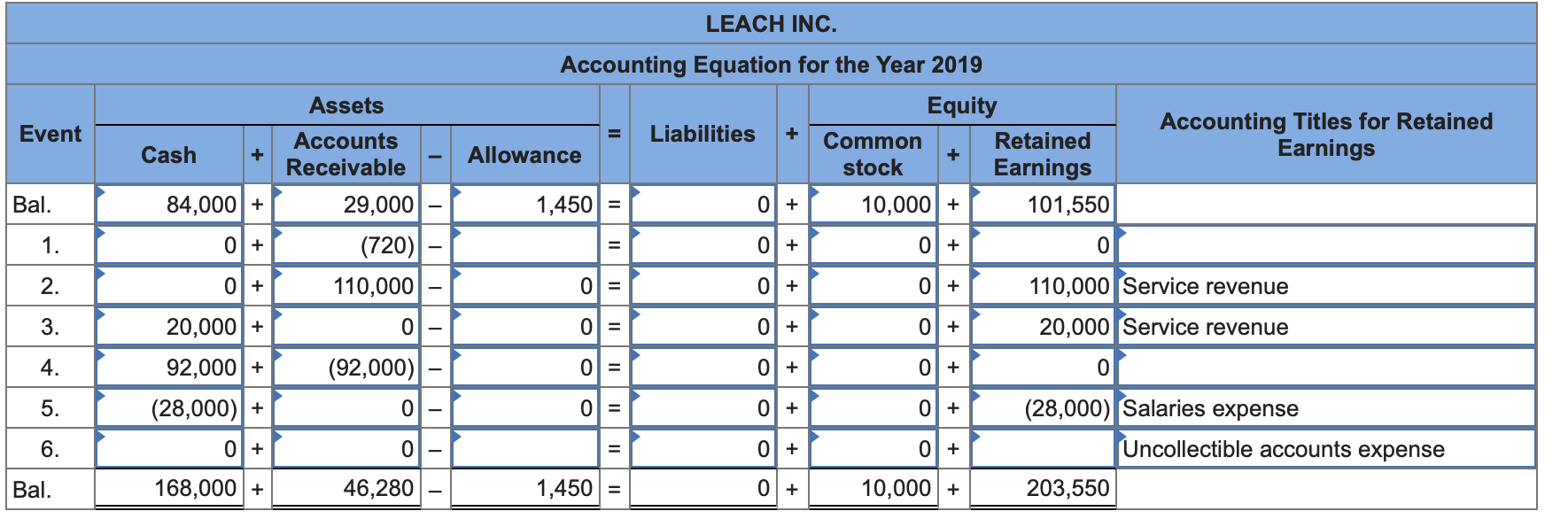

An estimate of the net realisable balance of accounts receivable can be reconciled by using information from the cash collections schedule: Accounts receivable are classified as an asset because they provide value to your company. In the preceding journal entry, the debit to accounts receivable increases its account balance from $242,000 to $290,000.

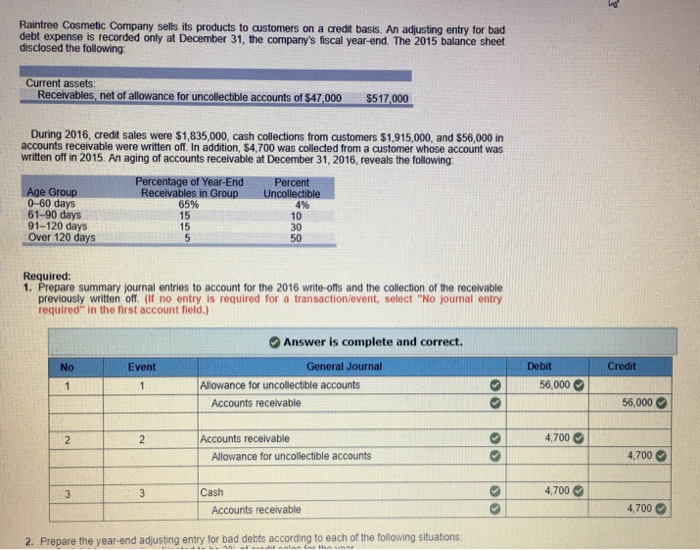

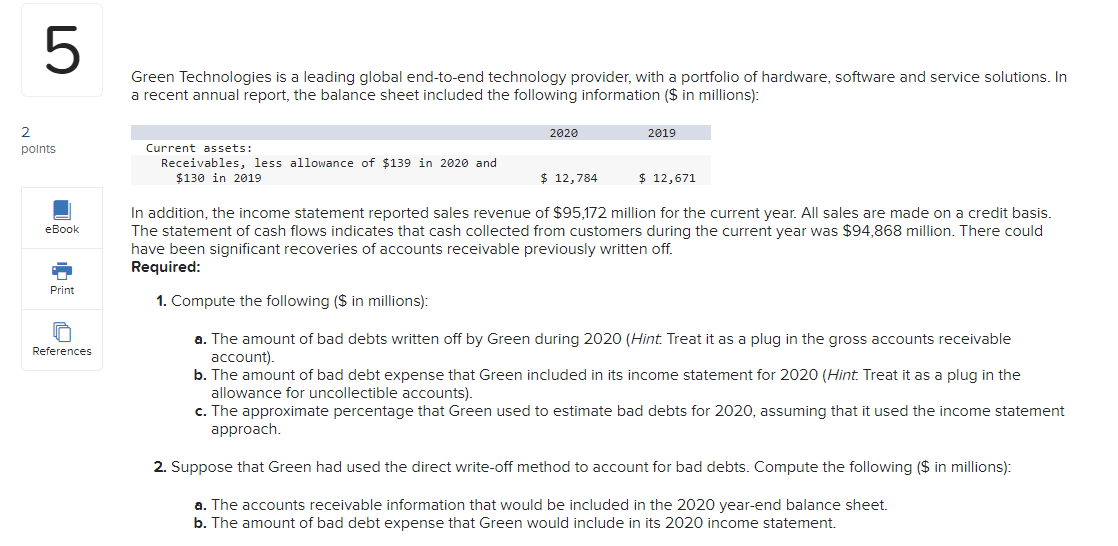

9.4 discuss the role of accounting for receivables in earnings management; After accounts are adjusted at the end of the fiscal year, accounts receivable has a balance of $475,000 and allowance for doubtful accounts has a. Cash collection formula.

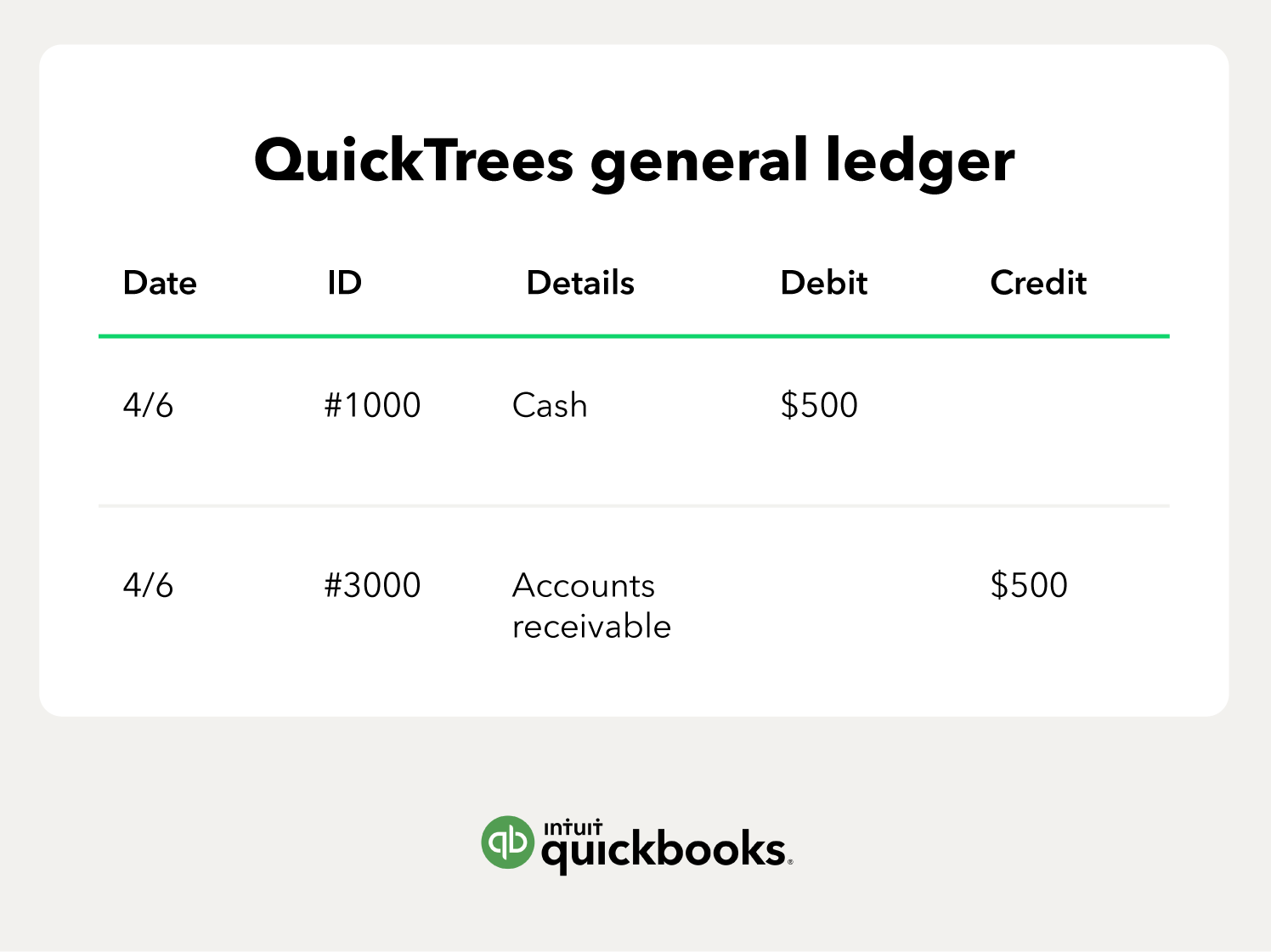

The money owed from customers that paid using credit. Increase assets and decrease assets. Select the amount listed for the accounts receivable (a/r).

When you sell on credit, you give the customer an invoice and don’t collect cash at the point of sale. Gst receivable occurs whe. #cadeveshthakur on instagram: Accounts receivable is the amount of credit sales that are not collected in cash.

On a company’s balance sheet, accounts receivable are the money owed to that company by entities outside of the company. Accounts receivable (ar) is an asset account on the balance sheet that represents money due to a company in the short term. It belongs under “cash” on the balance sheet, and is then called a “marketable security.” land and buildings.

Cash collected on accounts receivable would produce what effect on the balance sheet? (in this case, in the form of a future cash payment.) How would cash collected on accounts receivable affect the balance sheet?

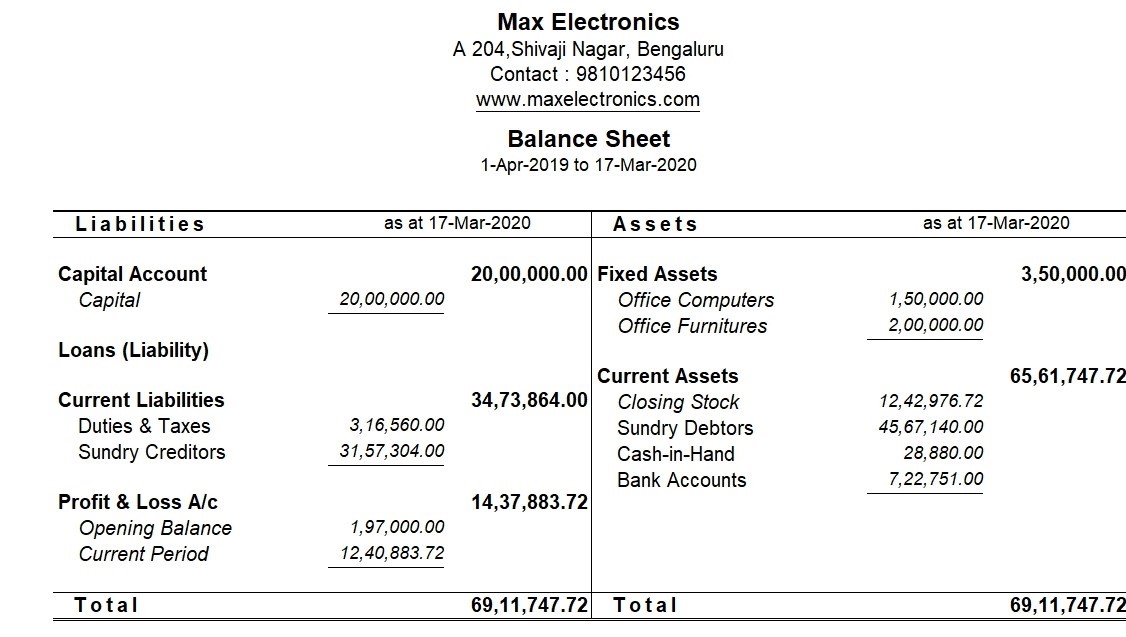

Investors want and gaap requires that the amount on the balance sheet must be reported at net realizable value. 9.3 determine the efficiency of receivables management using financial ratios; Its a/r balance decreases, while.

Where does accounts receivable go: Gst receivable occurs when the taxpayer has excess input tax credit in either of the. Review transaction reports.