Breathtaking Tips About Bank Loan In Balance Sheet Format Of Accounting Equation

For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it.

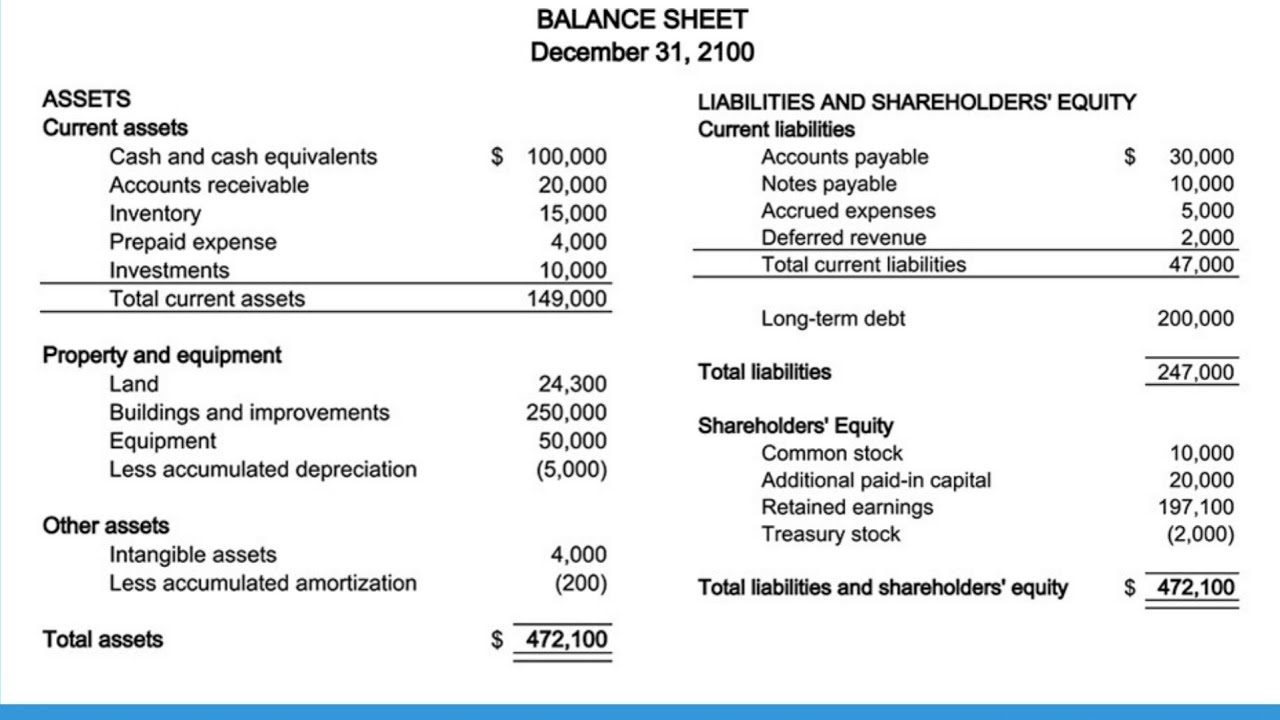

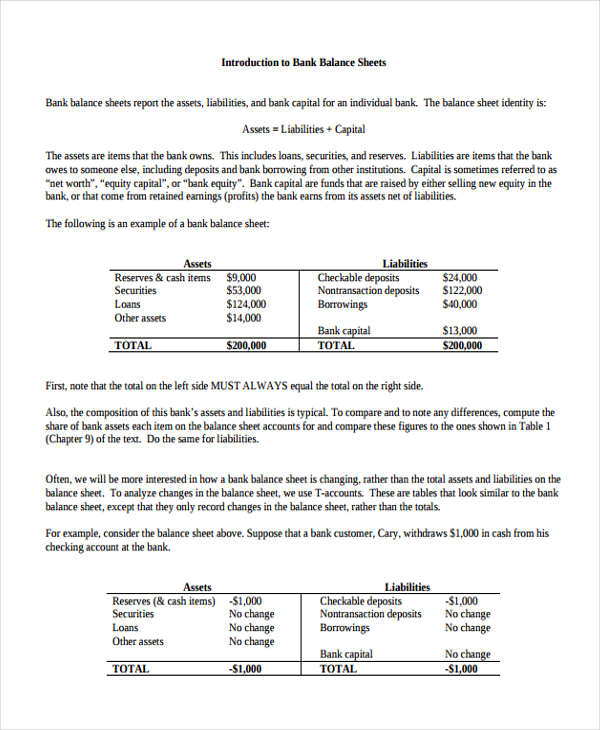

Bank loan in balance sheet format of accounting equation. The balance sheet equation is as follows: Assets = liabilities + owners’ equity the formula can also be rearranged like so: These are the resources owned by an entity, whether tangible or intangible.

The balance sheet equation looks like this. What is the balance sheet formula? Usually, the balance sheet is prepared from a trial balance.

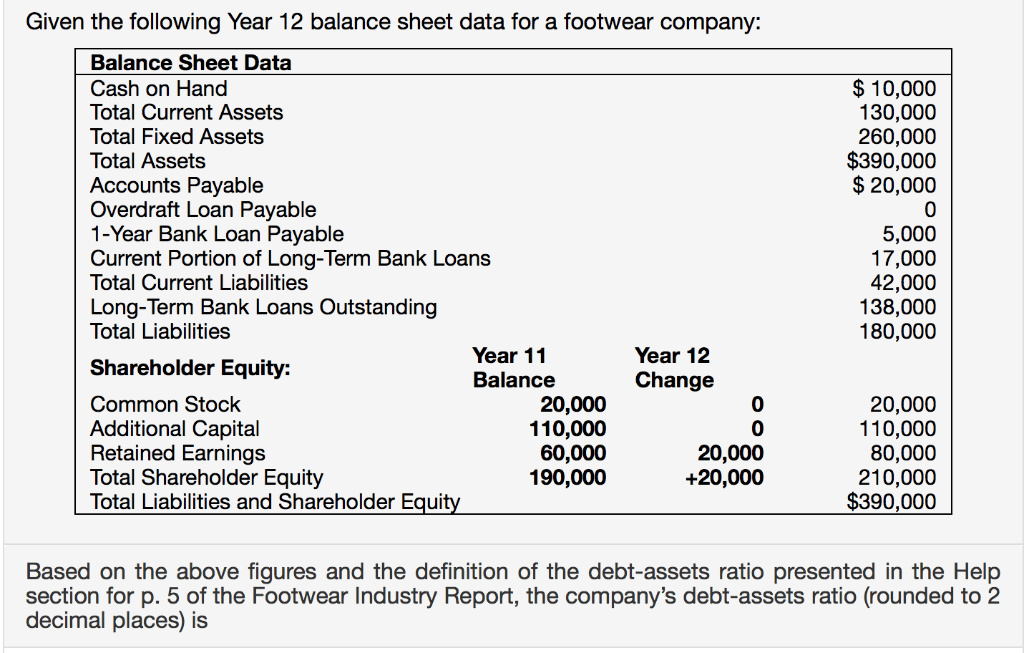

A typical balance sheet consists of the core accounting equation, assets equal liabilities plus equity. Assets = liabilities + shareholders’ equity. The transaction balances because there is an increase of $50,000 on both sides of the equation.

Asset = liabilities + equity ( logic every asset is financed by debt or equity) the universal equation helps financial professionals, business owners, and investors understand, compare, and make investment decisions. Parts of the balance sheet equation. Your balance sheet is a financial statement that tracks your company’s finances.

The balance sheet equation. Total assets = total liabilities + total. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

Assets = capital + liabilities in the aforementioned example, total assets of the company increased by a hundred thousand and simultaneously their liabilities grew by the same amount. However, both items are differentiated based on the nature of liability, repayment system, and loan tenure. In this article, we will learn how to prepare balance sheet and profit & loss account.

Assets = liabilities + equity. The three components of the equation will now be described in further detail in the following sections. The balance sheet equation forms the building blocks for the entire double entry accounting system.

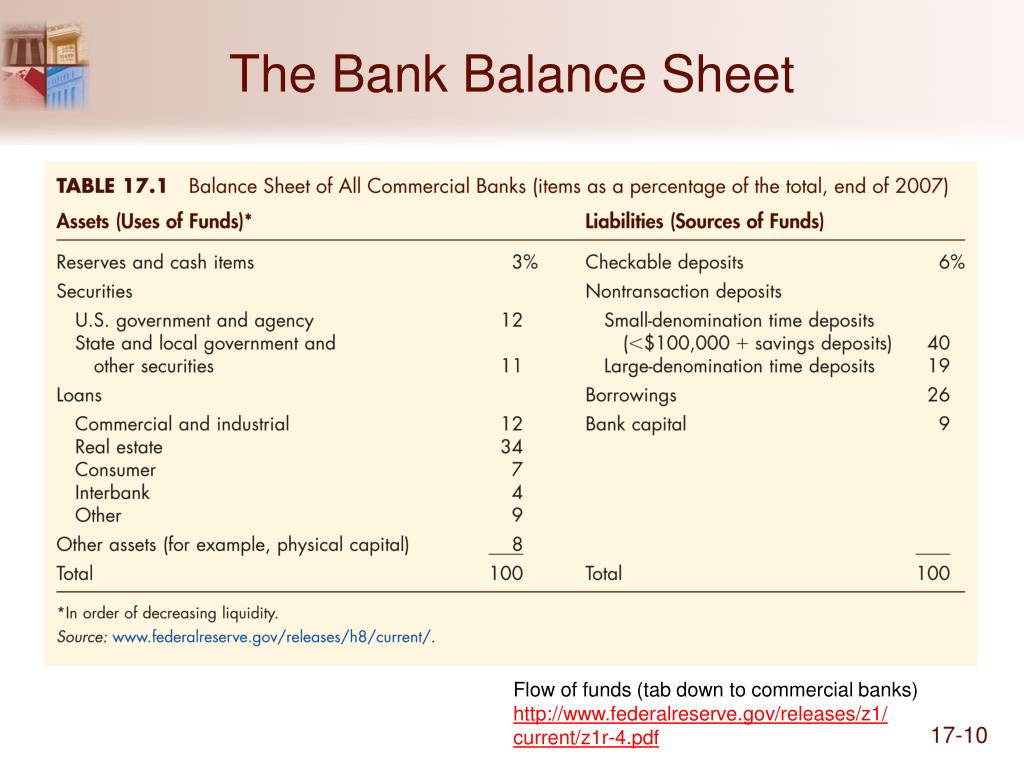

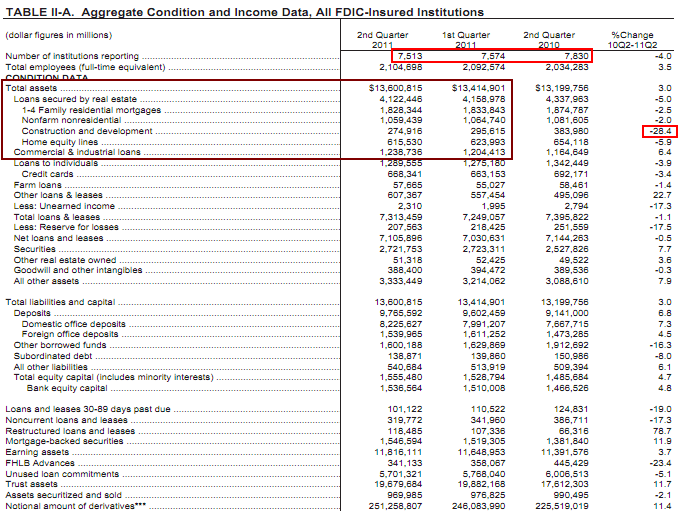

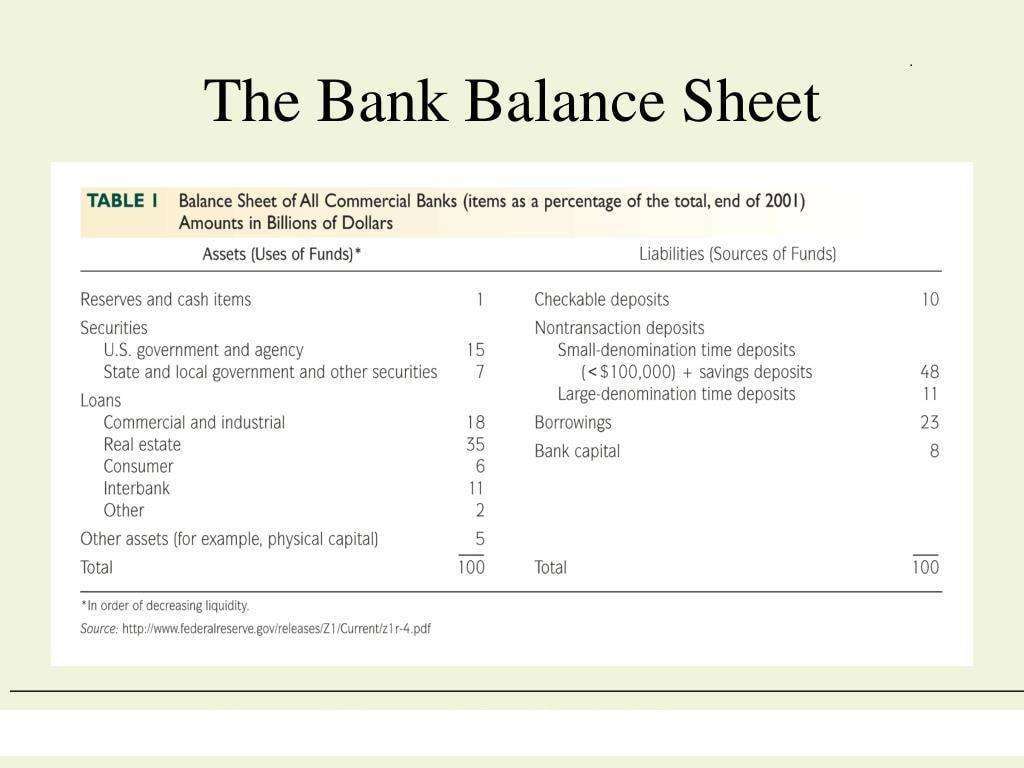

Assets = liabilities + shareholder’s equity. Assets = liabilities + equity the above equation means that at any point in time, a business’s assets should be equal to its liabilities and equity. Loan to deposit = total loans / total deposits a high ldr means a bank has a relatively higher amount of capital in loans than deposits.

The balance sheet equation or accounting equation is the most basic, fundamental part of accounting. A balance sheet is calculated by balancing a company's assets with its liabilities and equity. Assets are any items of value.

This transaction increases cash by $5,000 on asset side and creates a “bank loan” liability of $5,000 on equity side. The accounting equation shows on a company's balance sheet that a company's total assets are equal to the sum of the company's liabilities and shareholders' equity. Before you use the accounting equation, you need to know the parts of the balance sheet used in the equation.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)