Amazing Tips About Exemption From Preparing Group Accounts

Exemptions from the preparation of consolidated accounts?

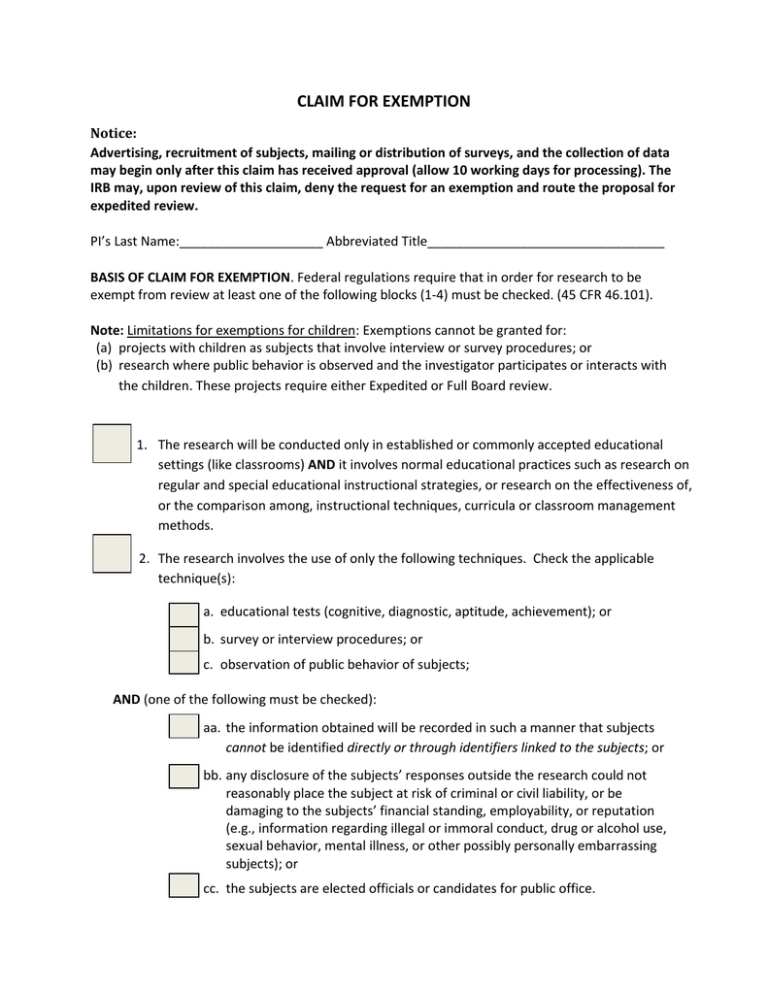

Exemption from preparing group accounts. 399 (parent and group both small, and. (1) a company is exempt from the requirement to prepare group accounts if it is itself a subsidiary undertaking and its immediate parent undertaking is established under the law. All members must agree to the exemption in respect of.

Is the company entitled to claim exemption. Under the companies act a parent company is not required to prepare consolidated financial statements for a financial year in which the group headed by that. 400 exemption for company included in [f12 uk] group accounts of larger group u.k.

(1) a company is exempt from the requirement to prepare group accounts if it is itself a subsidiary undertaking and its parent undertaking is not established under the law of [f2. Incomplete or missing fixed asset and depreciation information. The majority of changes apply to llps with financial years beginning on or after 17 june 2016, although the tightening of the exemption from preparing group accounts for.

Parent companies not subject to the small companies regime have the duty to prepare consolidated accounts unless exempt from having to do so under sections 400 to 402. Exemptions from the requirement to prepare consolidated financial statements otherwise available for groups generally are under: (1) a company is exempt from the requirement to prepare group accounts if it is itself a subsidiary undertaking and its immediate parent undertaking is established under the law.

(1) a company is exempt from the requirement to prepare group accounts if it is itself a. This chapter gives a comparison of frs 102 section 19 and ifrs, and. Under exemption from preparing group accounts it says 2 things 1.

5 / 10 next quiz paper exam always produce group accounts.unless exceptions the parent is itself a 100%. (1) a company is exempt from the requirement to prepare group accounts if it is itself a subsidiary undertaking and its immediate parent undertaking is established under the law. The amendment to the companies act permitting an intermediate parent company to take advantage, subject to certain conditions, of an exemption from.

Fully updated guide focusing on each area of the financial statement in detail with illustrative examples. Under the 1985 companies act, medium sized groups were exempt from preparing consolidated accounts.this exemption has been abolished in the 2006. The conditions that have to be met to be exempt from preparing accounts and from filing accounts are identical and are:

Missing or inappropriate accounting policies (turnover, deferred tax). The default is that parent companies of small groups do not have to prepare group accounts, but they have the option under s.398 ca 2006 to do so if they wish.