Cool Tips About Consolidation In Forex Meaning

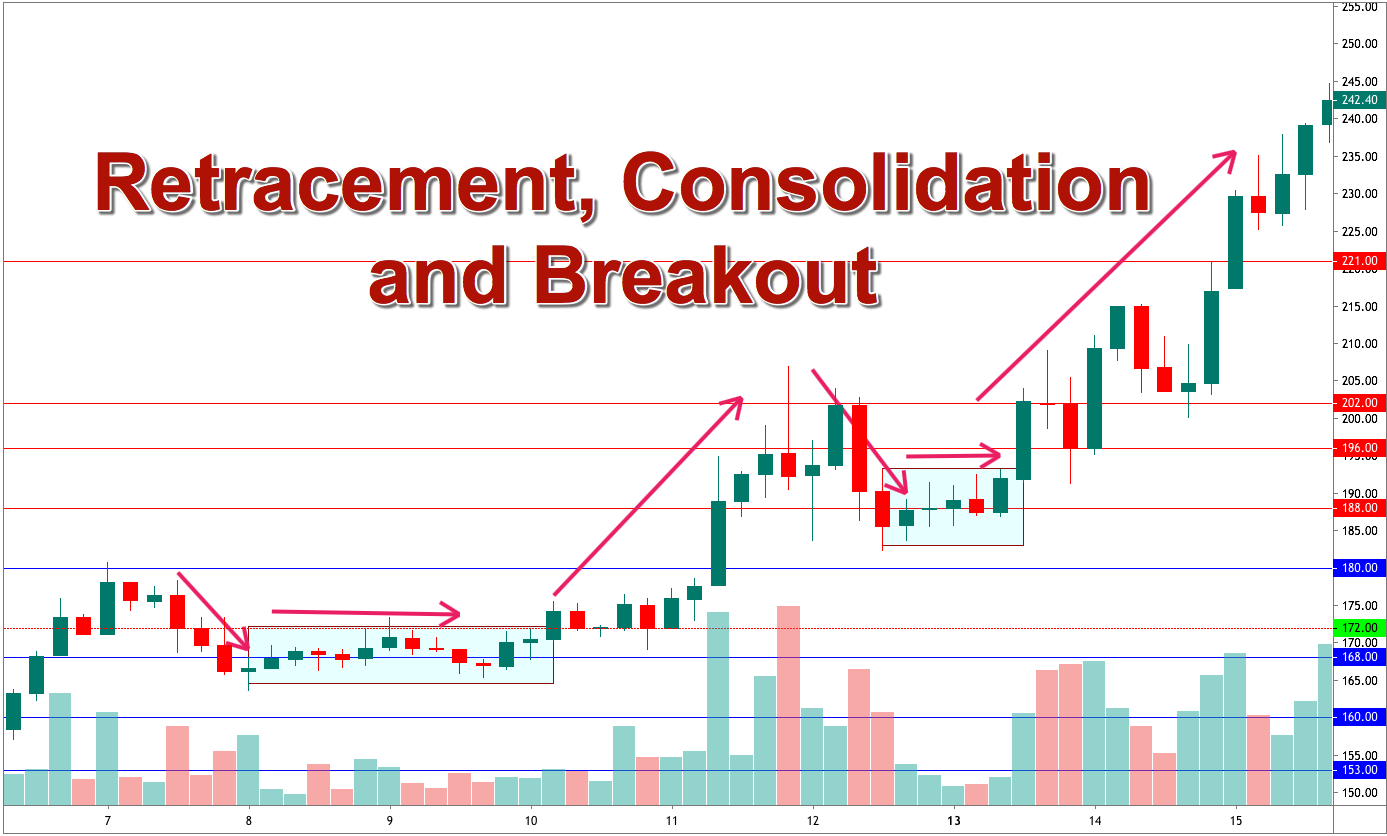

The simplest way to describe a consolidation is a period in the market where price moves sideways rather than predominately up or down, such as in a trend, for.

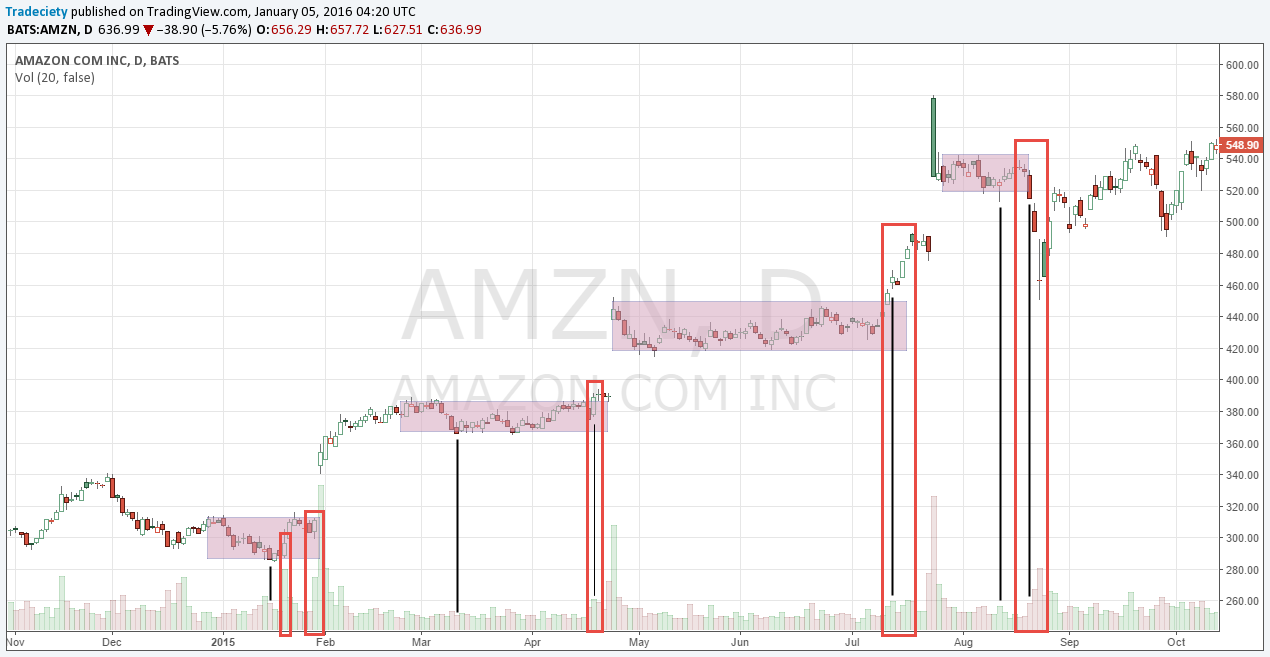

Consolidation in forex meaning. Instead, its price is only experiencing rangebound price activity. There are different consolidation patterns as we will see. Consolidation patterns can provide valuable insights into market trends and help traders make informed decisions.

It frequently occurs after downtrends or uptrends and can be seen as a. Consolidation is a common pattern in forex trading that occurs when the price of a currency pair moves within a relatively narrow range for an extended period. Consolidations happen either during trending market phases or before a new trend.

Price has “ consolidated “. The relative strength index (rsi) is another popular technical indicator that can be used to identify consolidation. Among the arsenal of tools available to analyze price trends, consolidation patterns stand out as intriguing and powerful indicators.

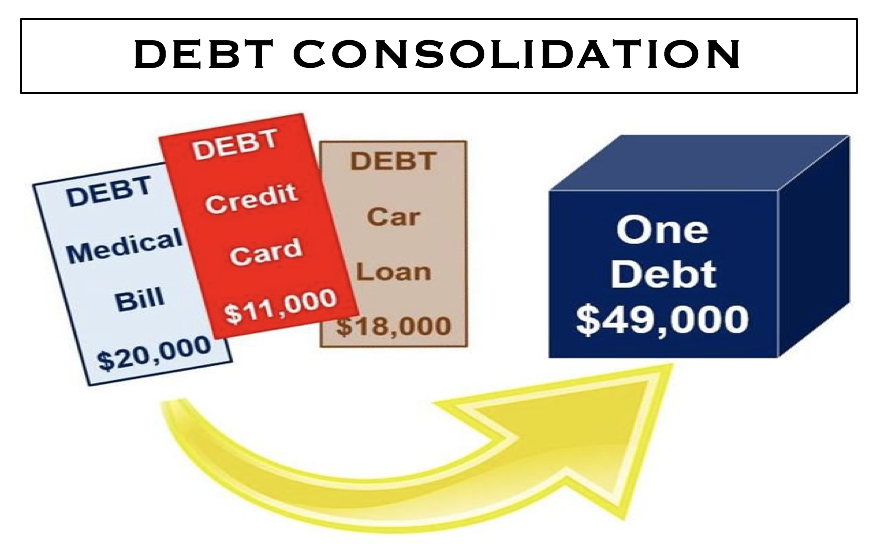

What is a consolidation pattern? One of the most common causes is the absence of any significant news or. Consolidation is a common term used in the forex market to describe a phase where the price of a currency pair moves within a specific range.

Consolidation is a term used in forex trading to describe a period when the price of a currency pair remains within a specific range, without making any significant. There are a number of factors that can contribute to consolidation in the forex market. Consolidation illustrates the lack of a trend in a particular trading range.

The rsi measures the strength of a currency pair. Consolidation in forex refers to a period of time where the price of a currency pair moves within a defined range, without making significant. The consolidation pattern in forex is a chart pattern defined by sideways price movements within a range before a breakout in a new direction.