Outstanding Info About Typical Cash Flow Statement

A typical cash flow statement comprises three sections:

Typical cash flow statement. The cfs measures how well a. Free cash flow eur 423 million; Operating, investing and financing activities.

We will use these names interchangeably throughout our explanation, practice quiz, and other materials. Define “cash” and “cash equivalents.” identify the three categories of cash flows used for reporting purposes. A company's cash flow can be categorized as cash flows from operations, investing, and.

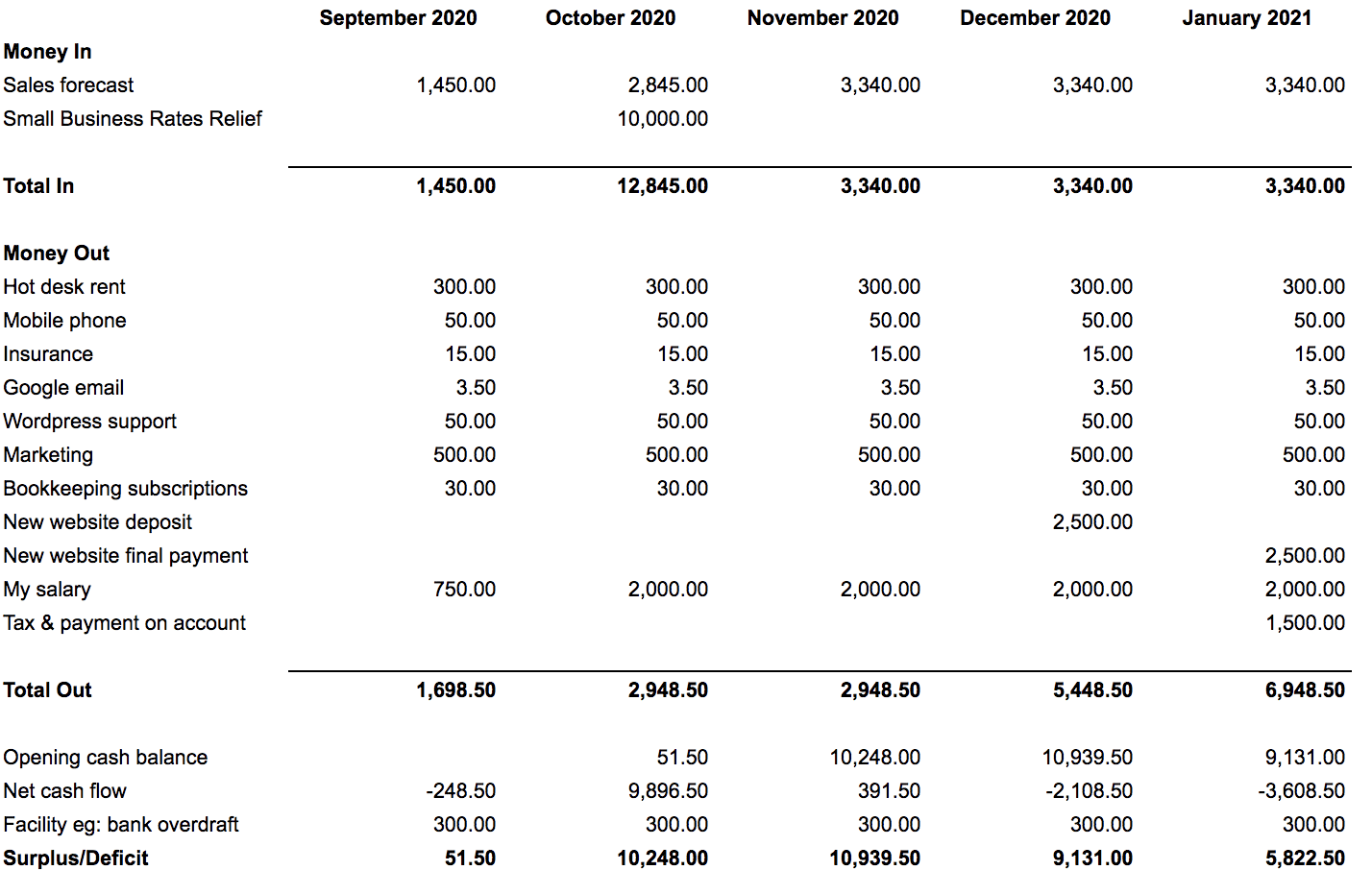

While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time. The cash flow statement is broken down into 3 parts The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business.

A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period. Sap s/4hana cloud for finance. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources.

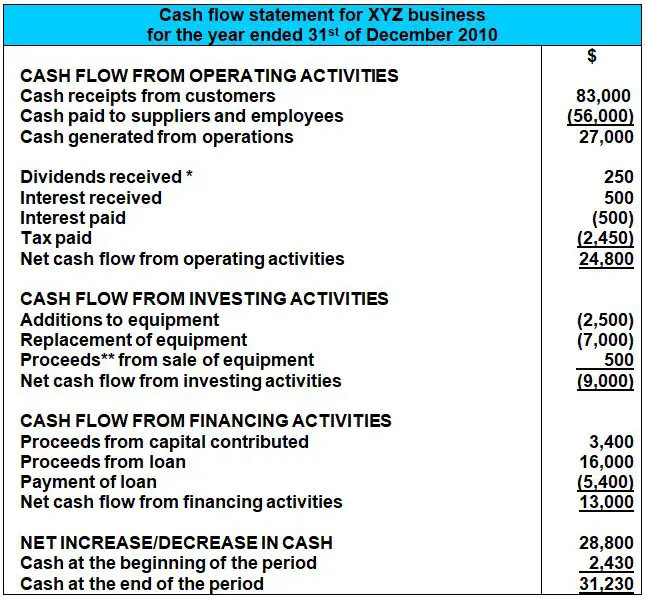

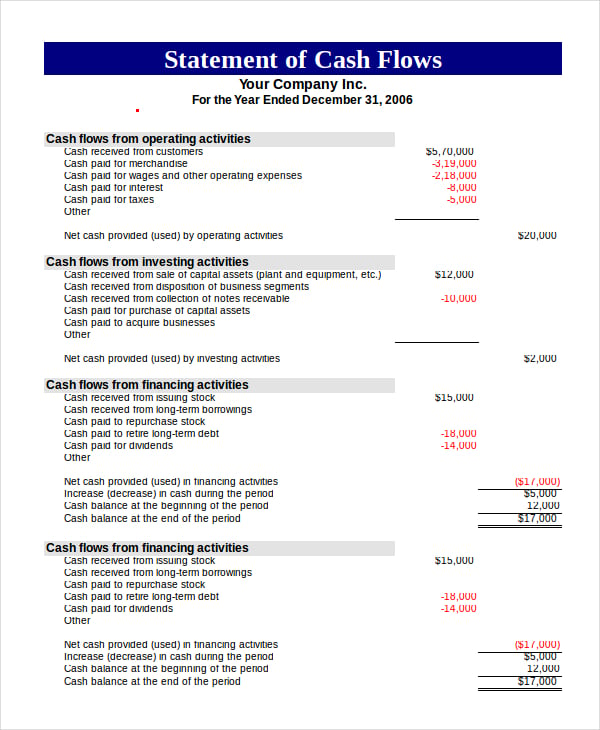

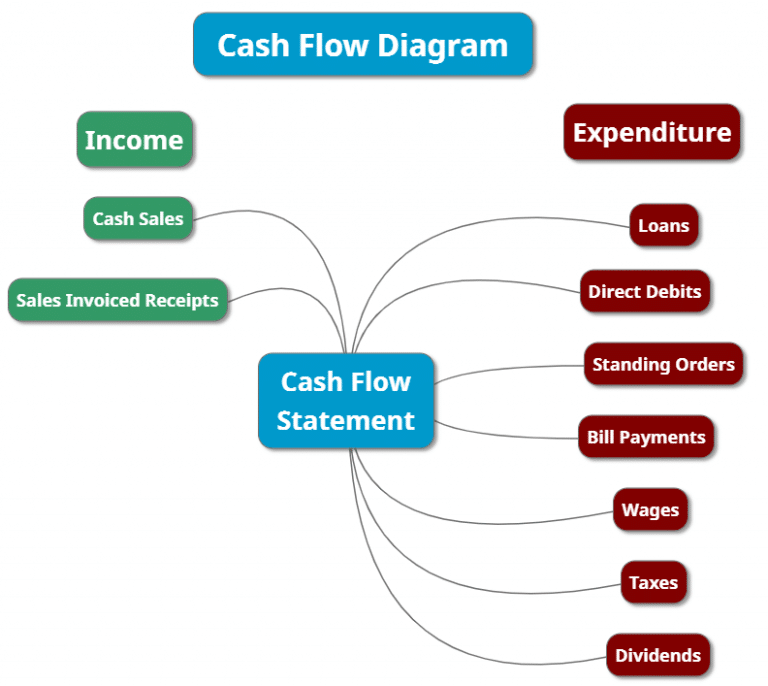

Describe the purpose of a statement of cash flows. A typical cash flow statement divides cash inflows and outflows into three main categories: Income statement and free cash flow.

A cash flow statement shows if you're earning more money than you're spending. It’s essential for evaluating a firm’s liquidity, identifying potential cash issues, and budgeting. The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf.

The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period. Indicate the type of transactions that are reported as operating activities and provide common examples. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

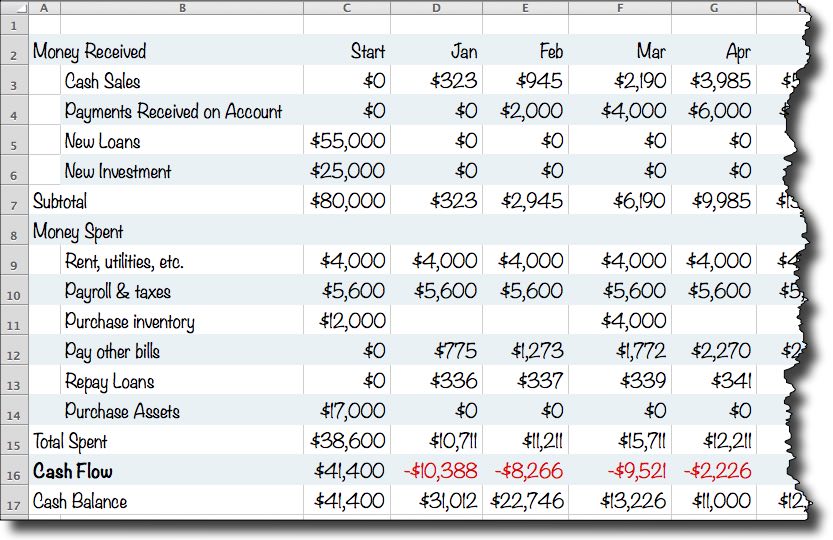

Basically, the document it gives you (and your investors) key insights into whether or not your business. Cash flows from operating activities Statement of cash flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the resulting cash balance at the end of the period.

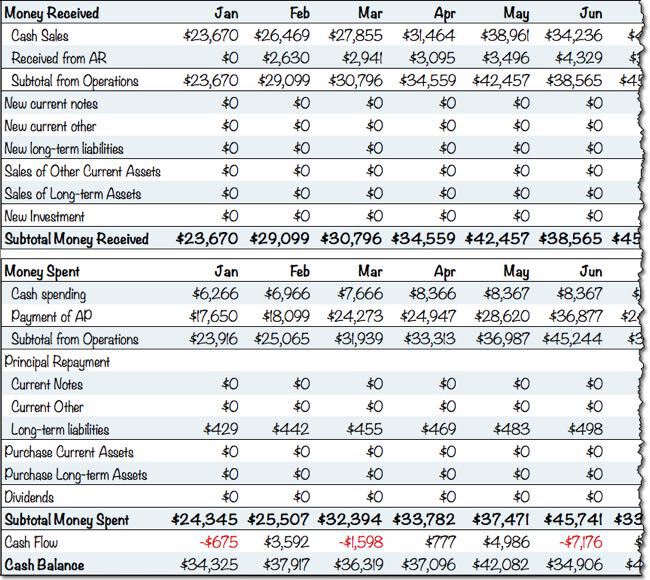

The three main components of a cash flow statement are cash flow from operations, cash flow from investing, and cash flow from financing. Used to show cash transactions over a specific period of time, usually monthly, quarterly, or annually, the cash flow statement includes cash and cash equivalents such as undeposited funds and checking and saving accounts, and shows if cash has come into the company, or has been paid out. The cash flow statement is a financial statement that reports a company's sources and use of cash over time.

Cash flow from operating activities cash flow from investing activities cash flow from financing activities let’s look at each of these areas in more detail. A cash flow statement is an important tool used to manage finances by tracking the cash flow for an organization. A cash flow statement is a crucial financial document that lists both your business's sources of cash and your business's expenses over a given time period.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)