Nice Tips About Changes In Retained Earnings

This information can be included in the income.

Changes in retained earnings. While the term may conjure up images of a bunch of suits gathering around a big table to talk about. In the next accounting cycle, the re ending balance from the previous accounting period will. January 2, 2022 6 minutes to read accounting & taxes retained earnings.

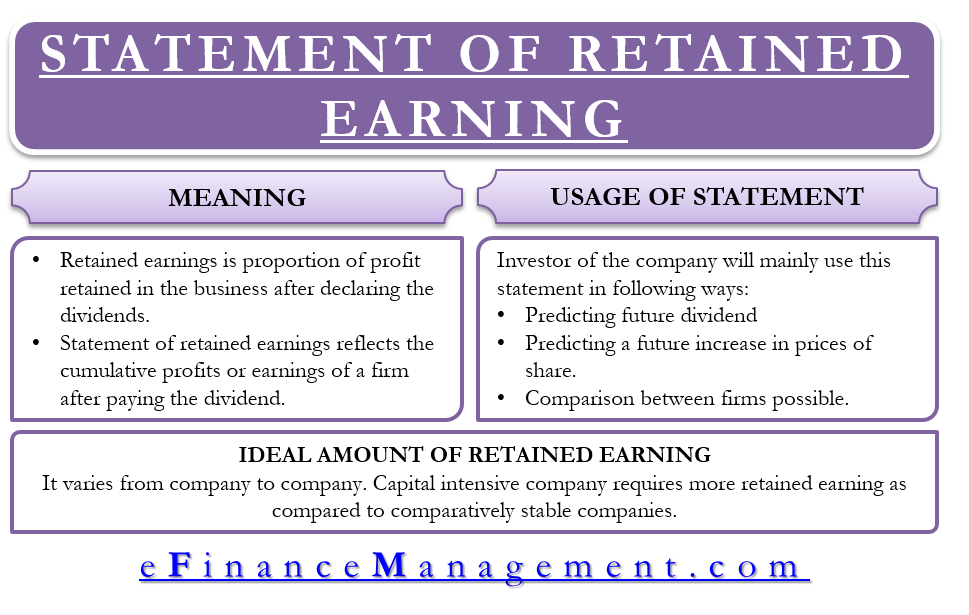

Ending retained earnings is at the bottom of the statement of changes to retained earnings which is only assembled after net income (the true bottom line) has. Understanding the composition and changes in retained earnings is vital for stakeholders to assess the company's financial performance and future prospects. Retained earnings is a critical financial metric that reveals the cumulative net earnings a company has retained over time, rather than distributed as dividends to.

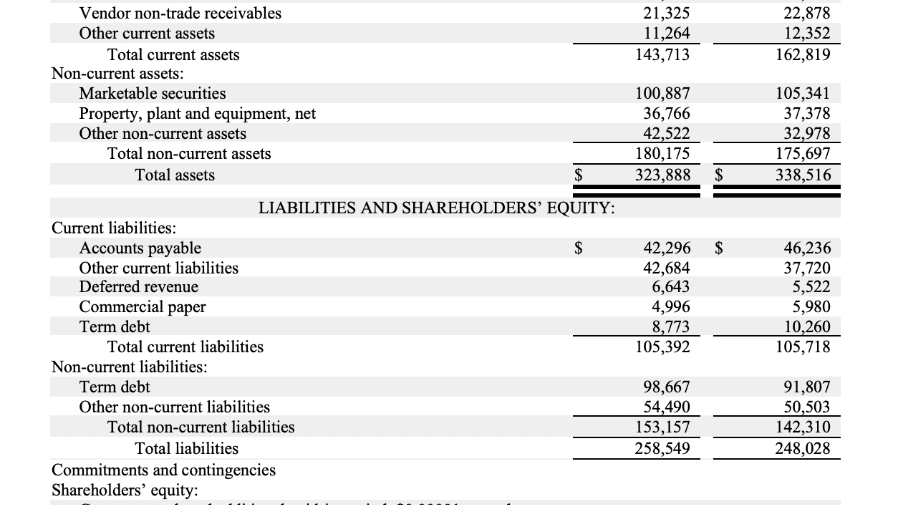

Retained earnings shows the company’s accumulated earnings (or deficit in the case of losses) less dividends. Changes in unappropriated retained earnings usually consist of the addition of net income (or deduction of net loss) and the deduction of dividends and appropriations. The retained earnings (also known as plowback [1]) of a corporation is the accumulated net income of the corporation that is retained by the corporation at a particular point of time,.

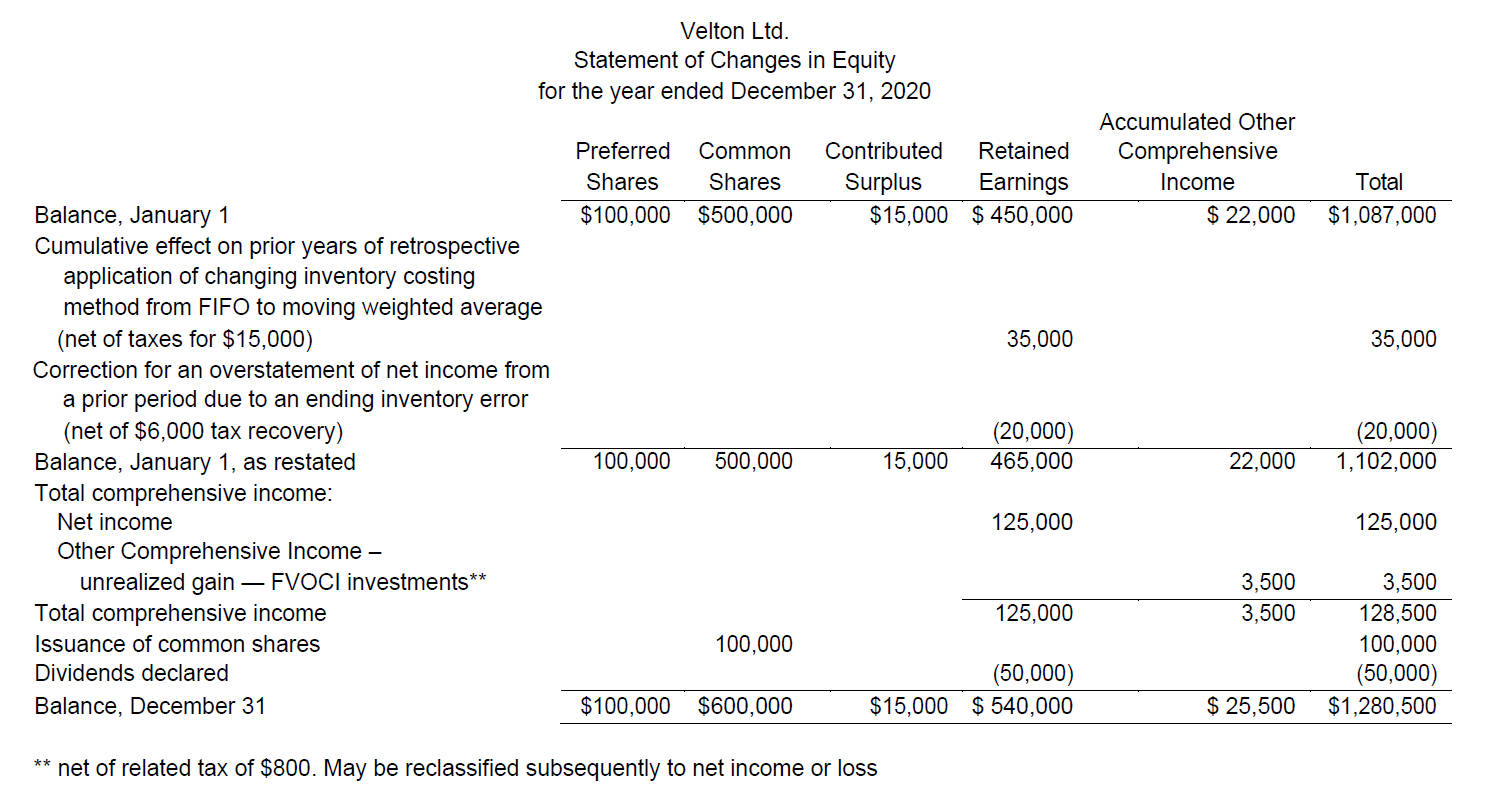

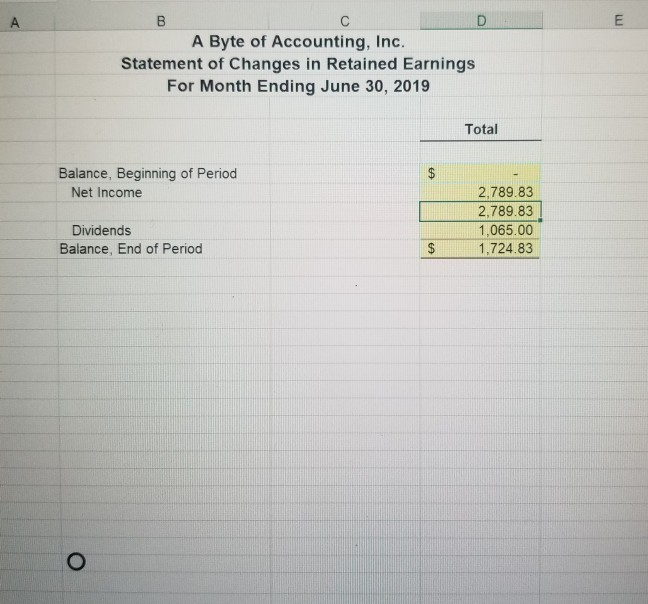

The statement of retained earnings reconciles changes in the retained earnings account during a. The statement of retained earnings is a financial statement that provides insights into the changes in a company’s retained earnings over a specific time period. Statement of changes in equity, often referred to as statement of retained earnings in u.s.

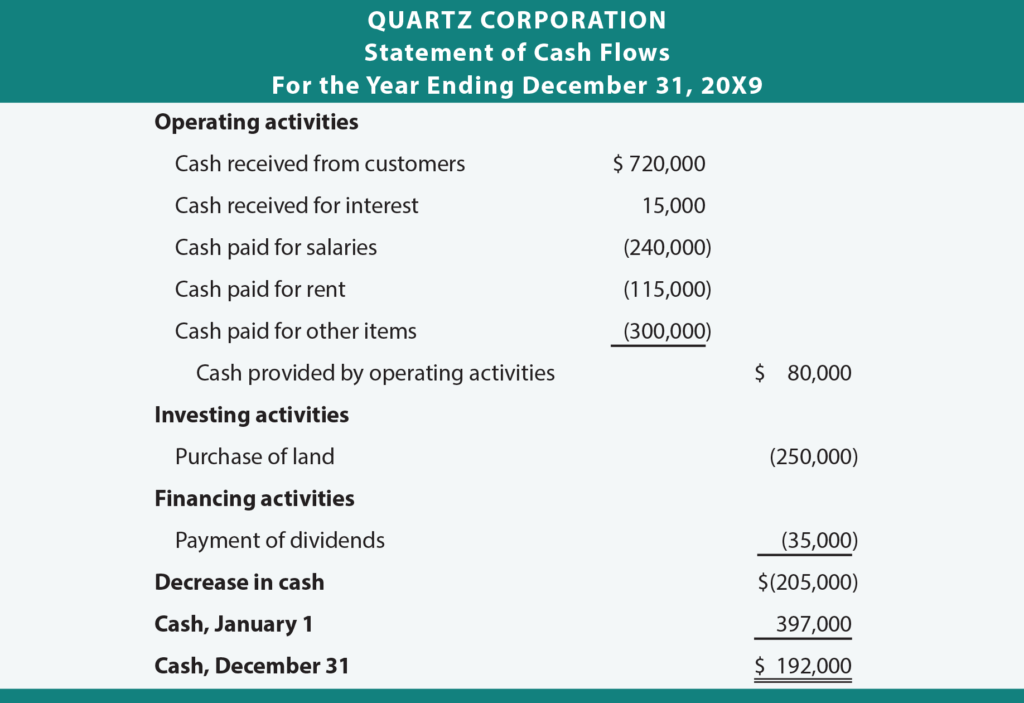

September 08, 2023 what is the statement of retained earnings? Financial analysis cont… today’s session is emphasizing. At the end of each accounting period, retained earnings are reported on the balance sheet as the accumulated income from the prior year (including the current year’s income), minus dividends paid to shareholders.

The changes in the re account are called “changes in retained earnings” and are presented in the financial statements. The statement of retained earnings provides an overview of the changes in a company’s retained earnings during a specific accounting cycle. Gaap, details the change in owners’ equity over an accounting period by.

The statement of retained earnings (retained earnings statement) is defined as a financial statement that outlines the changes in retained earnings for a. A statement of retained earnings details the changes in a company's retained earnings balance over a specific period, usually a year.

:max_bytes(150000):strip_icc()/statement-of-retained-earnings-final-8500839aff40433dba054ce0af9f9f42.png)