Unbelievable Tips About Balance Sheet Worksheet

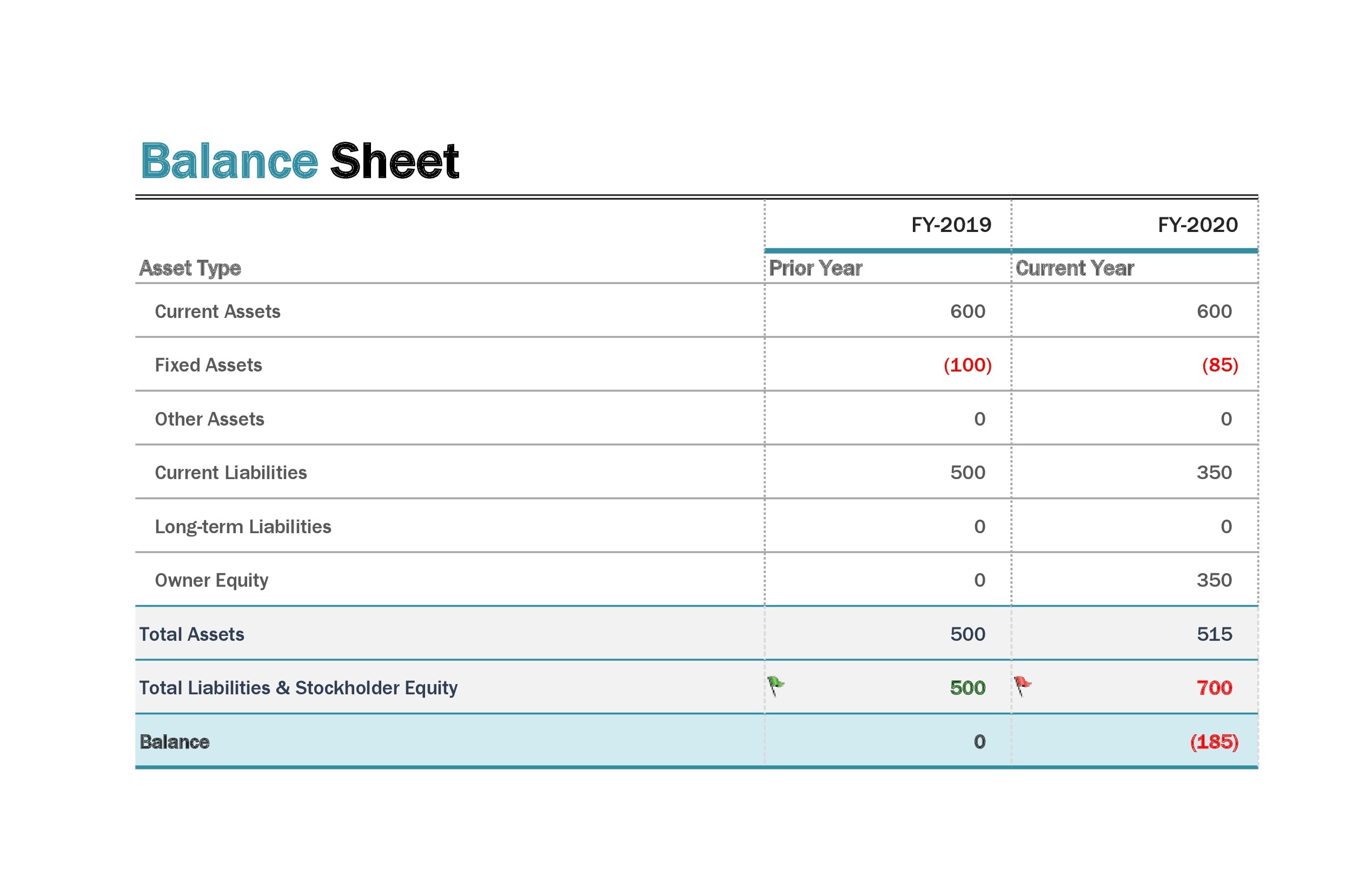

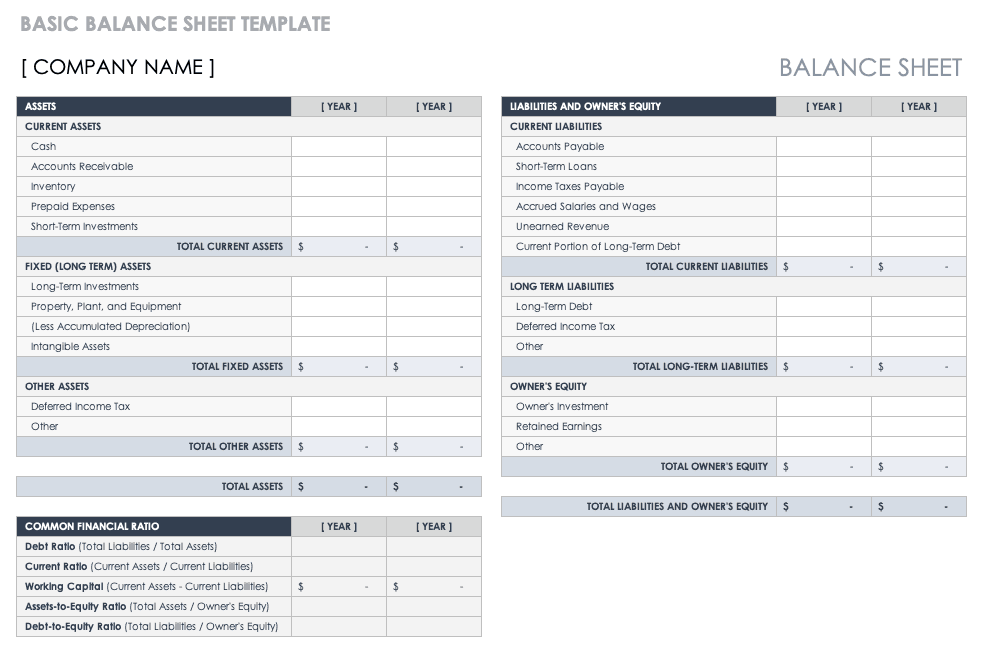

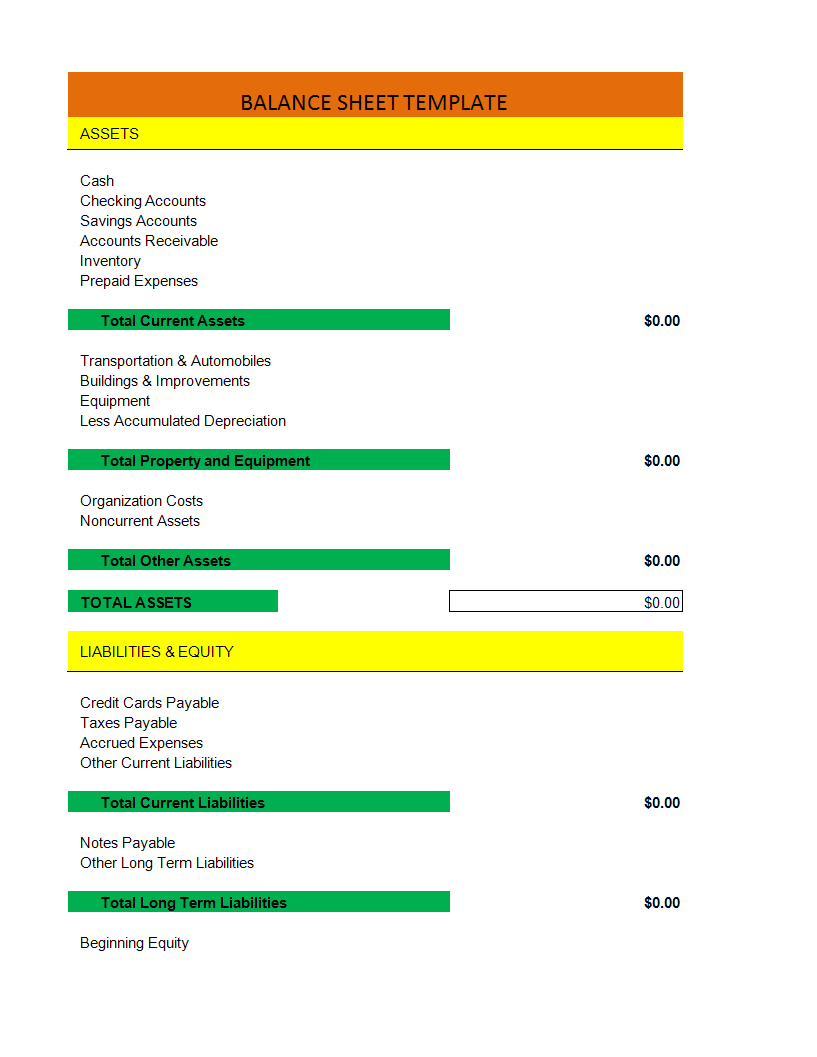

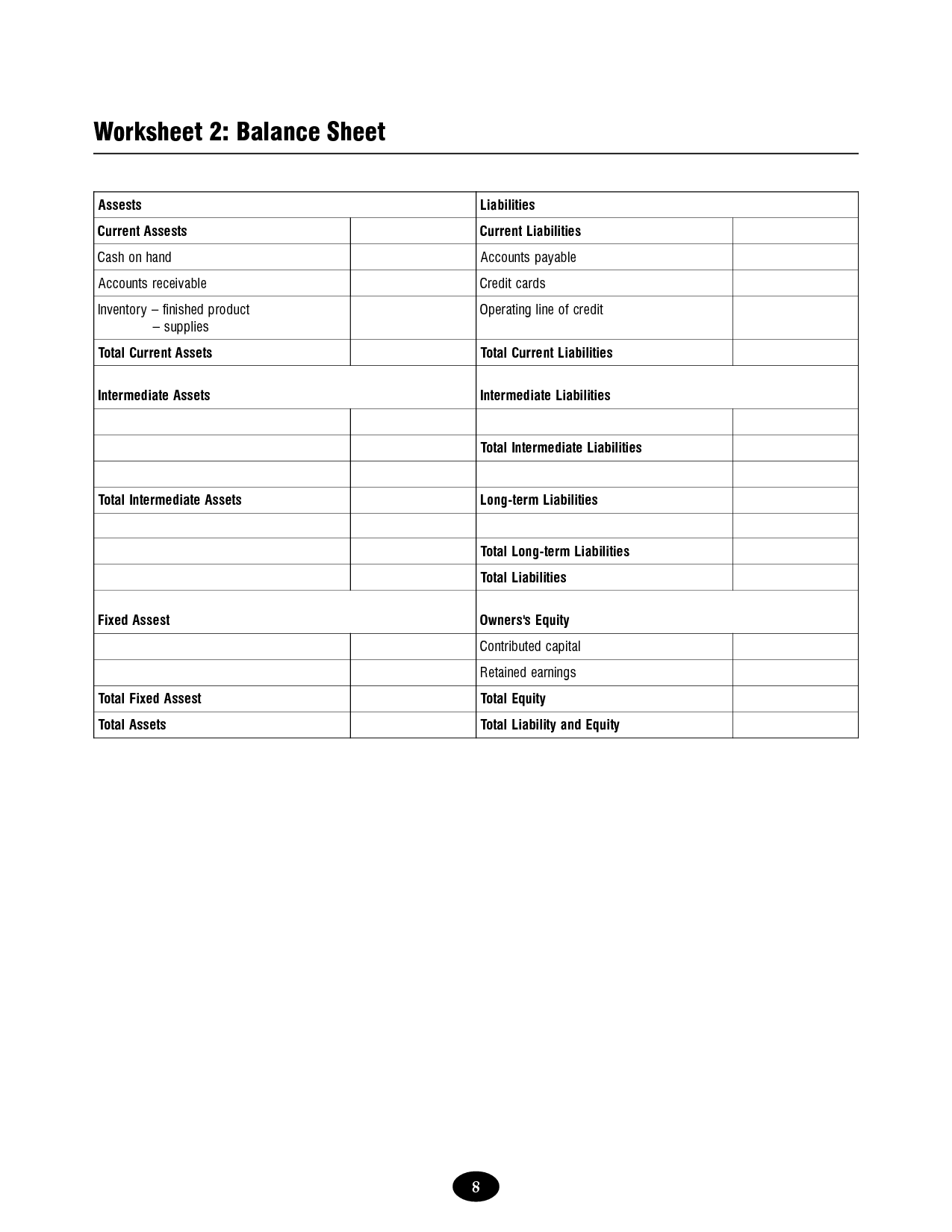

See below for more information on the different asset and liability categories.

Balance sheet worksheet. A balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health. A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date. Which of the following is a category, classification, or element of the balance sheet?

Your total assets and total liabilities are reflected in the balance field. While the balance sheet can be. Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date.the main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date.

It shows the balance between the company’s assets against the sum of its liabilities and shareholders’ equity — what it owns versus what it owes. Often, the reporting date will be the final day of the accounting period. Assets = liabilities + equity.

Assets = liabilities + equity. Key takeaways a balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. The balance sheet is based on the fundamental equation:

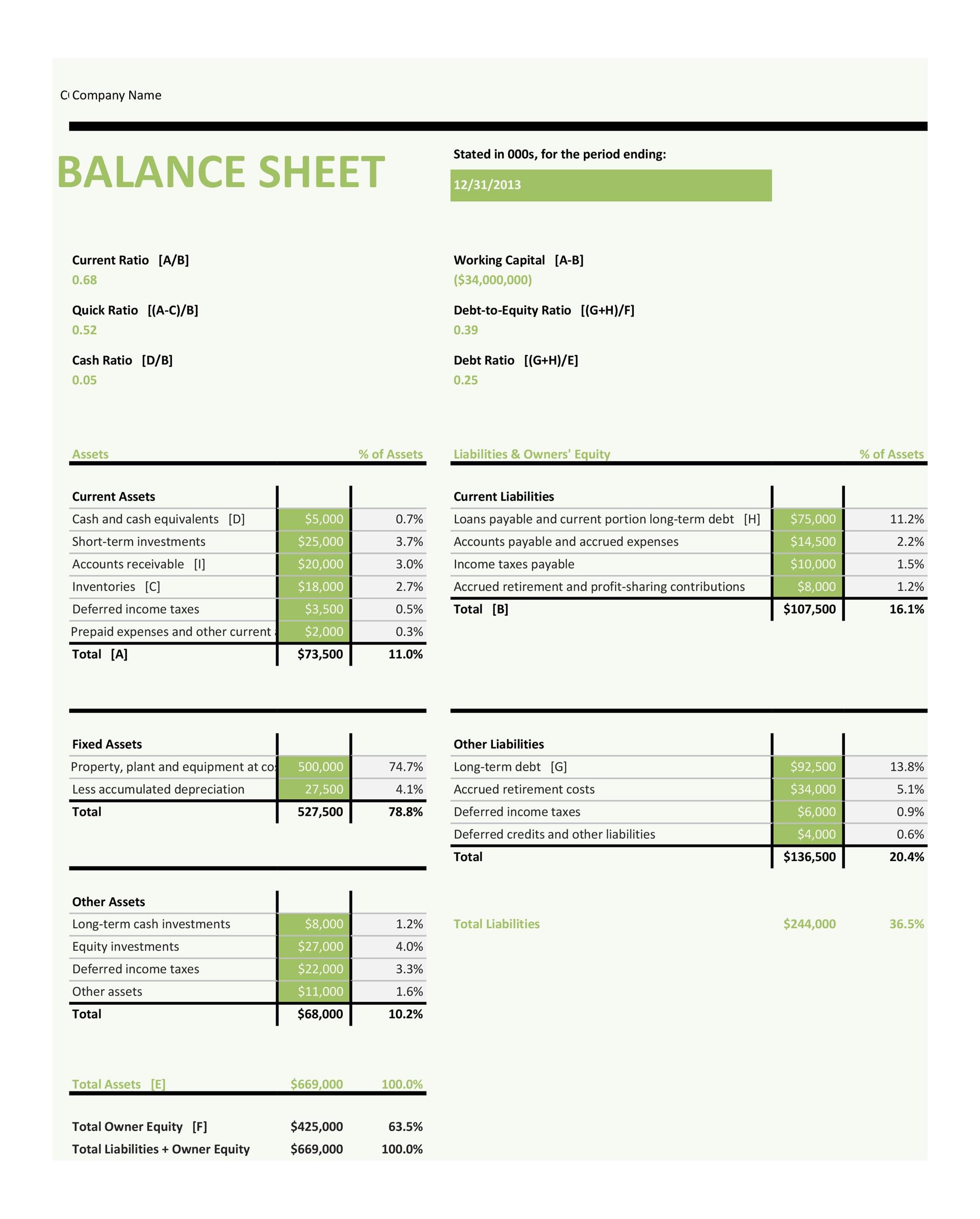

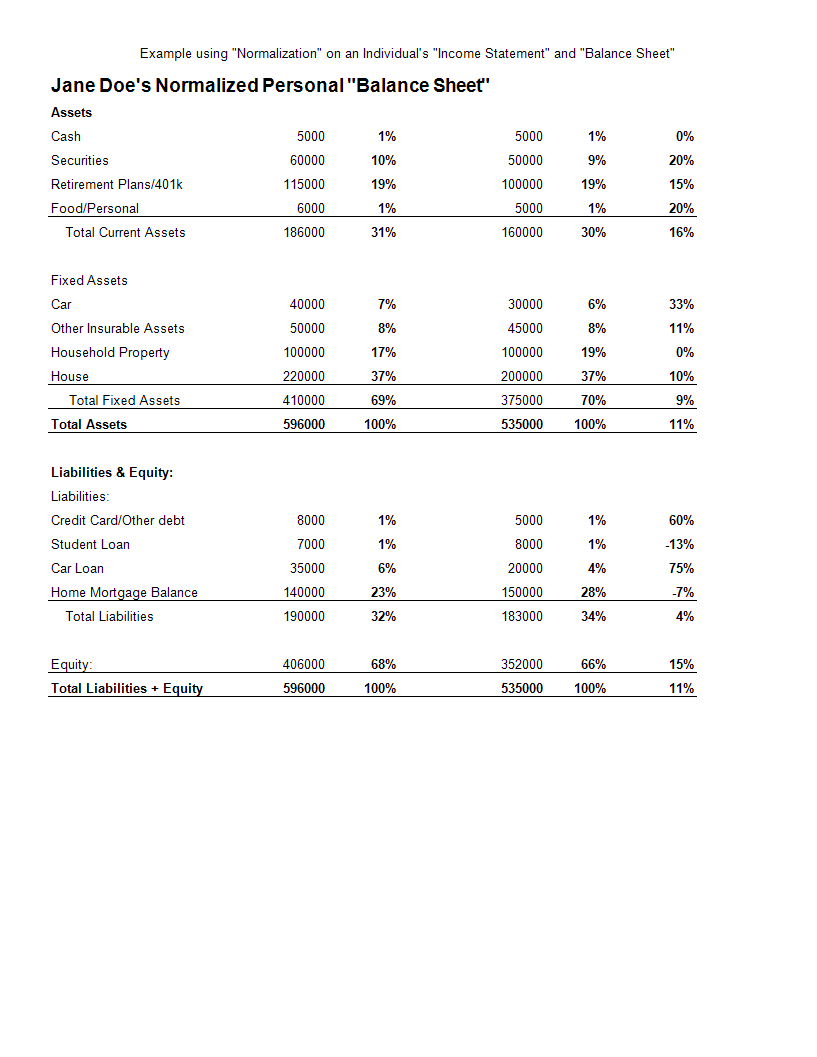

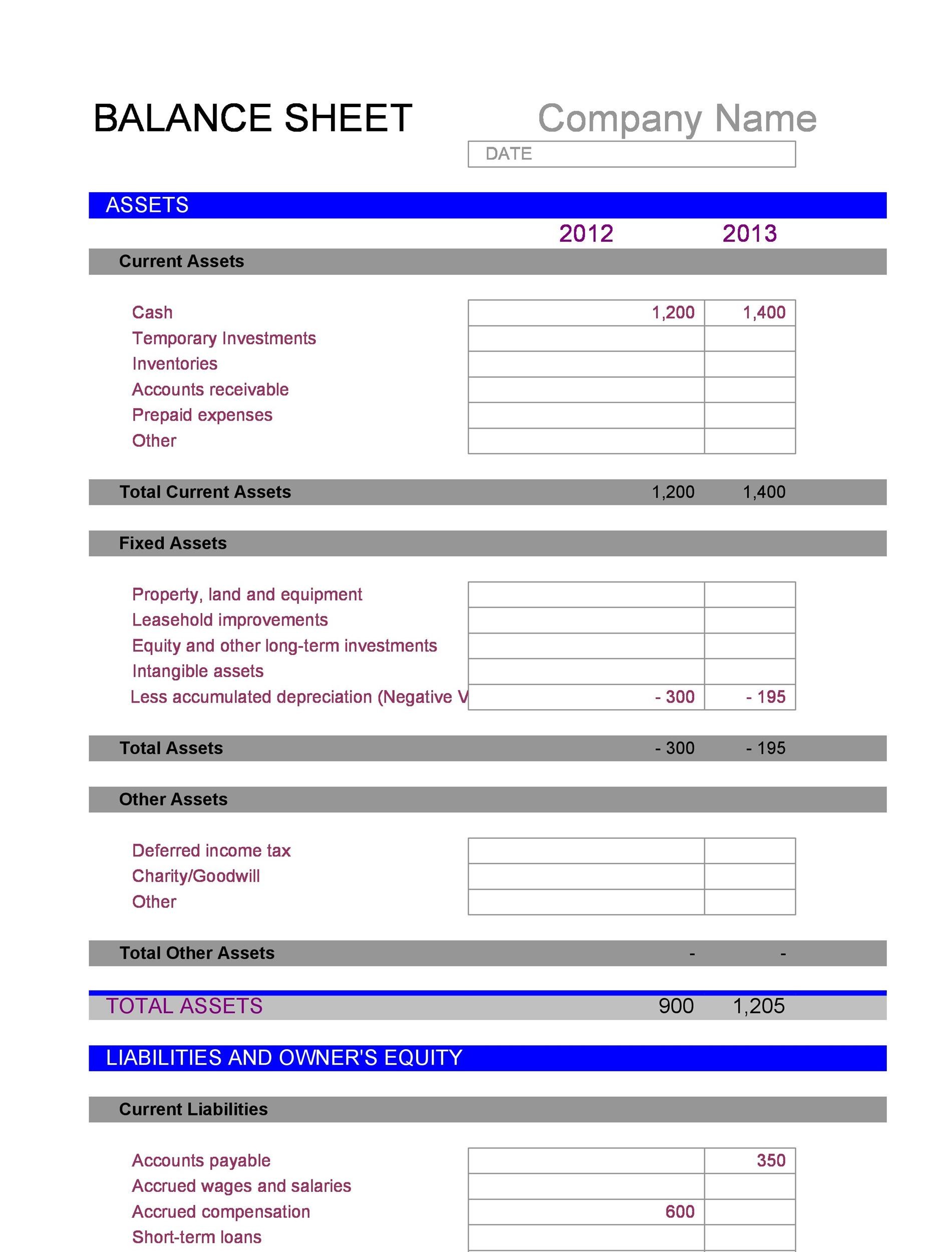

Learn about the format and calculations of a balance sheet in excel, read tips about excel balance sheets and view some faqs about creating a balance sheet. The ability to read and understand a balance sheet is a crucial skill for anyone involved in business, but it’s one that many people lack. Personal / finance / personal balance sheets 40 excel personal balance sheet templates (& examples) having a personal balance sheet template is a great way to keep track of everything you owe and own.

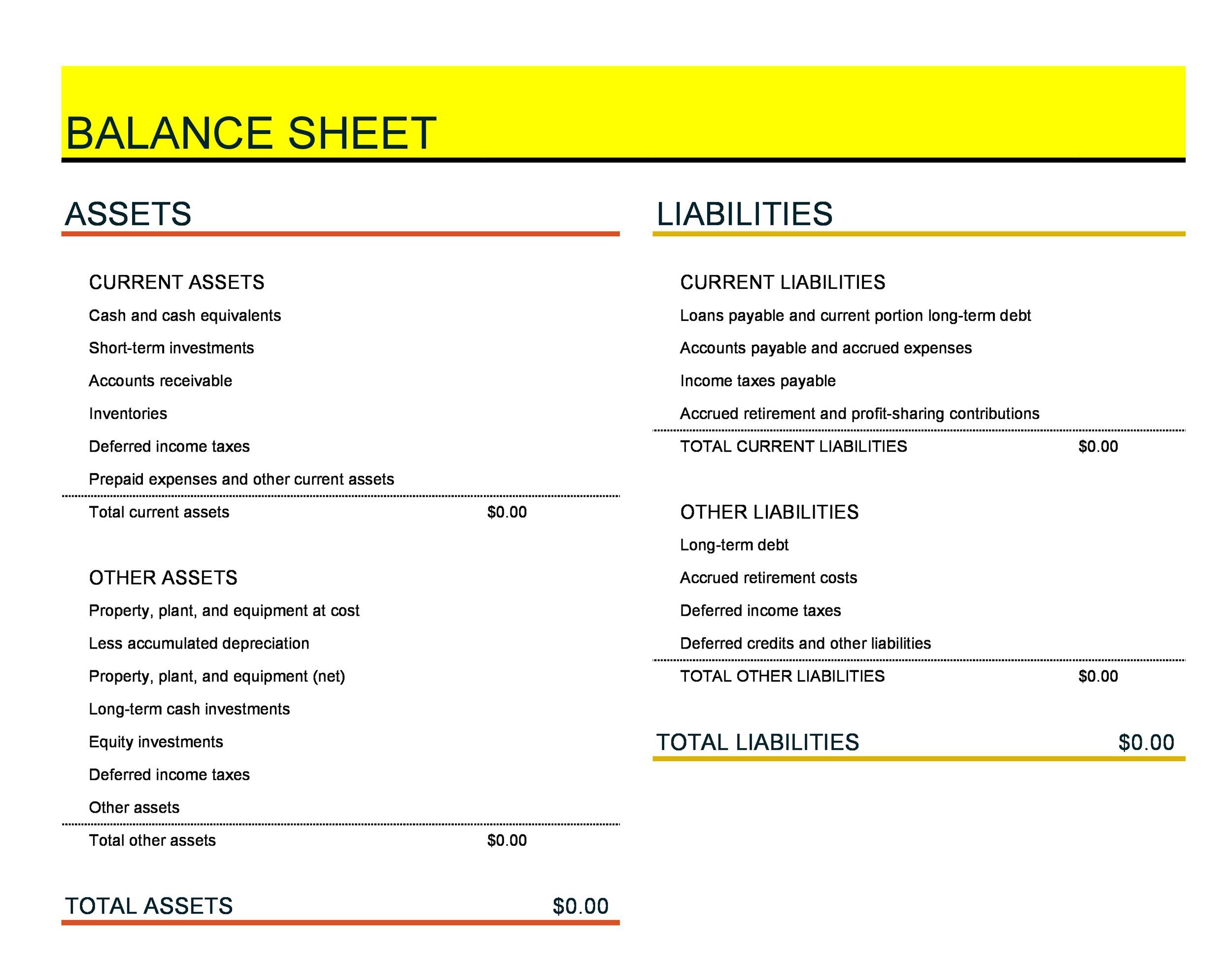

Choosing the excel balance sheet template is a great place to start, as it is a simple, straightforward and easily customizable company balance sheet. A balance sheet captures the net worth of a business at any given time. You pay for your company’s assets by either borrowing money (i.e.

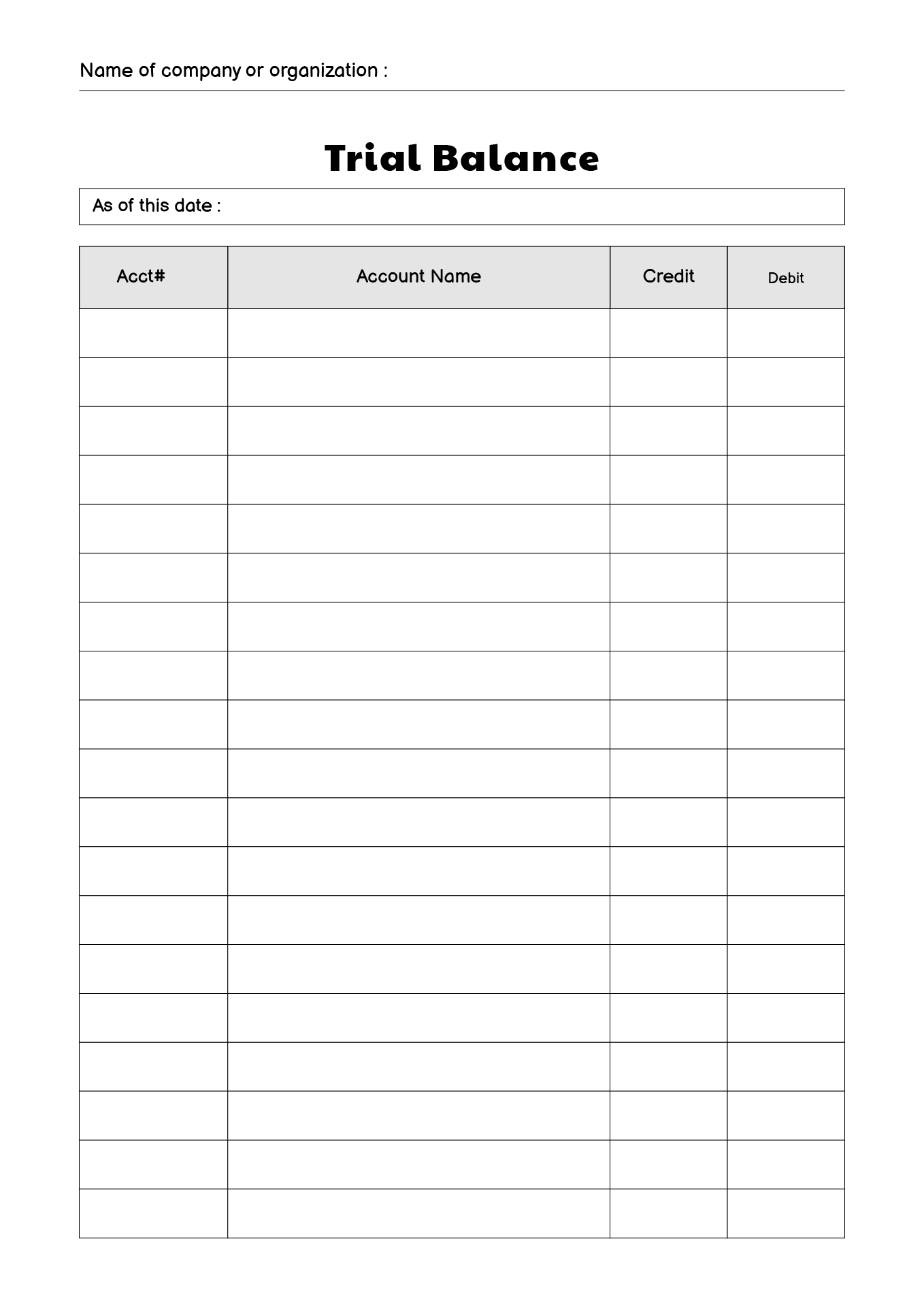

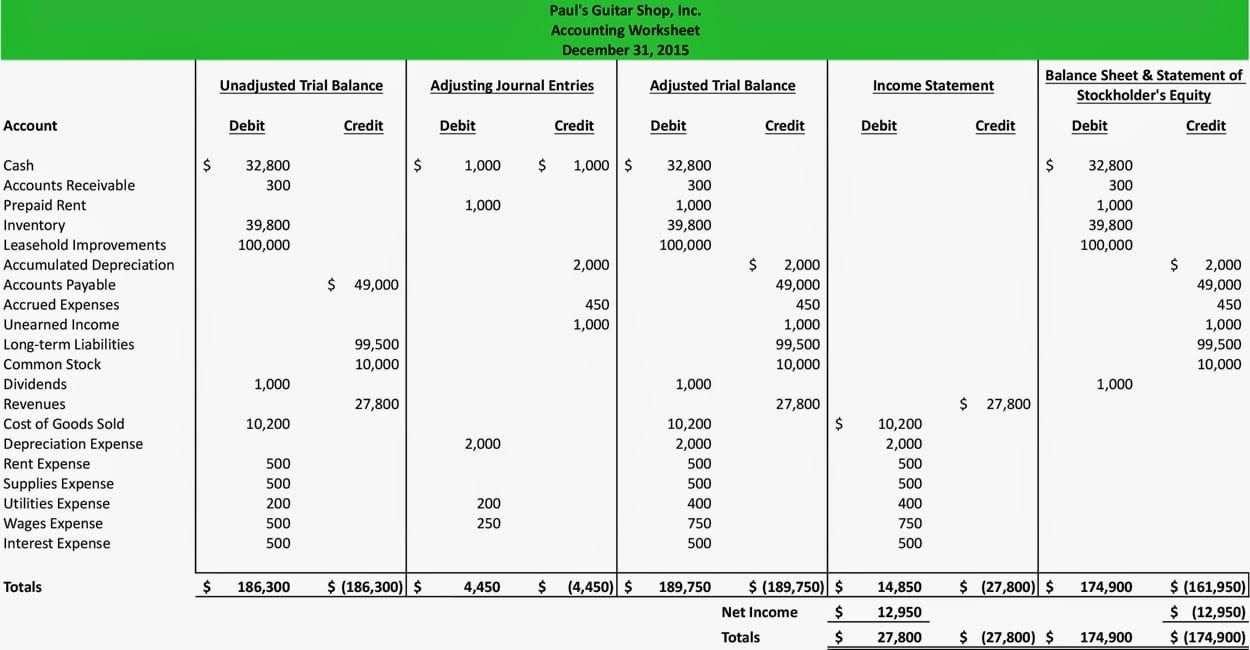

It can also be referred to as a statement of net worth or a statement of financial position. Prepare a balance sheet identify the three main components of the statement of cash flows the following is the adjusted trial balance of maggie’s music shop. Using this template, you can add and remove line items under each of the buckets according to the business:

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. With this information, you can make adjustments that could either increase your assets or make sure you aren’t drowning in debt. Assets go on one side, liabilities plus equity go on the other.

Calculator take a look at this balance sheet for the great american department store. The balance sheet is based on the fundamental equation: Which of the following is an asset account?

Assets = liabilities + owner’s equity. You can create a personal balance sheet by completing the following steps, including getting all relevant documents, listing your assets and liabilities, and calculating your net worth. Plus, find tips for using a balance sheet template.