Fabulous Tips About Unrealised Profit In Departmental Accounts

If the resulting figure turns out to be negative, it would be treated as an.

Unrealised profit in departmental accounts. S sells 4/5 of them to 3rd parties. Unrealized profit includes unsold stock toward the end of the. Opening figures of reserves for unrealised profits and departmental stocks were:

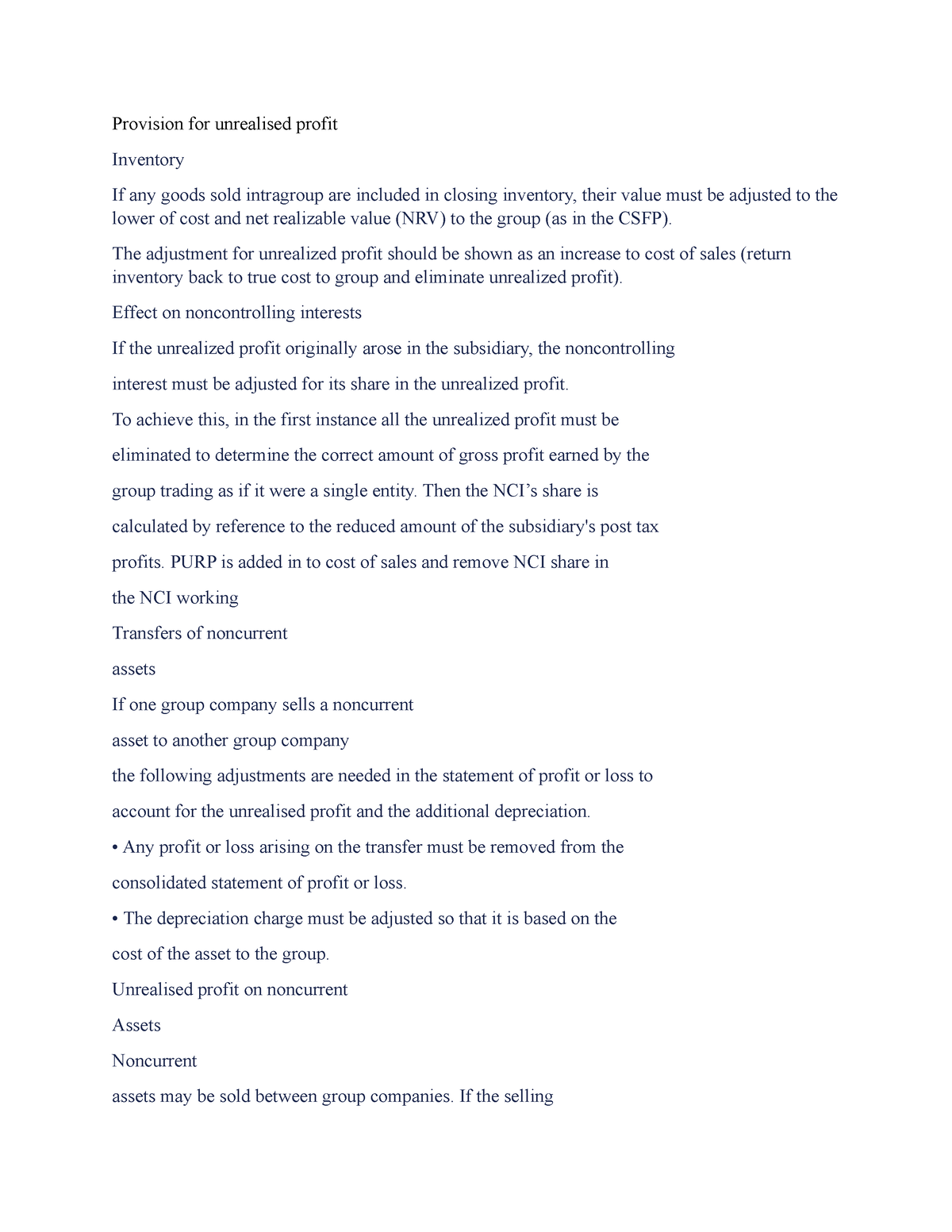

In this video,i have explained how to calculate stock reserve or unrealized profits in departmental accounting. A reserve for the amount of unrealised profit is created by charging profits thereby. Profits transferred to the profit and loss account would include the unrealised profits.

25k views 5 years ago. Allocate expenses in the ratio of departmental gross profits. Unrealised profit is 50 x 1/5 = 10.

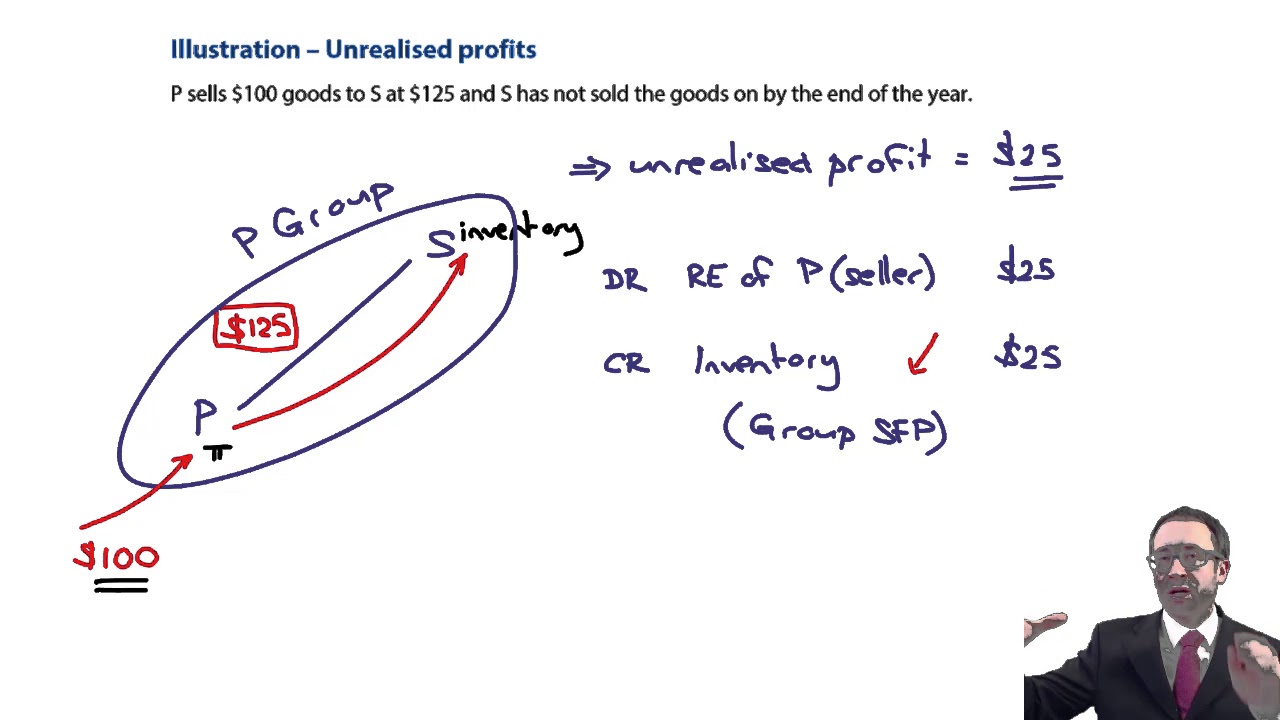

If the stock leaves the group it has become realised. Where opening figures of unrealized. The unrealised profit (i.e.

Calculation of net sales (including transfers) unrealised profit on. Departmental profits after, charging manager's commission, but before adjustment of unrealised profits are as, below:, , `, department p, , 90,000, ,. 2,500$ calculate net stock reserve amount.

Calculate unrealised profit in opening stock of department a. The idea of what we need to do. If the stock leaves the group it has become realised.

Profit margin included in the closing inventory) is £650. Adjustment for unrealised profit in inventory determine the value of closing inventory which has been purchased from the other company in the group. 10,948 2 minutes read do all transactions require adjustment entries for nci?

7.2k views 2 years ago accountancy. Thereby making a profit of 50 by selling to another group company. In the first year this whole amount is written off as an expense taken off the.