Favorite Info About All Accounting Ratios Formula Trial Balance Performa

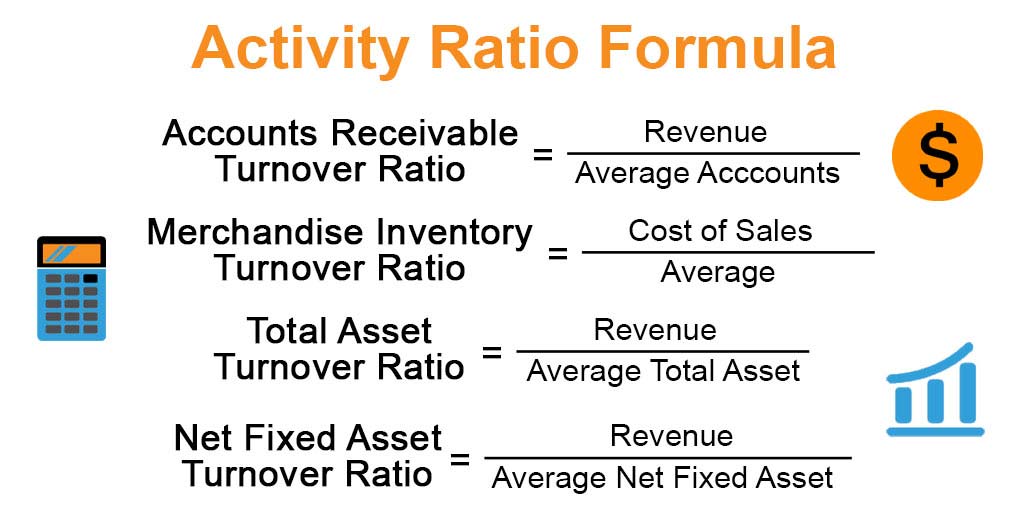

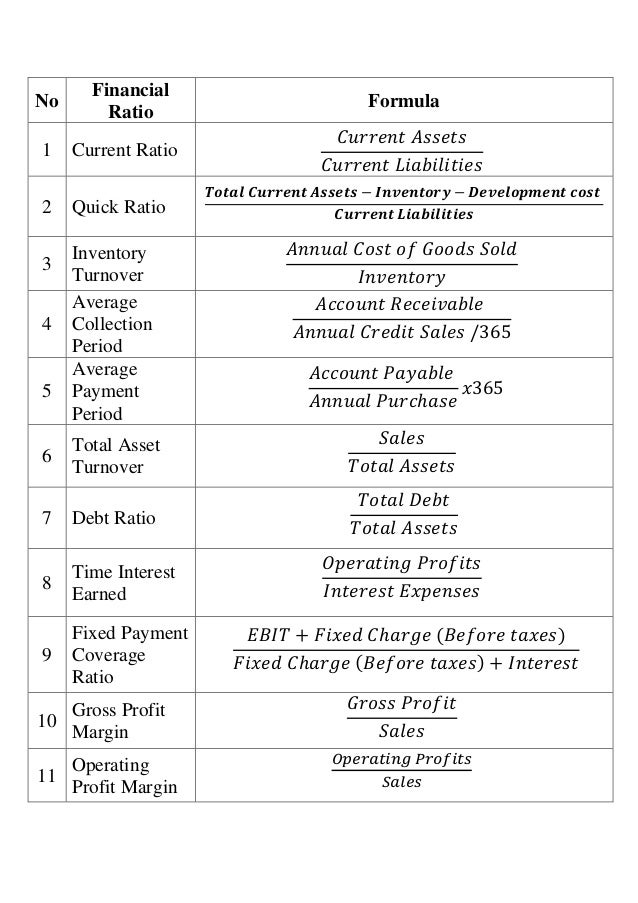

A selection of popular ratios from the accounting ratios formulas guide.

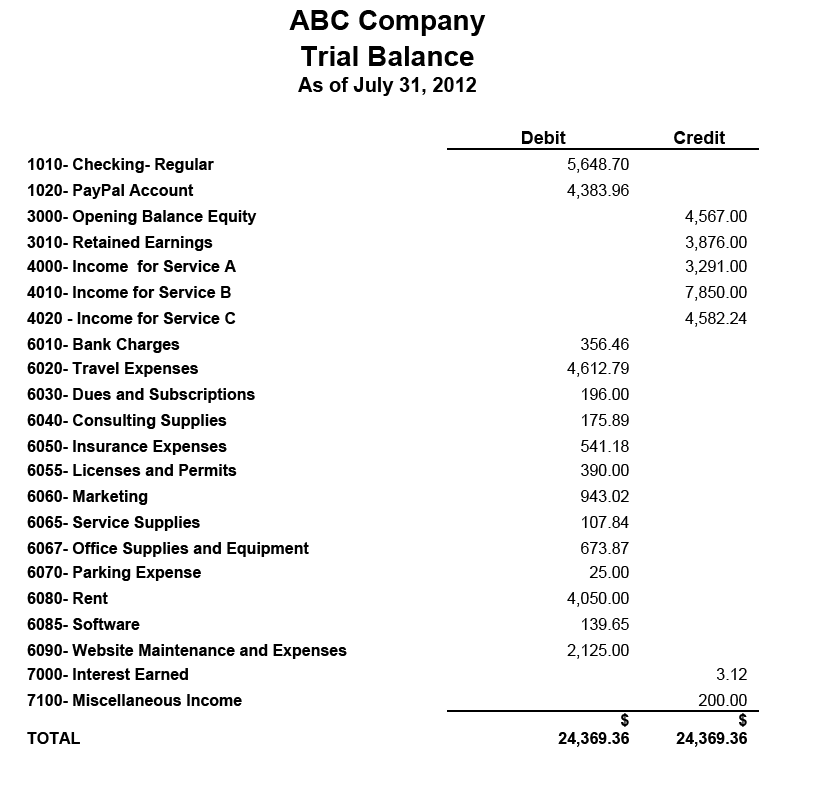

All accounting ratios formula trial balance performa. Note that for this step, we are considering our trial balance to be unadjusted. The sum of these columns should be the same. Using the figures will allow you to compare the business performance from one period to another.

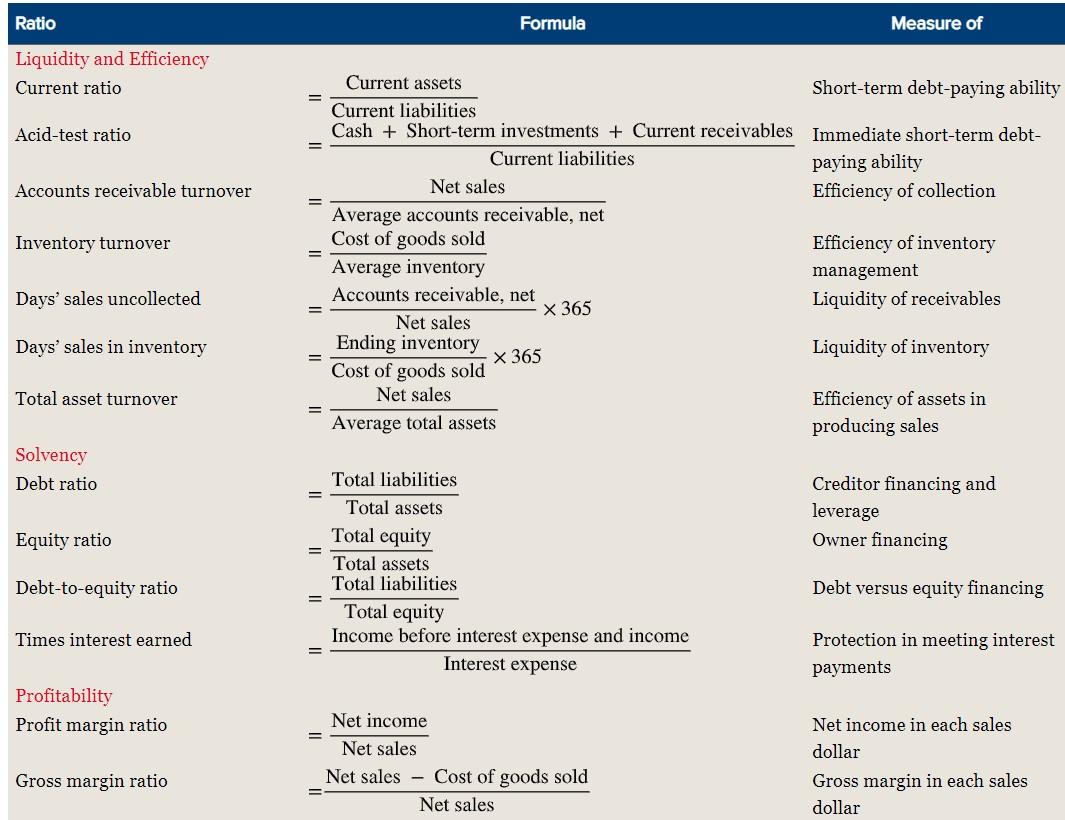

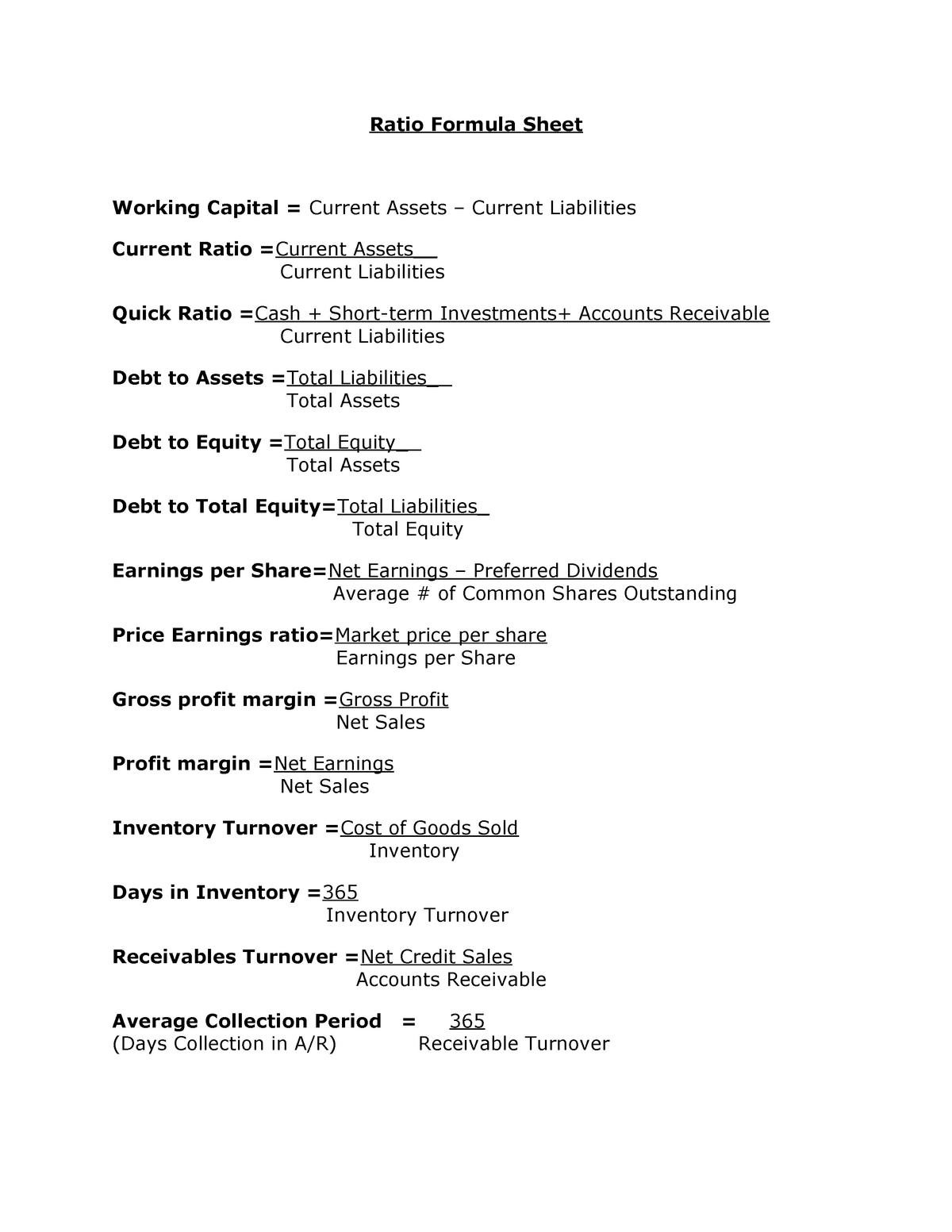

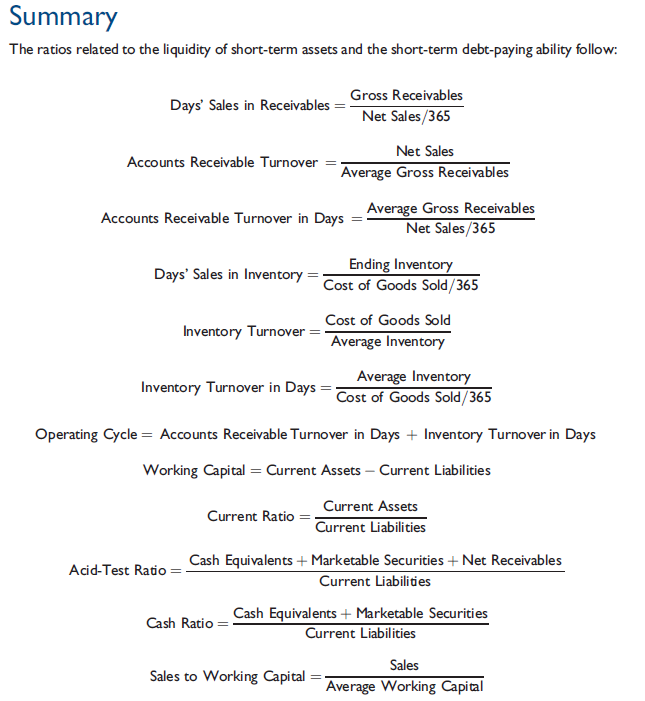

Liquidity ratios, activity ratios, solvency ratios, and profitability ratios. = (funded debt x 100) / total capitalization. 12 types of balance sheet ratios.

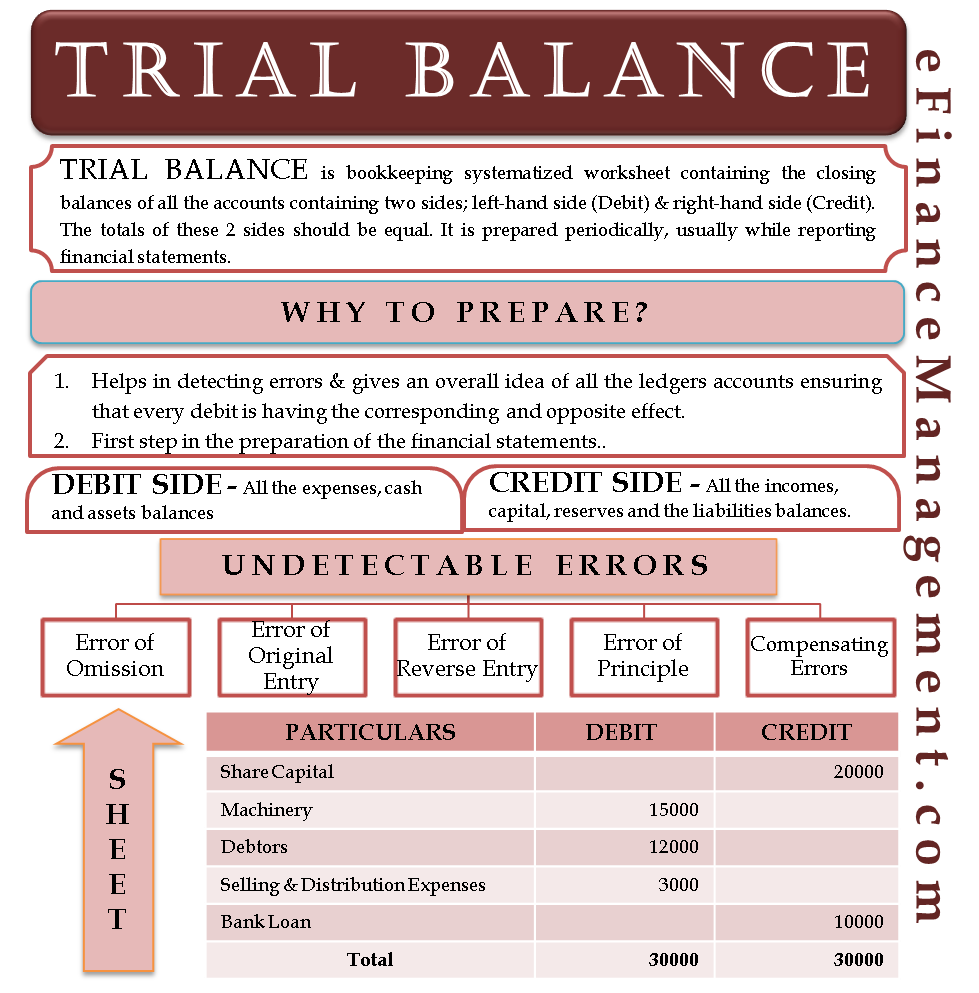

What is the trial balance format? Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. The debit balances ‘and the credit balances are listed under their respective fields.

A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. It includes transactions done during the year and the opening and closing balances of ledgers, as every entity needs to evaluate its financial position over a particular period. = outsiders' funds / shareholders' funds.

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. How to comment on accounting ratios? Liquidity, profitability, debt, operating performance, cash flow, and investment valuation.

Track company performance determining individual financial ratios per period and tracking the change in their values over time is done to spot trends that may be developing in a company. A trial balance is a summary of balances of all accounts recorded in the ledger. Balances used to form the financial statements;

A trial balance is an accounting or bookkeeping report that lists balances from a company’s general ledger accounts. One can divide financial ratios into six critical areas of analysis: A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

Includes extra columns for adjusting journal entries Funded debt to total capitalization ratio. Ratio formula accounting equation, aka balance sheet equation assets = liabilities + shareholders' equity income statement:

The twelve balance sheet ratios below can be calculated with the formula using financial statements of the company that is usually available in the annual report or on its website. Return on assets = net income ÷ average total assets. It is prepared at the end of a particular period to indicate the correct nature of the balances of various accounts.

Return on equity = net income / average shareholder equity 2. Financial ratios can help check the financial health of a business. Popular ratio formulas.