Who Else Wants Info About Without Donor Restrictions

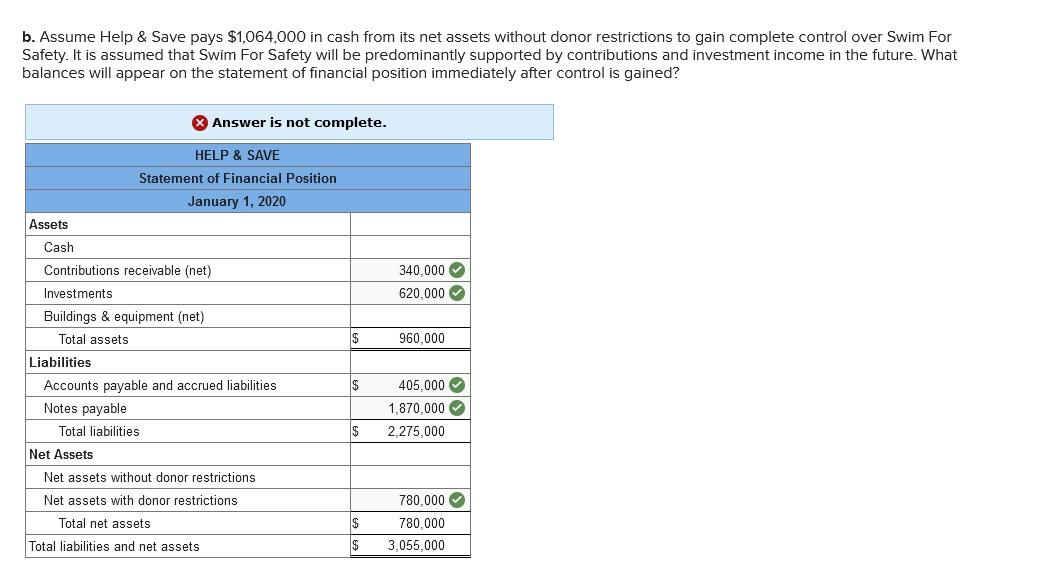

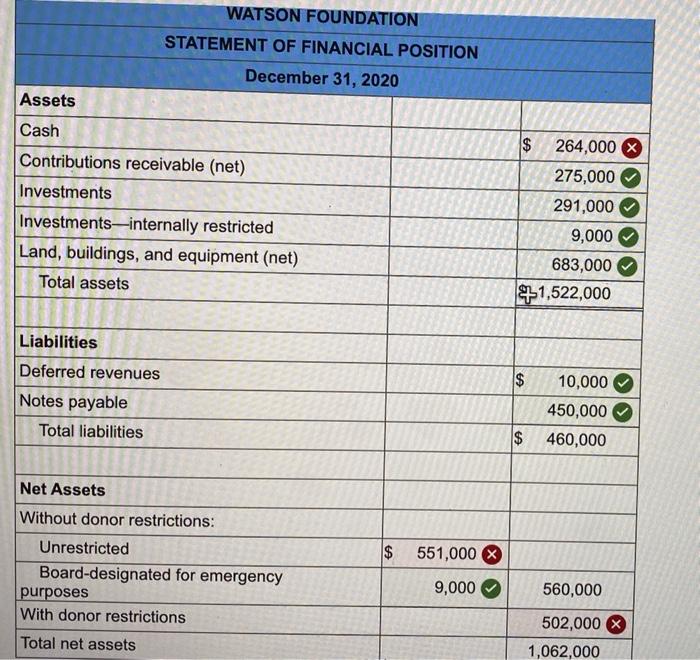

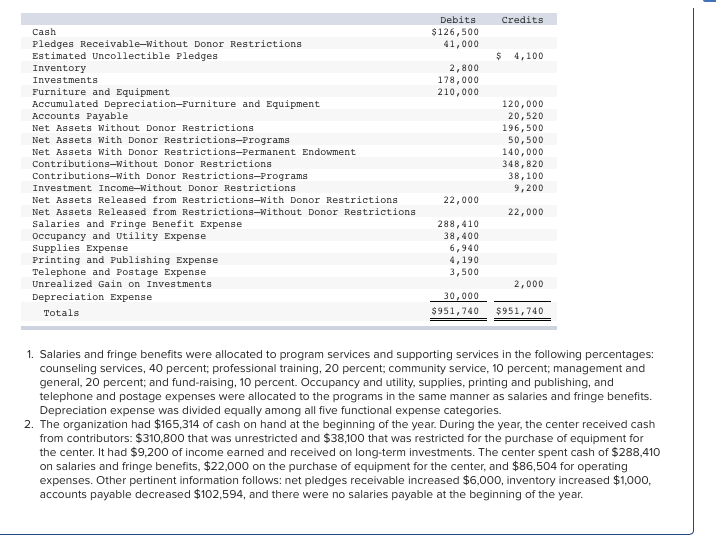

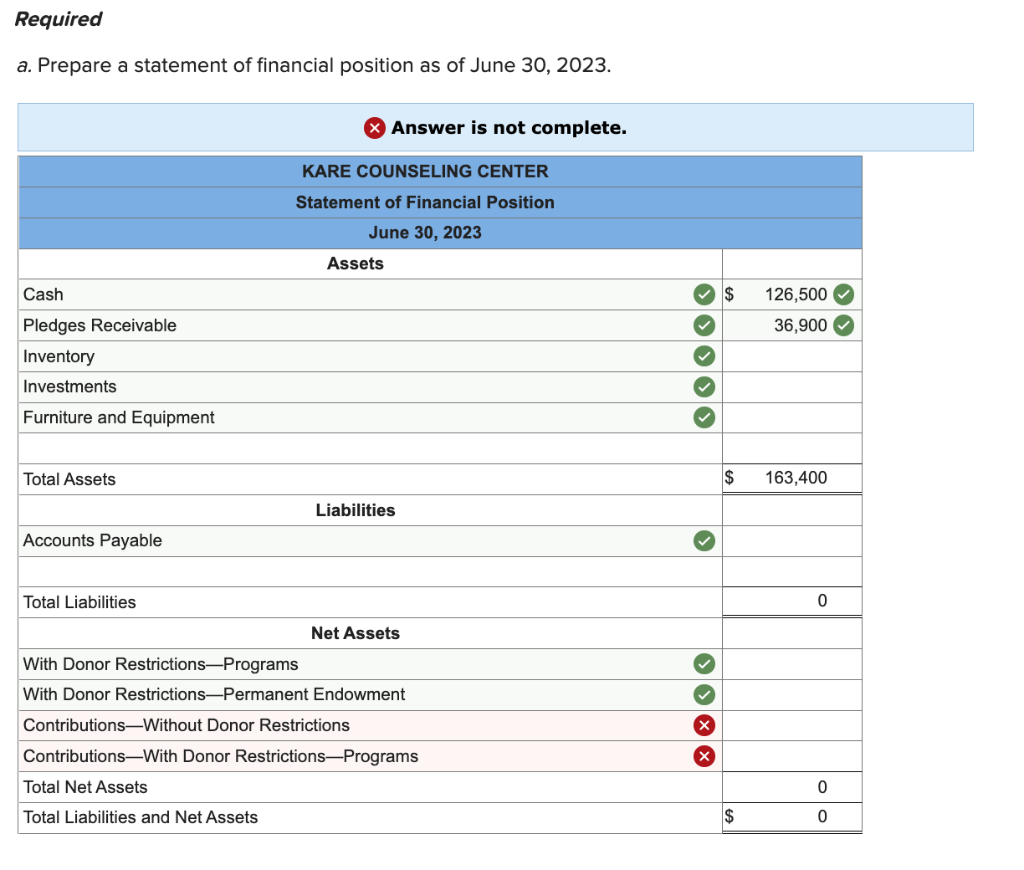

Those amounts currently reported as unrestricted net assets should now be reported as net assets without donor restrictions.

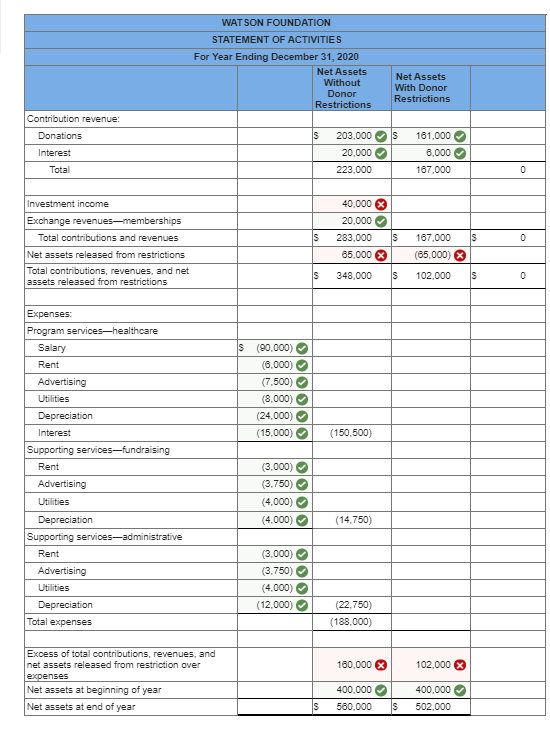

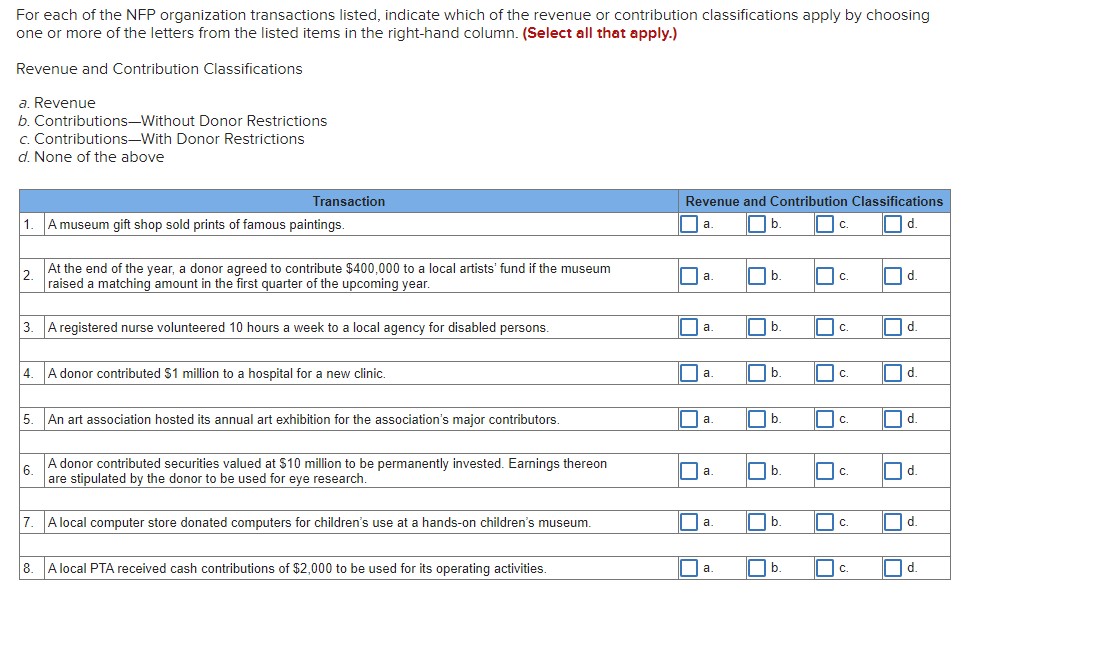

Without donor restrictions. This line is a direct connection. The change in net assets without donor restrictions indicates if an organization operated the most recent fiscal period at a financial gain or loss. When a donor makes a donation, they can mark it as restricted.

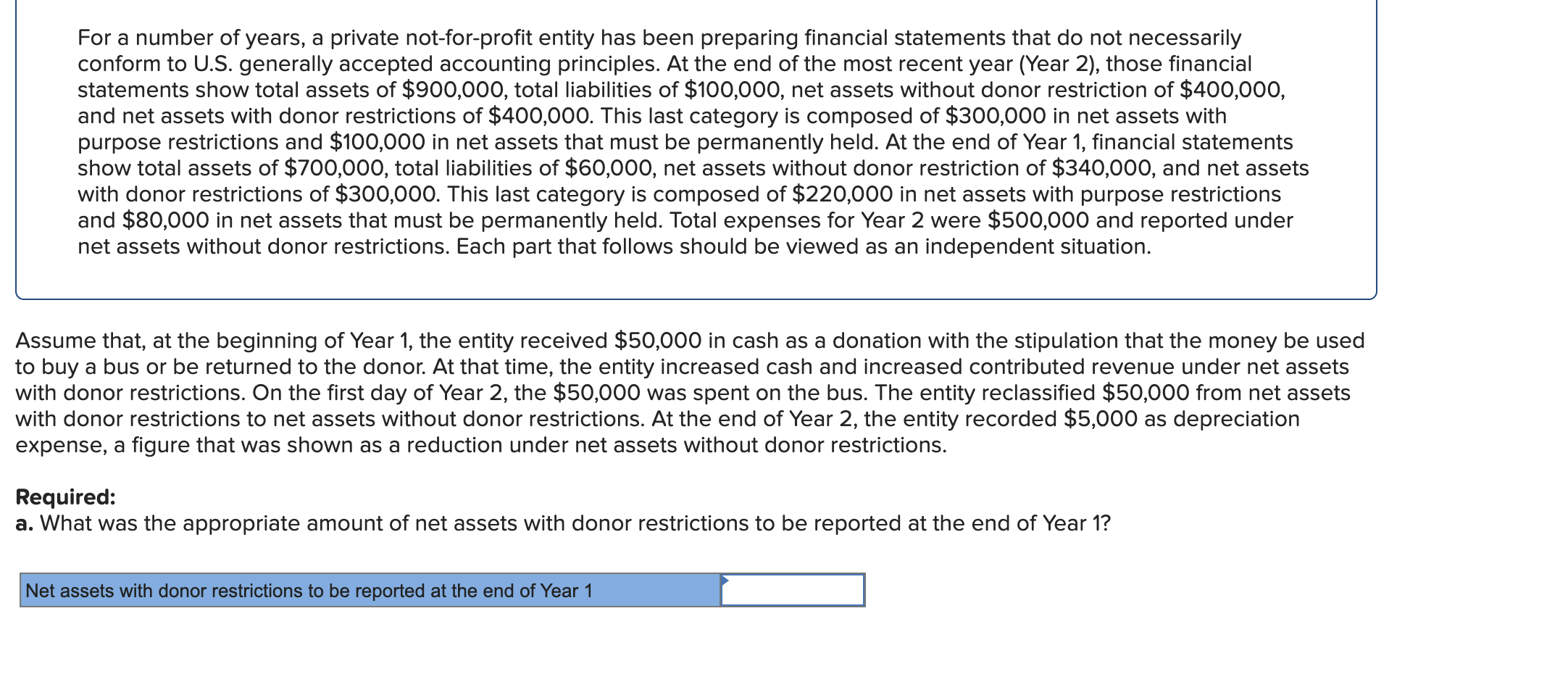

Net assets with donor restrictions that are temporary in nature are bound by time or a specific purpose. These two classifications are used to segregate any funds that the nonprofit may have access to as of the date of the statement into whether or not any of the funds are. Then remove net assets with strings attached,.

Net assets without donor restrictions. Once the time has expired or the purpose has been fulfilled,. What are unrestricted net assets?

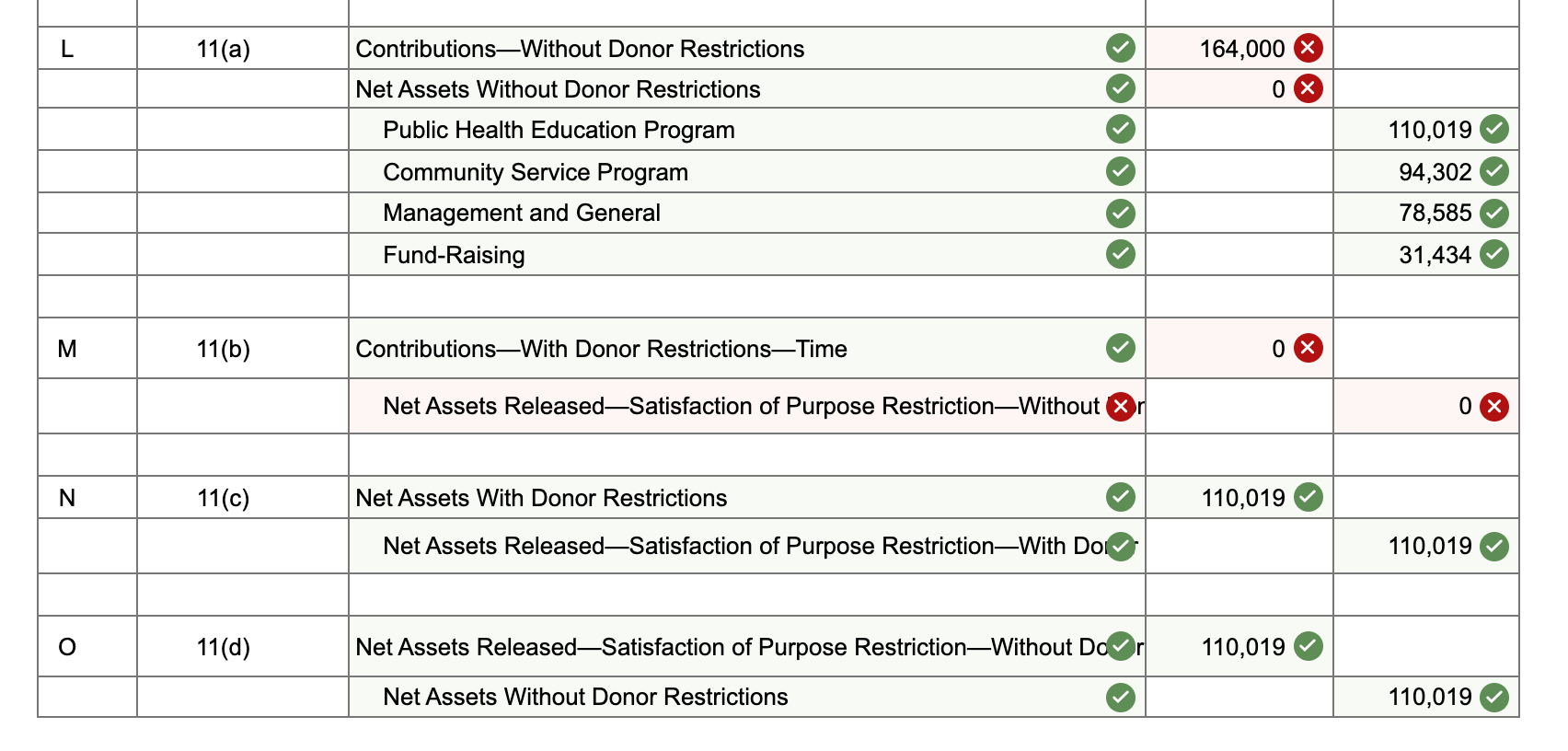

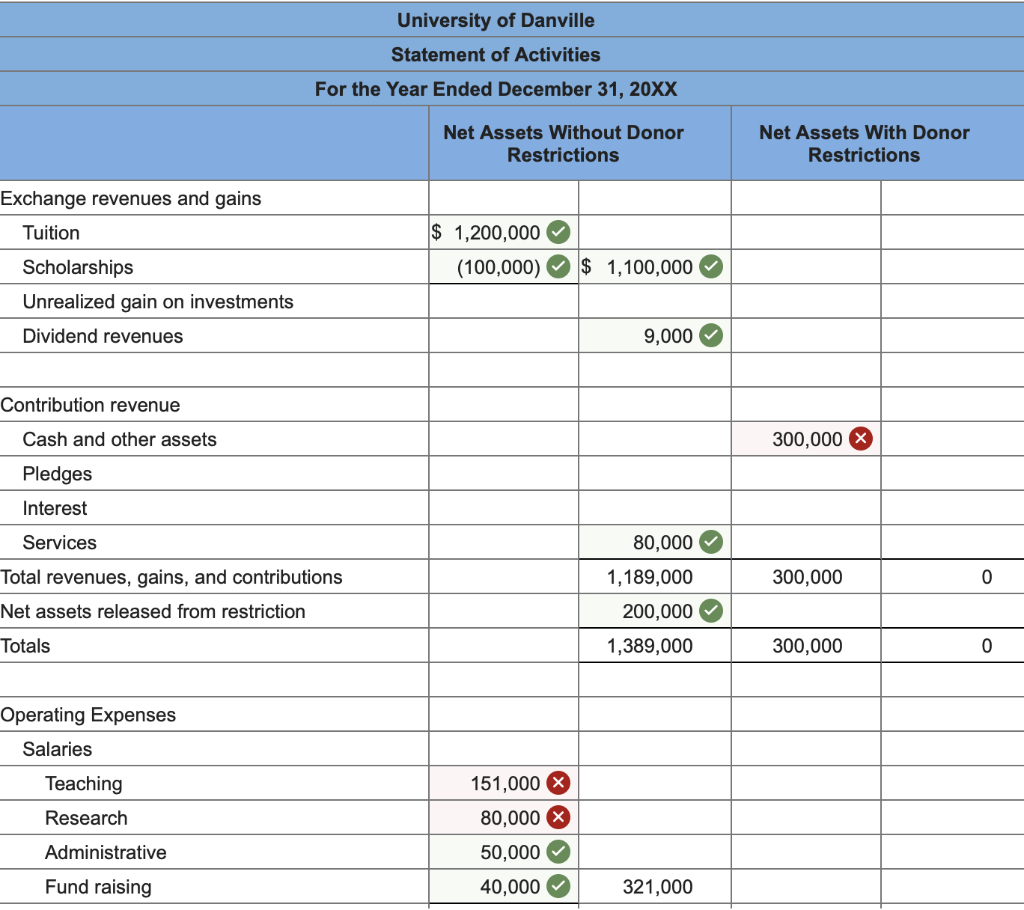

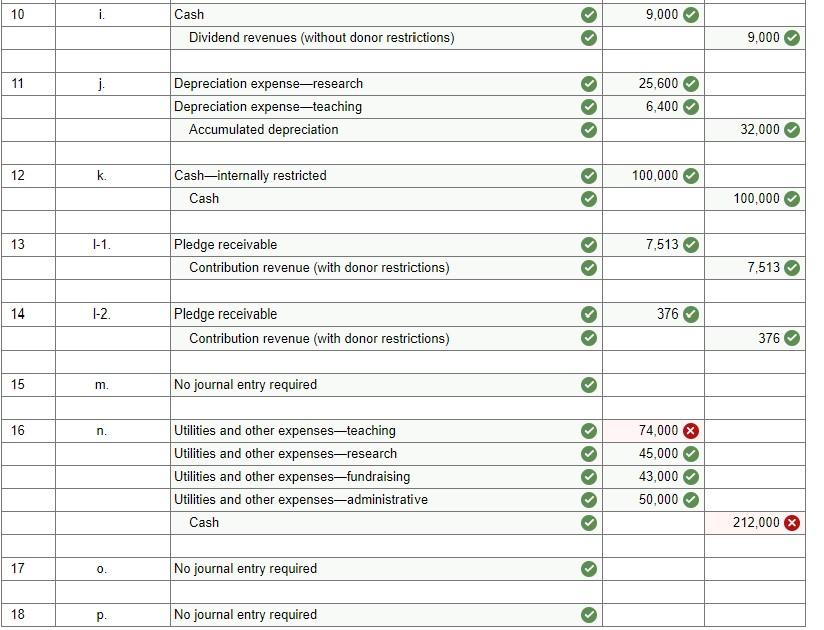

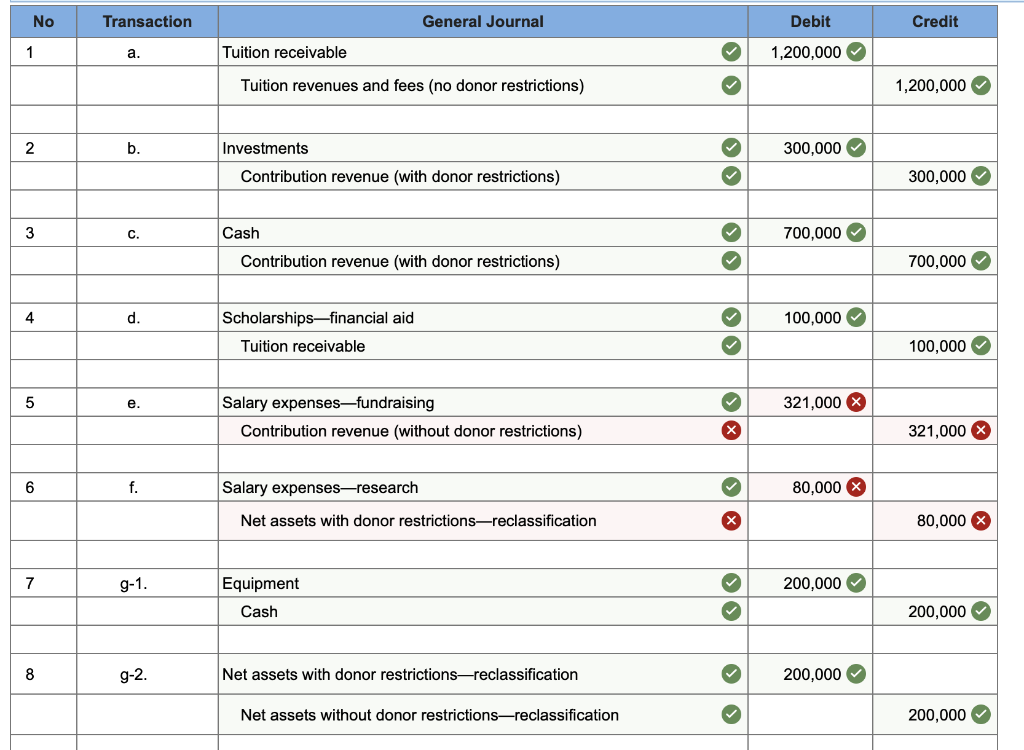

The nfp statement of activities classifies and reports activity using two broad net asset classifications: With donor restrictions and without donor restrictions. Net assets without donor restrictions first subtract liabilities from total assets to come up with total net assets.

The nature of the not. Classify and report net assets in two categories—net assets with donor restrictions and net assets without donor restrictions—based on the existence or. June 23, 2021 donors can impose two different types of stipulations on contributions provided to nonprofits, restrictions.

Net assets without donor restrictions are net assets available for use in general operations and not subject to donor restrictions.