Smart Tips About The Balance Sheet Of A Service Company Has

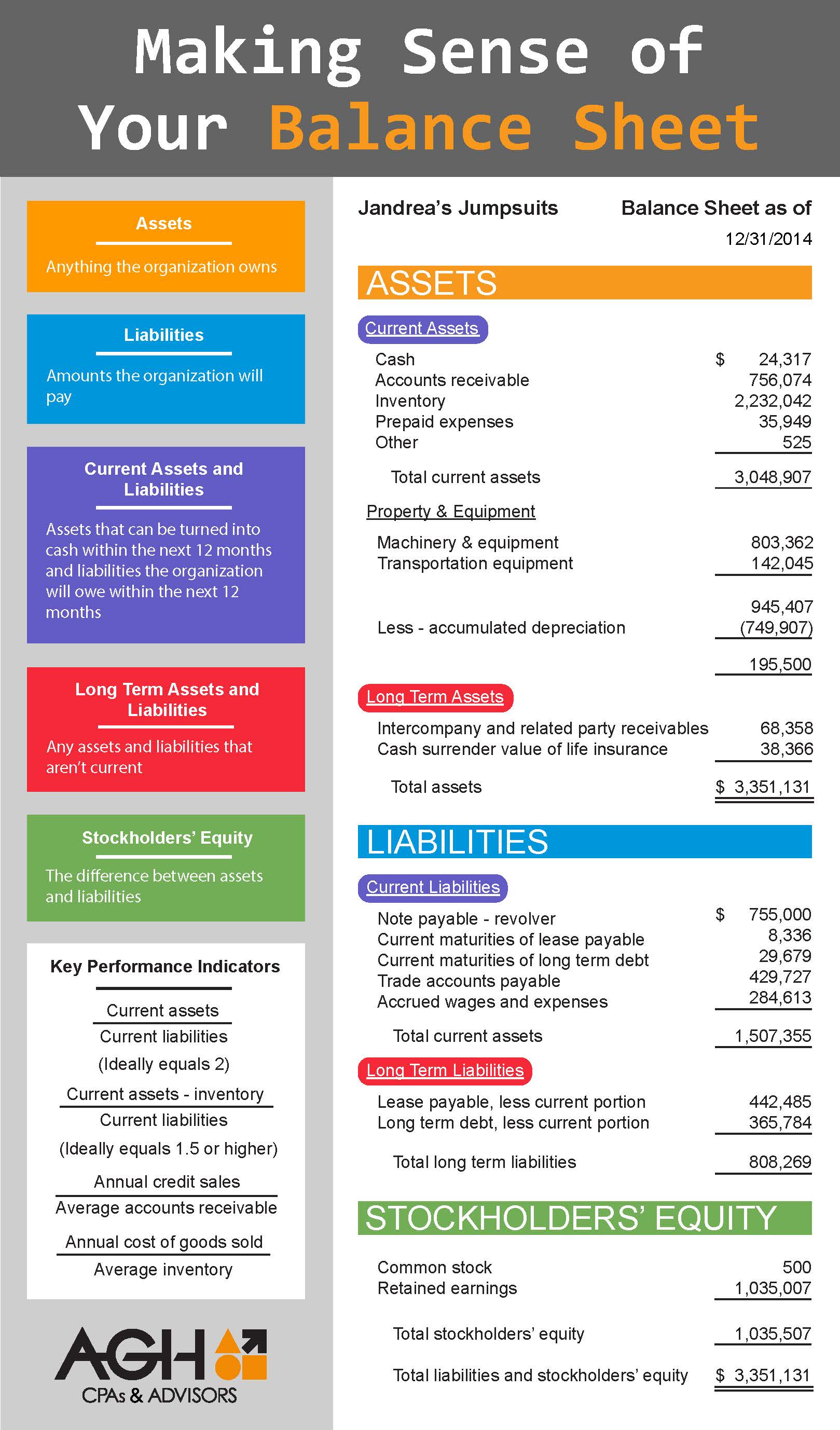

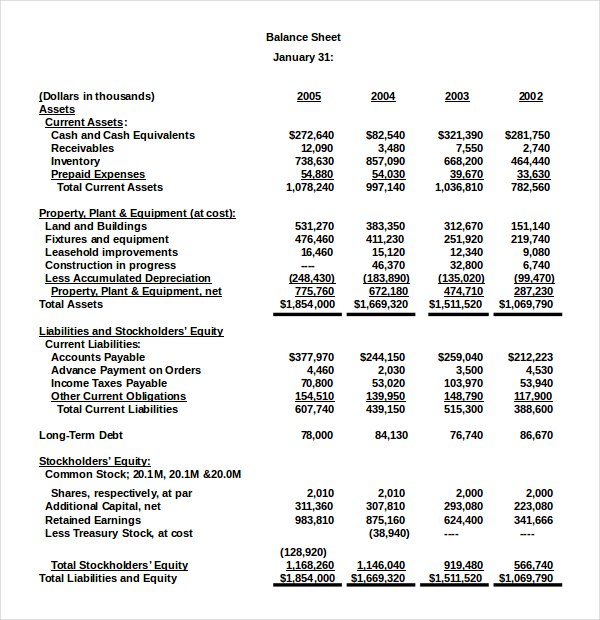

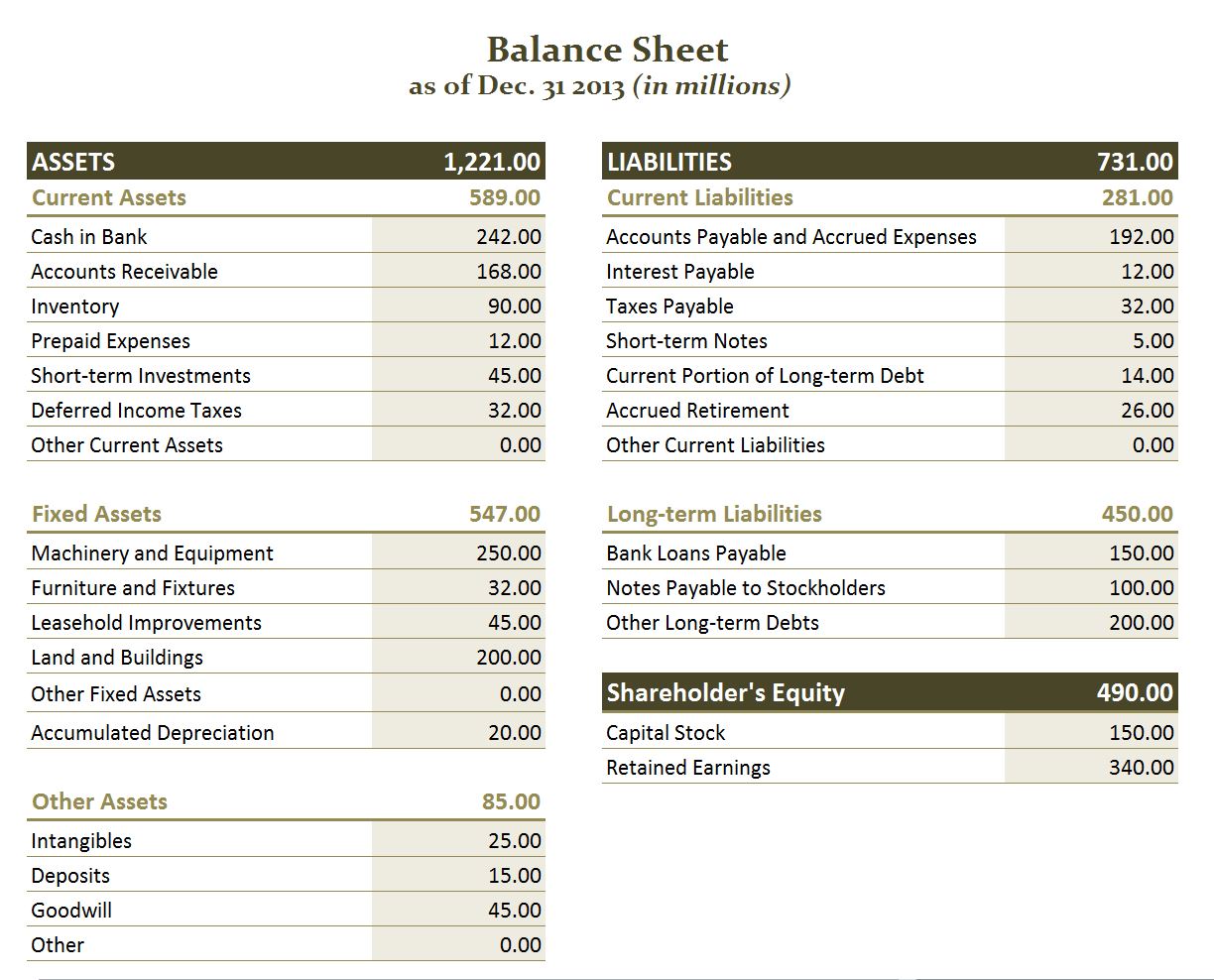

The balance sheet definition of a company is a formal record prepared by a company to present its financial position at the end of an accounting period, typically on a specific date like the end of a month, quarter, or year.

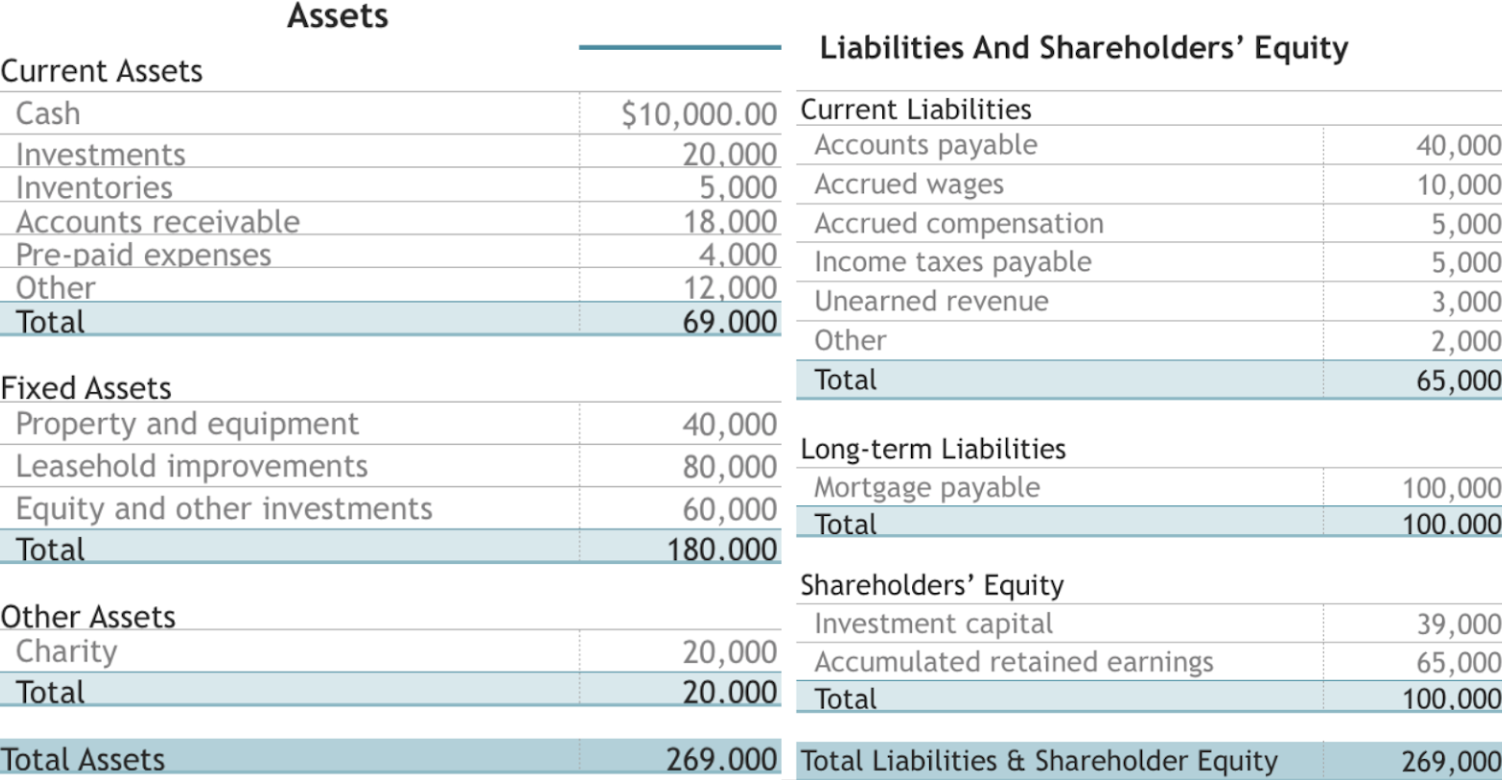

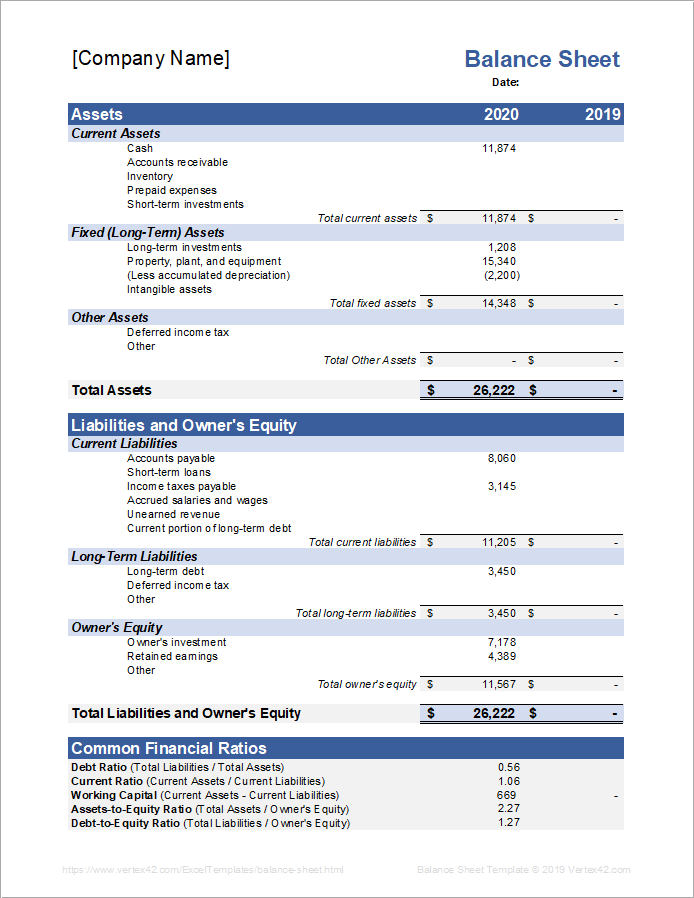

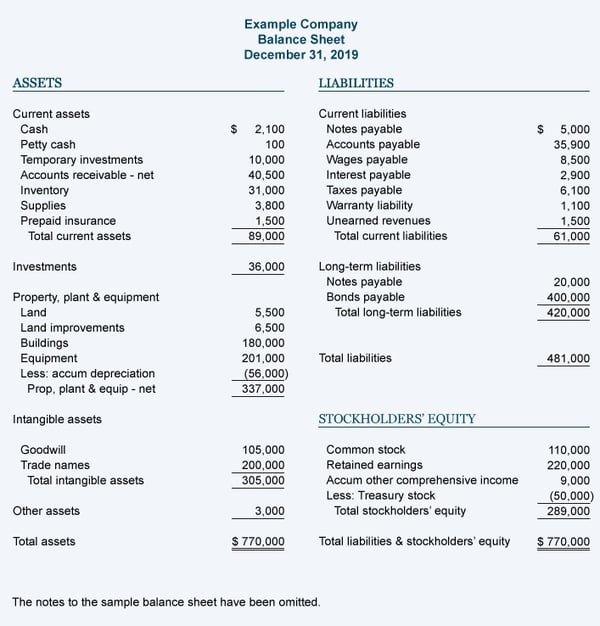

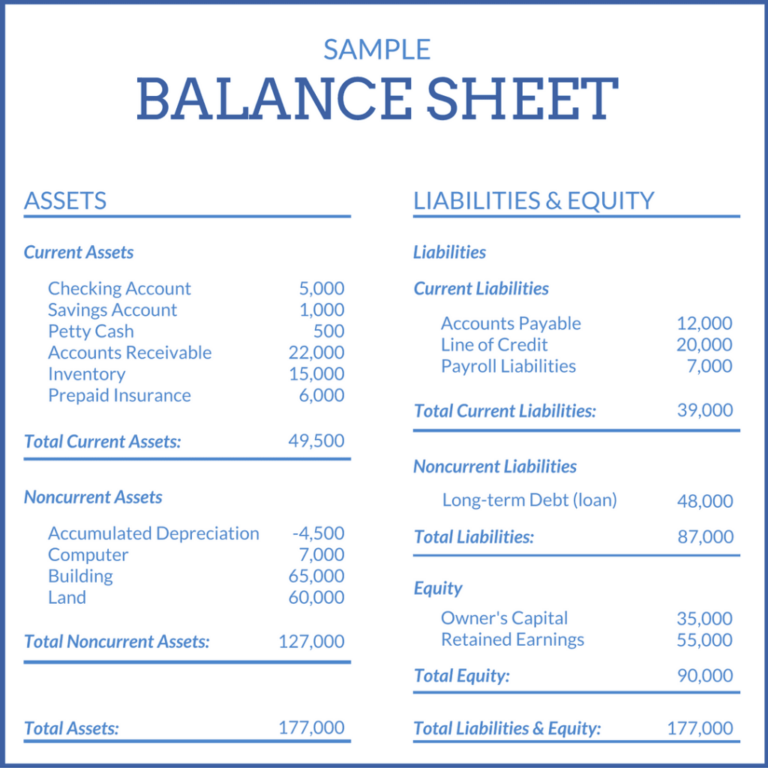

The balance sheet of a service company has. Assets refer to properties owned and controlled by the company. Assets are anything your company owns, including cash, office equipment, company vehicles, investments and buildings. A balance sheet provides a summary of a business at a given point in time.

It adheres to the fundamental accounting equation: It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. The balance sheet has been described as a snapshot of a company's financial condition.

Assets are things that a company owns that have value. Balance sheets serve two very different purposes depending on the audience reviewing them. Add total liabilities to total shareholders’ equity and compare to assets.

The balance sheet is one of the three core financial statements that are used to. Assets section in this section all the resources (i.e., assets) of the business are listed.

List the assets for your service company on the balance sheet. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. End the asset section by totaling the two categories to achieve a grand.

To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity. A balance sheet covers a company’s assets as. C) three categories of inventory.

D) two categories of inventory. The runoff of the bond portfolio has brought the total size of the fed’s balance sheet down by more than $1 trillion as of november, from a record peak of near $9 trillion reached in early 2022. The balance sheet is a key financial statement that provides a snapshot of a company's finances.

The differences in income statements can be further understood by examining the balance sheets of both types of companies. To do this, you’ll need to add liabilities and shareholders’ equity together. All its accounts are divided into equity, liabilities and assets.

Each of these sections is briefly discussed below: A) manufacturer b) service company c) retailer d) wholesaler The balance sheet can also be used to gain a view of how much debt the company has in relation to its assets.

A balance sheet summarizes the assets, liabilities, and capital of a company. The balance sheet is based on the fundamental equation: What are some examples of assets?

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)