Simple Tips About Investment In Subsidiary Double Entry

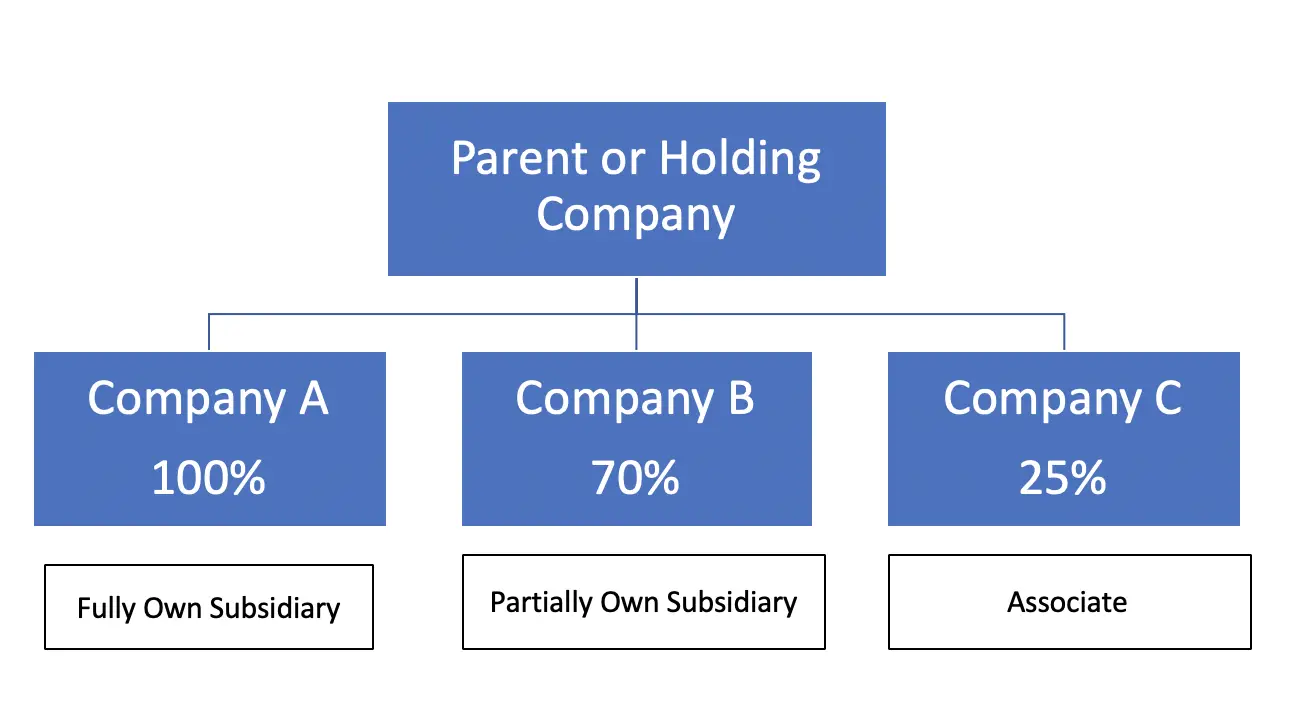

A subsidiary (aka a joint company structure) is owned and/or controlled, either fully or partially (at least 50%), by another company (called the parent company).

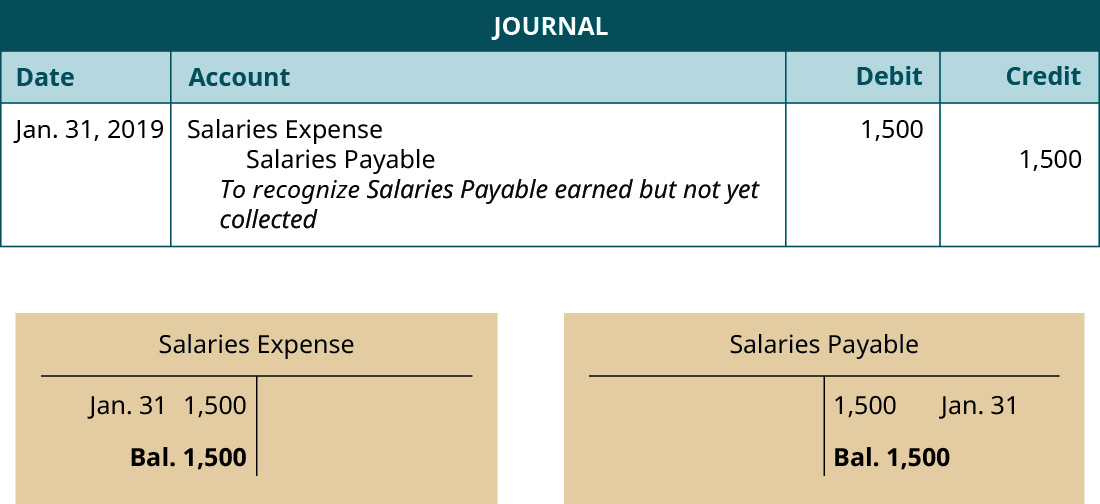

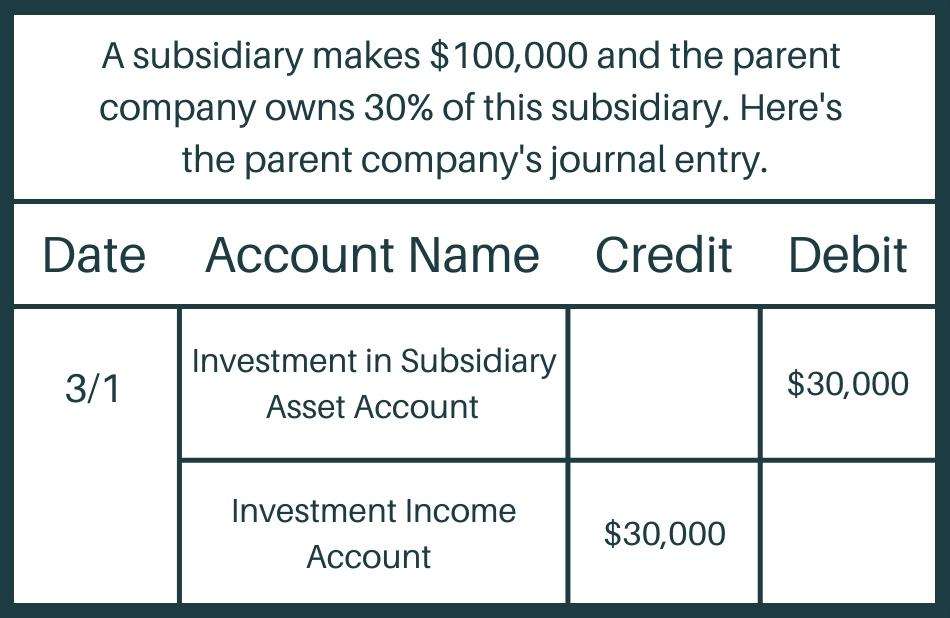

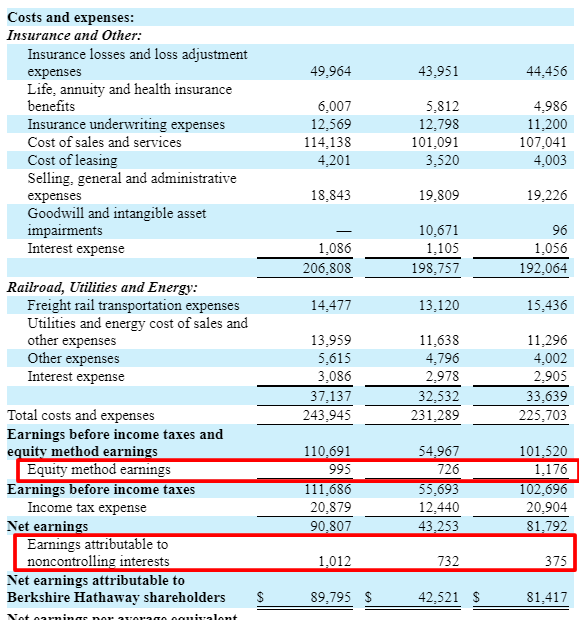

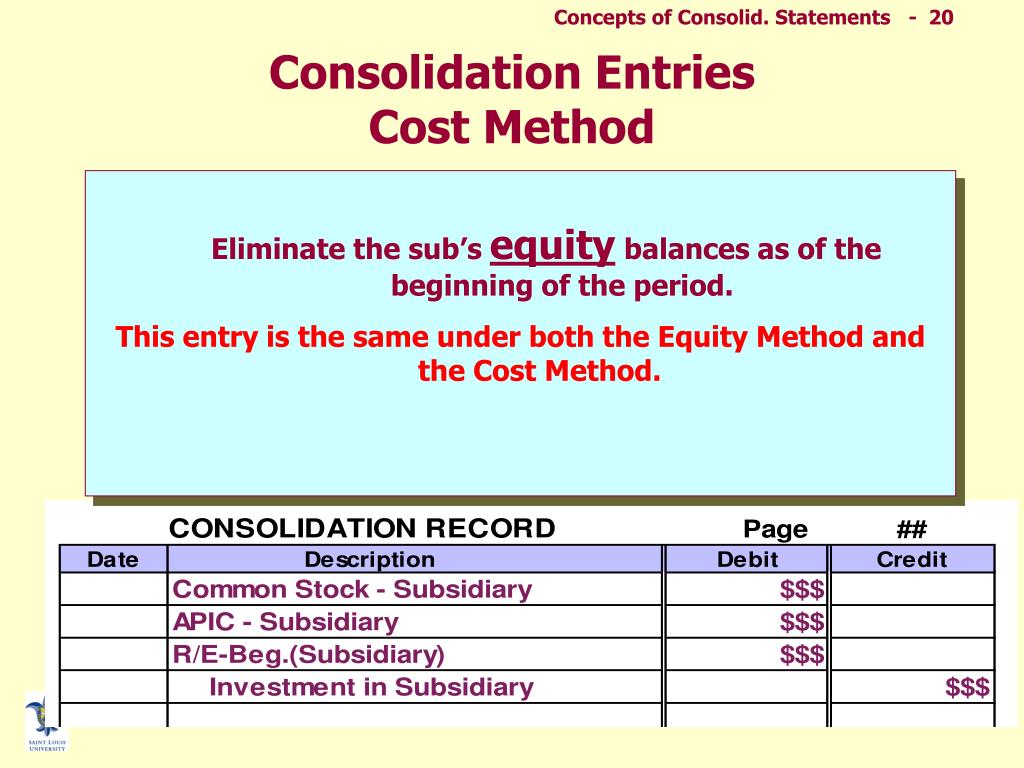

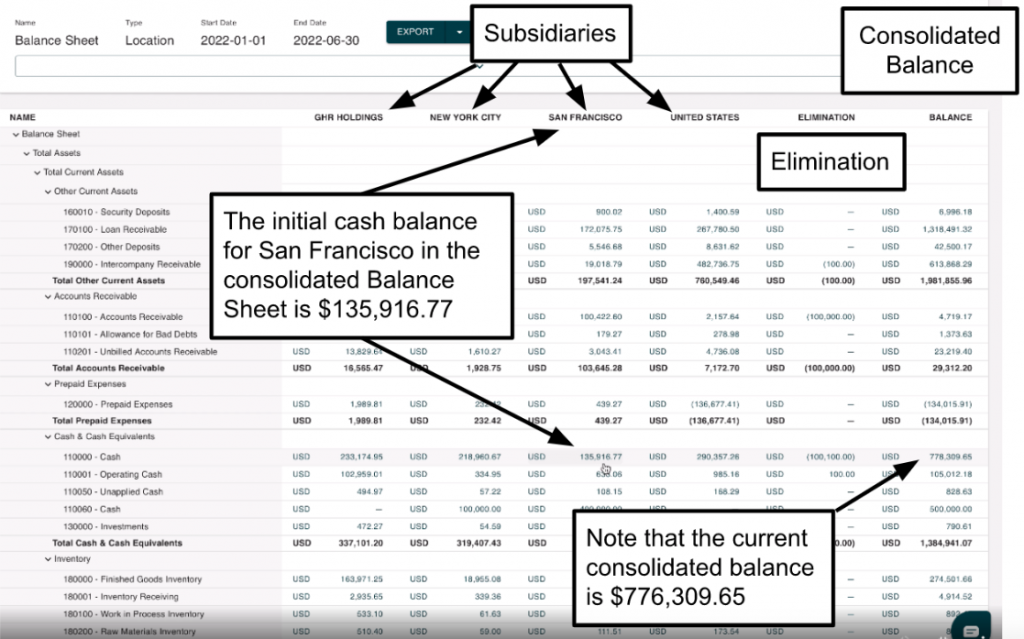

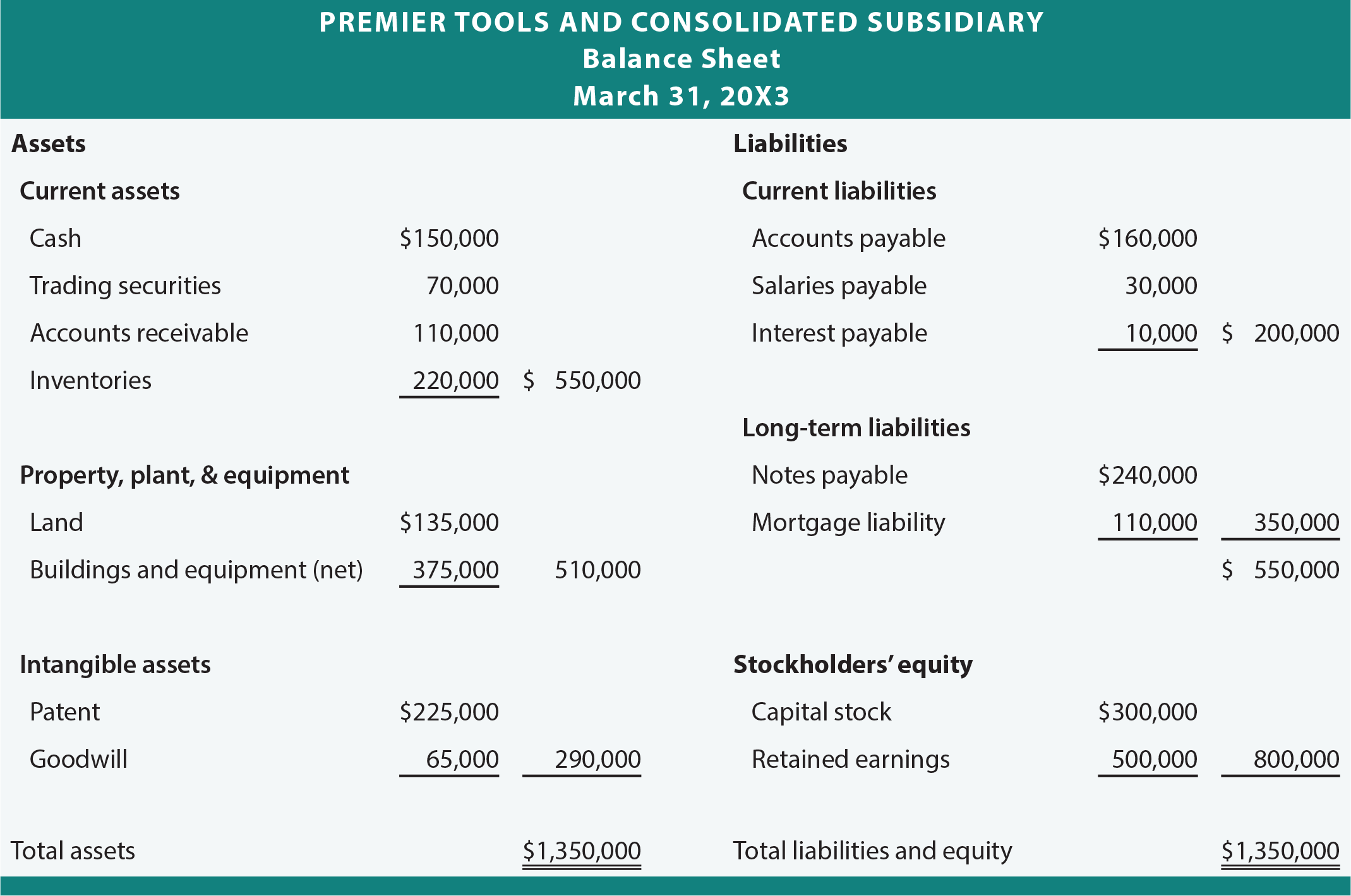

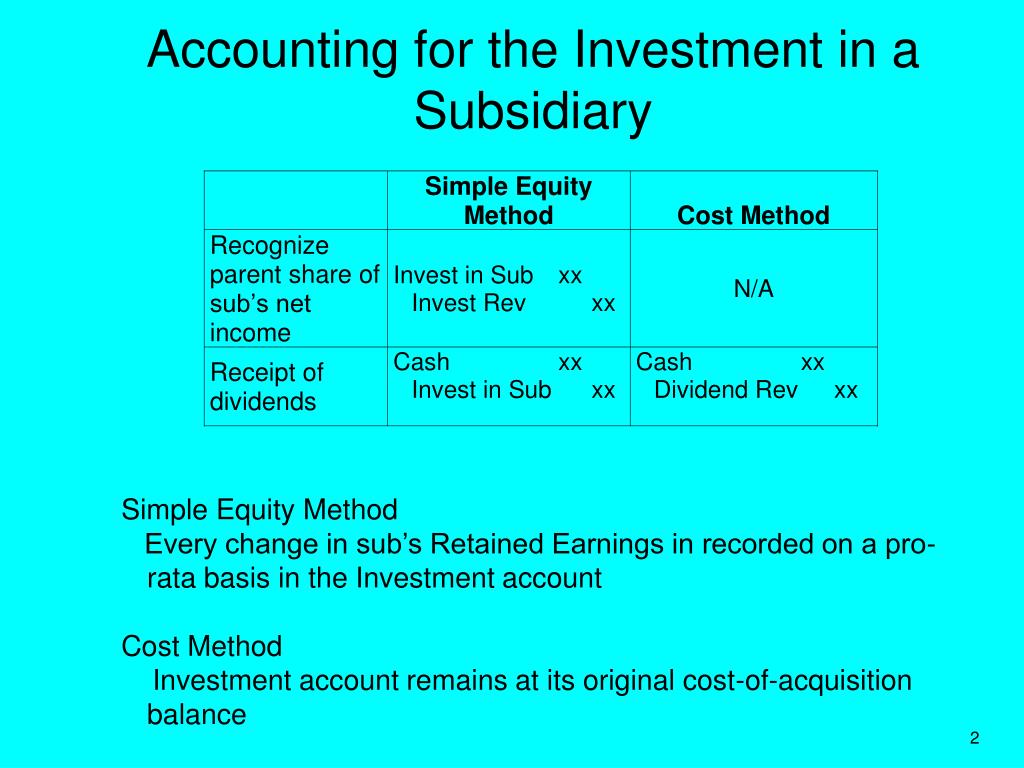

Investment in subsidiary double entry. In this journal entry, the balance of investment in subsidiary on the balance sheet will decrease by $6,000 as a result of the $6,000 cash dividend received. The assets and liabilities are then added together in full. The concept accounting entries for acquisition of subsidiary reflects that when a company acquires a subsidiary, it needs to account for the transaction properly in its financial.

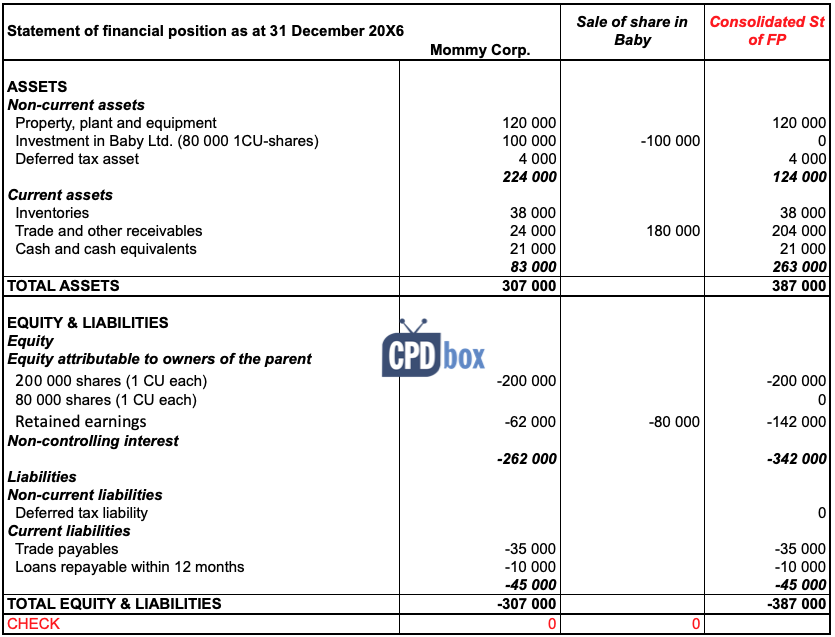

Holds an initial investment in a subsidiary (investee). The accounting depends on whether control is retained or lost: Hence, while there is no goodwill on.

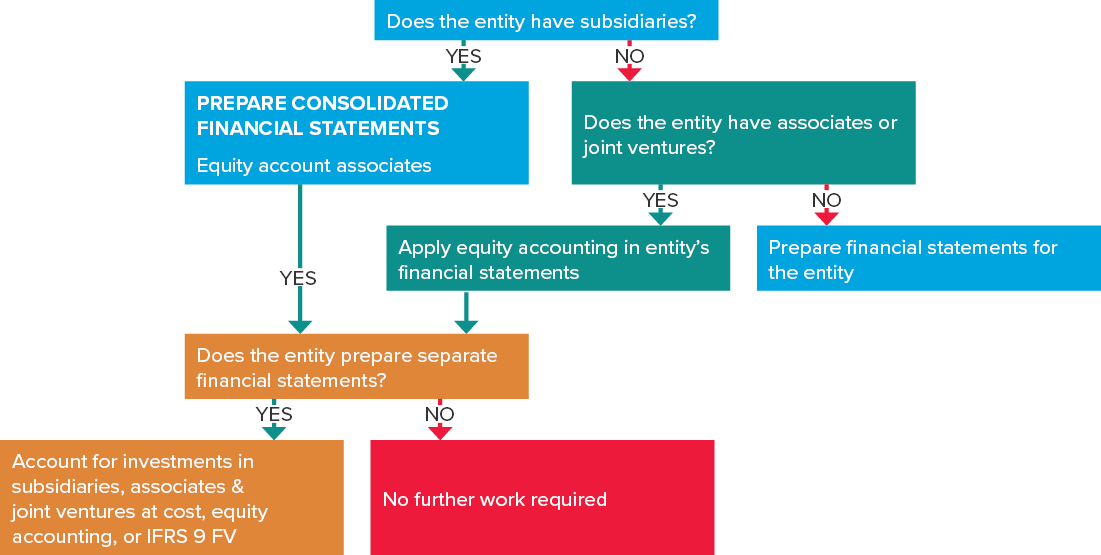

Involving an investment in a subsidiary. A parent has a 100% owned subsidiary which it is liquidating. Statements and to the financial statements of an investor that does not have investments in subsidiaries but has investments in associates or joint ventures accounted for using the.

Partial disposal of an investment in a subsidiary while control. Where the investee is a subsidiary which is consolidated, the gain or loss depends on whether the parent uses the fair value. Ias 27 — investments in a subsidiary accounted for at cost date recorded:

Journal entry for investment in subsidiary. In parent company financial statements, the net carrying amount of a subsidiary attributable to the parent should equal the amount reported in the parent company’s balance sheet. I have a scenario.

Partial disposal of an investment in a subsidiary. In the fact pattern described in the request, the entity preparing separate financial statements: Suppose, book ltd acquires 60% shares in paper ltd in the month of april 20×1 against consideration of 5,000,000.

Investments that result in control i.e. The subsidiary has not been trading and has no assets except some cash.

Hkas 27 separate financial statements contains accounting and disclosure requirements for investments in subsidiaries, joint ventures and associates when an entity prepares. To help you visualize this concept, here is a brief example. 11 sep 2018 ias 27 separate financial statements — investments in a subsidiary.

In addition to the potential cash payments outlined above, the parent company may also decide to pay for the subsidiary by giving the subsidiary’s previous owners new shares. In this journal entry, investment in subsidiary account is an investment asset account on the balance sheet, in which its normal balance is on the debit side. This $7,000,000 of investment in subsidiary account will be eliminated in the consolidated financial statements of the group company.