Wonderful Info About Negative Income Statement

It can misrepresent the value of the company.

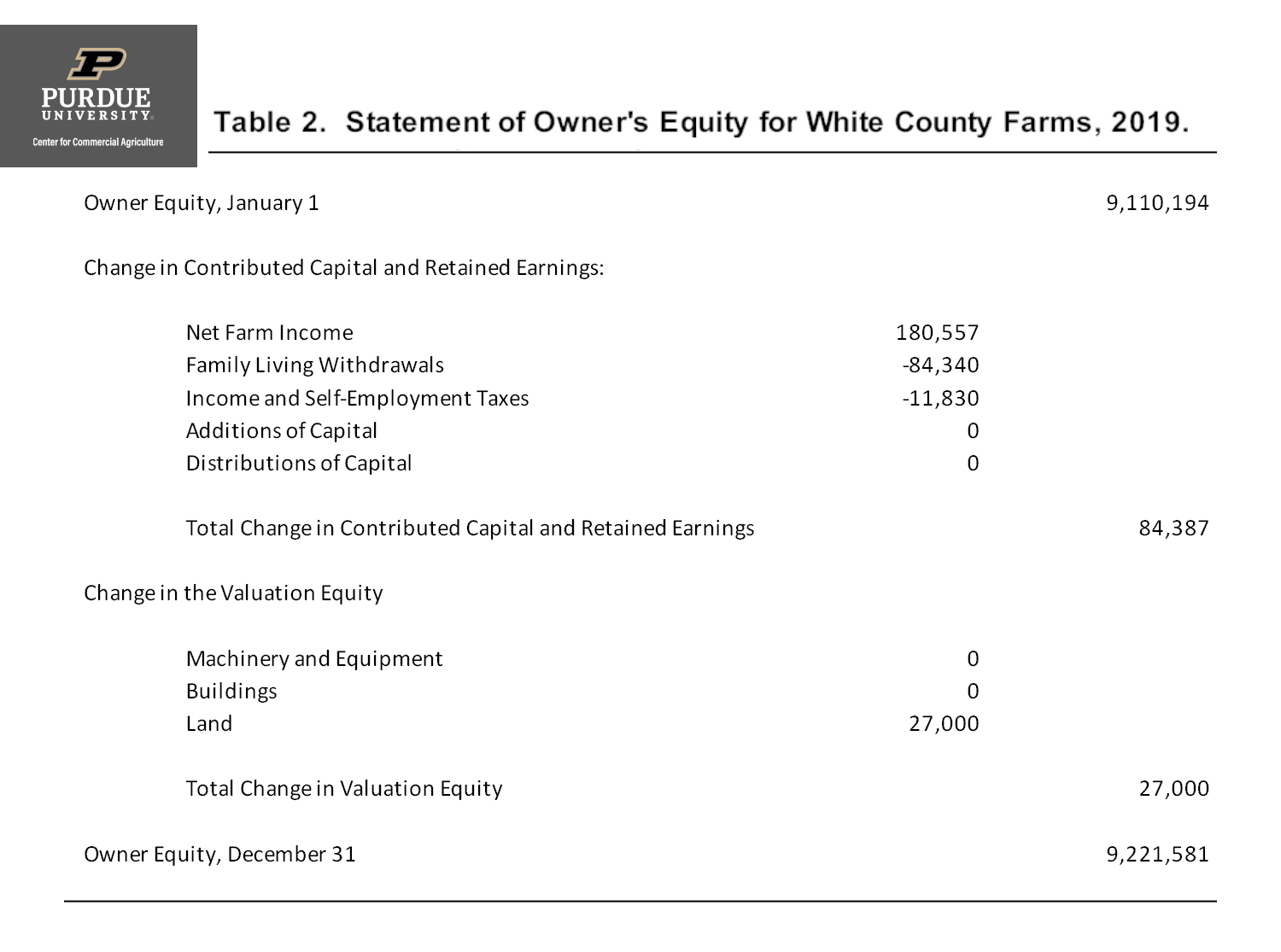

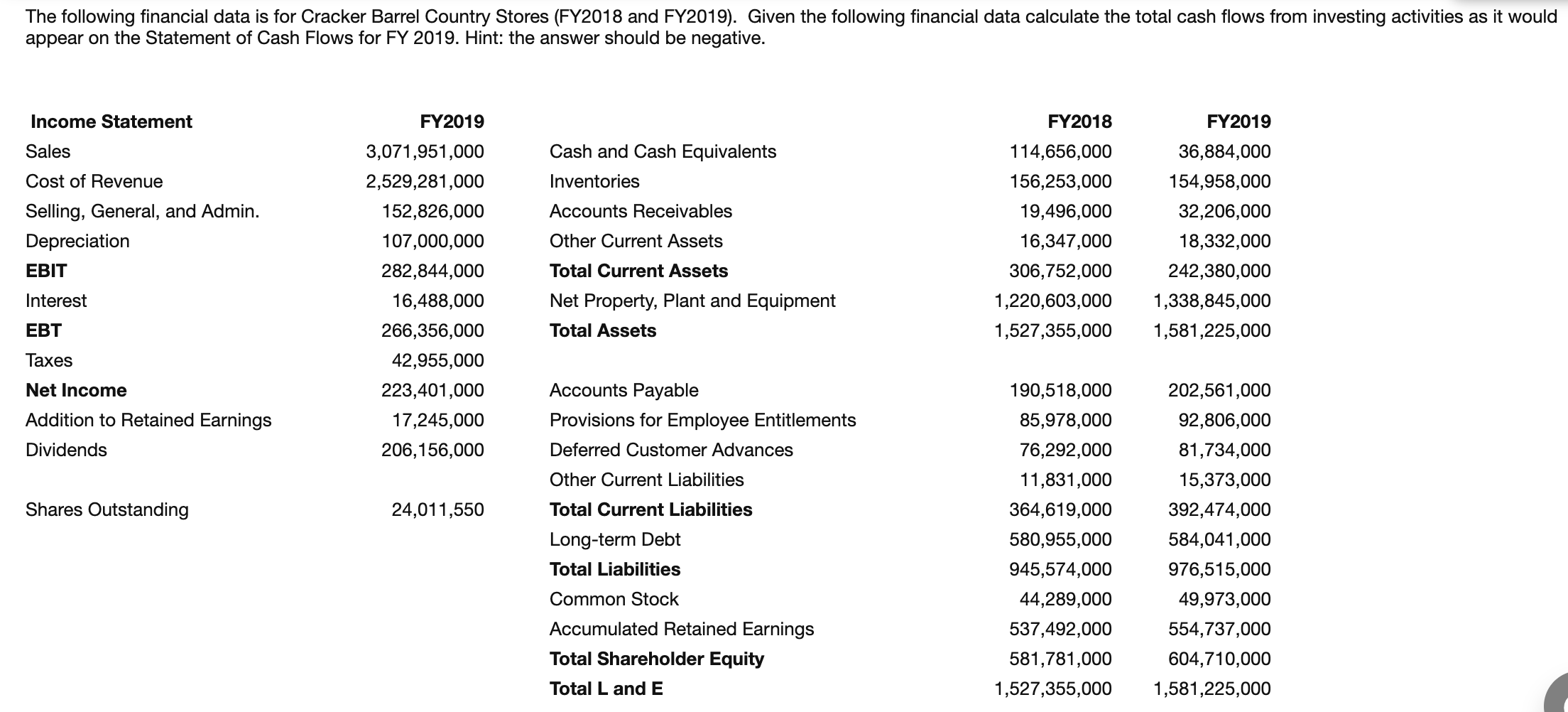

Negative income statement. Assets (increase) = liabilities (decrease) + owner’s equity (increase) the assets of the company are increased when net profit is calculated. (jcp) as of q2 2018. The company later filed for bankruptcy in the summer of 2020, partly due to its persistent negative cash flow problems.

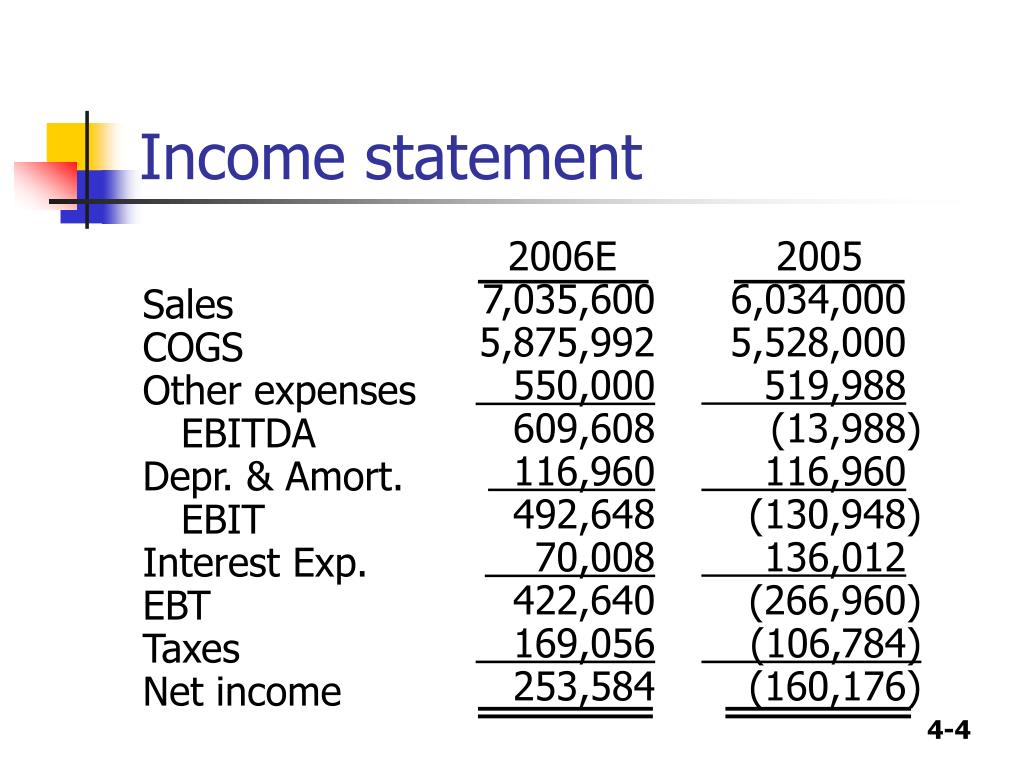

Negative goodwill is the opposite of goodwill, where one company pays a premium for. The net income becomes negative, meaning it is a loss, when expenses exceed sales, according to investing answers. The liability might be decreased as.

Ngw in the balance sheet. In our case, our protagonist, mr. When you subtract the expenses and costs from.

Precise targeting in an ideal world, suppose an individual pays income tax only if the household income crosses $10,000. At the bottom of our cash flow statement, we see our total cash flow for the month: Total cash flow is the sum of operating,.

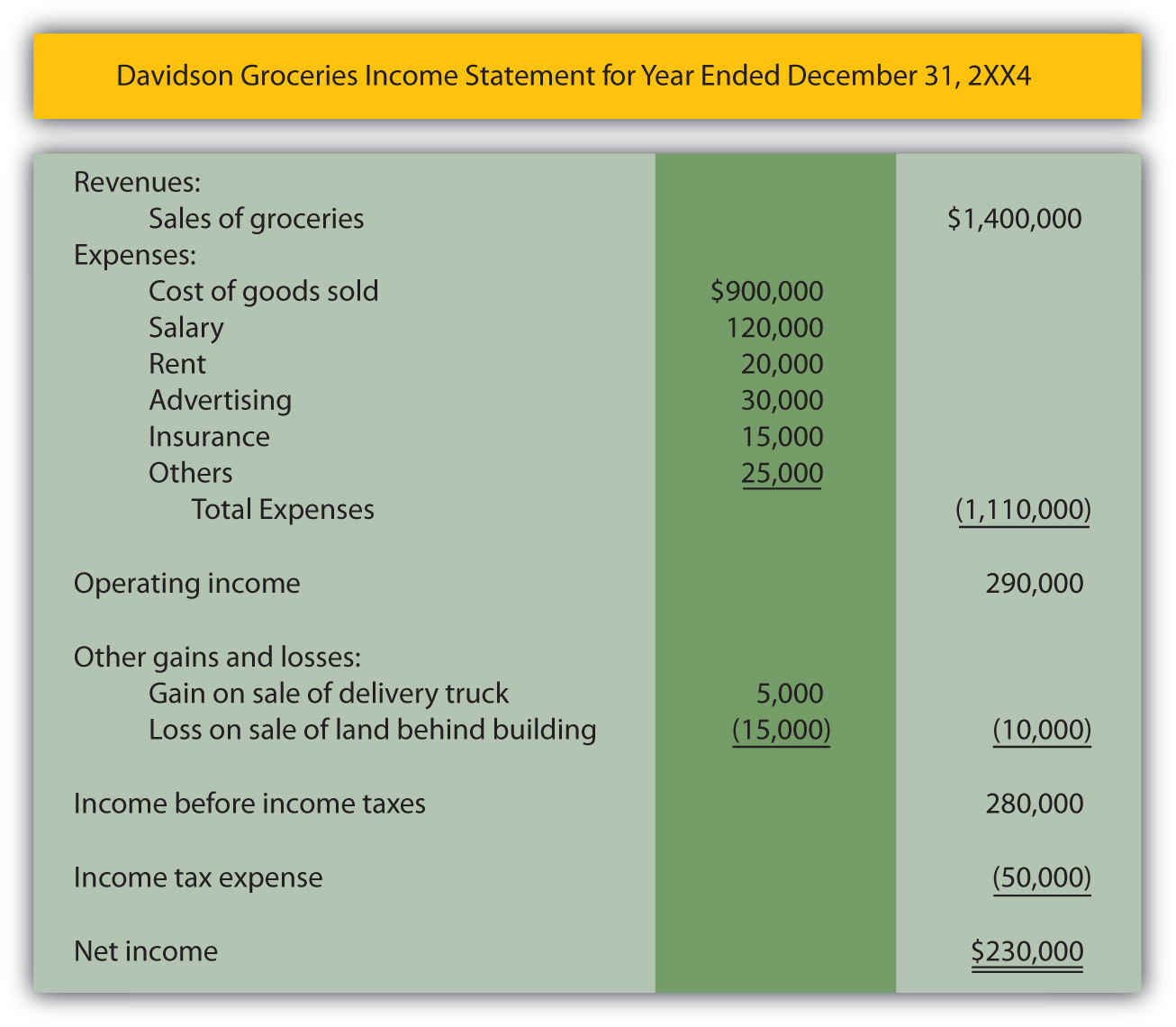

This $10,000 must be booked as a gain on the sale of assets on the income statement, which was the case for 3m in the examples above. To calculate the negative profit, we would subtract the total expenses from the total revenue: Looking at the company's filings, net income is carried over from the income statement and is the starting point for.

Miscalculation on the income statement leads to all sorts of problems beyond just misinterpretation of earnings, including poor allocation of resources and poor cost. List of the disadvantages of an income statement 1. If there is a negative number listed on the income statement next to interest expense, is that number added or subtracted?

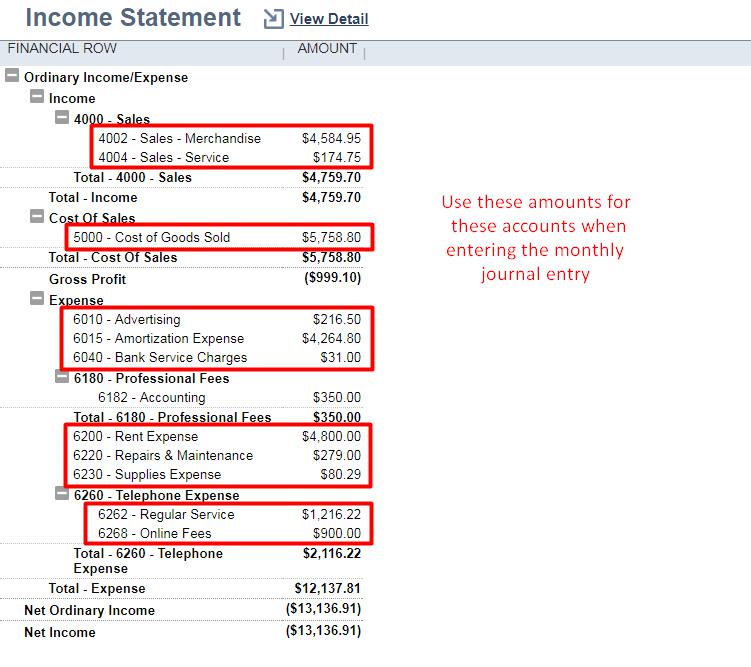

The journal entries would look like. Gains and losses are reported on the income statement. Revenues and expenses are part of the income statement, and at the bottom line, you will find the net income or net loss.

Below is the cash flow statement for jc penney inc. A negative number on an income statement. An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s revenues, expenses, and profits over a.

The income statement shows what a company’s earnings (or profits) are by showing all its revenues and expenses for a specific period. Cash flow for the month.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)