Perfect Info About Current Liabilities On A Balance Sheet

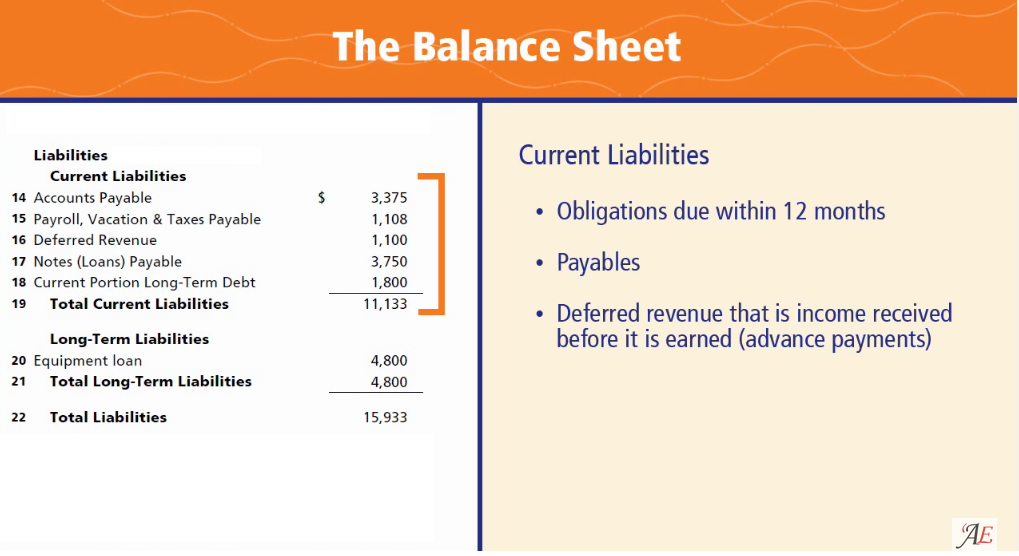

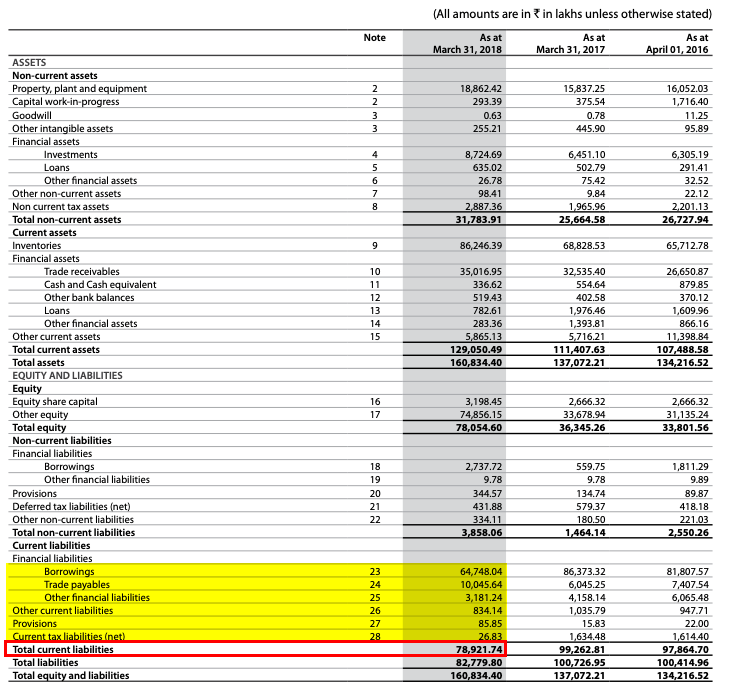

The current liabilities section of a balance sheet shows the debts a company owes that must be paid within one year.

Current liabilities on a balance sheet. Table of contents what are current liabilities? · have a market value of $5 billion or more. Current tax liabilities are measured at the amount expected to be paid to taxation authorities, using the rates/laws that have been enacted or substantively enacted by the.

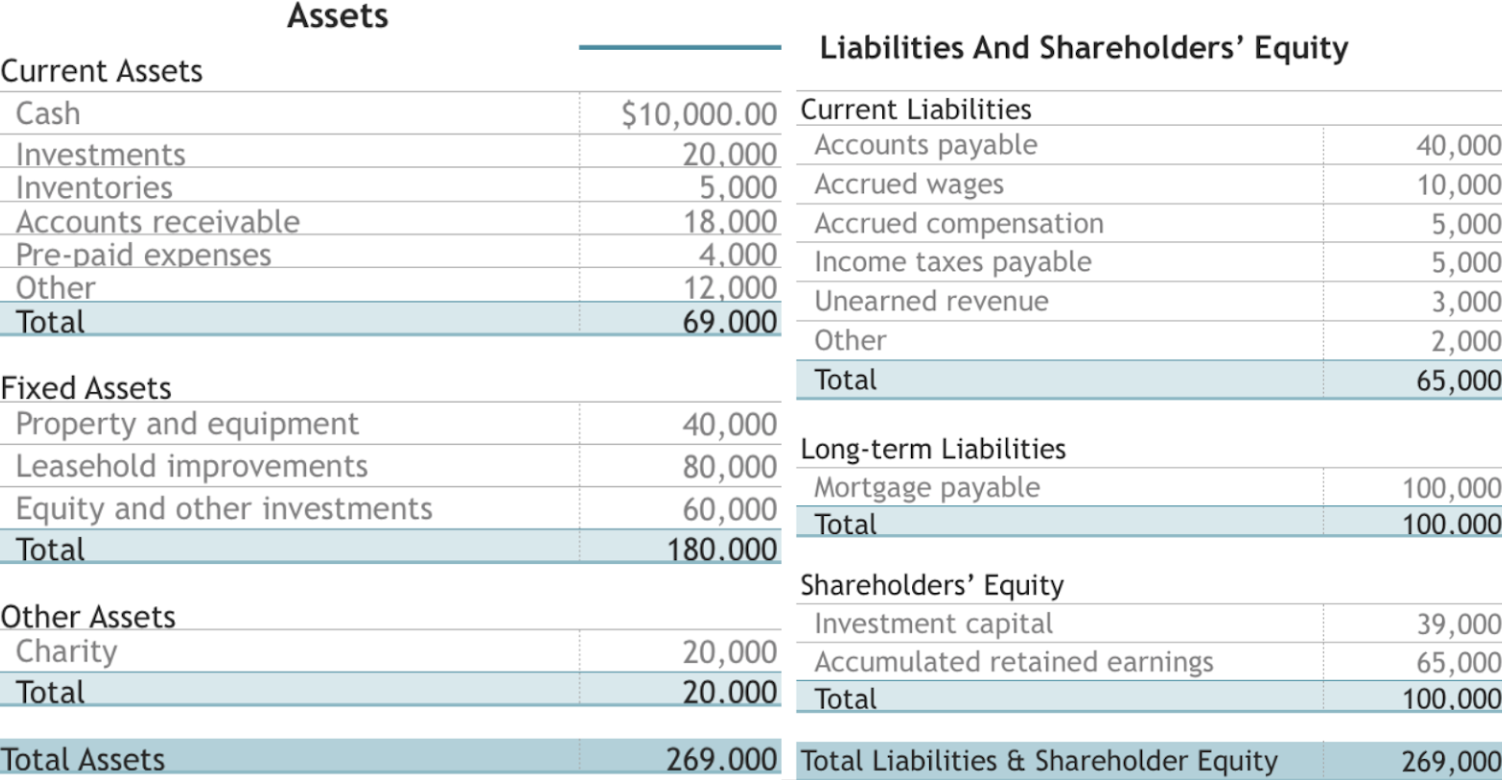

Example of how to calculate current liabilities. Short term or current liabilities 1. Changes in current liabilities from the beginning of an accounting period to.

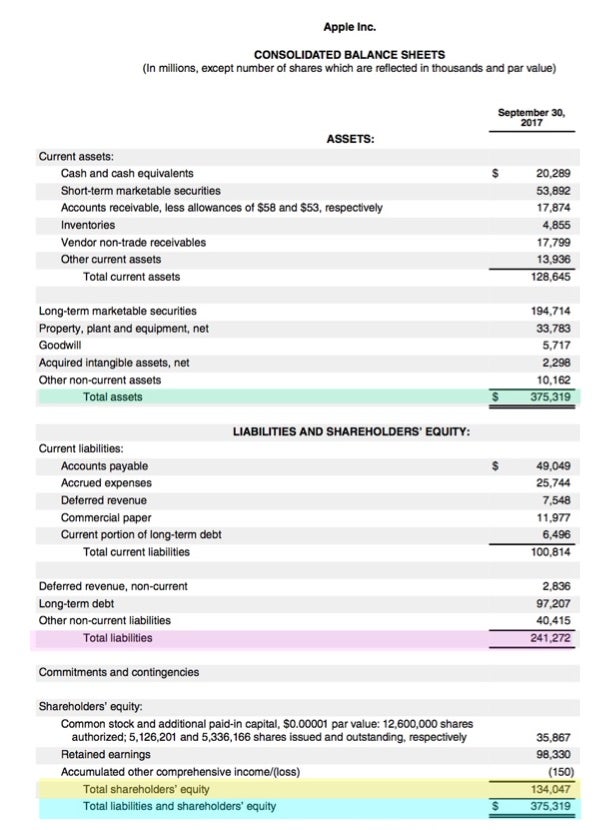

Capital the capital of a business is the amount which the owner or owners of the business contribute. These debts are the opposite of. To make my balance sheet powerhouses list, a company must:

Liabilities are to be settled within one financial year (liabilities</strong> that have a term of more than one year for settlement. A liability occurs when a company has undergone a transaction that has. Current liabilities are the obligations of the company expected to get paid within one year and are calculated by adding the value of trade payables, accrued expenses, notes.

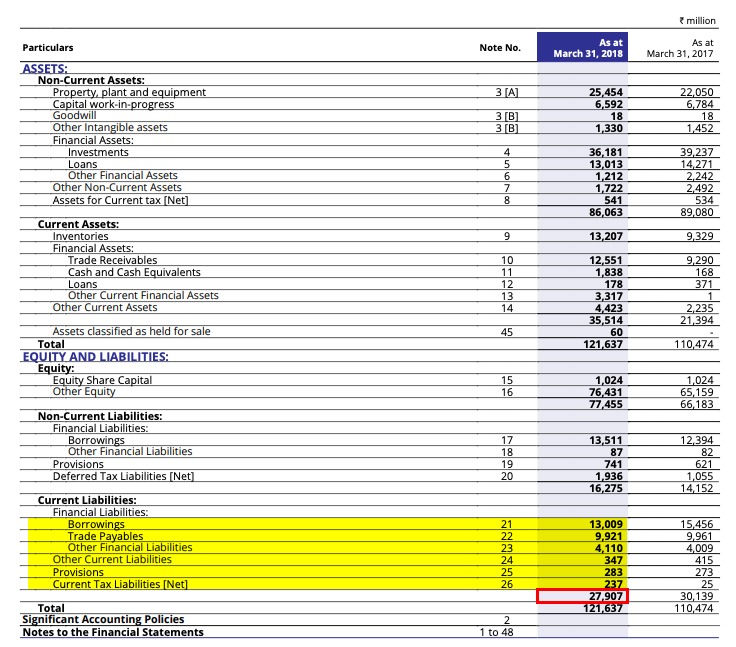

( t) balance sheet as of dec. Current liabilities on the balance sheet refer to the debts or obligations that a company owes and is required to settle within one fiscal year or its normal operating cycle,. · have debt no more than 10% of the company’s net.

Current liabilities using the at&t (nyse: Liabilities are listed at the top of the balance sheet because, in case of bankruptcy, they are paid back first before any other funds are given out. The owner performs the following calculation to find their current liabilities:

To calculate current liabilities, you can review your company’s balance sheet and add all of the items from. Current liabilities are financial obligations of a business entity that are due and payable within a year. Current liabilities are reported on the classified balance sheet, listed before noncurrent liabilities.

Current liabilities = $300 + $500 + $1,200 + 250 = $2,250. Current liabilities is a term that describes all of the obligations and debt that a company has to pay off within 12 months.

:max_bytes(150000):strip_icc()/AppleBalanceSheetInvestopedia-45d2b2c13eb548ac8a4db8f6732b95a0.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)