Have A Info About Example Of Expenses In Income Statement

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

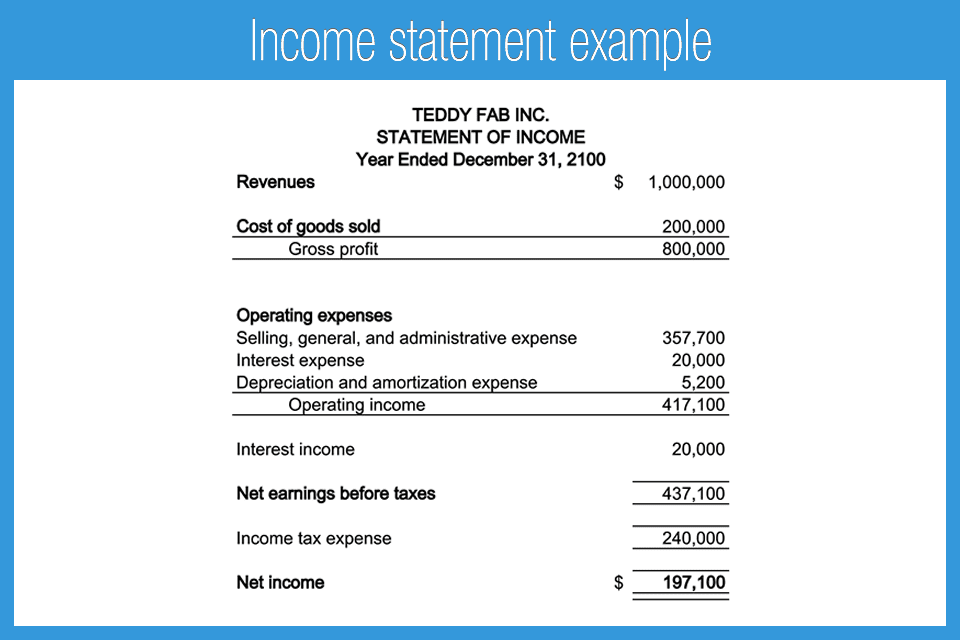

The income statement shows a company’s expense, income, gains, and losses, which can be put into a mathematical equation to arrive at the net profit or loss for that time period.

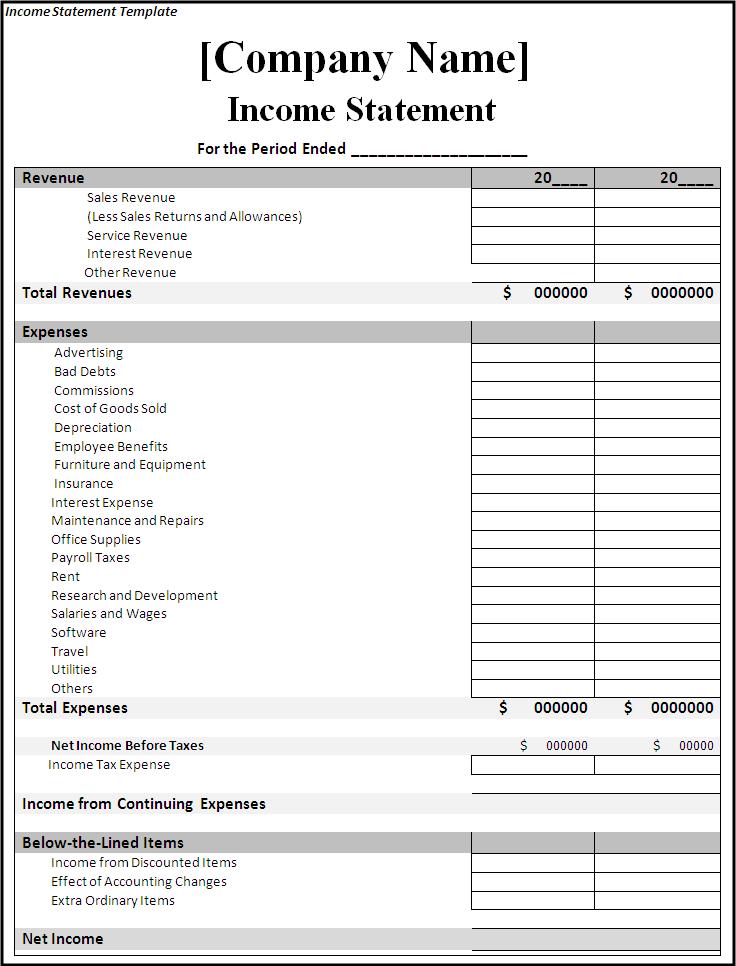

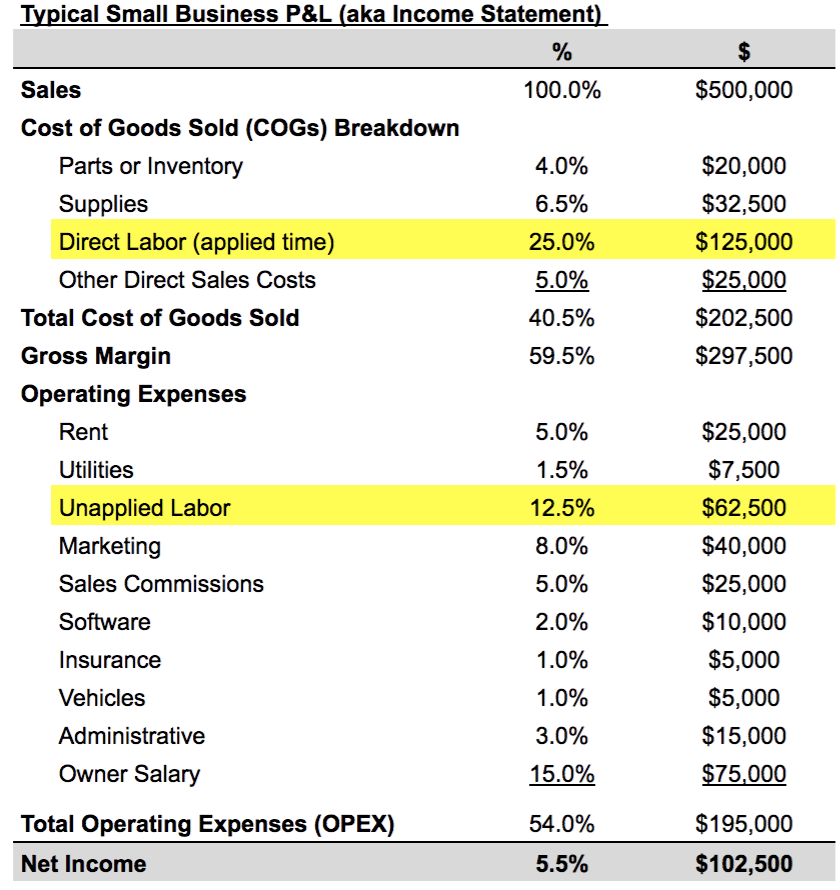

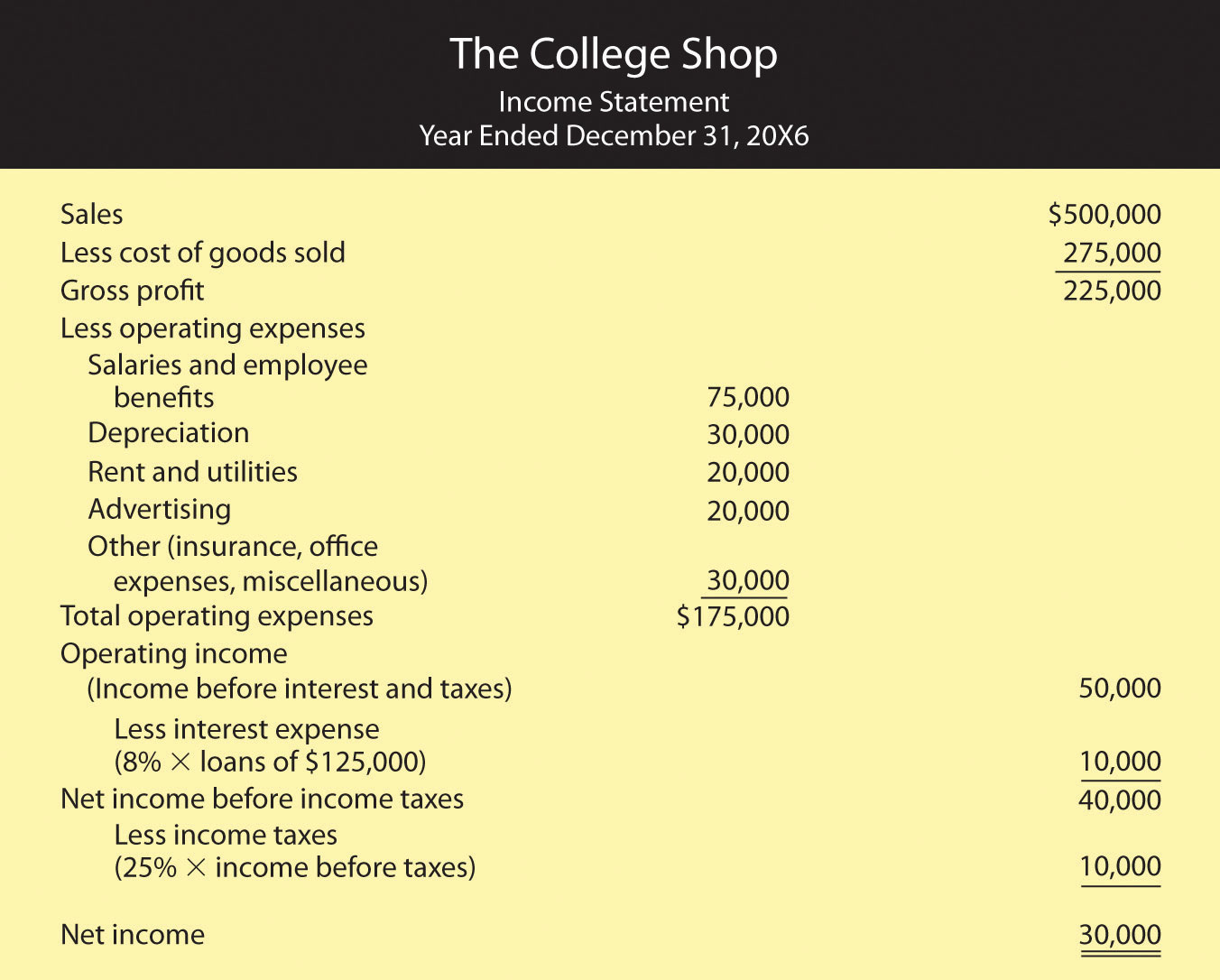

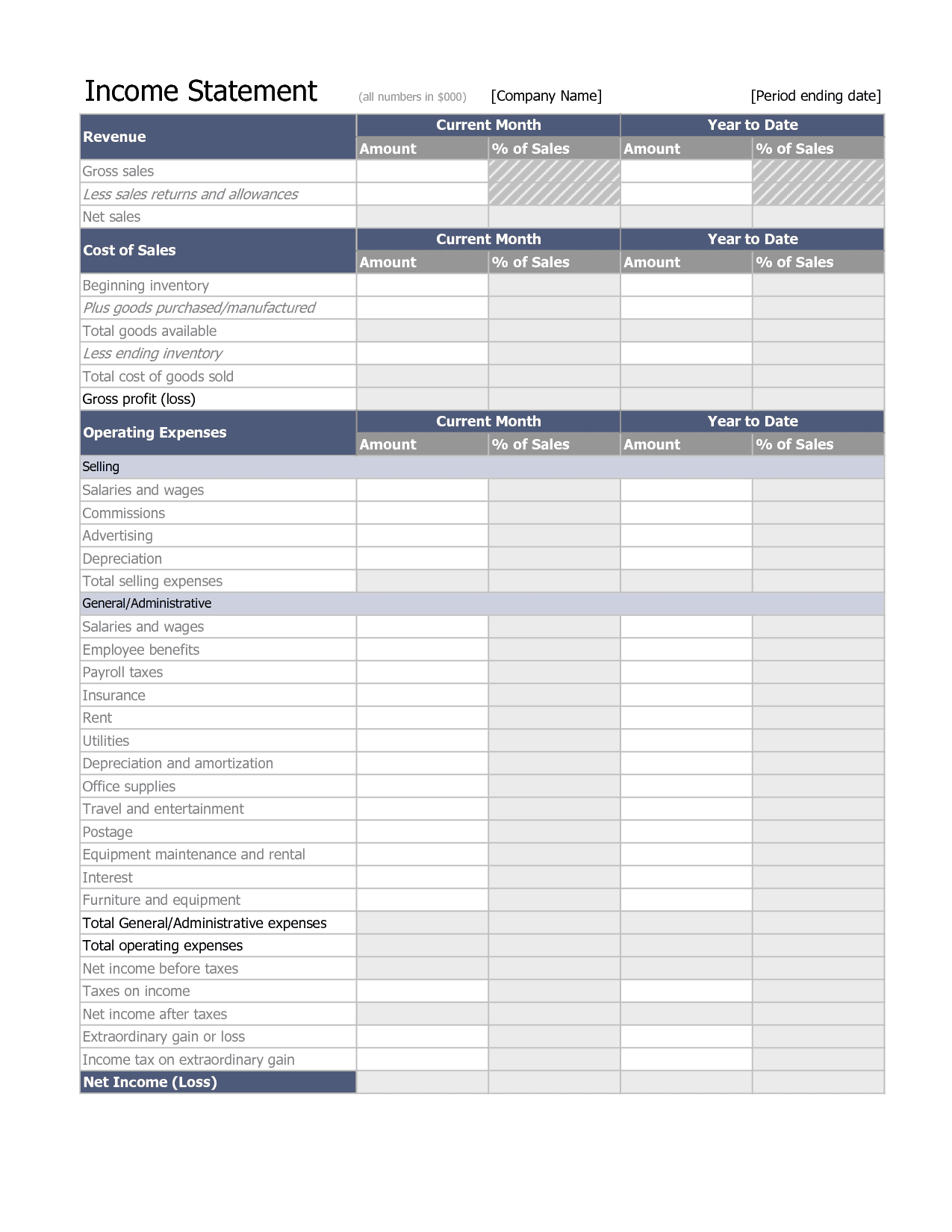

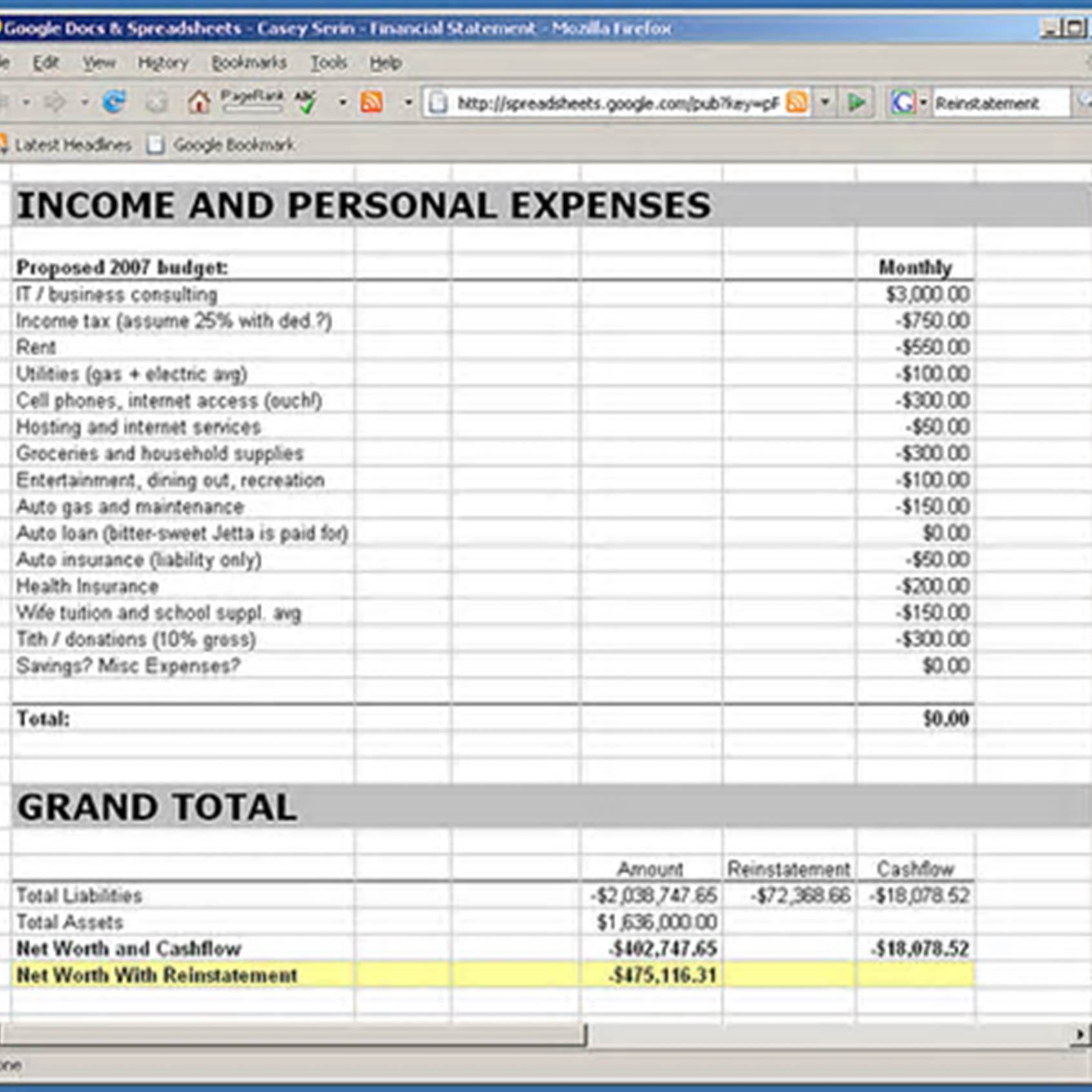

Example of expenses in income statement. The statement’s format will vary from business to business because they have different income and expenses. Expenses are recognized when incurred regardless of when paid. This means that the income and expenses presented in the income statement have already been.

The income statement complies with the accrual basis of accounting. Deduct your expenses and losses from your revenue and gains to reach your income before tax and interest (ebit). Expenditures denote the amount of money that a business uses to purchase a fixed asset or for increasing fixed asset value.

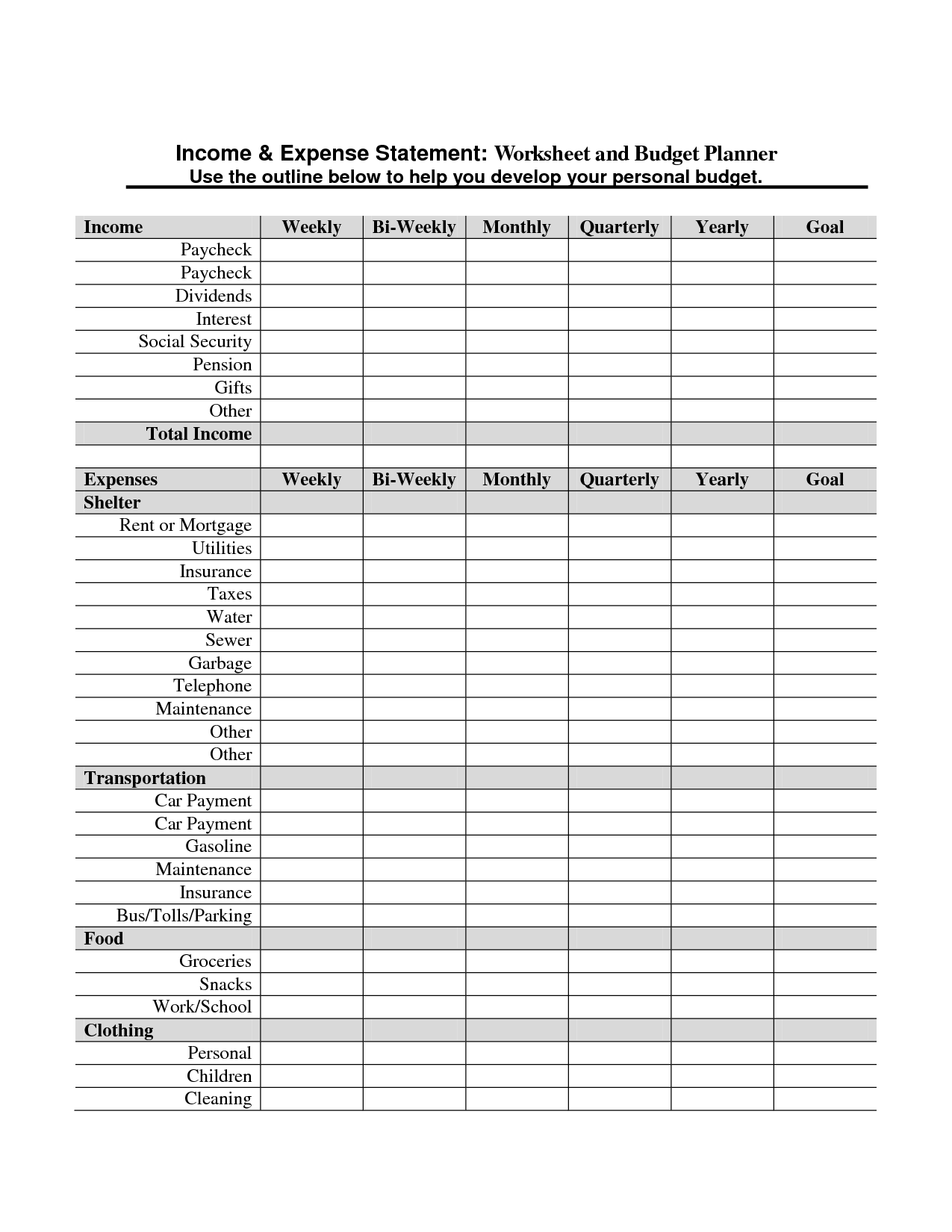

Below is an example of an income and expenditure. This information helps you make timely decisions to make sure that your business is on a good financial footing. Here’s an example of an income statement from a fictional company for the year that ended on september 28, 2019.

The gao audit report on the u.s. You can look at an income. Add up all your revenue and gains.

Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). For example, $57,100 (the net income). An income statement might use the cash basis or the accrual basis.

For example, if you itemize, your agi is $100,000 and your. But there is a floor. Also sometimes referred to as “operating expenses,” these include rent, bank & atm fee expenses, equipment expenses, marketing & advertising expenses, merchant fees, and any other expenses you need to make to keep your business going.

Depreciation is a way of accounting for the loss in value of an asset over time, while amortization is similar but specifically refers to. Go to the alternative version. As you can see at the top, the reporting period is for the year that ended on sept.

Some investors and analysts use income statements to make investing decisions. Interest paid (or bank charges). The simplest (and free) way to do one is to use a spreadsheet.

The income statement focuses on four key items: Both small and large companies use such a format. Income statement example.

The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20. The income statement is a useful way to see how a company makes money and how it spends it. For example, a company in the manufacturing industry would likely have cogs listed.