What Everybody Ought To Know About Provision For Doubtful Debts In Profit And Loss Account

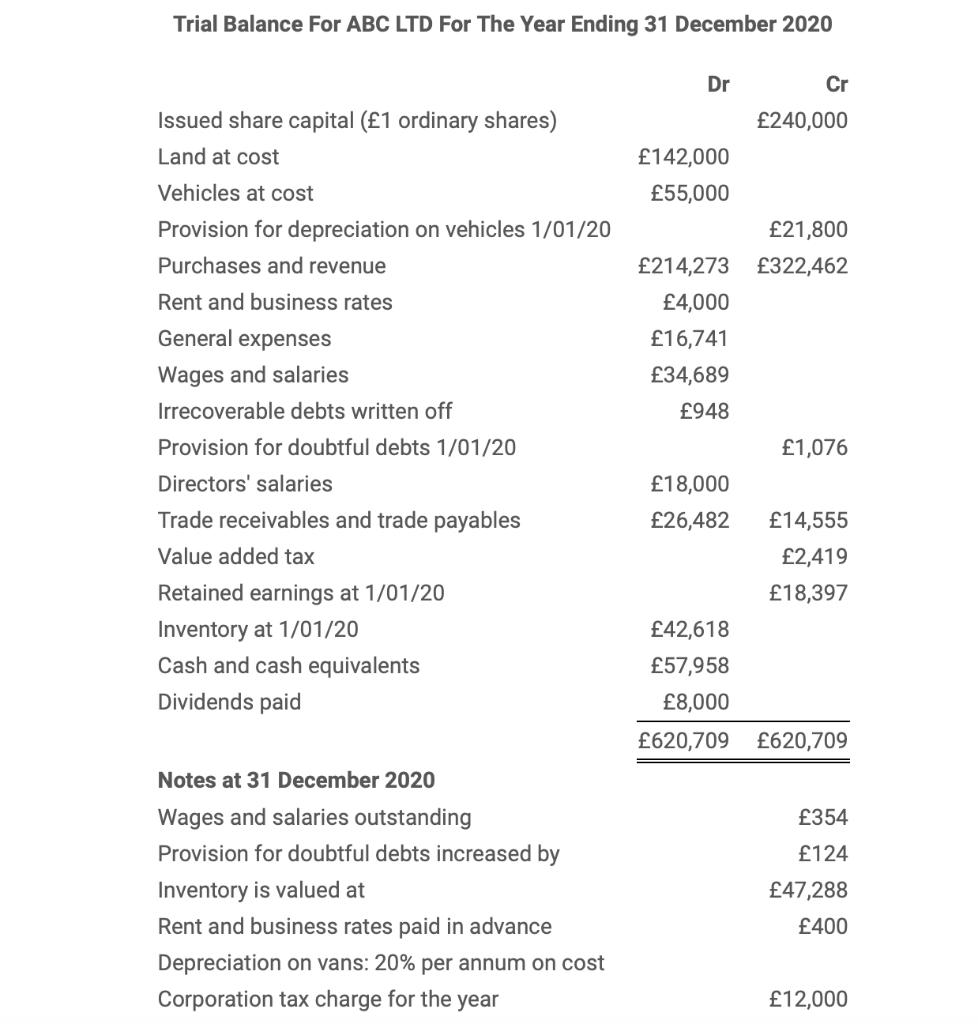

In the profit and loss account for years ended december 31, 2014, 2015 & 2016, jonah shall recognize provision for doubtful debts amounting to $900 (dr.), $200 (cr.) and.

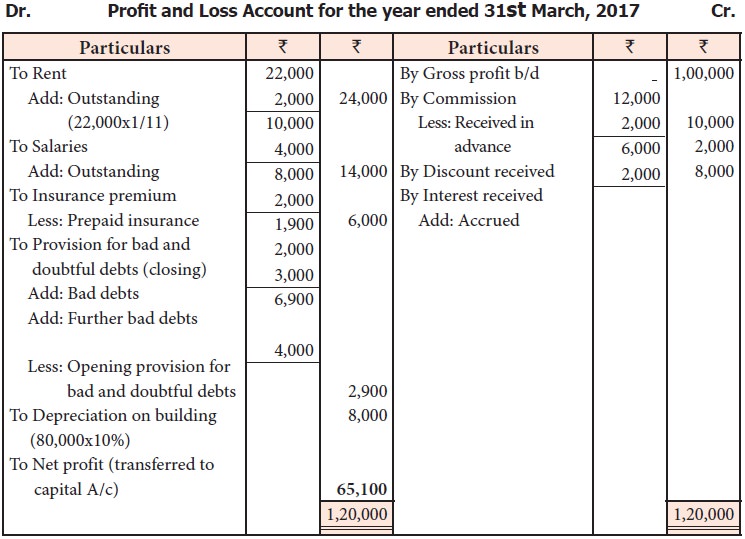

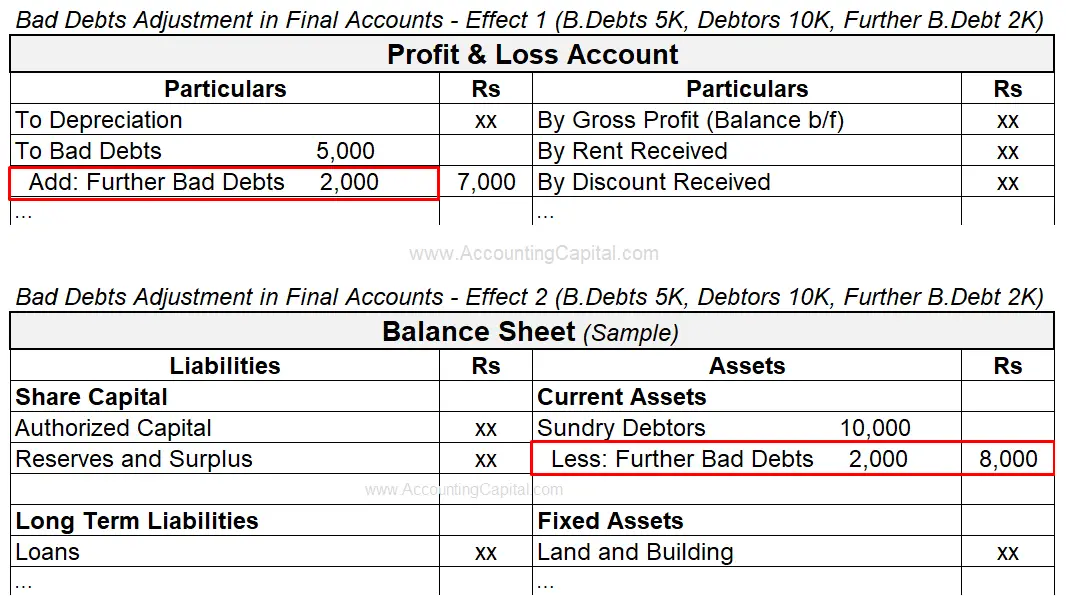

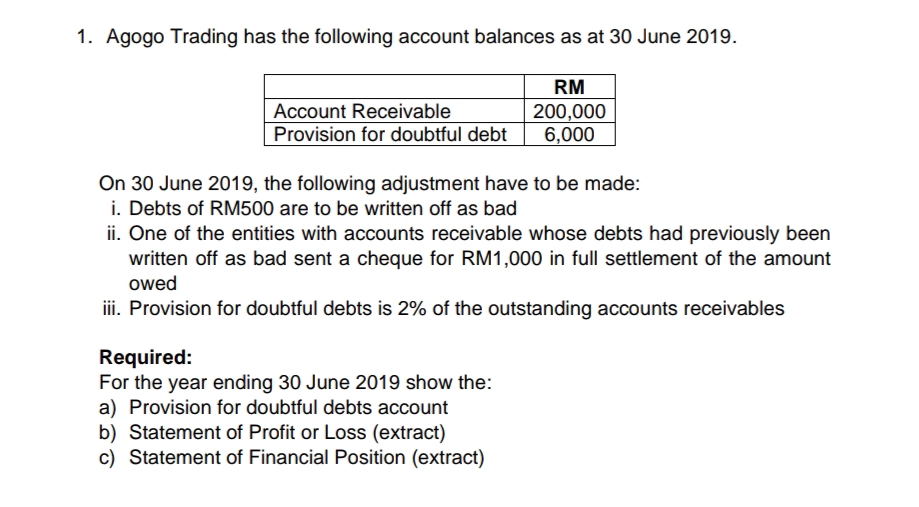

Provision for doubtful debts in profit and loss account. Abc ltd must write off the $10,000 receivable from xyz ltd as bad debt. Once doubtful debt for a certain period is realized and becomes bad debt, the actual amount of bad debt is written off the balance sheet—often referred to as write. To this end, a new account is opened in the books called provisions for bad debts account, or provisions for doubtful debts account.

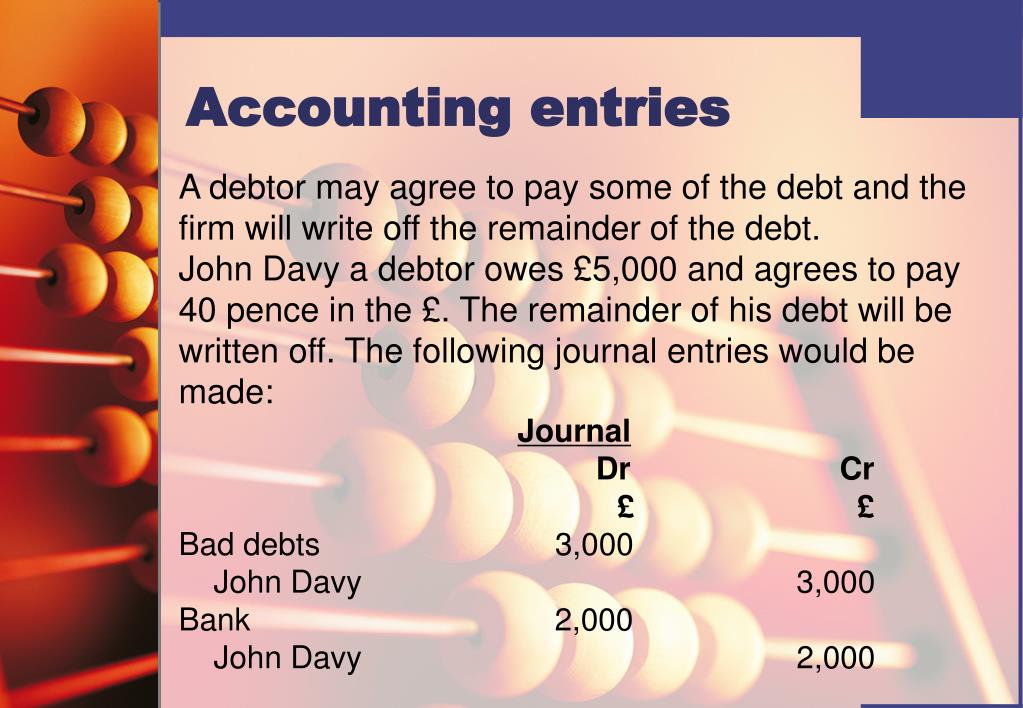

Accounting entry to record the bad. Prudence requires that an allowance be created to recognize the potential loss arising from the possibility of incurring bad debts. The general rule is:

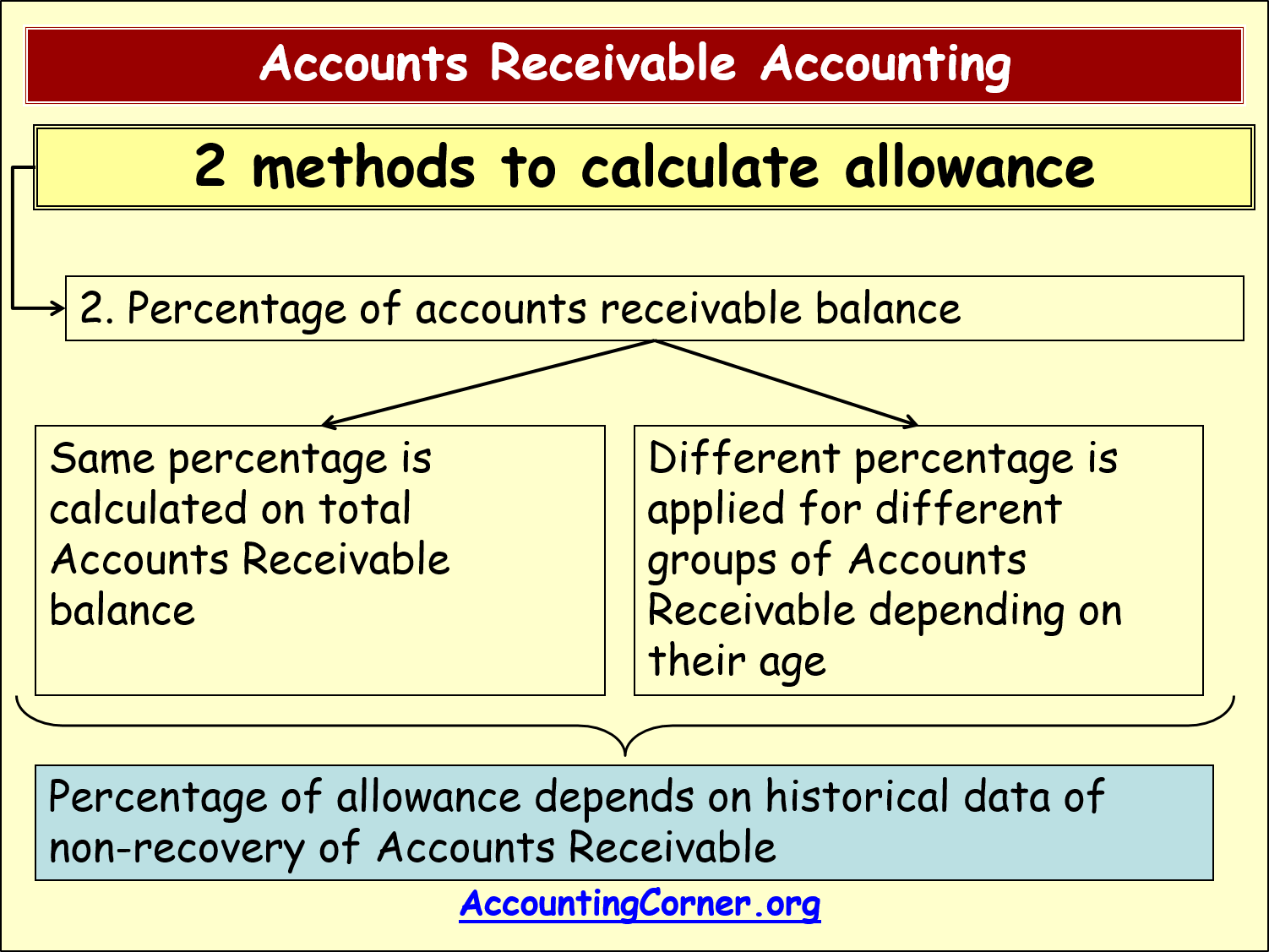

The provision for doubtful debts, which is also referred to as the provision for bad debts or the provision for losses on accounts receivable, is an estimation of the amount of. Provision is created out of profits of the current accounting period to reduce the amount of loss that may take place in the future. When this account is first.

If provision for doubtful debts is the name of the account used for recording the current period's expense associated with the losses from normal credit sales, it will appear as. A provision for bad and. Such receivables are known as doubtful debts.

Prepare the bad debts account, provision for bad debts account, profit and loss account and balance sheet from the following information as on december 31,2011.rs. The provision for doubtful debts, often described as the provision for losses on accounts receivable or bad debt provision, describes the estimated amount of. The following journal entry is made to record a reduction in provisions for bad or doubtful debts:

By analyzing the past trend, a business can ascertain the approximate percentage that becomes uncollectible every year out of the total credit allowed to buyers. Allowance for doubtful debts on 31 december 2009 was $1500. The provision for doubtful debts is also known as the provision for bad debts and the allowance for doubtful accounts.

The nature of various debts decides the amount of doubtful debts. Provision for bad debts account; This provision is created by debiting the profit and loss account for the period.

The provision can be brought up to the required amount by again debiting the profit and loss account and crediting the provision for bad and doubtful debts account. Allowance for doubtful debt is created and increased on the credit side of allowance for doubtful debt account. The account is decreased or.

The provision for doubtful debt is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected. The provision for doubtful debts is.