Heartwarming Tips About Depreciation In Balance Sheet

Depreciation represents how much of the asset's value has been used up in.

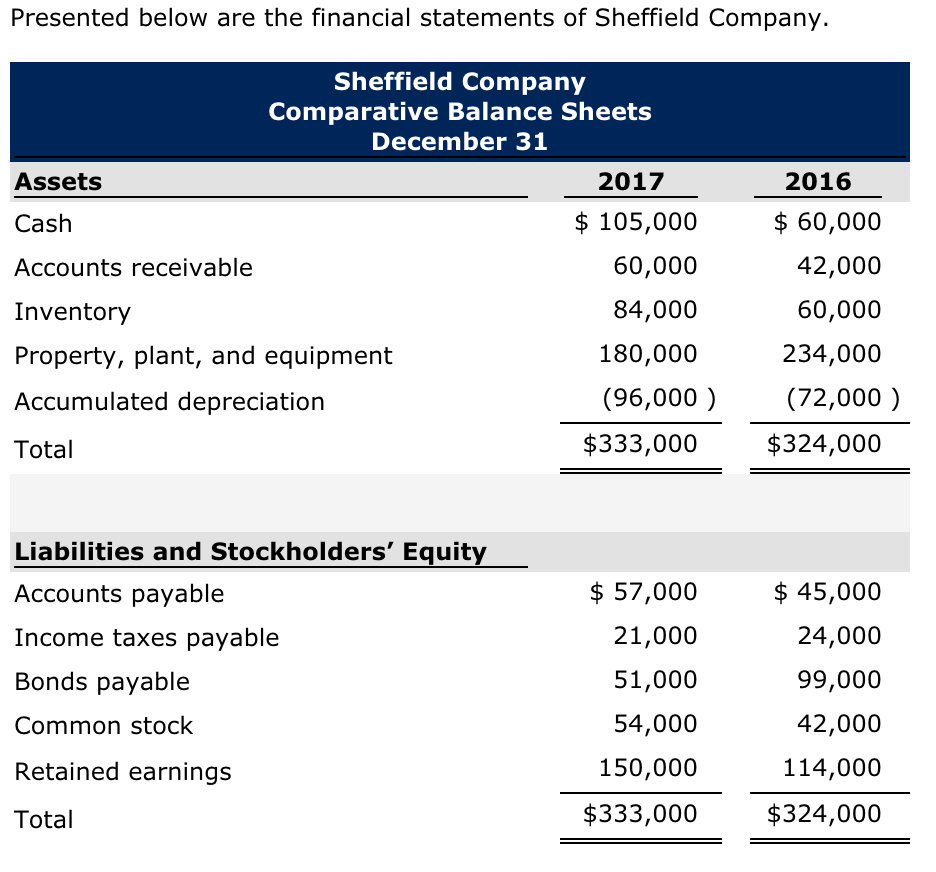

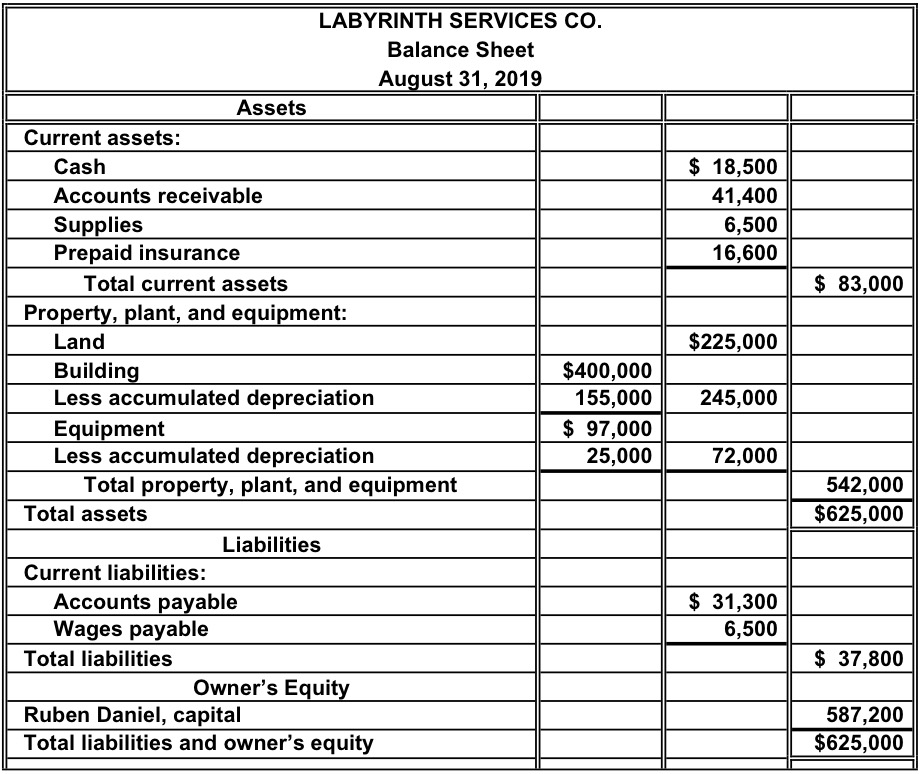

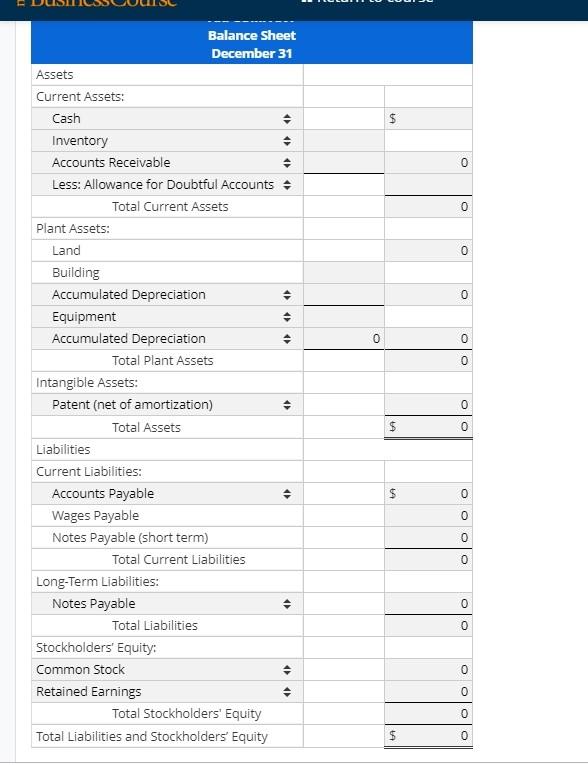

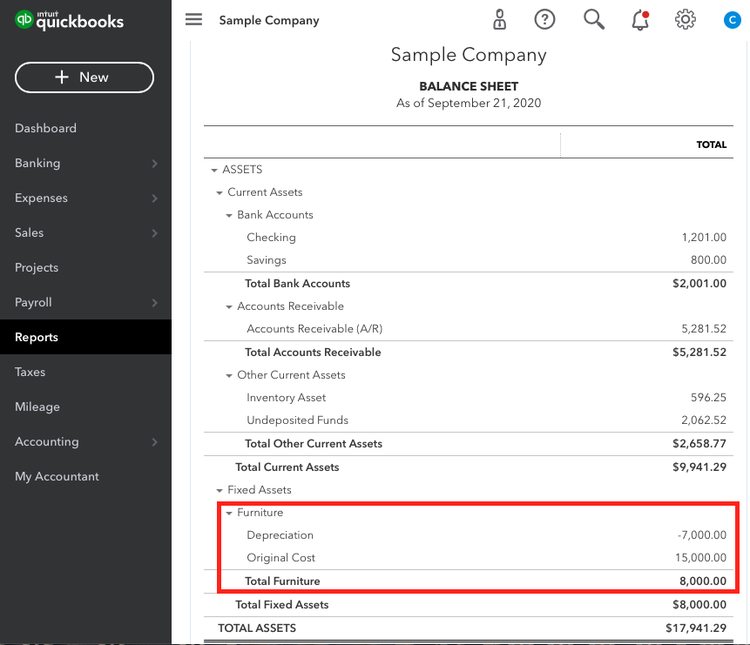

Depreciation in balance sheet. Accumulated depreciation on the balance sheet serves an important role in in reflecting the actual current value of the assets held by a business. Depreciation, or the decrease in value of a company asset, is reported on financial statements. However, the accumulated depreciation allows assets to deduct the deterioration.

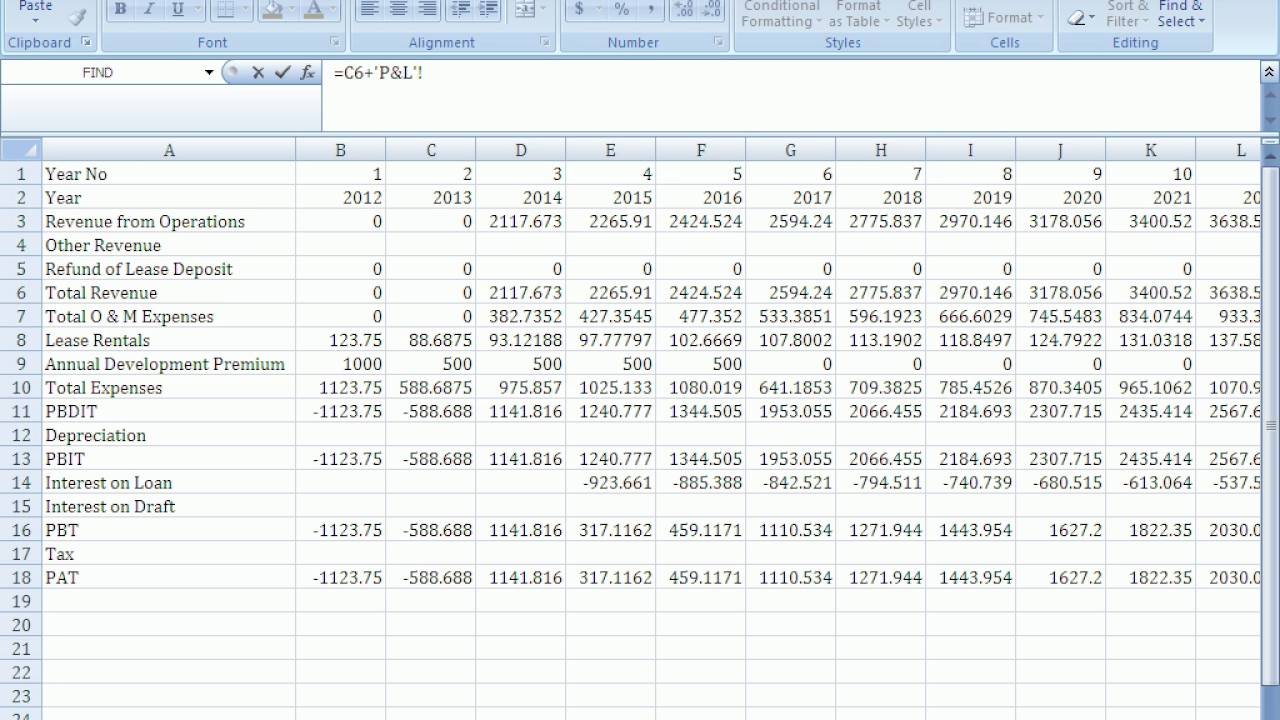

Accumulated depreciation is presented on the balance sheet just. Depreciation expense is the amount that a company's assets are depreciated for a single period (e.g, quarter or the year), while accumulated depreciation is the total amount of wear to date. Gain insights into where depreciation expense is recorded with our comprehensive guide.

For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it at $8,000 per year. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time.

Balance sheet depreciation is a way of calculating the decrease in value of an asset over its. When a company invests in depreciable assets such as machines and equipment, investors can expect to see an increase of assets on the balance sheet for that year. It subtracts a fixed percentage from the asset’s remaining book value every year.

Depreciation is an accounting practice used to spread the cost of a tangible or physical asset over its useful life. Accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

The accumulated depreciation account is a contra asset account on a company's balance sheet. Depreciation is found on the income statement, balance sheet, and cash flow statement. This means an asset loses more value in its early years.

Assets like cars and computers often use this method because they lose value quickly at first. It appears as a reduction from the gross amount of fixed assets. Defining the declining balance method.

In other words, the asset's accumulated depreciation is equal to the asset's cost (or to its estimated salvage value). It can thus have a big impact on a company’s financial performance overall. Companies seldom report depreciation as a separate expense on their income statement.

Depreciation is an important concept for managing. Depreciation is a financial accounting method used to allocate the cost of tangible assets over their useful lives. It represents the reduction of the original acquisition value of an asset as that asset loses value over time due to wear, tear, obsolescence, or any other factor.

In most accounting methods, assets are recorded at the original cost in the balance sheet. Depreciation is a financial accounting method used to allocate the cost of tangible assets over t. clearias on instagram: Depreciation provides a way for businesses and individual investors to measure the decline in value of tangible fixed assets over their useful lives.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)