Outstanding Info About Financial Ratios Examples

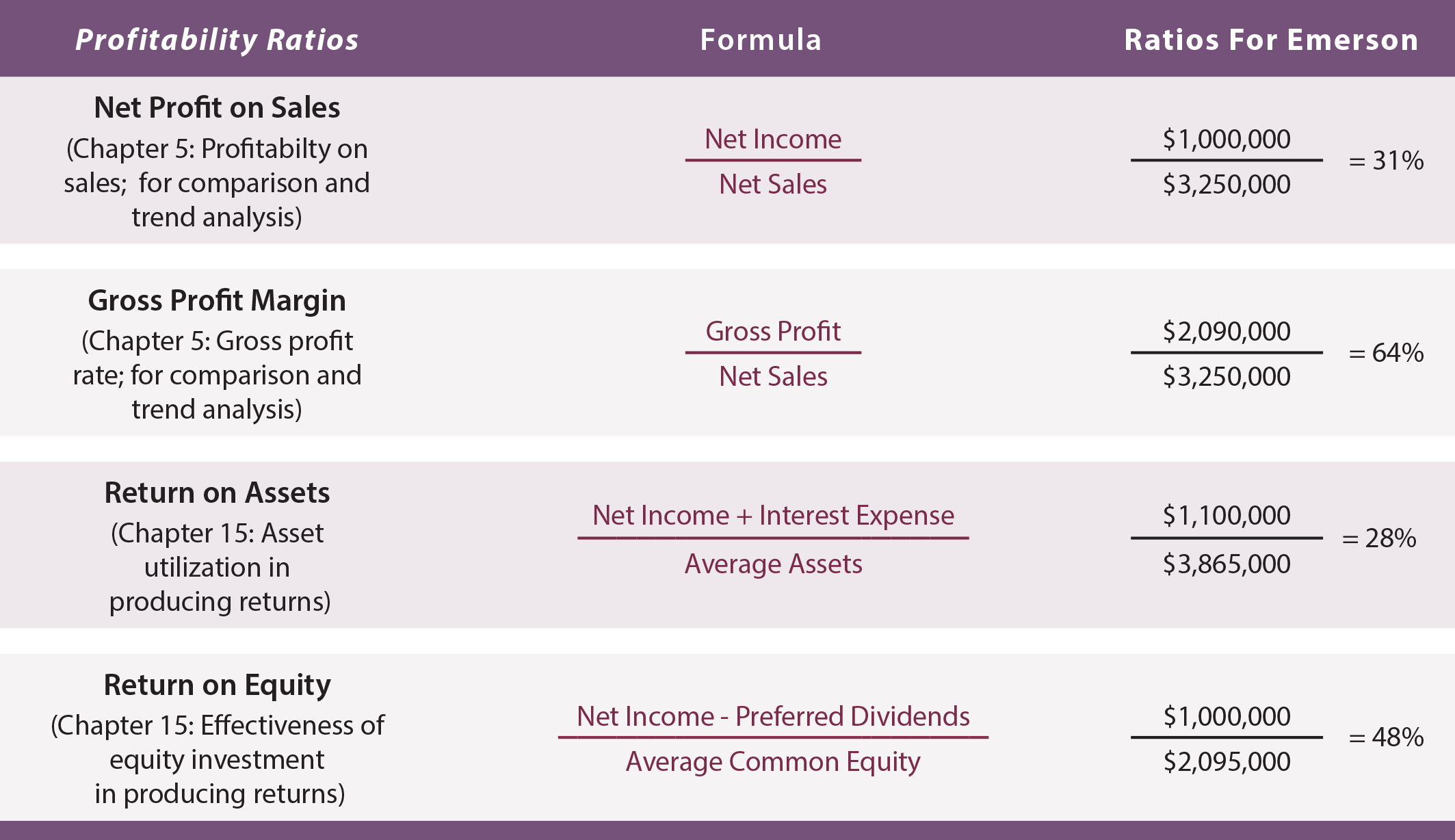

A higher roa is better, as it indicates that the company can generate more income from each dollar of assets.

Financial ratios examples. List of top 5 types of financial ratios. What are the 5 financial ratios used to determine? Financial ratios for credit rating analysis.

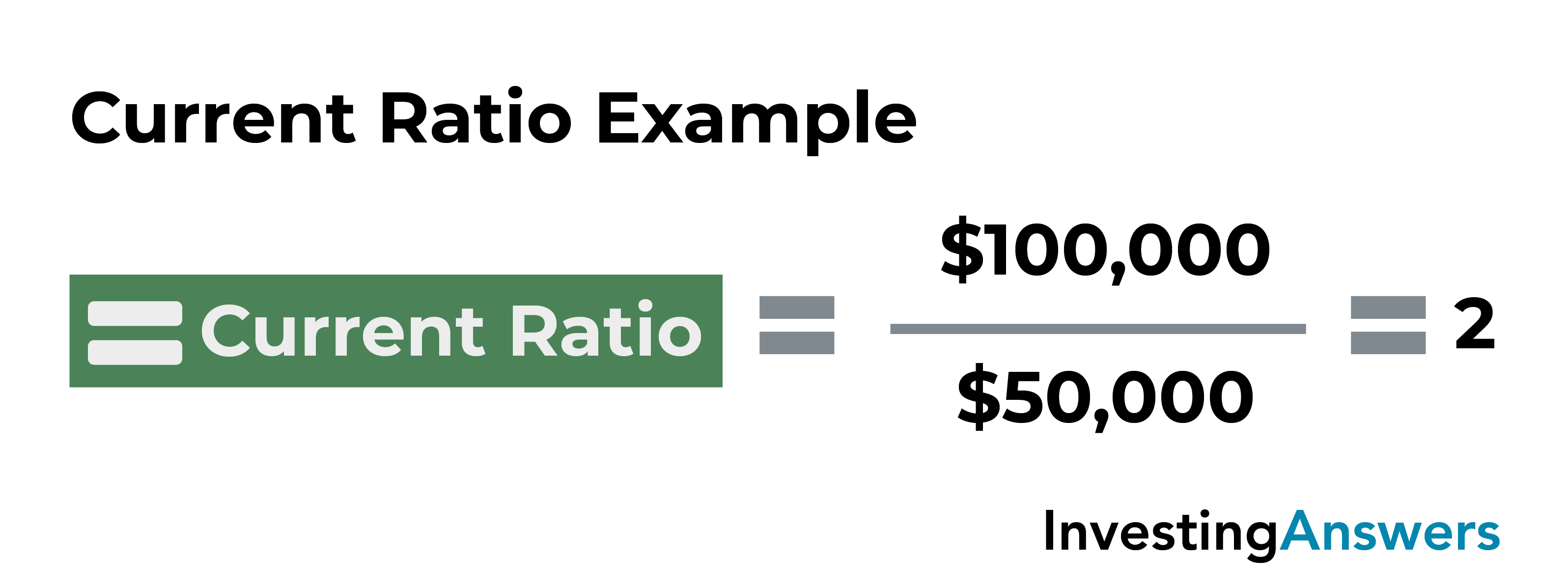

For example, a company's existing current ratio may be 1.1; The term liquidity refers to how easily a company can turn assets into. Financial ratios such as the turnover ratios and the return on ratios will need 1) an amount from the annual income statement, and 2) an average balance sheet amount.

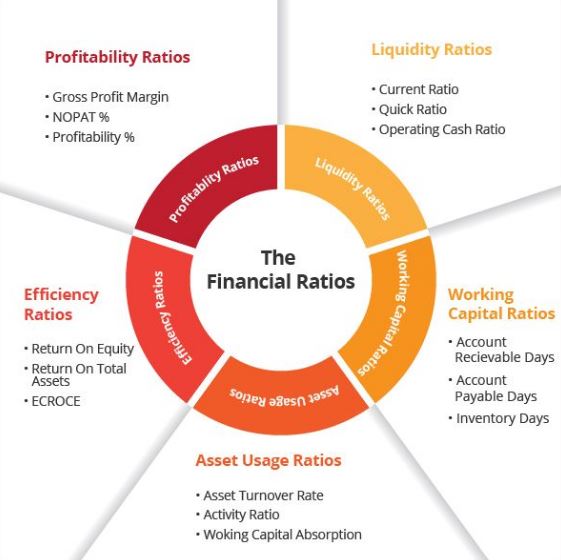

These financial ratios quickly break down the complex information from financial statements. The five key financial ratios include liquidity ratios, profitability ratios, debt ratios, efficiency ratios, and market value ratios. Liquidity, solvency, efficiency, profitability, market prospect, investment leverage, and coverage.

For the required calculations that. Financial ratios are ratios used to analyze the finances and performance of a company. Instead of opening account of an individual.

Although there are many financial ratios businesses can use to measure their performance, they can be divided into four basic categories. Examples of ratio analysis include current ratio, gross profit margin ratio, inventory turnover ratio. If the company wants to become more liquid, it mayor set the internal target of holding a current ratio of 1.2 by the end of the taxation year.

Activity ratios (also called efficiency ratios) profitability ratios; This ratio provides insight into the company’s profitability and profit trend. Formula, decomposition, interpretation, pros, cons.

Cash ratio = ( cash + marketable securities ) ÷ current liabilities measures the ability of a company to pay its current liabilities using cash and marketable securities. One example is the net profit ratio, calculated by dividing net profit by sales. It represents the portion of assets that are financed by liabilities.

Our explanation will involve the following 15 common financial ratios: An example of a financial ratio is the current ratio, calculated as current assets divided by current liabilities, which assesses liquidity. Financial ratios are often divided up into seven main categories:

2) return on equity (roe) return on equity measures a company’s ability to generate earnings in relation to its shareholders’ equity. Ratio #5 debt to total assets; For example, say you’re considering investing in the tech sector, and you are evaluating two potential companies.

We'll discuss the 5 main categories of financial ratios and walk through 31 examples, their meanings, and how to interpret them. In general, an roa above 5% is considered good. Common ratios used to measure financial health