Best Of The Best Tips About Goodwill Impairment Loss Journal Entry

Accounting for reversal of an impairment.

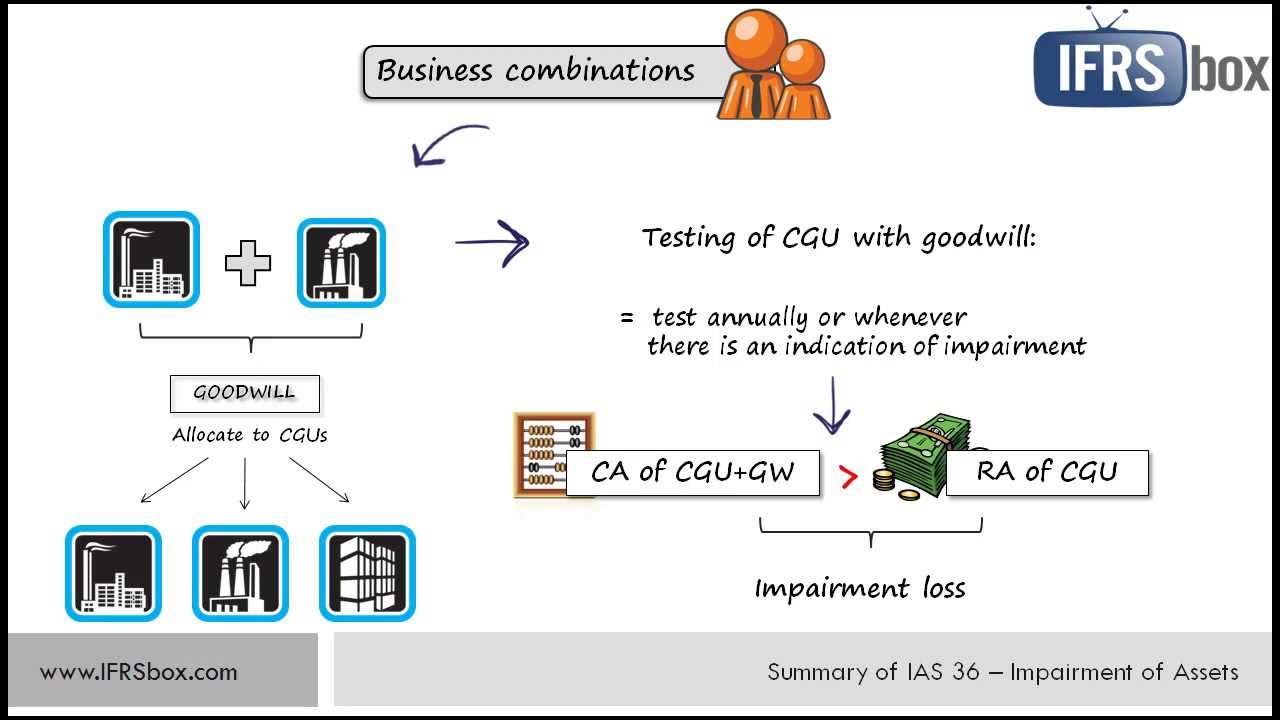

Goodwill impairment loss journal entry. An impairment loss is recognised immediately in profit or loss (or in comprehensive income if it is a revaluation decrease under ias 16 or ias 38). The impairment loss will be applied to write down the goodwill, so that the intangible asset of goodwill that will appear on the group statement of financial position will be $270. The impairment loss will be applied to write down the goodwill, so that the.

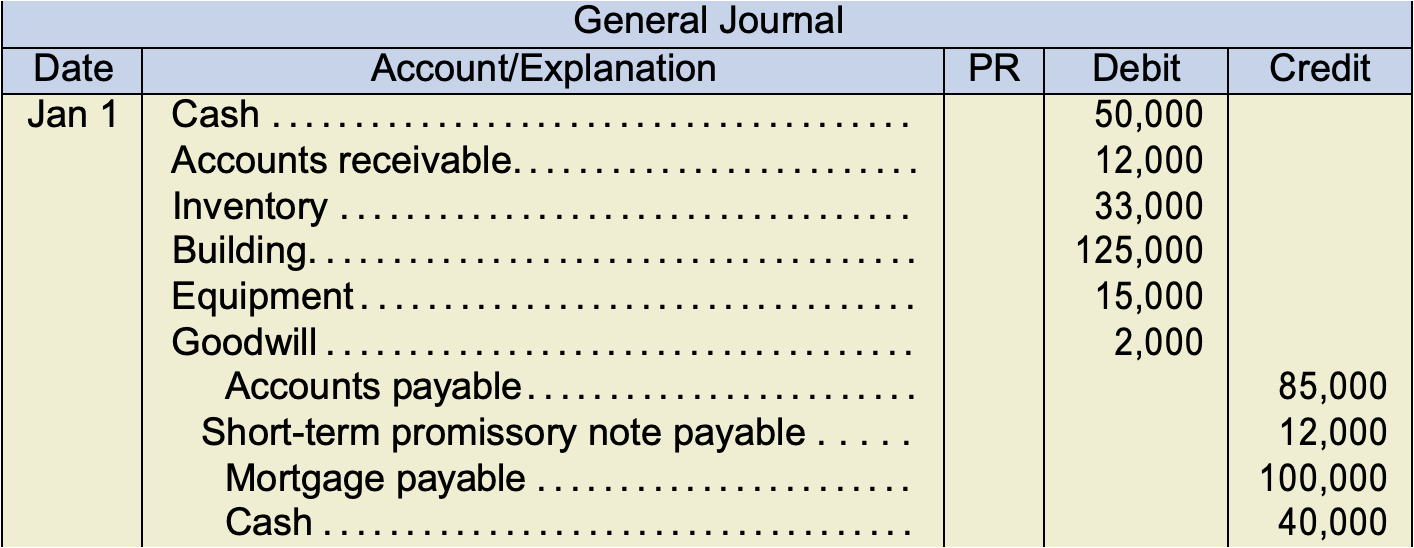

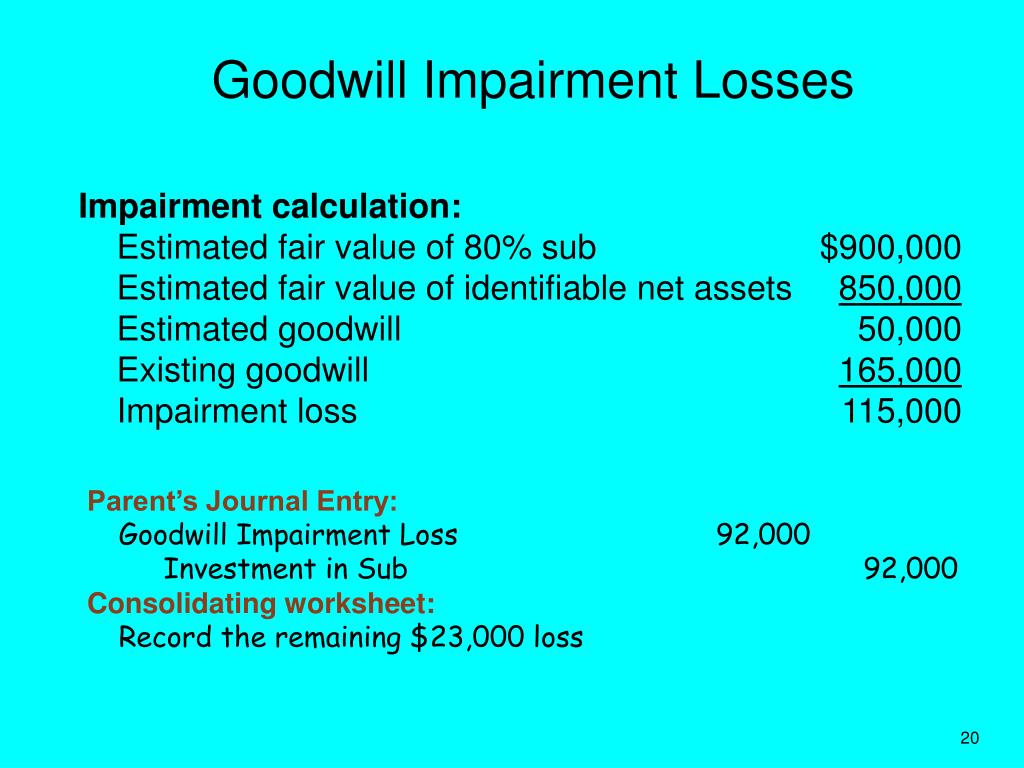

Record the journal entry to recognize any goodwill impairment. Any excess of the carrying value over the implied fair value is recognized as an impairment loss. The company can make the journal entry for goodwill impairment by debiting the goodwill impairment account and crediting the goodwill account when it finds out that there is an impairment of goodwill as a result of periodic review.

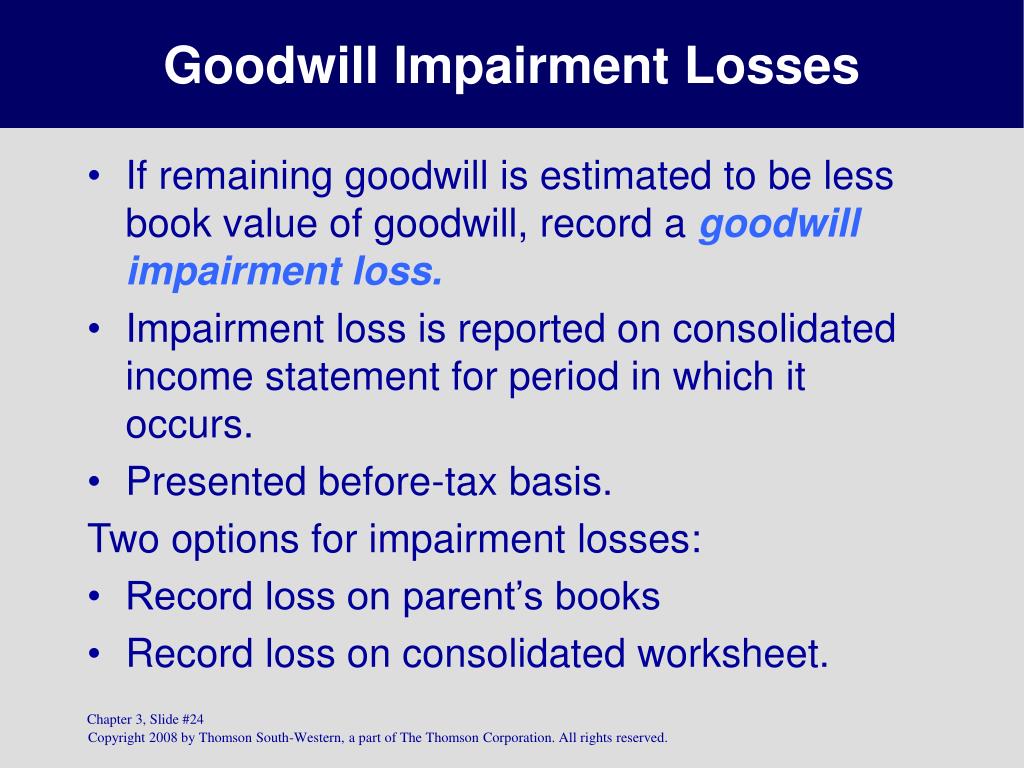

Only the parent’s share of the goodwill impairment loss will actually be recorded, ie 60% x $50 = $30. Any goodwill impairment loss is recognized for both the parent and nci, and allocated between both on a rational basis. If the goodwill account needs to be impaired, an entry is needed in the general journal.

Goodwill impairment is a charge that companies record when goodwill's carrying value on financial statements exceeds its fair value. Journal entries for impairment testing transactions. Goodwill impairment accounting occurs when the carrying value of goodwill on financial statements exceeds its fair value, leading to the declaration of a goodwill impairment.

Journal entry find out impairment loss if any given the following data for two reporting units: To illustrate the concept of. Goodwill impairment is an expense item on the income statement.