Top Notch Info About Prepaid Revenue Balance Sheet

![[Solved] I don't understand why I can't get the Statement](https://quickbooks.intuit.com/oidam/intuit/sbseg/en_ca/blog/images/unearned-revenue-balance-sheet.png)

In short, these expenses are considered assets because they represent future economic benefits for a business.

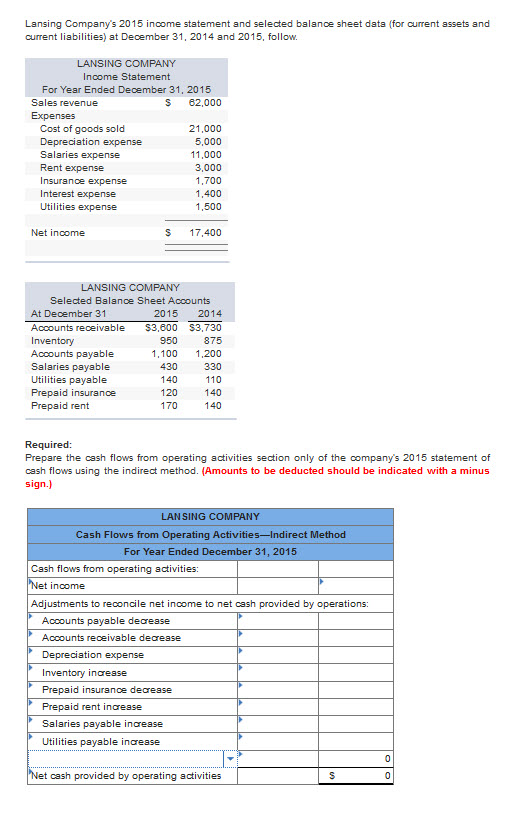

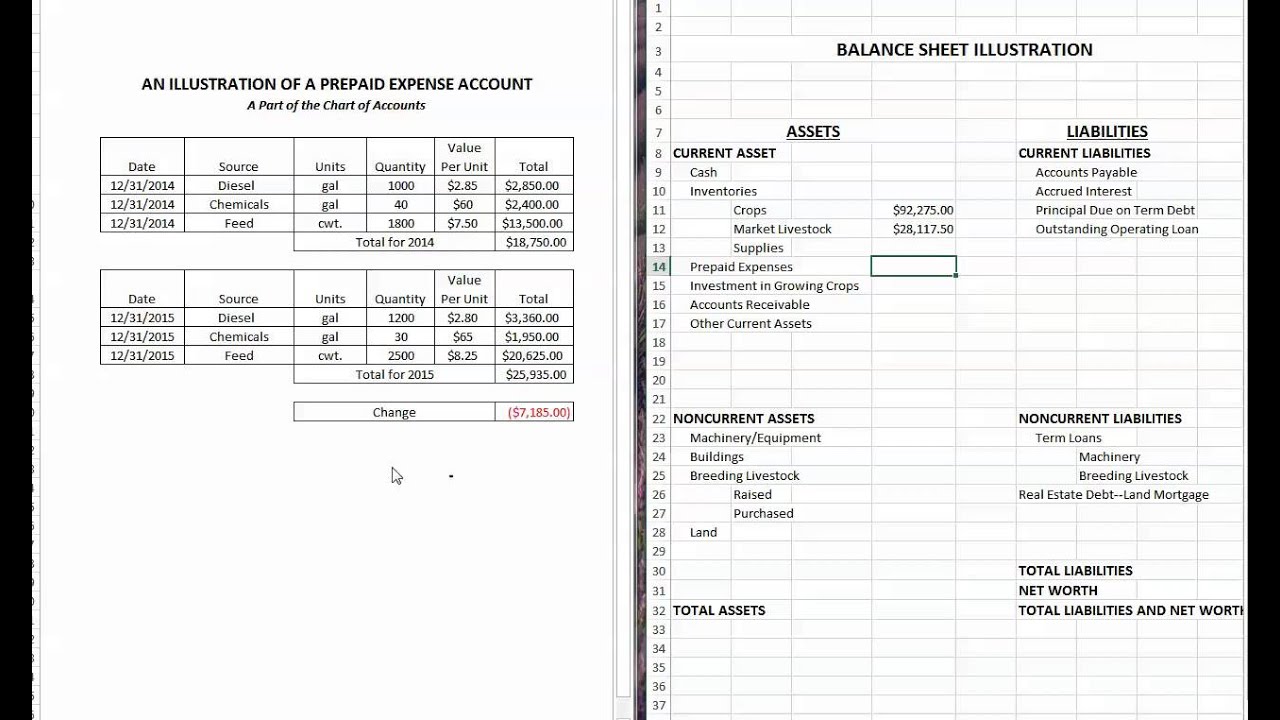

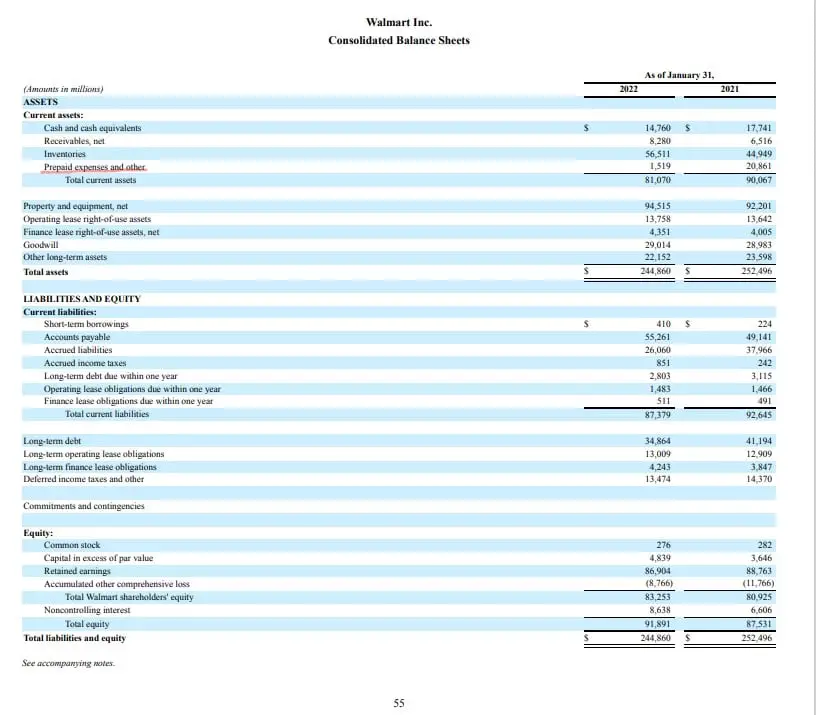

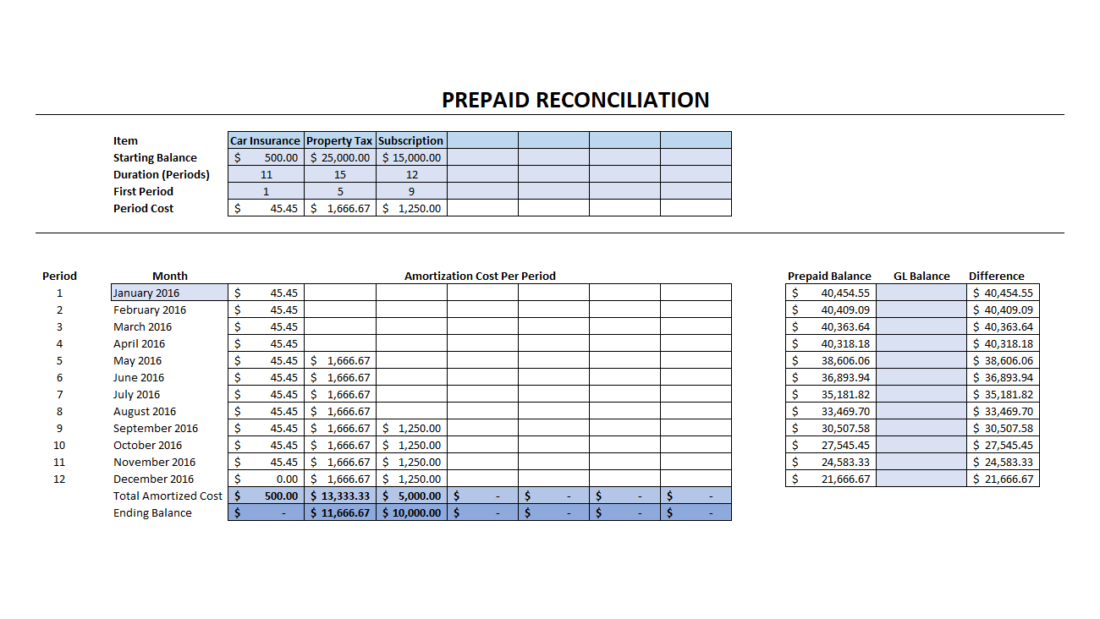

Prepaid revenue balance sheet. Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company. This journal entry credits the prepaid asset account on the balance sheet, such as prepaid insurance, and debits an expense account on the income statement, such as insurance expense. Key takeaways a prepaid expense is an amount paid in advance for the goods or benefits that are to be received in the upcoming period.

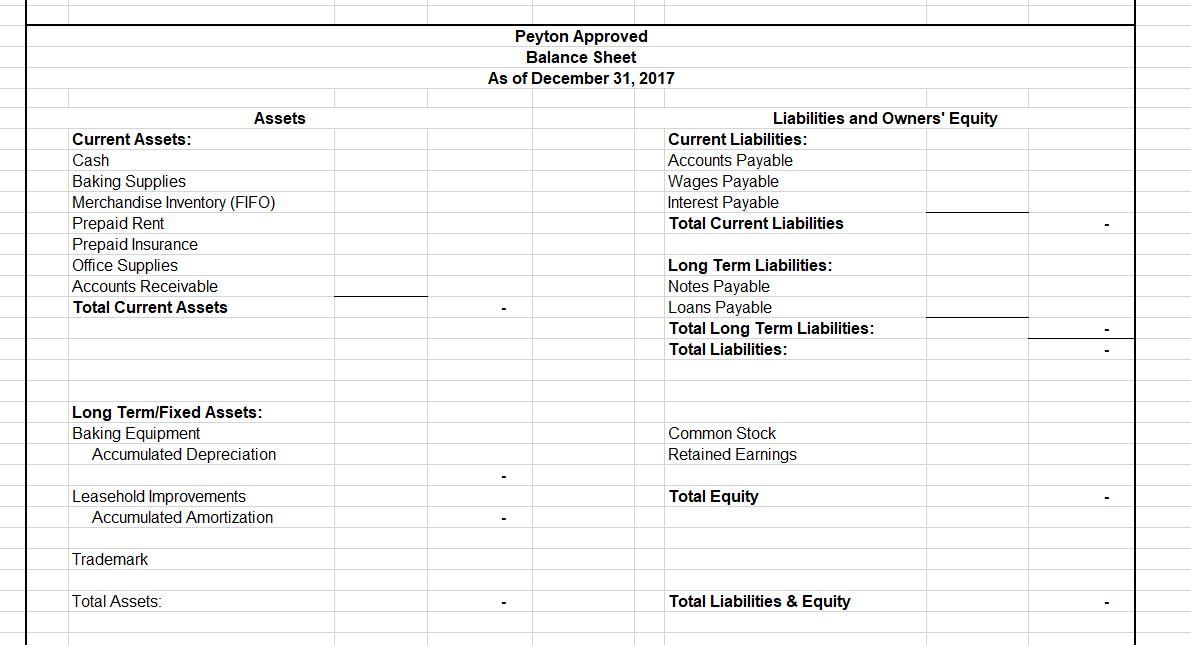

These are both asset accounts and do not increase or decrease a company’s balance sheet. As you use the item, decrease the value of the asset. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash.

What is prepaid revenue? Prepaid insurance is a key component of business accounting, whereby advance payments are made for insurance coverage. Prepaid expenses in balance sheet are listed as assets, too.

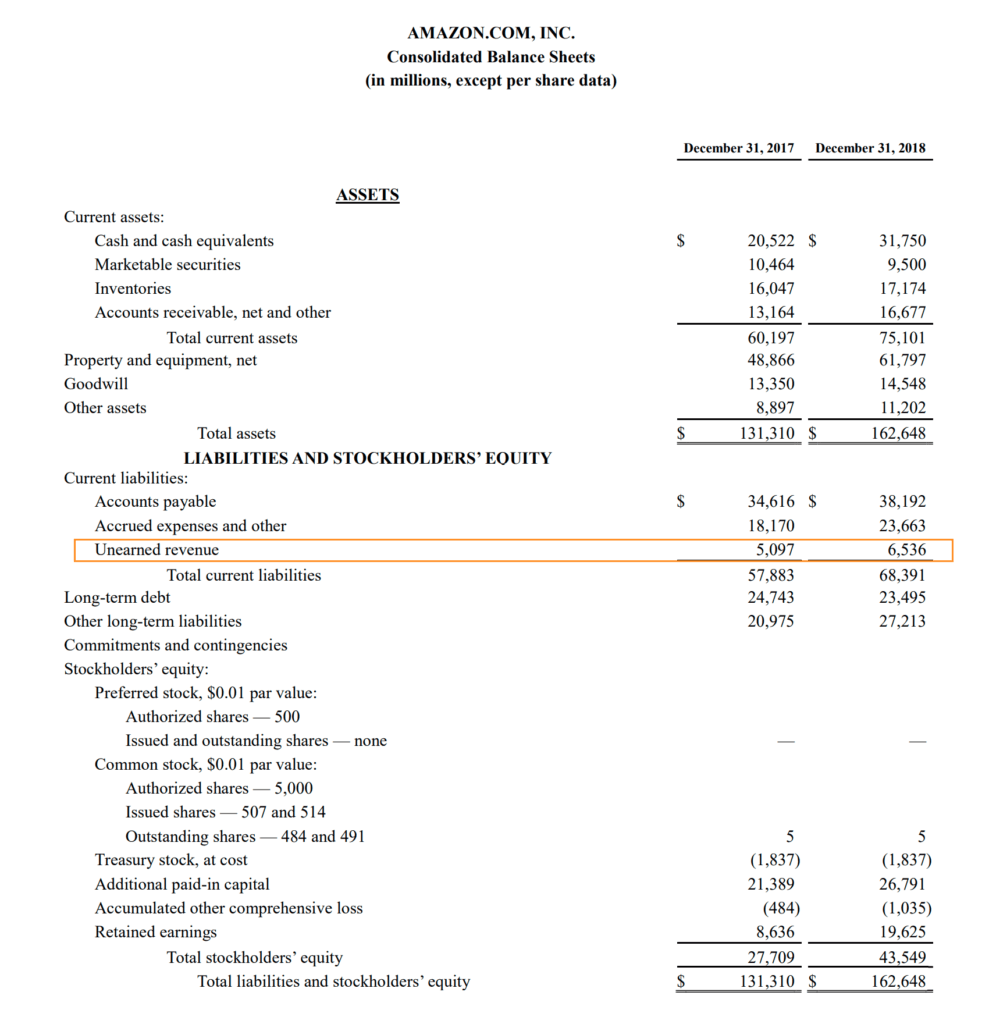

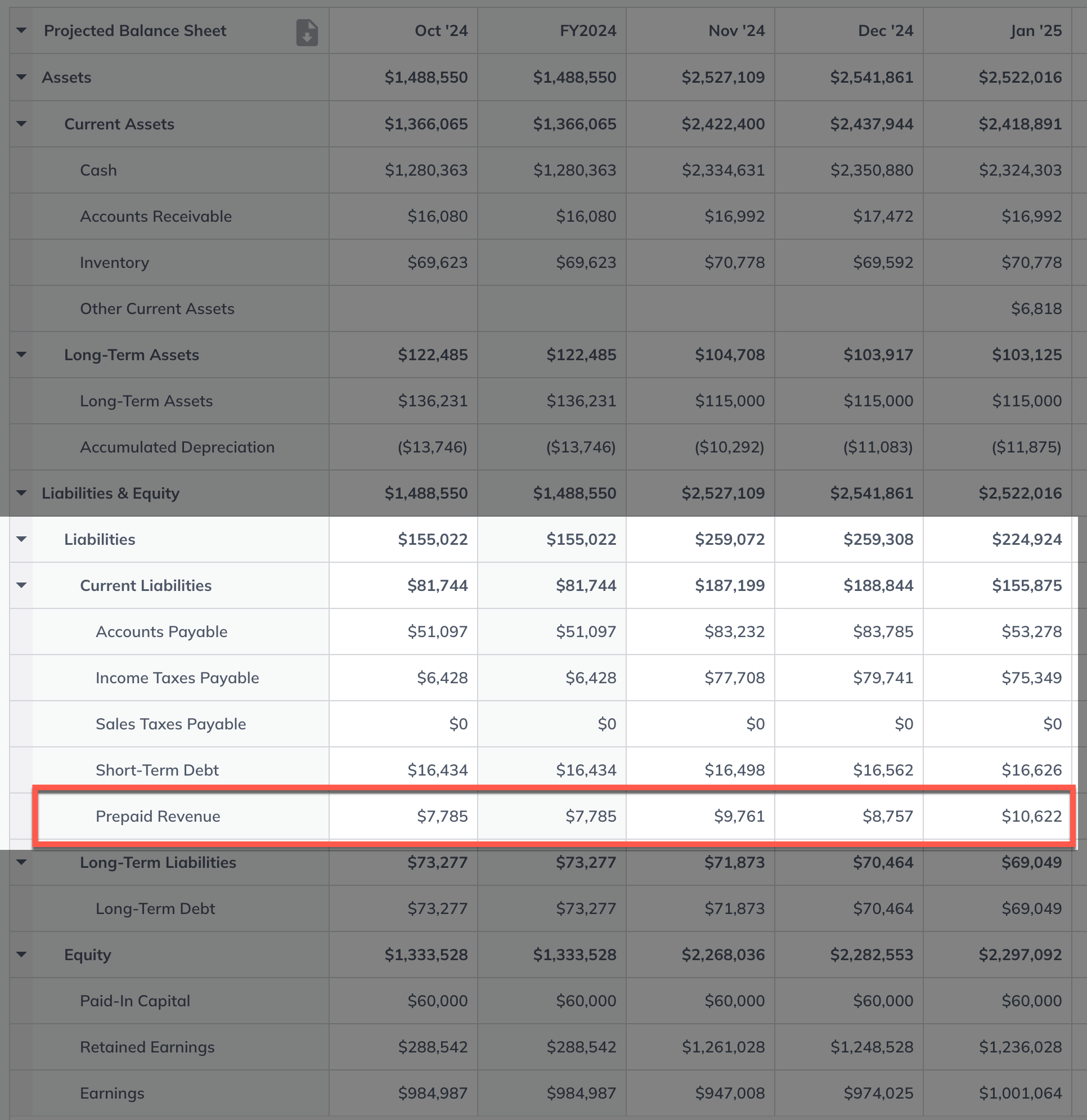

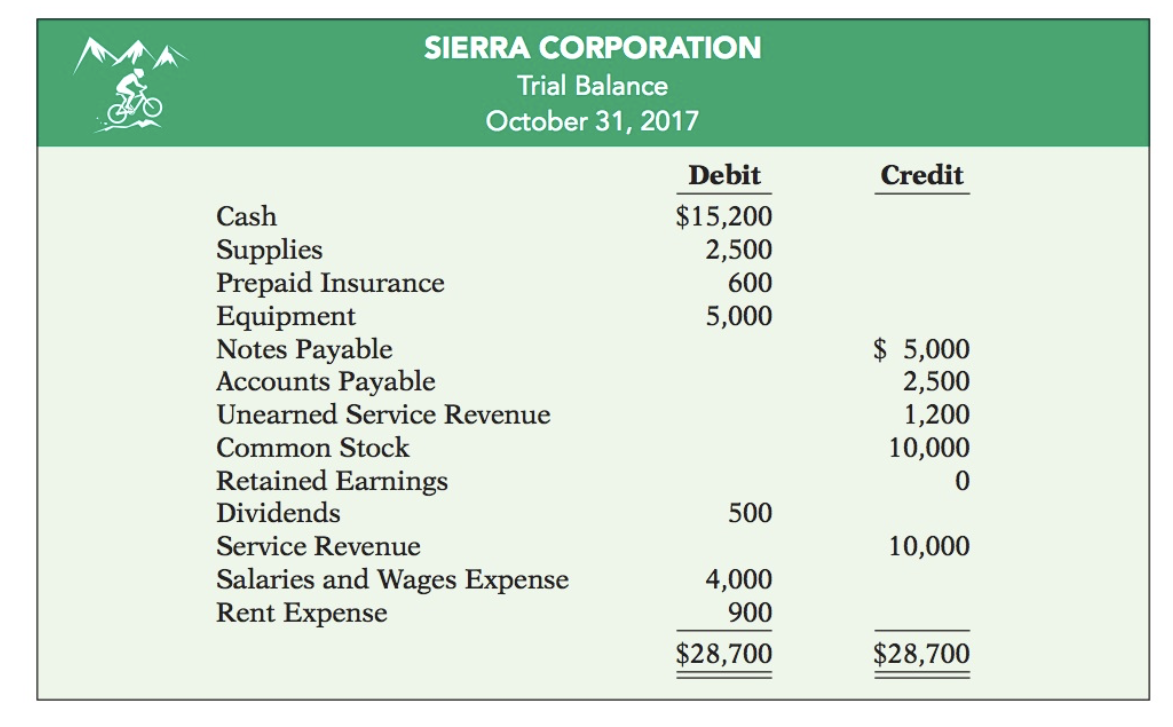

A prepaid expense is an asset on a balance sheet that results from a business making advanced payments for goods or services to be received in the future. Utility bill paid in advance for coming months that are still unaccounted for. Prepaid revenue occurs when businesses charge clients, and are paid, upfront for services they will perform for months to come.

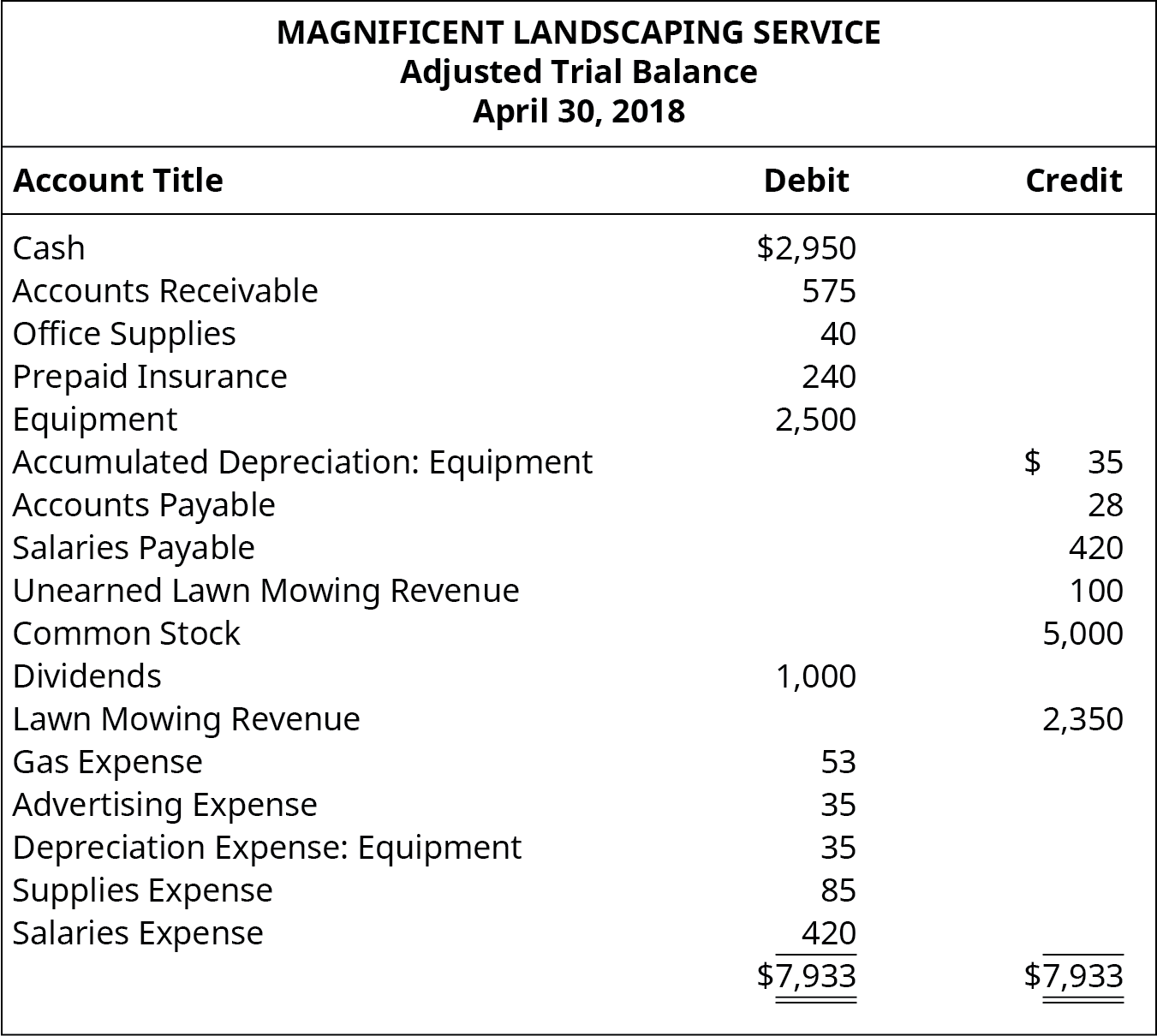

The gaap matching principle prevents expenses from being recorded on the income statement before they. Prepaid expenses are recorded on the balance sheet as an asset, most often as a current asset. Prepaid income is revenue received in advance but which is not yet earned.income must be recorded in the accounting period in which it is earned.

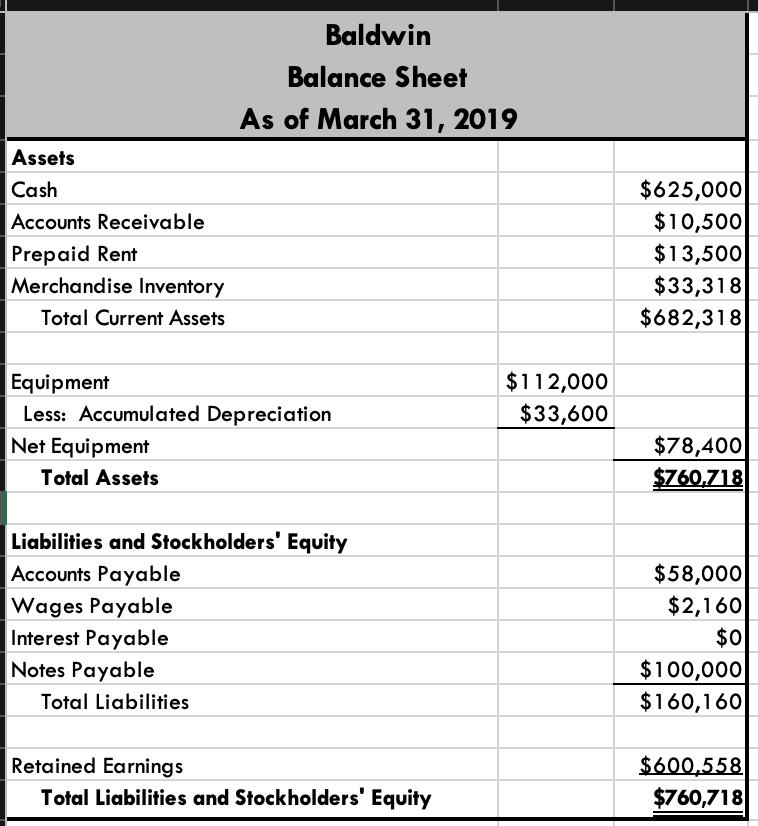

Effect of revenue on the balance sheet generally, when a corporation earns revenue there is an increase in current assets (cash or accounts receivable) and an increase in the retained earnings component of stockholders' equity. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and then charge it to expense. This involves a business paying for insurance coverage upfront for a specified duration, typically ranging from a few months to a year.

Some of these examples are given below: A concern when recording prepaid rent in this manner is that one might forget to shift the asset into an expense account in the month when rent is consumed. The various prepayment expenses disbursed by a firm include paid off rent, insurance, interest, salary, utility bills, and taxes.

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Every month, when you get the work you paid for, you reduce the prepaid expense entry by. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet.

Service revenue had a $9,500 credit balance in the trial balance column, and a $600 credit balance in the adjustments column. Accounting for prepaid income. Following accounting entry is required to account for the prepaid income:

The value of the asset is then replaced with an actual expense recorded on the income statement. For example, the following screenshot from the balance sheet of tesla (tsla) for fiscal year 2022 illustrates where to find prepaid expenses. Deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered.

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

![[Solved] The classified balance sheet and selected SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2022/11/636a720c3544d_396636a720c25008.jpg)