Lessons I Learned From Tips About Provision For Expenses In Balance Sheet

Now suppose that a party xyz ltd.

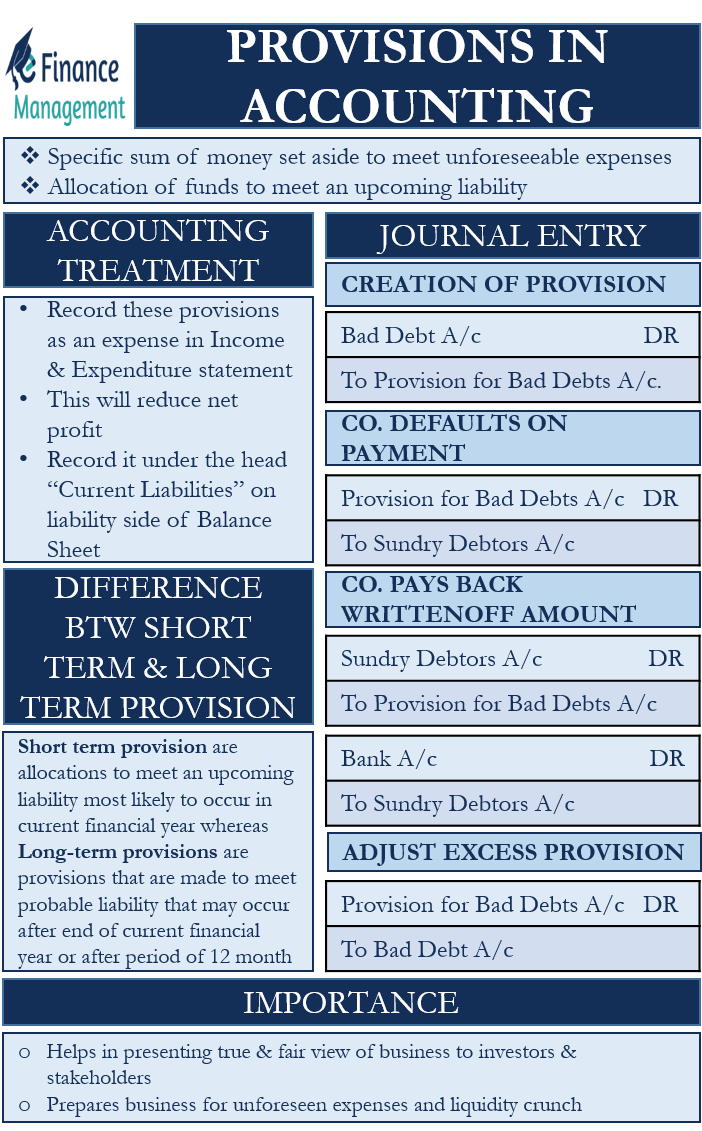

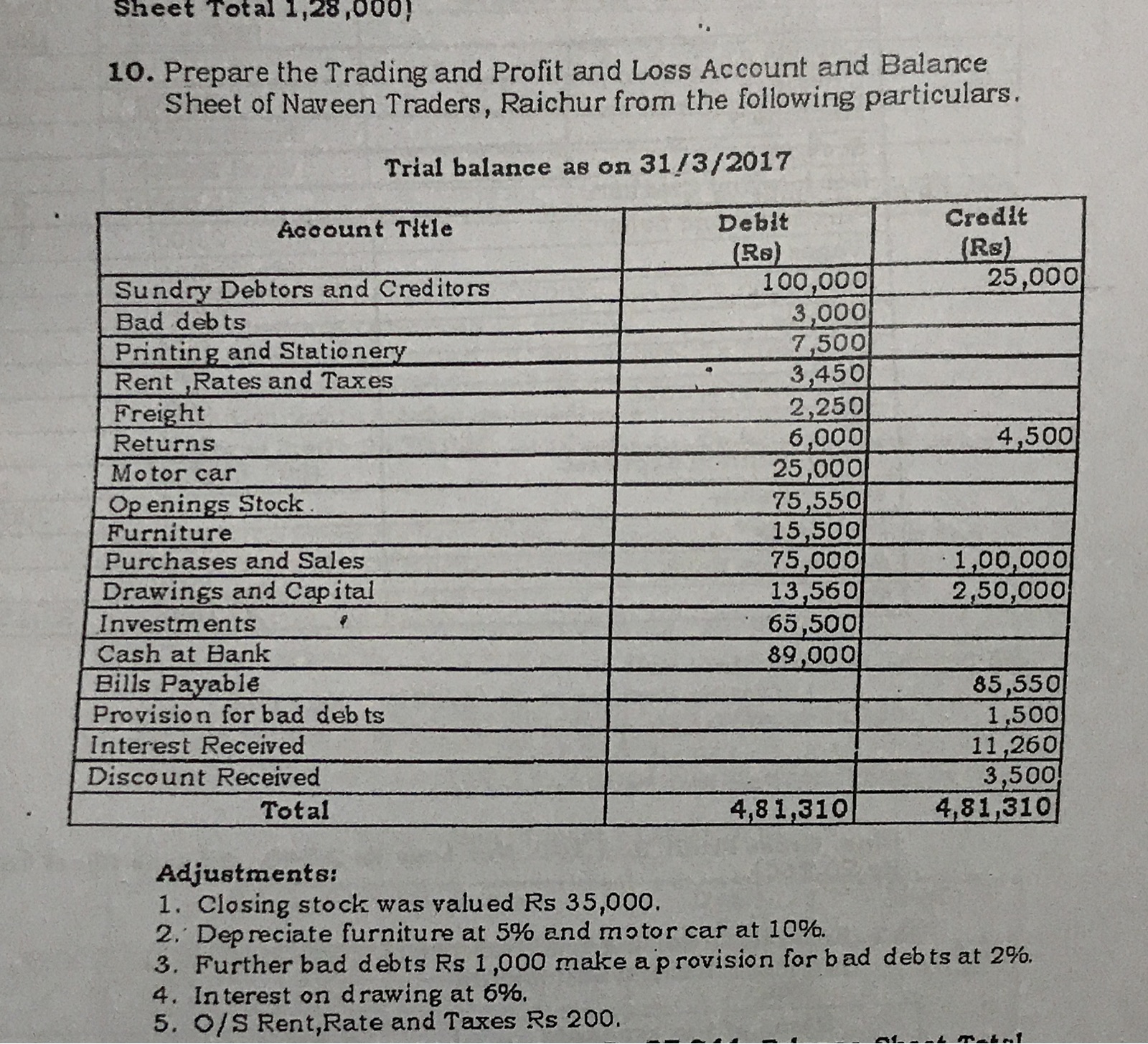

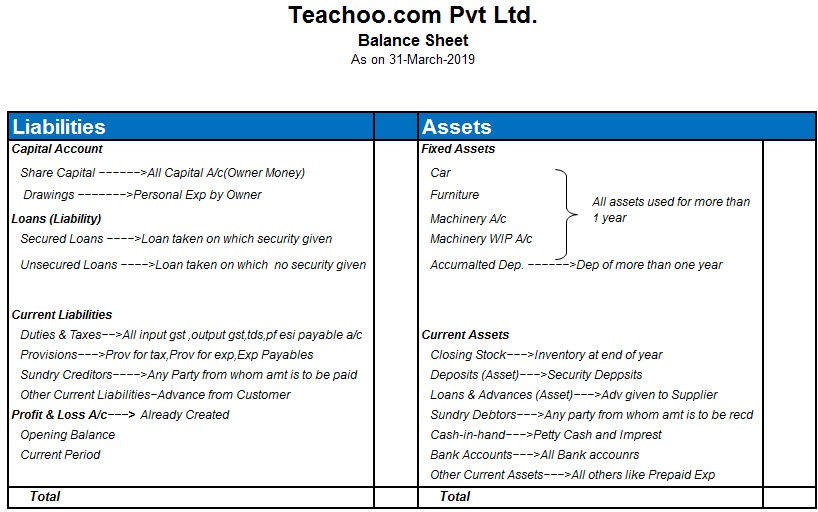

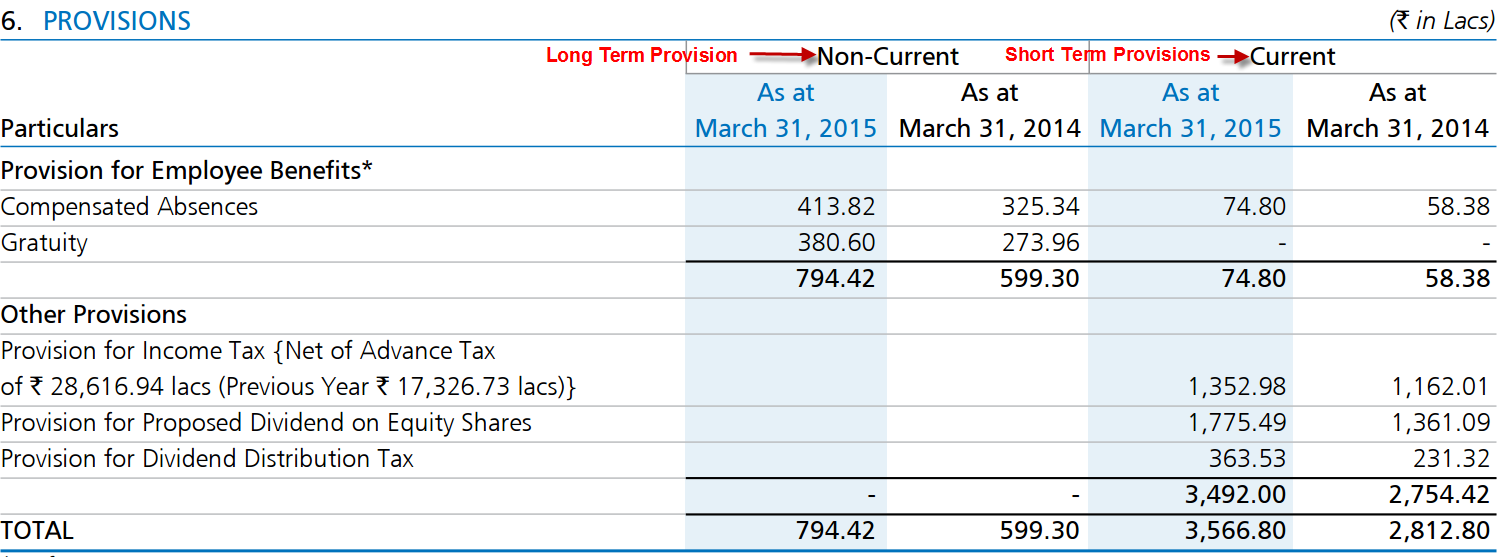

Provision for expenses in balance sheet. While provisions are funds kept aside from the net revenue or profits to bear specific future expenses, reserves are funds kept aside from profits to take care of any kind of expenses or liabilities, irrespective of the specificity. The provision expenses are the contingent liabilities, and provision for incomes are contingent assets subject to happening of a certain event if it’s a tax provision, then it will go to liabilities, and similarly, there are dozens of. The amounts set aside are based on estimates of future.

A provision is a liability of uncertain timing or amount. Bad debt provision strategy is about striking a balance between the minimum estimation and placing too much weight on potential crises that could happen but aren’t extremely likely to. They appear on a company’s balance sheet and are recognized according to certain criteria of the ifrs.

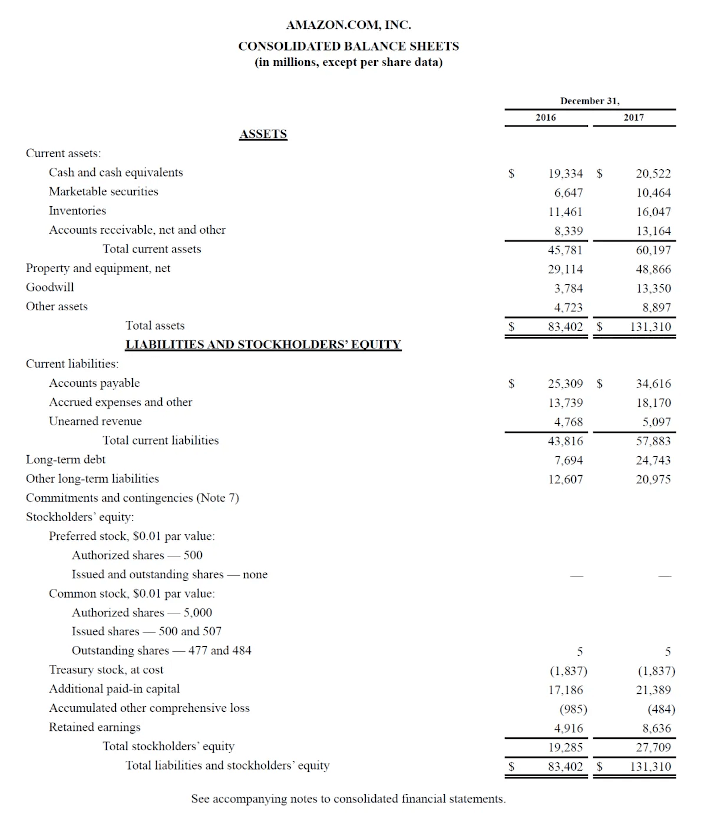

Updated may 31, 2021 reviewed by charles potters accrued expenses vs. The amount recognised as a provision should be the best estimate of the expenditure required to settle the present obligation at the balance sheet date, that is, the amount that an entity would rationally pay to settle the obligation at the balance sheet date or to transfer it to a third party. While studying the balance sheet, students often might have noticed an entry known as provisions, which was listed on the liabilities side of a balance sheet.

Definition of provisions so what is a provision? How to prepare a balance sheet in 5 steps. Using historical data as a baseline is a wise place to start.

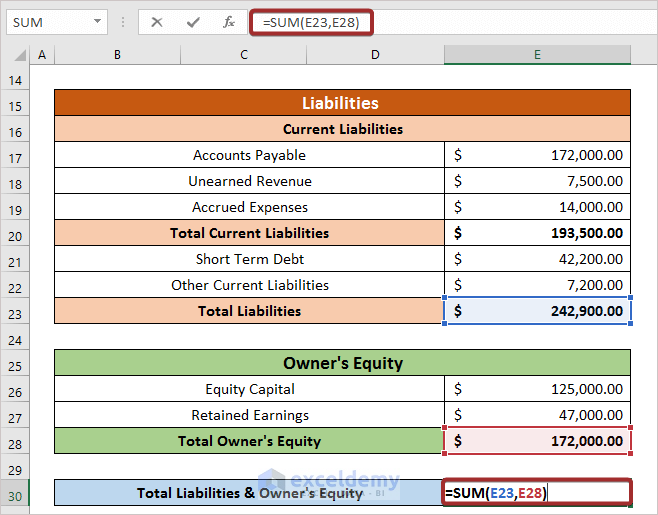

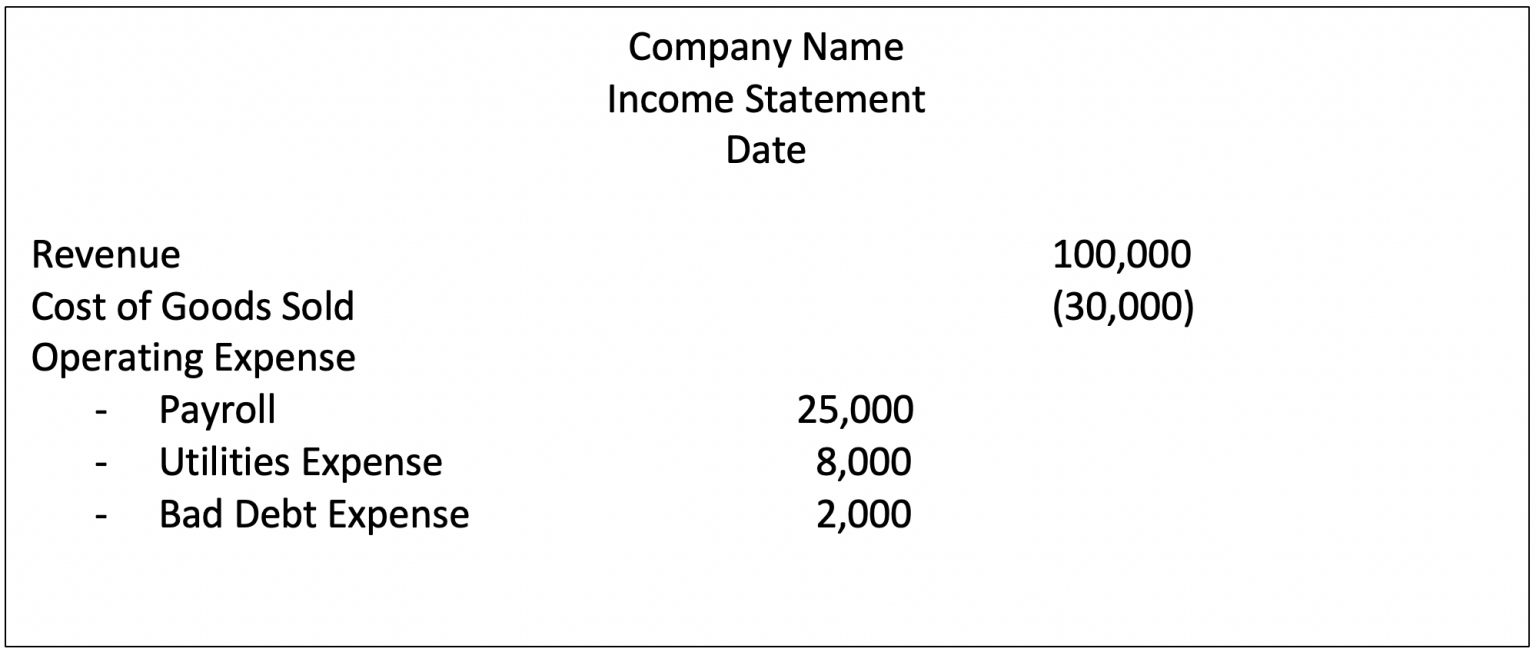

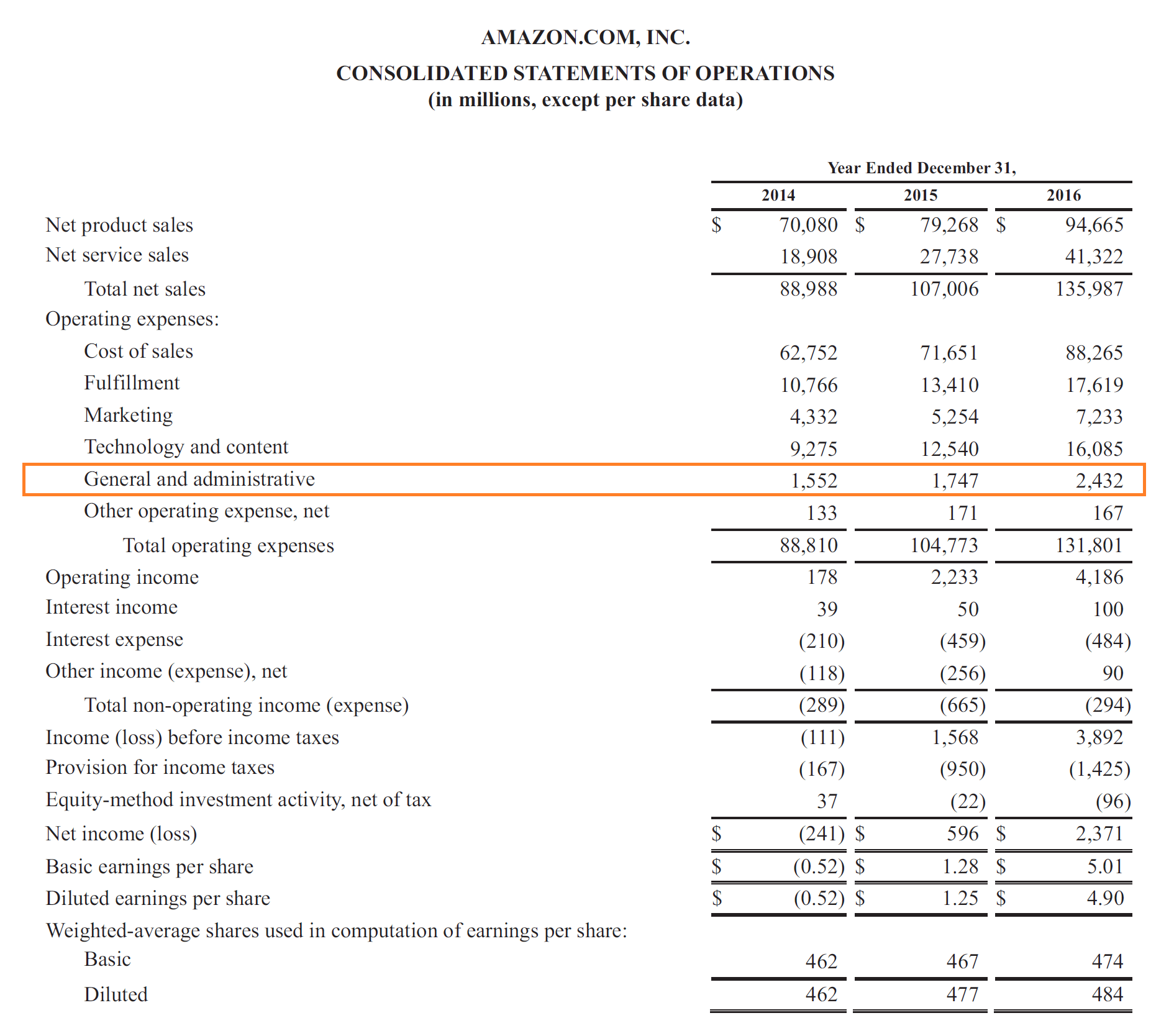

Provisions are recorded as an expense in the income statement and a corresponding liability is recorded in the balance sheet. Provisions include warranties, income tax liabilities, future litigation fees, etc. This journal entry will increase both total expenses on the income statement and total liabilities on the balance sheet by the same amount of $3,000 as of 2022.

Provisions help adjust this balance by ensuring that business expenses are recognised in the same year. Ias 37 defines and specifies the accounting for and disclosure of provisions, contingent liabilities, and contingent assets. To calculate tax provisions, a company may take tax deductions into account, such as meals, interest expenses and depreciation allowances.

Gaap), a provision is an expense. Summary a provision stands for liability of uncertain time and amount. An overview in accounting, accrued expenses and provisions are separated by their respective degrees of.

Provisions are recognized as an expense on the income statement, in the same period as any related revenue or when reasonably estimated. To provision for expense a/c. Gaap but a liability in ifrs.

Furthermore, this provision will reflect in the “current liabilities” section of the balance sheet. General provisions are balance sheet items representing funds set aside by a company as assets to pay for anticipated future losses. A provision for bad debt is one that has been calculated to cover the debts encountered during an accounting period that is not expected to be paid.

In accounting, first, recognise provisions as liabilities on the balance sheet, and liability is then expensed on the income statement after it occurs. We will pass a journal entry for the same as: The liability may be a legal obligation or a constructive obligation.

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)