Awesome Tips About Demat Account Statement For Income Tax

The working of a demat account is similar to that of a savings.

Demat account statement for income tax. The income from the demat account is in the form of capital gains as well as dividends. So while demat accounts themselves are not taxed, income tax is levied. What are the tax implications on demat account transactions?

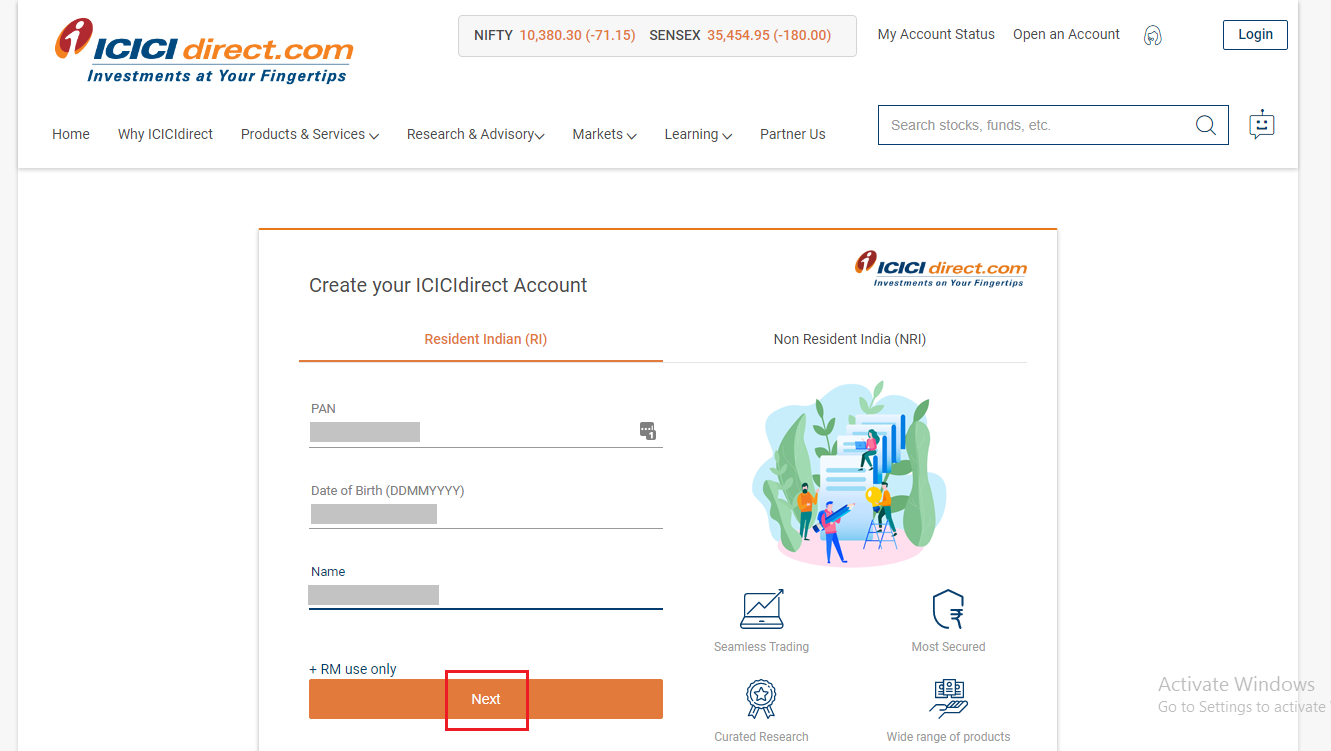

For filing your income tax returns and declaring any income earned through your demat account holdings, you have to first get a demat account. It makes the entire process of share trading secure and speedy. Taxation is the process through which the government collects a portion of citizens' earnings, which is then utilised for public welfare initiatives like infrastructure,.

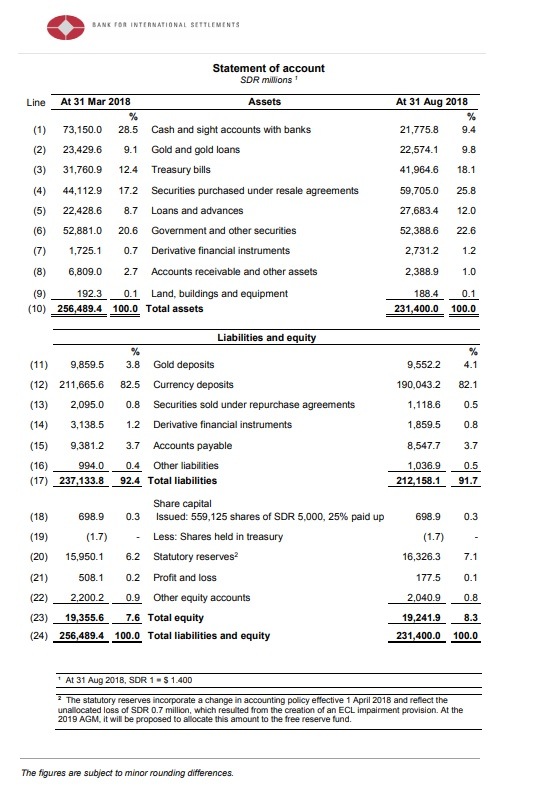

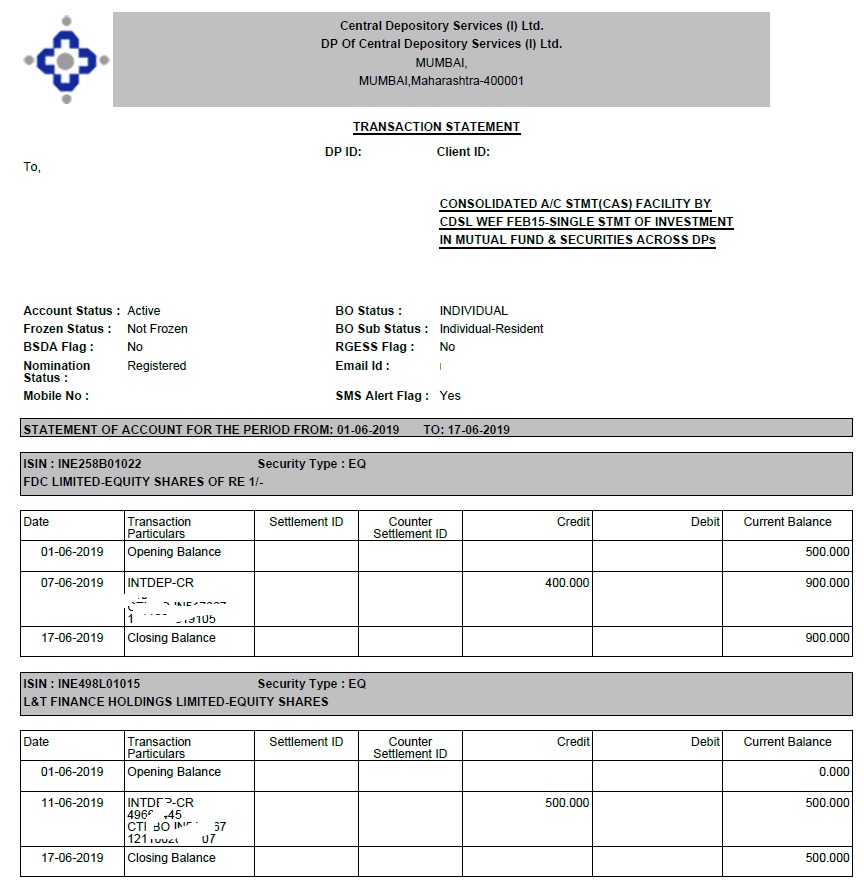

Check your securities /mf/ bonds in the consolidated account statement issued by nsdl/cdsl every month. Here is the direct link to. You just have to log on to the website of a central depository or your broker and use your credentials to access your demat account statement.

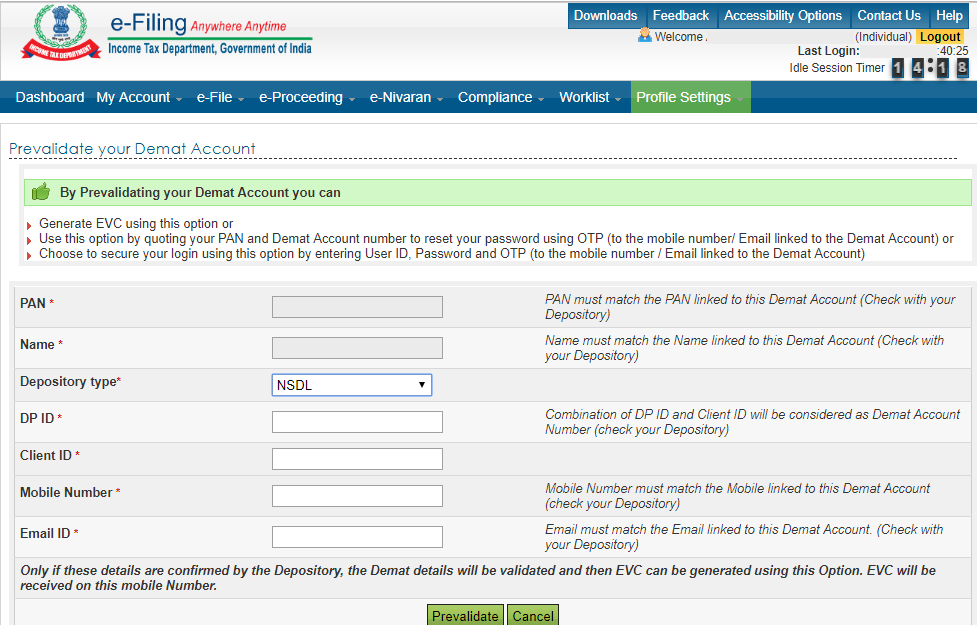

A demat account helps reduce tax liability by investing in investments like the ulips or elss. To obtain the consolidated account summary of demat account on nsdl, follow the below steps. Income tax laws allow you to set off your capital loss incurred over the short term against the corresponding capital gains made in the financial year.

To understand your trading activity and for its income tax compliance, you need documents like tax p&l, contract note, ledger / account statement. A demat account dematerializes the shares i.e., converts the physical shares into an electronic form. Here’s a detailed guide to know income tax implications on demat account transactions.

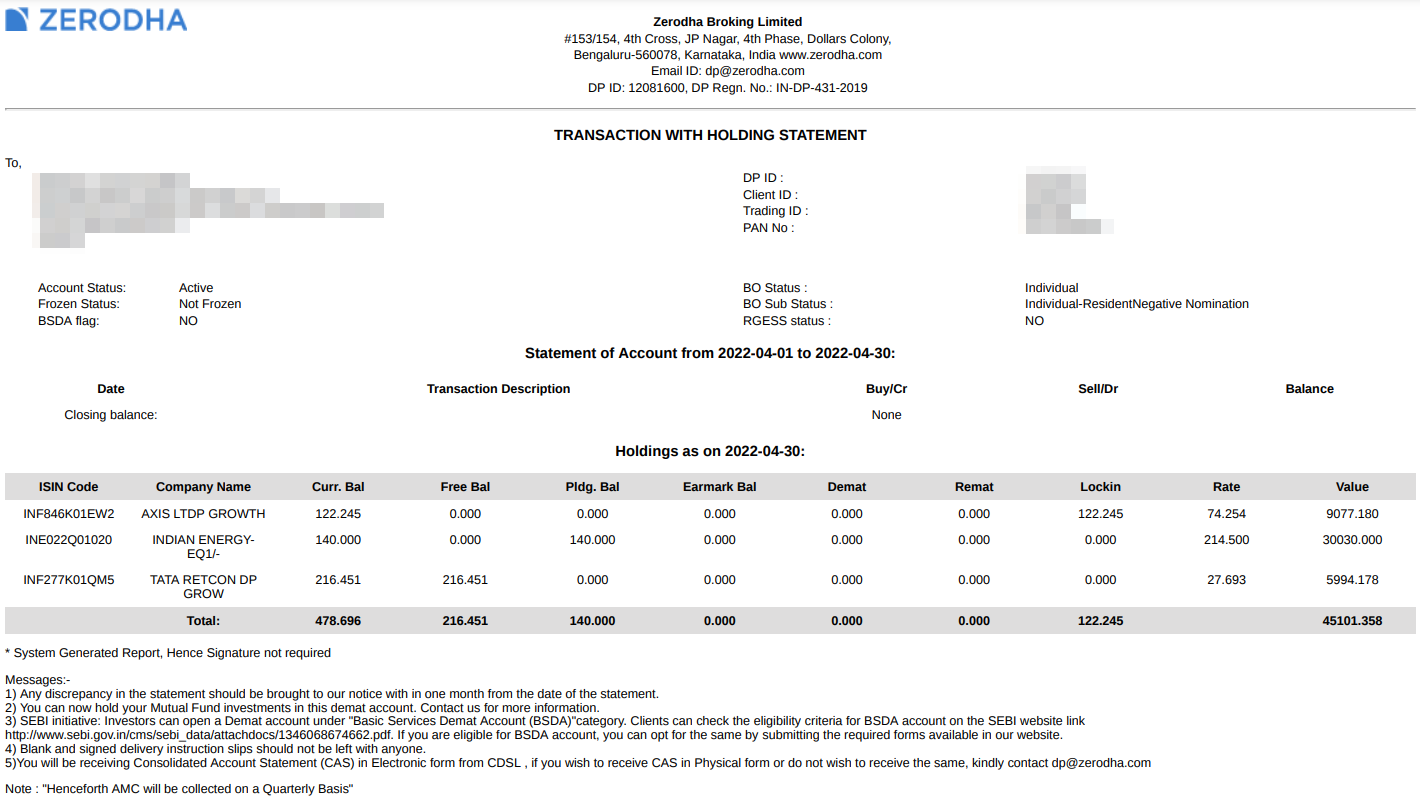

Brokers provide capital gains statements to help calculate taxes on demat account transactions. Sgb in demat account sapna narang, managing partner at capital league, a boutique wealth management firm, adds that sgb allotment typically appears in. Read this article to understand income tax implications on the.

Tax on demat account: In this method, where you download the demat holding statement depends on which central depository your dp is registered with. Contents [ show] demat account has become the necessary thing in case you want to invest in stock markets.

A statement from the central depository: Know about the income tax on demat account and its. This article aims to provide an overview of the tax implications on demat accounts in india, including the tax on demat account transactions, income tax on demat accounts, filing.

A demat account holding statement is a detailed account of all the shares you hold, the dates they were purchased on, their current value, and other relevant details. You may need to have your. You can also carry forward.

While one person is allowed to have one pan card, they can open two or more demat accounts using the same pan card. The new utility will help taxpayers import prefilled data and edit it before filing the income tax return (itr). Visit nsdl and look for the nsdl cas web page.