Supreme Info About Calculating Net Cash Flow From Operating Activities

These operating activities may include:

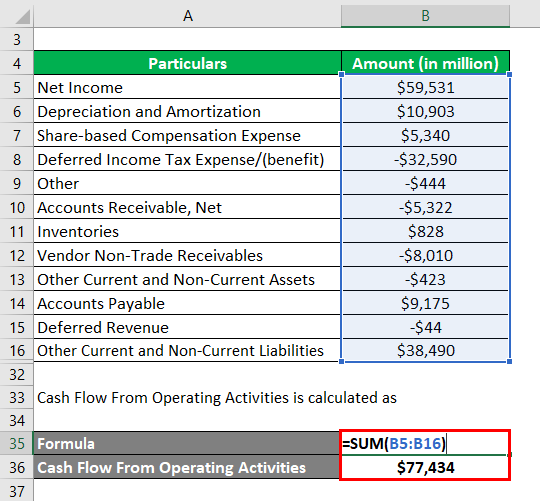

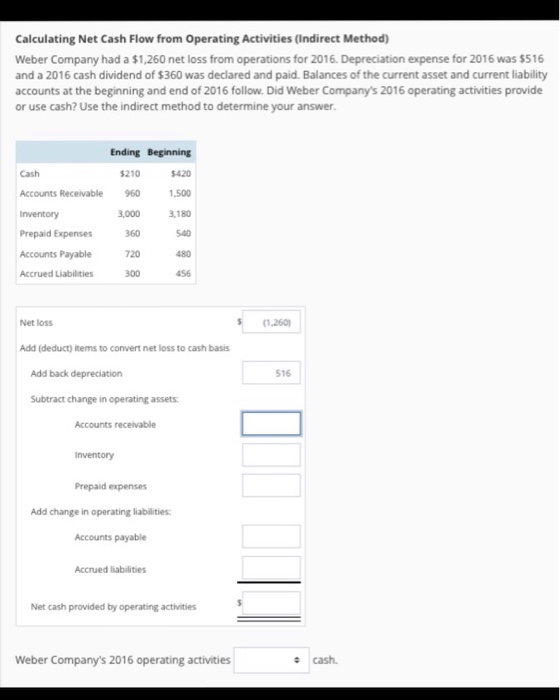

Calculating net cash flow from operating activities. Let us work through the same cash flow from operations example we used for using the direct approach. The same can also be calculated by subtracting the company’s cash payments from the cash receipts. Cash flow from operating activities.

Cash flow is calculated using the direct (drawing on income statement data using cash receipts and disbursements from operating activities) or the indirect method (starts with net income. This formula is simple to compute, and it’s often ideal for smaller businesses, partnerships, and sole proprietors. In this case, depreciation and amortization is the only item.

If the asset sold is related to investing activities, the net cash received from the sale of the asset should be recorded under investing activities, and the operating profit should be adjusted for the gain or loss on the sale. Net cash flow from operating activities is a financial metric that indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a service. The format shown below can be used.

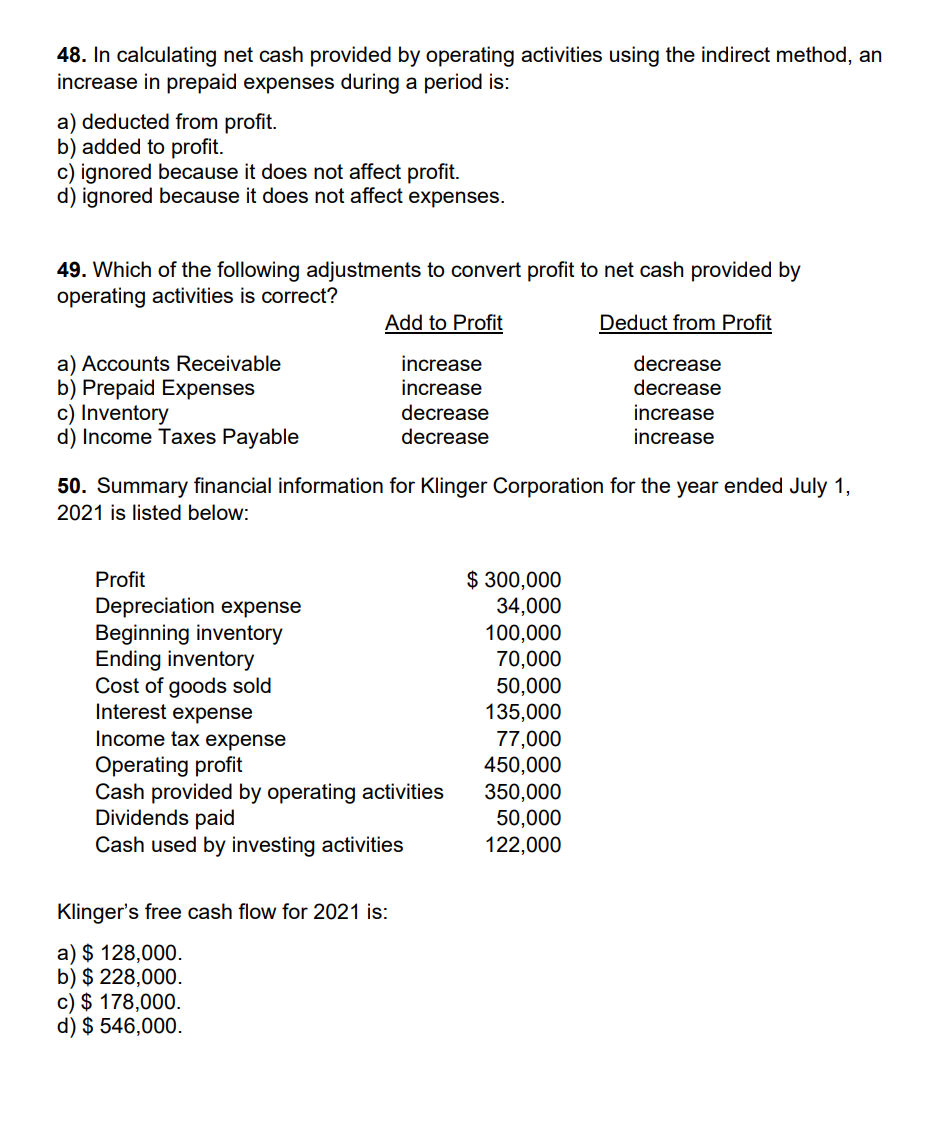

The ocf calculation will always include the following three components: Net cash flow (ncf) = cash flow from operations (cfo) + cash flow from investing (cfi) + cash flow from financing (cff) the three sections of the cash flow statement (cfs) are added together, but it is still important to confirm the sign convention is correct, otherwise, the ending calculation will be incorrect. Direct method under the direct method, the information contained in the company's accounting records is used to calculate the net cfo.

Put simply, ncf is a business’s total cash inflow minus the total cash outflow over a particular period. Key takeaways net income is a key metric of profitability and is a major driver of stock prices and bond valuations. The formula for net cash flow calculates cash inflows minus cash outflows:

Table of contents what is net cash flow formula? Net cash flow can be calculated in 3 simple steps. Operating cash flow formula:

Net cash flow = operating cash flow + financing cash flow + investing cash flow where: Operating cash flow indicates whether a company is able to. Adjust for changes in working capital.

People who work in finance calculate net cash flow with the following formula: Understand how these examples differentiate investing, financing, and operating activities. Net cash flow from operating activities definition.

Here, we have a dataset containing the values of net cash flow from operating, investing, and financing activities of a company. Ncf= net cash flows from operating activities. The net cash flow formula is figured out after adding the net cash flow from operating activities, net cash flow from investing activities, and net cash flow from financing activities.

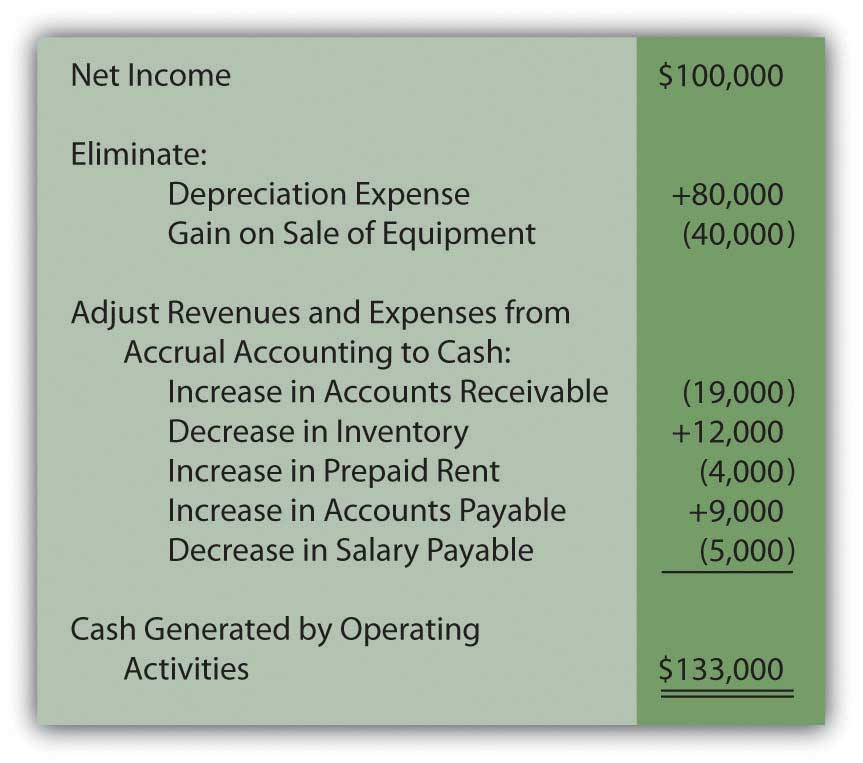

Operating cash flow is a measure of the amount of cash generated by a company's normal business operations. Businesses can calculate the net cash flow from operating activities (cfo) using: Cash flows from operating activities makes adjustments to net income.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)