Divine Tips About Cecl Asc 326

A checklist to assist nonlenders with their transition to asc 326, which includes the current expected credit losses model (cecl).

Cecl asc 326. Cross reference report and archive to locate and access legacy standards. The fasb’s new standard on accounting for expected credit losses (codified in asc 326) adds to us gaap the cecl impairment model that is based on expected losses rather than incurred losses. Implementing asc 326:

In june 2016, the fasb issued accounting standards update (asu) no. Cecl disclosure requirements aren’t just for banks. Refer to appendix e within the publication for a summary of important changes.

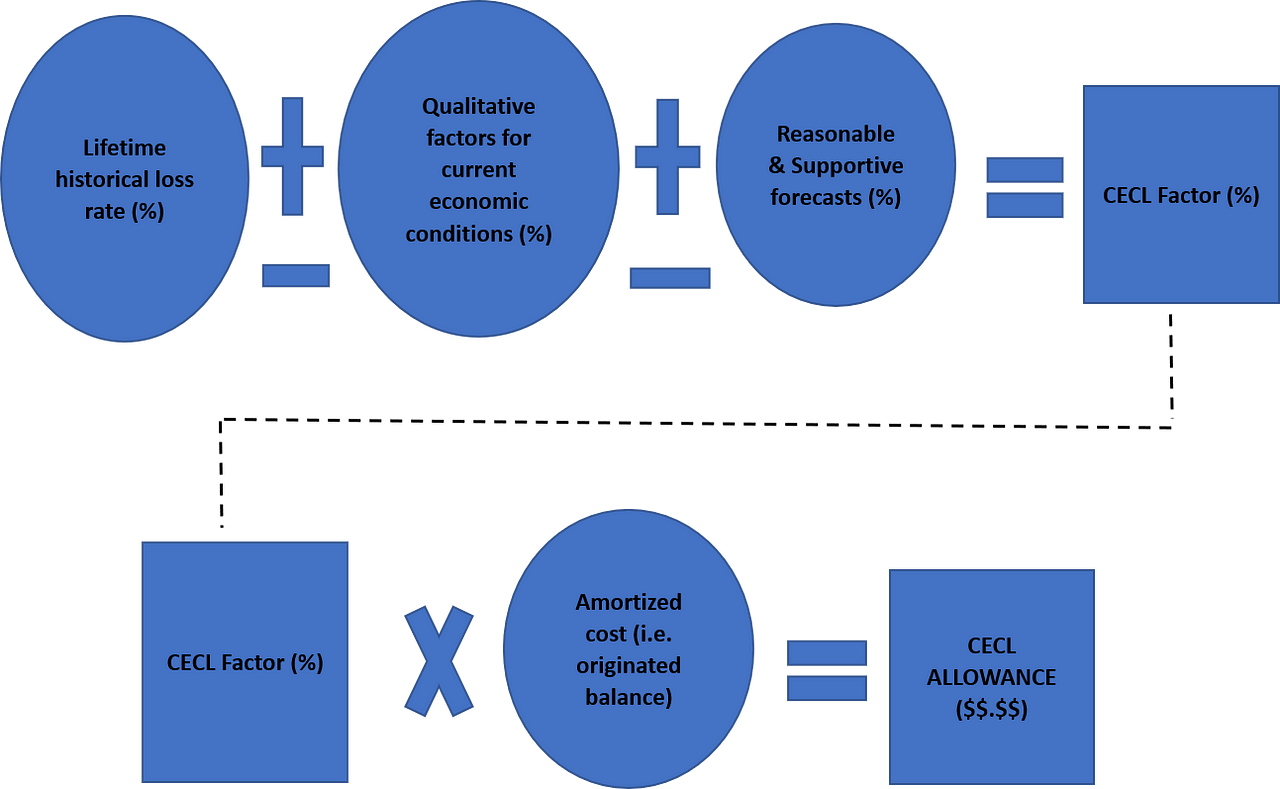

The asu requires entities to measure credit losses on most financial assets carried at amortized costs and certain other instruments using an expected credit loss model (aka the cecl model). Pending content system for filtering pending content display based on user profile. Asc 326 introduces a new way of measuring credit losses inherent in.

Our speakers discuss the key changes from. Our white paper, implementation and audit readiness for lenders: The fasb pushed back the effective date of cecl from january 2021 to january 2023 for smaller sec reporting companies,.

As companies have started implementing accounting standards codification (asc) 326 financial instruments—credit losses (also known as cecl, for current expected credit losses), many questions have come up about how asc 606 and asc 326 interact. Accounting by now, we’ve all heard the headlines: Receive cash or another financial instrument from a.

Reversion to historical data under cecl model posted on jan 14, 2020 by vicky hale, cpa | tags: Accounting standards codification—what you get. Under the new guidance, an entity recognizes its estimate of expected credit losses as an allowance.

Asc 326, provides important information to members of management responsible for implementation of accounting standards codification (asc) topic 326 and audit committees responsible for overseeing those implementation efforts. Cash, evidence of an ownership interest in an entity, or a contract that conveys to one entity a right to do either of the following: