Casual Tips About Retained Earnings In A Balance Sheet

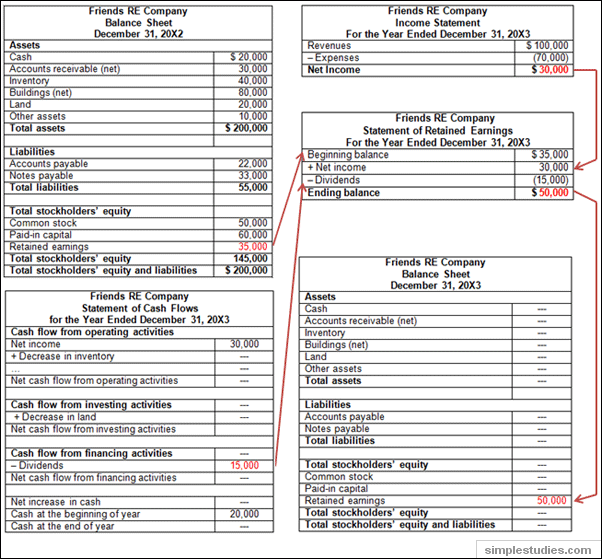

Determine beginning retained earnings balance;

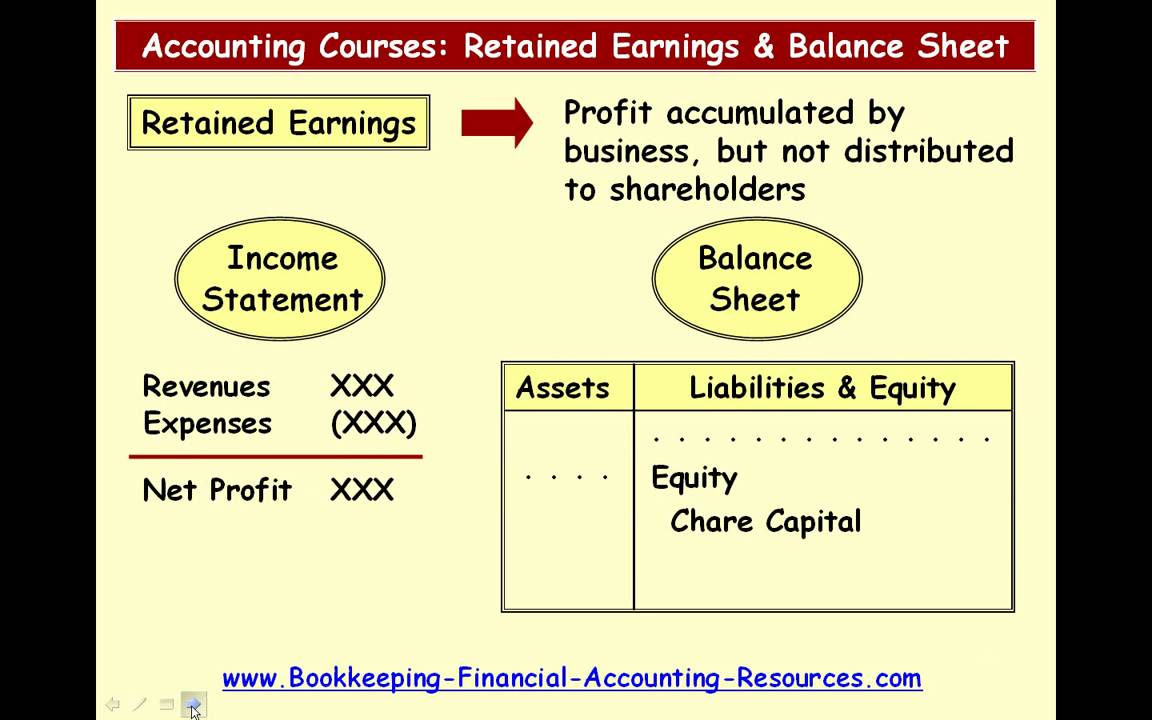

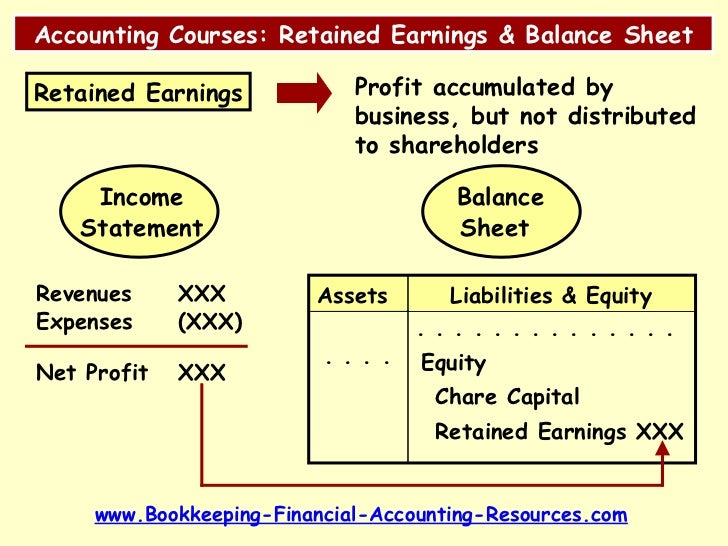

Retained earnings in a balance sheet. Essentially, it’s the portion of net profits not paid out as dividends but instead reinvested in the core business or kept for future use. During the year, the company earned a net income of $200,000 and distributed $50,000 in dividends. Retained earnings are cumulative on the balance sheet.

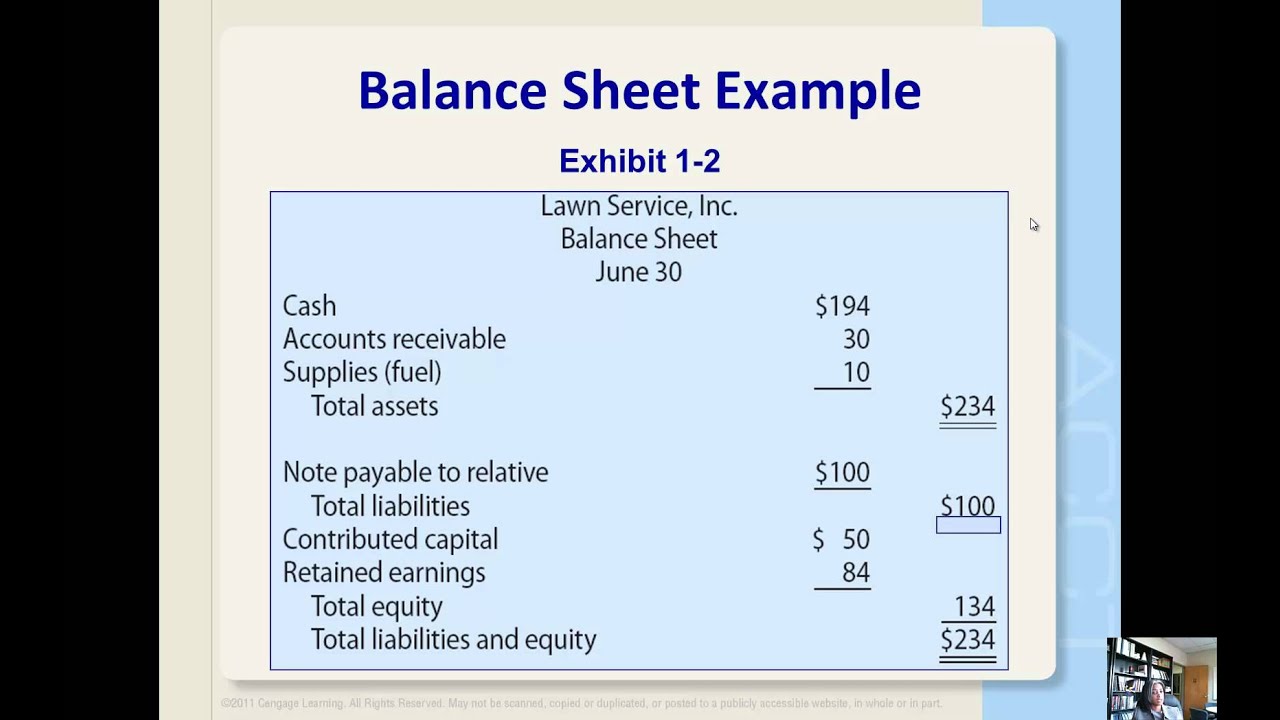

A balance sheet is a snapshot in time, illustrating the current financial position of the business. The company's annual net income was $200,000. The formula for calculating retained earnings is as follows:

Your accounting software will handle this calculation for you when it generates your company’s balance sheet, statement of retained earnings and other financial. At the start of the year, abc ltd had $500,000. Retained earnings increase when profits increase;

Retained earnings on a balance sheet represent the cumulative amount of net income that a company has kept, rather than distributed to its shareholders in the form of dividends. Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. Subtract dividends issued to shareholders;

Retained earnings are shown in two places in your business’ financial statements: This balance, found under shareholder’s equity, can be utilized for reinvestment in business expansion, debt reduction, or reserves against future losses. Retained earnings are an equity balance and as such are included within the equity section of a company's balance sheet.

To calculate retained earnings for a month, quarter or year is simple. Sometimes a separate statement for the. Retained earnings can be found in the shareholders’ equity section of a company’s balance sheet.

Take the previous period's retained earnings, add your profits and subtract any dividends you issued during the period. Retained earnings on a balance sheet are the net income that a company has decided to keep or ‘retain’ after distributing dividends to its shareholders. It is a measure of all profits that a business has earned since its inception.

Movements in a company's equity balances are shown in a company's. As an important concept in accounting, the word “retained” captures the fact. Retained earnings on a balance sheet.

On the bottom line of your income statement (also called the profit and loss statement) in the shareholder’s equity section of your. How do you calculate retained earnings on a balance sheet? It is represented in the equity section of the balance sheet.

Dividends can be found in the financing activities section of a company’s statement of cash flows. Let's break down the retained earnings calculation for abc ltd: Abc ltd decided to pay out.