Sensational Info About Is Shareholders Equity A Liability

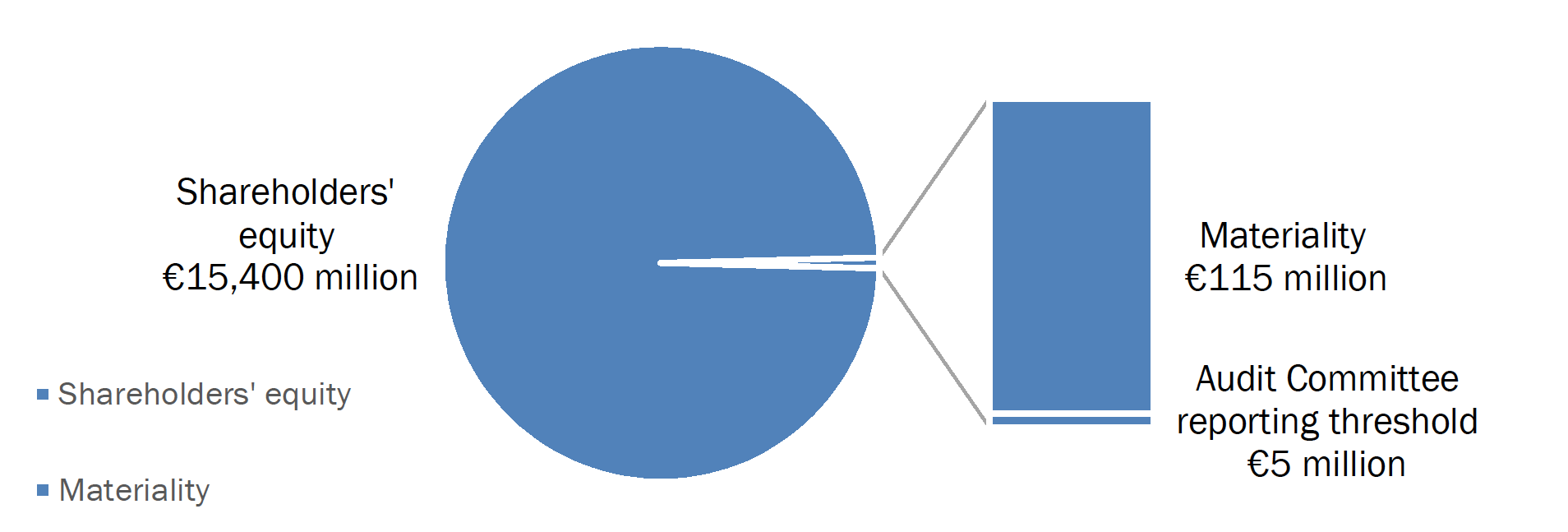

Suzanne kvilhaug shareholders' equity represents the net worth of a company, which is the dollar amount that would be returned to shareholders if a.

Is shareholders equity a liability. Although a stockholder's equity has similarities to a liability, it is not considered to be a liability itself. Shareholder equity (se) is a company's net worthand it is equal to the total dollar amount that would be returned to the shareholders if the company must be liquidated and all its debts are paid off. For example, if a business has total assets worth $100,000 and.

No, shareholders’ equity is not an asset but an obligation. By adam hayes updated july 18, 2022 reviewed by margaret james what is the shareholder equity ratio? It is the amount that the business owes.

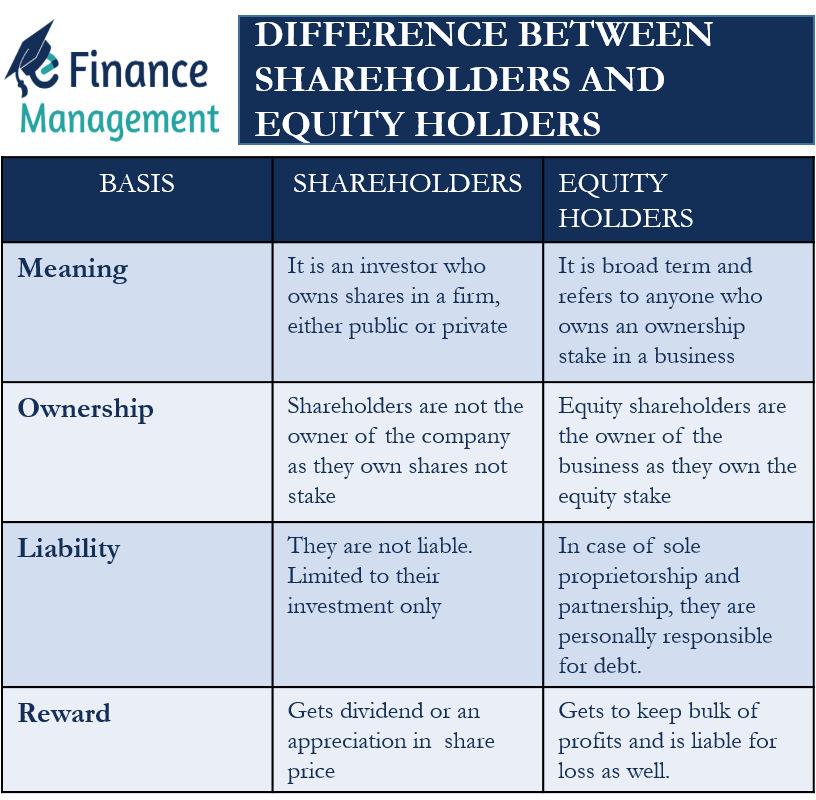

On november 25, 2019 accountants use the words assets, “liabilities” and “equity” a lot. Another thing that brings out the difference between shareholders and equity holders is a liability towards business. Usually, if you are an equity holder,.

Equity as a liability share capital and retained profits are the chief components of shareholders’ funds or equity. Thus, shareholder equity is equal to a company's total assets minus its total liabilities. As an accounting measure, shareholders’ equity (also referred to as stockholders’ equity) is the difference.

Shareholders’ equity is the shareholders’ claim on assets after all debts owed are paid up. Shareholder’s equity represents the net value of a company. The shareholder equity ratio indicates how much of a.

If the company is a corporation, stockholder equity is the third part of the balance sheet. It is an obligation to the company’s shareholders. If one person owns the business, this part is called.

As equity is owed to shareholders it is a balance sheet. But what do these words really mean? It is calculated by taking the total assets minus total liabilities.

Shareholder equity denotes the worth of a company after. Shareholders' equity is the net amount of a company's total assets and total liabilities as listed on the company's balance sheet. Dividends and shareholder discretion while it is typical for equity instrument holders to receive dividends, the issuer is usually not contractually obligated to pay.

Equity, also known as owner’s equity, is the difference between the total assets and total liabilities of a business. Stockholders equity (also known as shareholders equity) is an account on a company’s balance sheet that consists of share capital plus retained earnings. Liabilities and stockholder equity.

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

:max_bytes(150000):strip_icc()/ShareholderEquitySE_V1-def750af6b7d42b78c60369d49f6e68f.jpg)