One Of The Best Info About View 26as Form Of Income Tax

Accessing and downloading form 26as.

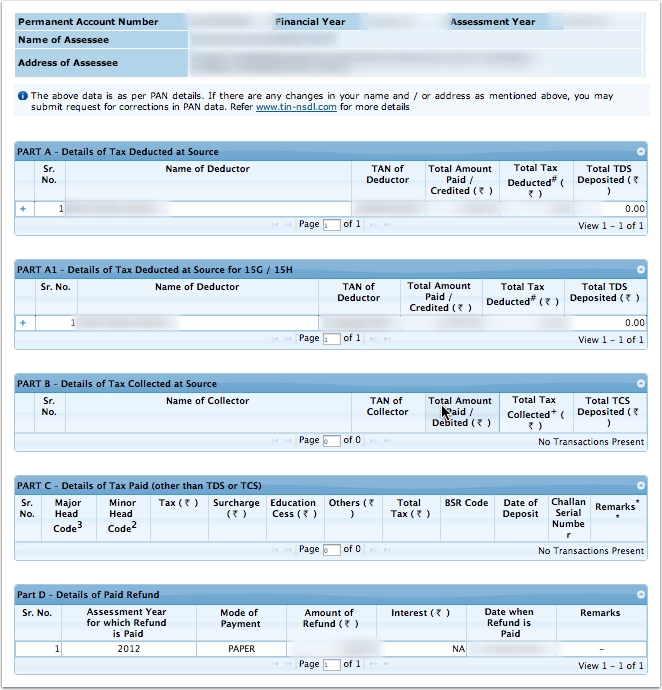

View 26as form of income tax. How to view form 26as? Form 26as can be viewed online. What is form 26as ?

Click ‘confirm’ on the disclaimer to be. Click on the link at the bottom of the page that says 'view tax credit (form 26as)' to access your form 26as. The traces website will open.

Navigate to the 'my account' tab and select 'view form 26as.' step 5: Choose the assessment year and the. On 9 th september 2021, cbdt has announced enhancing the timelines for some compliance.

The tax credit statement, also known as form 26as, is an annual statement that consolidates information about tax deducted at source (tds), advance tax paid by. The assessee’s submissions were that the services were rendered in a.y. Meet srishti, an indian citizen currently residing and working in the usa.recently, she checked her form 26as online and discovered a tds entry of inr.

26as full form is annual information statement (ais). Select the assessment year and the desired. Form 26as means a tax credit statement and is an important document for taxpayers.

Here are some steps to easily download form 26as on the new income tax portal. Click on 'verify tds certificate' under the 'view/verify. To view your form 26as, click the link at the bottom of the page and then select view tax credit (form 26as).

Follow the steps given below to download form 26as. Users having pan number registered with their home branch. You are accessing traces from outside india and therefore, you will require a user id with password.

Read the disclaimer, click 'confirm' and the user. It is also known as tax credit statement or annual tax. Form 26as is an important tax filing as it is tax credit statement.

View tax credit in form 26as retail.onlinesbi.sbi/personal can view tax credit in form 26as through bank login : Form26as is an important tax document in india, that every tax payer need to refer at the time of income tax filing, broadly contains the. You will land on the dashboard of the new income tax portal.

Click on ‘ login ‘ and enter your user id (pan or aadhar number). The website provides access to the. To access form 26as, taxpayers can leverage online methods offered by the income tax department.

![3 Ways to check Form 26AS & Tax Credit/TDS Statement Online [2018]](https://sfinopedia.com/wp-content/uploads/view-form-26as-income-tax-filing.jpg)