Underrated Ideas Of Tips About Profit And Loss Explained

.png?width=1300&height=818&name=Profit Loss Macbook (1).png)

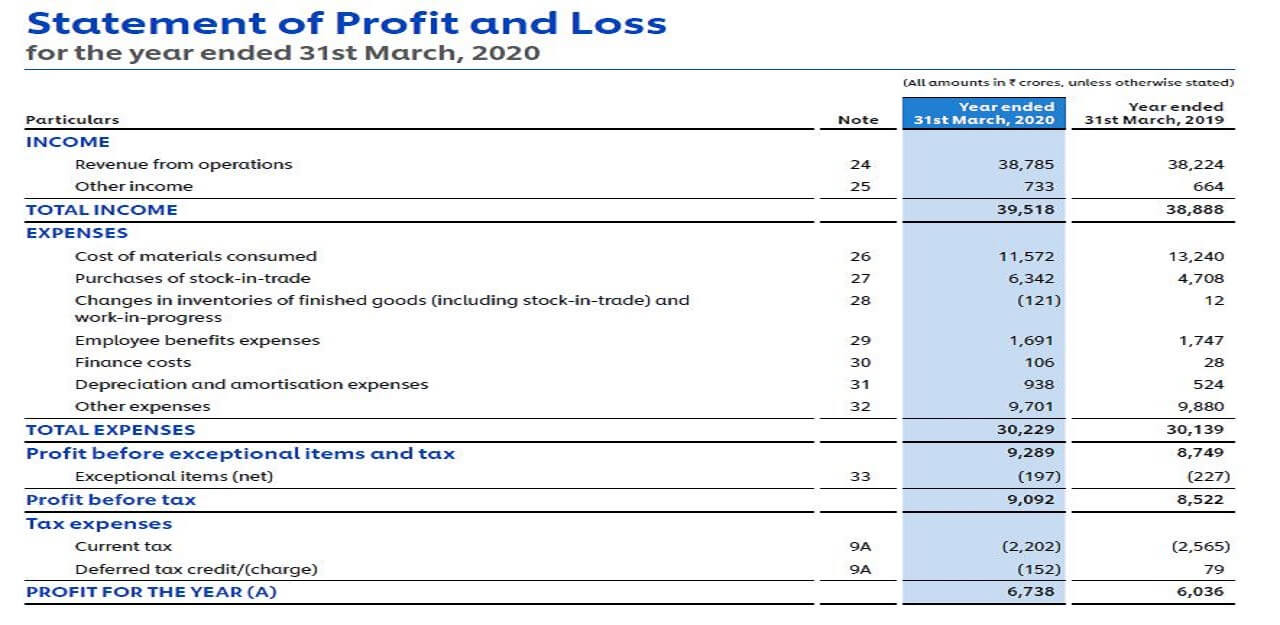

The p&l reporting period can be any length of time, but the most common are monthly, quarterly, and annually.

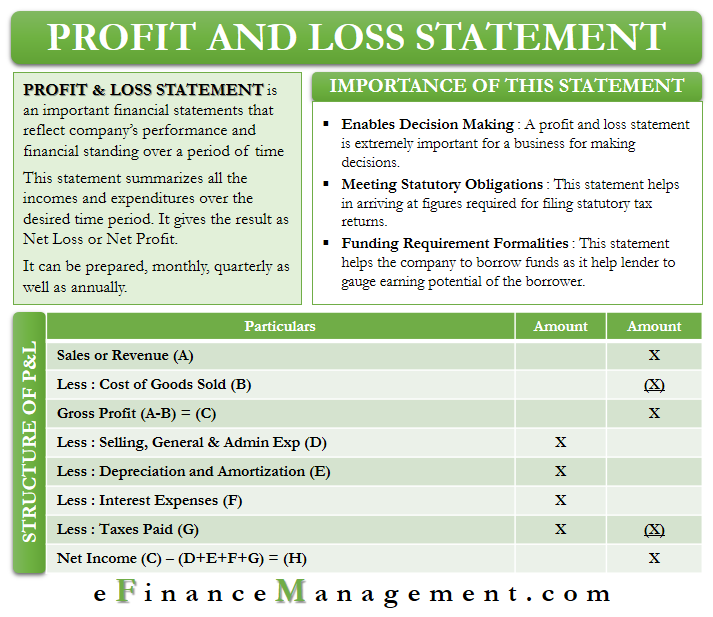

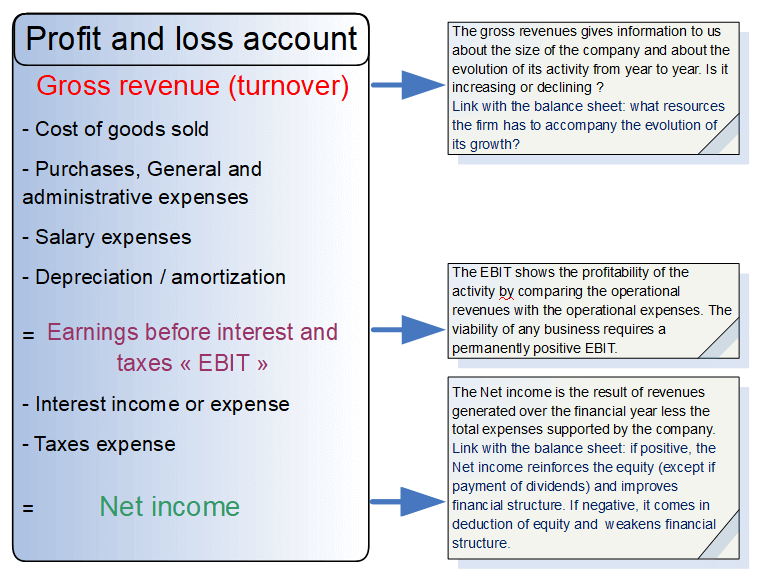

Profit and loss explained. The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of a company, in a specified period. For accounting purposes, companies report gross profit, operating profit, and net profit (the bottom line). What is profit and loss statement?

Written by tim vipond what is the profit and loss statement (p&l)? The result is either your final profit (if. The statement shows the company's net profit or loss over that period of time, giving investors and management valuable insight into the company's.

A profit and loss statement demonstrates the results of operations for a fiscal period, reflecting revenue, expenses, and profitability. Profit and loss statement explained. The higher its profit, the better the business’s ability to grow, invest in operations.

When revenue exceeds expenses, the result is net income, commonly called profit. Using the above p&l example, we can make the following calculations: This summary provides a net income (or bottom line) for a reporting period.

A profit and loss (p&l) statement summarizes the revenues. Your p&l statement shows your revenue, minus expenses and losses. Every product has a cost price and a selling price.

Profit and loss (p&l) accounting is the process of creating a profit and loss statement to help companies have a clear view of the revenues and expenses over a period. A profit and loss statement, also called an income statement or p&l statement, is a financial document that summarized the revenues, costs, and expenses incurred by a company during a specified period. Two approaches to calculating p&l statements are:

The judge's ruling orders former president donald trump and his company to pay $354 million in fines, plus almost $100 million in interest, and restricts trump's business activities in the state. A profit and loss (p&l) statement, also known as an income statement, is a financial statement that summarizes a company's revenues and expenses over a period of time, usually a quarter or a year. The report is produced by product control;

The rising costs overshadowed a decent holiday quarter. A balance sheet provides both investors and creditors with a snapshot as to how effectively a company's management uses its resources. The profit and loss statement summarizes all revenues and expenses a company has generated in a given timeframe.

It's a straightforward presentation of a. The outcome is either your final profit or loss. However, its true depth and complexity are often not fully appreciated.

Profit and loss statement (p&l) definition. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. Based on the values of these prices, we can calculate the profit gained or the loss incurred for a particular product.

:max_bytes(150000):strip_icc()/plstatement_finalJPEG-5c89842bc9e77c0001423049.jpg)