Spectacular Info About Cash Flow Statement Definition In Accounting

In financial accounting, a cash flow statement, also known as statement of cash flows, [1] is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing and financing activities.

Cash flow statement definition in accounting. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. Cash inflows refer to receipts of cash while cash outflows to payments or disbursements. The cash flow statement is required for a complete set of financial statements.

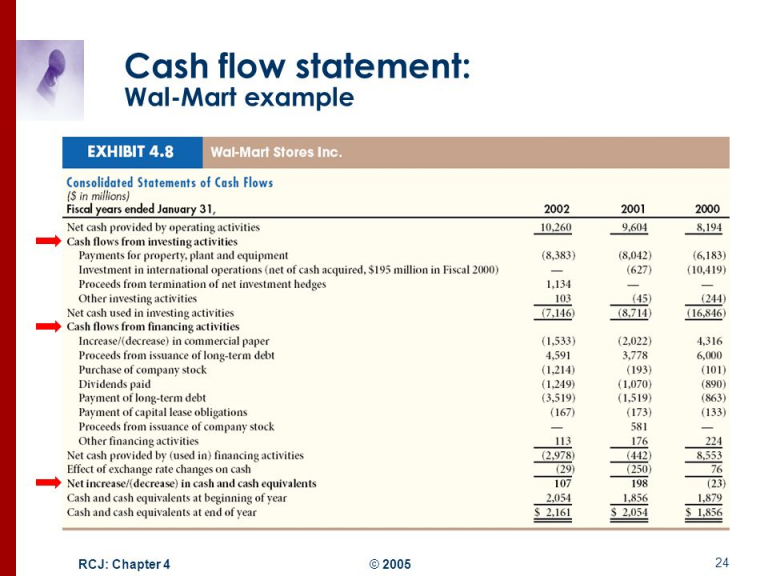

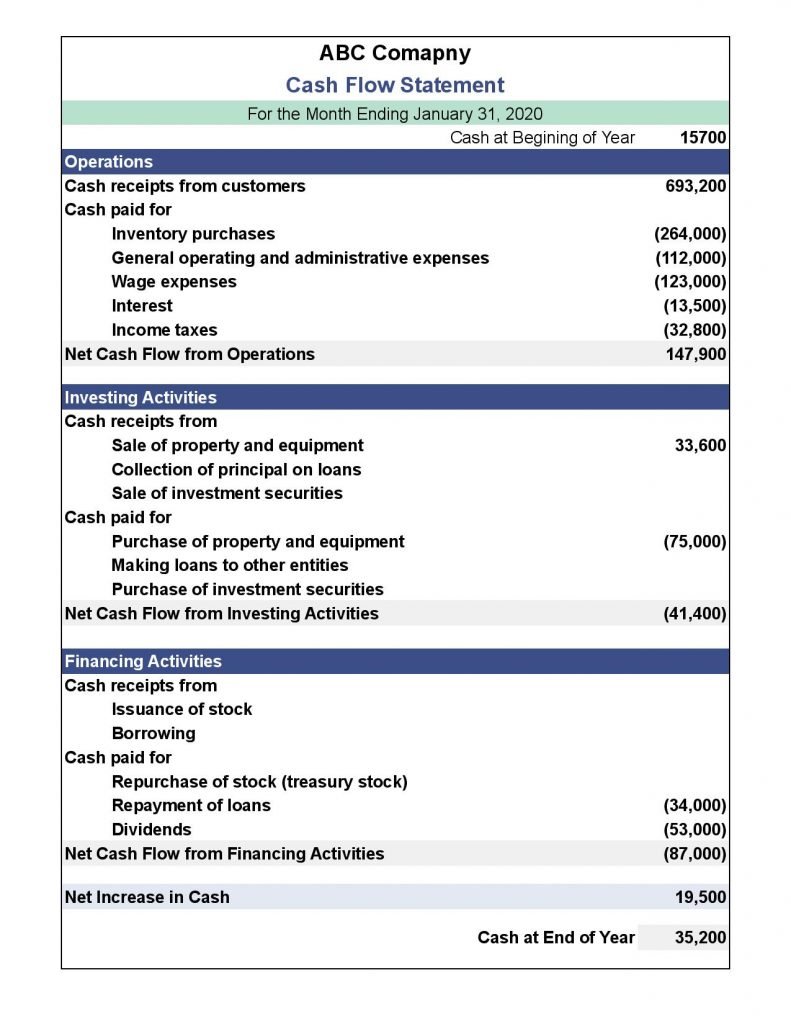

It tells you how cash moves in and out of a company's accounts via three main channels: We will use these names interchangeably throughout our explanation, practice quiz, and other materials. Operating, investing, and financing activities.

A cash flow statement tells you how much cash is entering and leaving your business in a given period. What is a cash flow statement? The cfs measures how well a.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources.

It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business. Statement of cash flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the resulting cash balance at the end of the period. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)