Sensational Info About Balance Sheet Net Income Formula

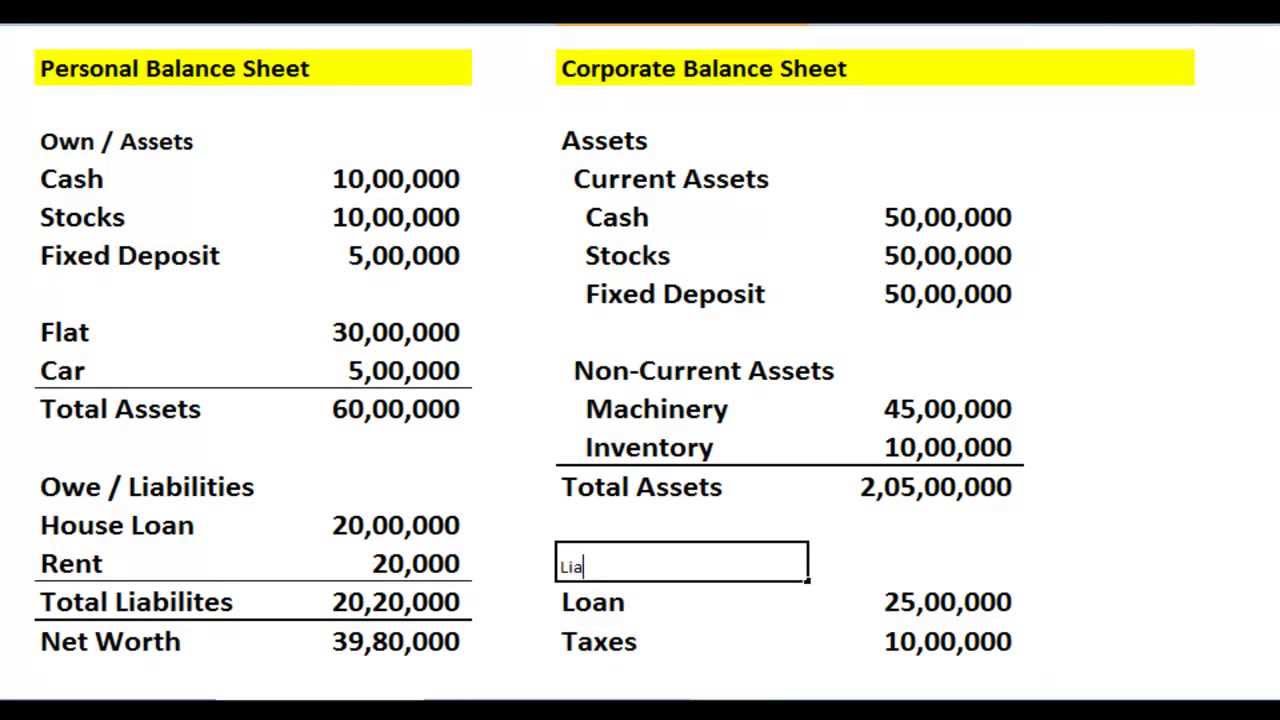

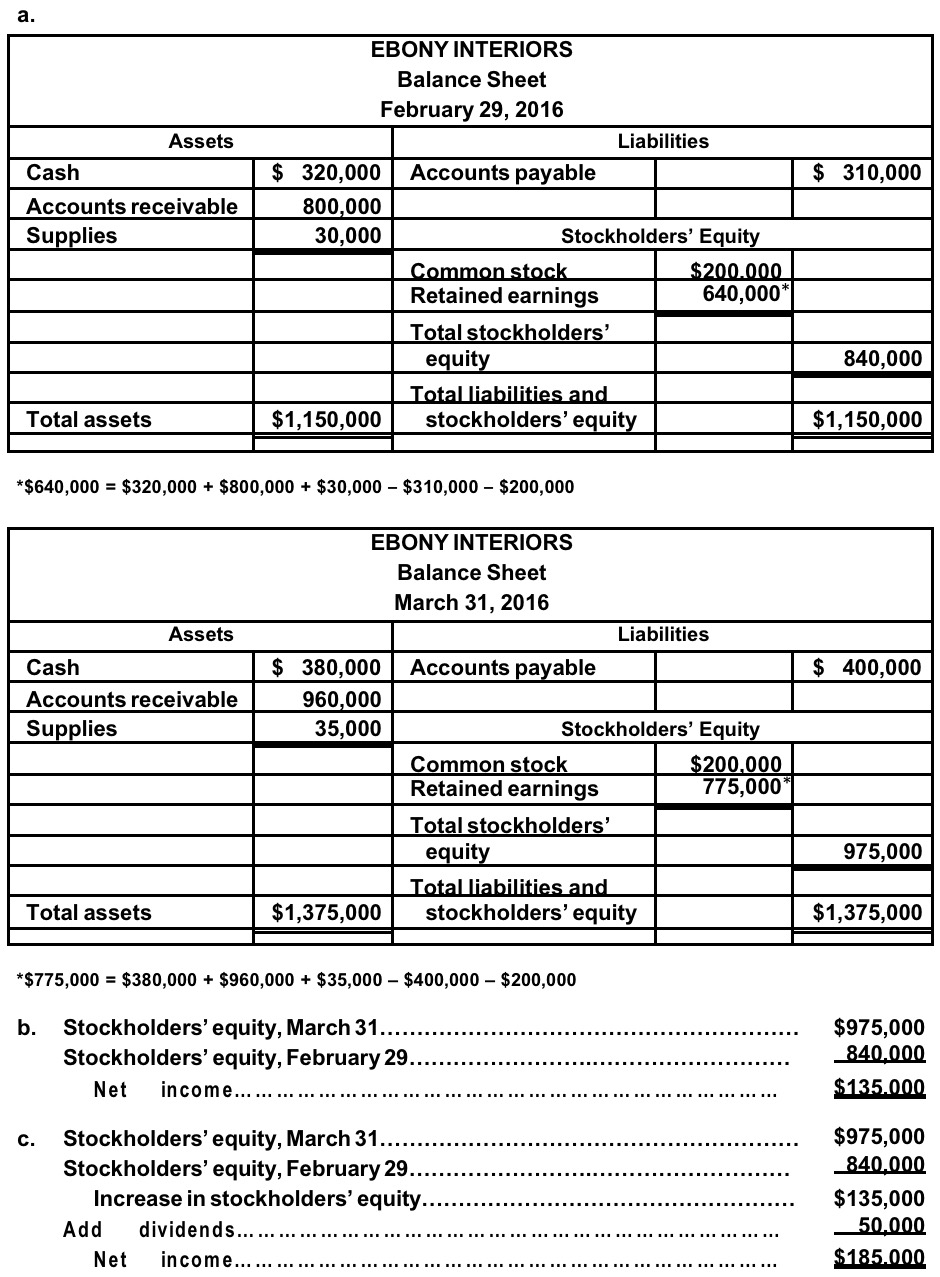

Remember the balance sheet formula:

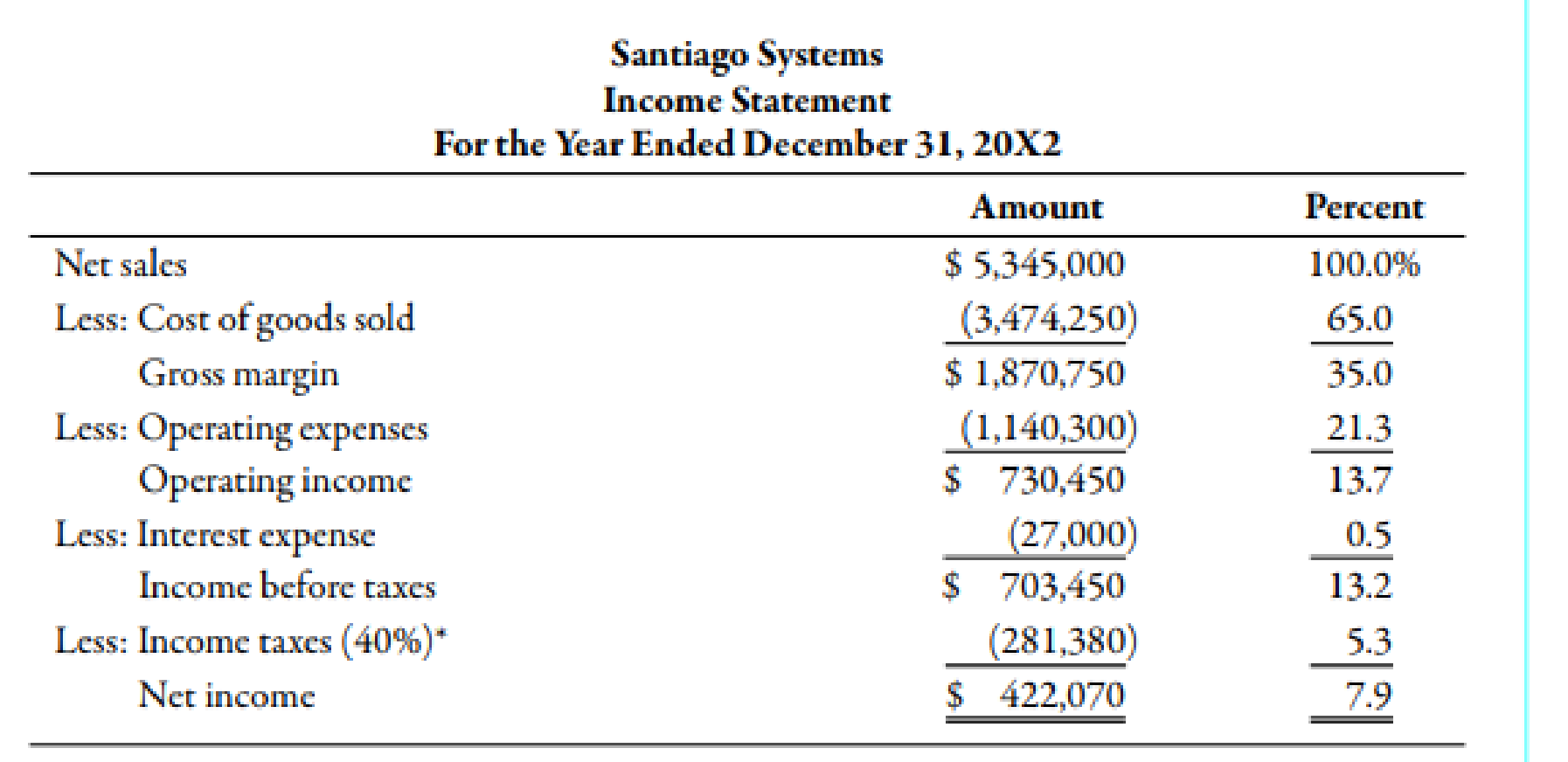

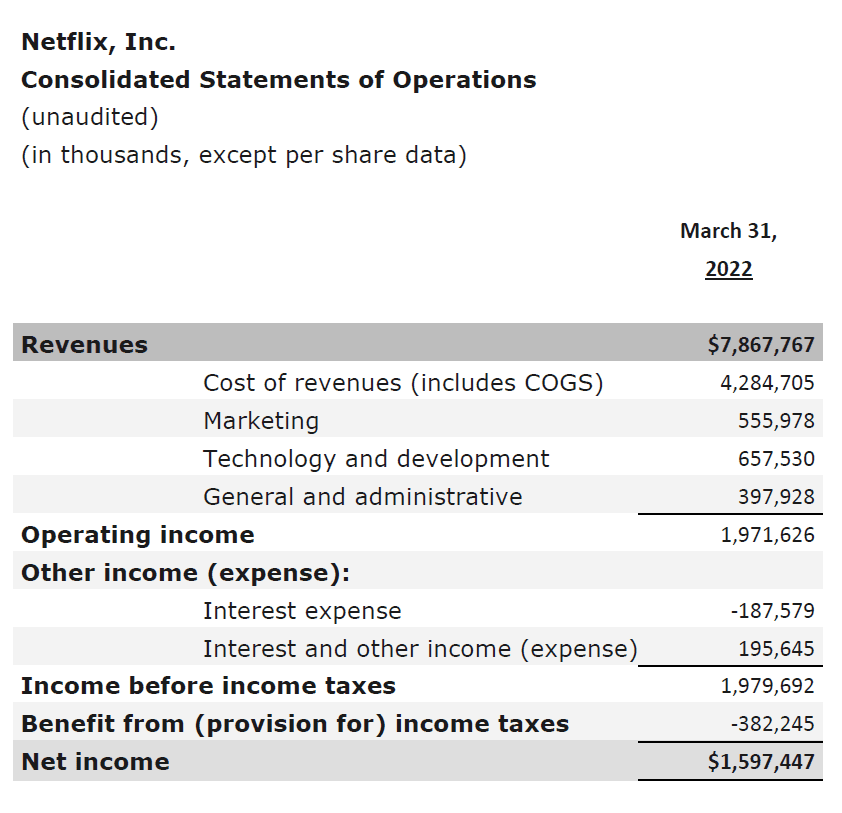

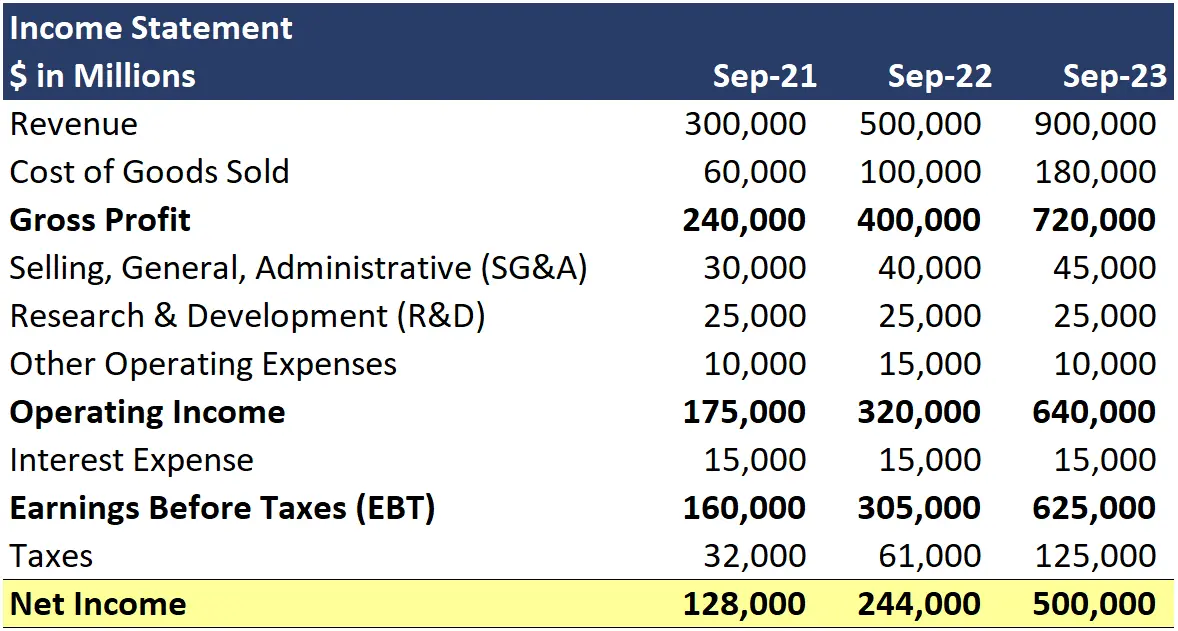

Balance sheet net income formula. Net income (ni) formula net income is calculated by subtracting all expenses from total revenue/sales: Assets = liabilities + equity. (check out our simple guide for how to calculate cost of goods sold ).

The formula is: The net income is a simple formula that measures excess revenue above total expense. The net income is very important in that it is a central line item to all three financial statements.

As mentioned above, net income is the amount of revenue that remains after your business pays off all its expenses. Gross profit is the number you get when you take your revenue and subtract your cost of goods sold (cogs). The balance sheet is based on the fundamental equation:

Dividend of € 1.80 per share; Now compare that to the same line from the previous quarter's or previous year's balance sheet. Net income formula.

Total revenues “ total expenses = net income. Special dividend of € 1.00 per share. Cfi’s financial analysis course as such, the balance sheet is divided into two sides (or sections).

Depreciation is a financial accounting method used to allocate the cost of tangible assets over t. This means net income can be defined as follows: The formula for the calculation is as follows:

Key takeaways net income (ni) is calculated as revenues minus expenses, interest, and taxes. While it is arrived at through the income statement, the net profit is also used in both the balance sheet and the cash flow statement. You will need certain minimum items from the balance sheet to calculate the net income of your business.

The left side of the balance sheet outlines all of a company’s assets. For a more detailed version of the net income formula, you can break down exactly what factors into those expenses. \text {assets} = \text {liabilities} + \text {shareholders' equity} assets = liabilities +shareholders’ equity this formula is intuitive.

Net income flows into the balance sheet through retained earnings, an equity account. Within the owners’ equity section, there may be several stock categories listed on a company’s balance sheet: Net cash € 10.7 billion.

The difference between them is the starting point for determining the company's net income. To do this you will need to: To get the correct result, you need the average value of assets during the period, not the total value at the end of the period.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)