Top Notch Tips About Financial Statement Of Restaurant Business

February 21, 2024.

Financial statement of restaurant business. The first thing to tick off your restaurant financial audit checklist is gathering the essential financial statements. Record adjusted ebitda margin fourth. Board of directors at the company’s 2024 annual meeting.

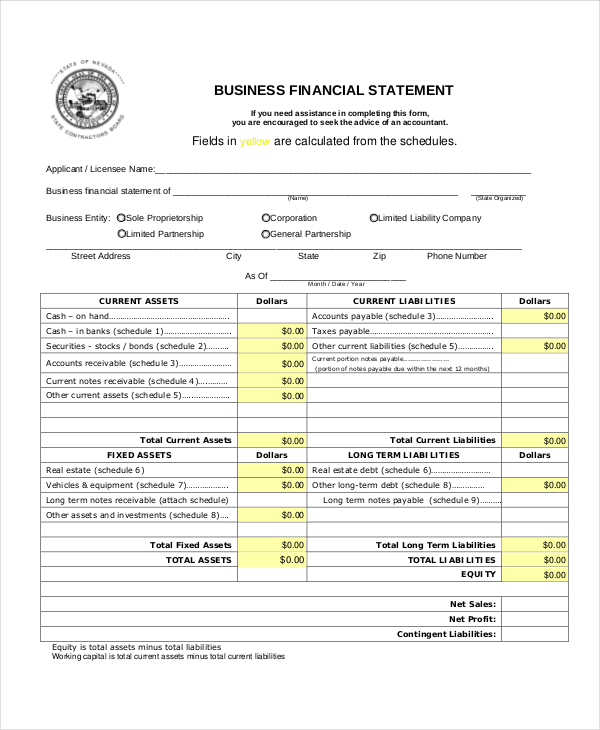

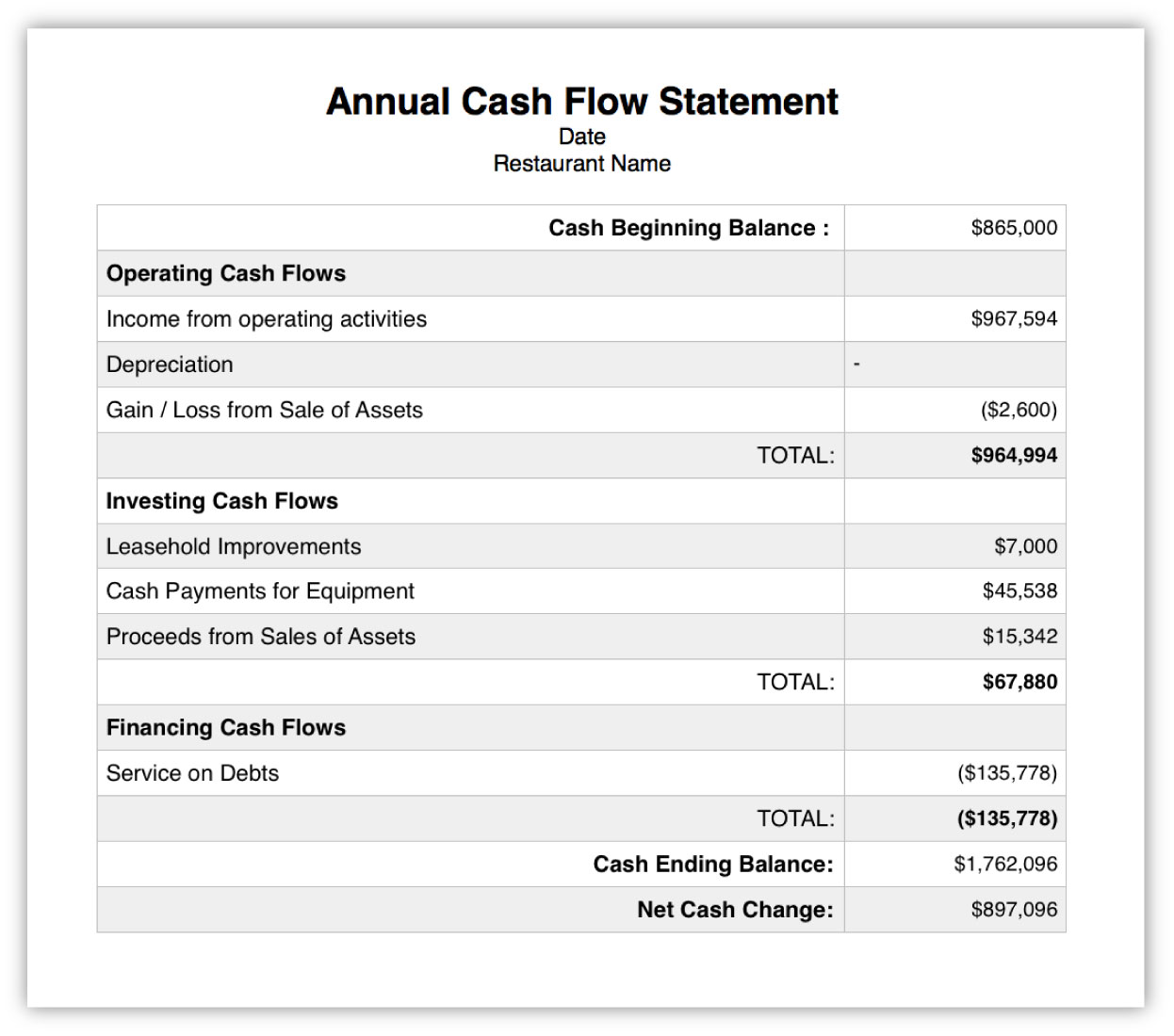

Food and beverage sales report; Here’s the formula summarizing a balance sheet: Profit and loss (p&l) statements (also known as income statements), balance sheets, and cash flow statements.

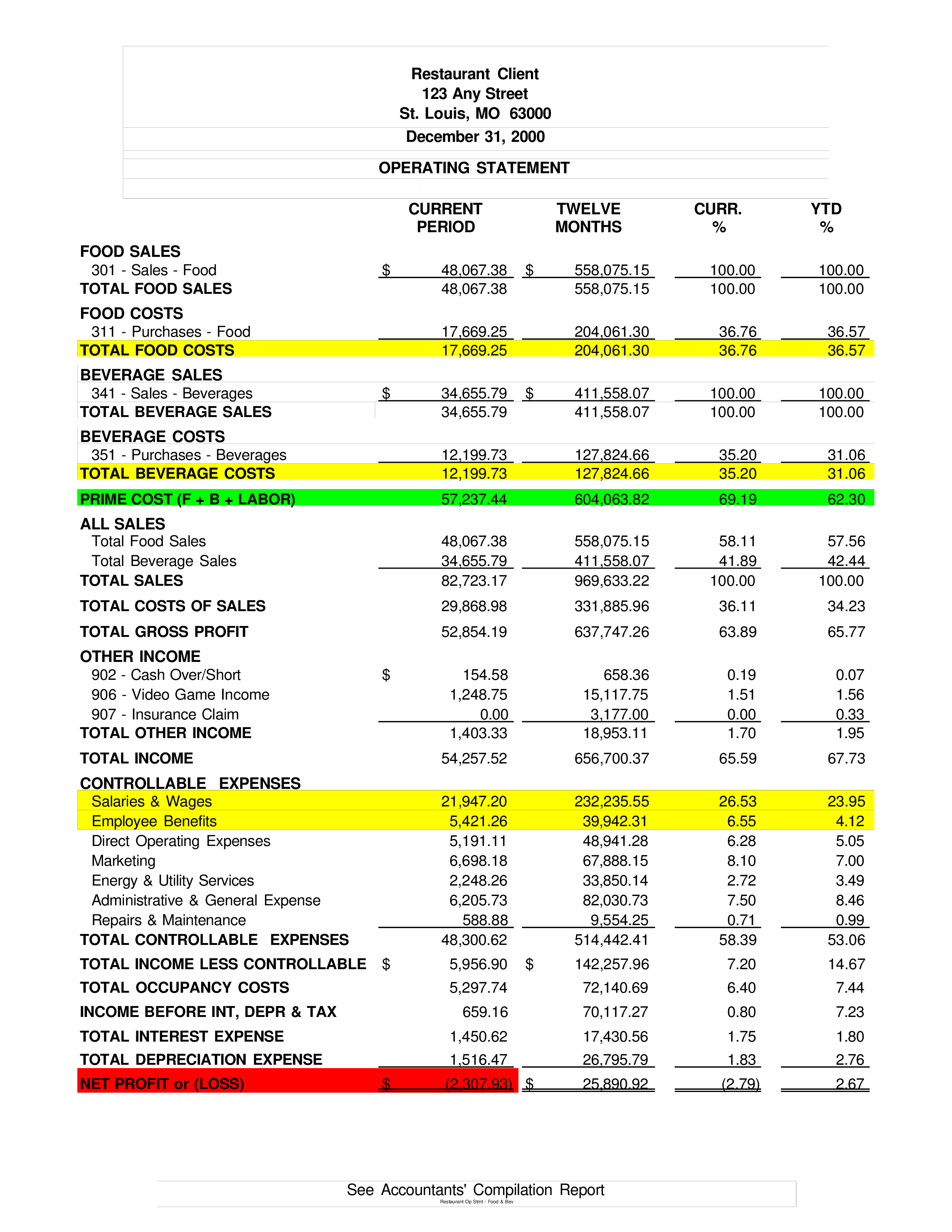

As we learned, the restaurant income statement not only measures income, but it's also a great tool for management. In this article, we’ll go over standard financial statements restaurant owners should keep an eye on. For a restaurant, this financial statement enables you to analyze your restaurant's financial progress.

Restaurant financial statements are a vital tool for monitoring the financial performance, profitability, and overall health of a restaurant. Statement of financial position statement of assets and. Creating a comprehensive business plan is crucial for launching and running a successful restaurant.

The 4 basic financial statements every restaurateur needs to know: Income statement revenue statement earnings statement operations statement performance statement balance sheet — the balance sheet is also called: Shows a restaurant's revenue, expenses, and profit or loss over a period of.

These are often referred to in the finance world as “the three statements” — the income statement, balance sheet, and cash flow statements. Income statement (p/l statement) this document shows restaurant owners how much they’ve made versus their losses, so they can determine whether their roi was sufficient to balance their spending. In conclusion, financial analysis plays a crucial role in restaurant management.

As a restaurant owner, understanding your financial statements is crucial for making informed decisions that can drive the growth and profitability of your business. For the quarter, gaap earnings per diluted share was $4.93, up 33% from the previous quarter. It helps you measure the financial health of your business and calculate your restaurant’s.

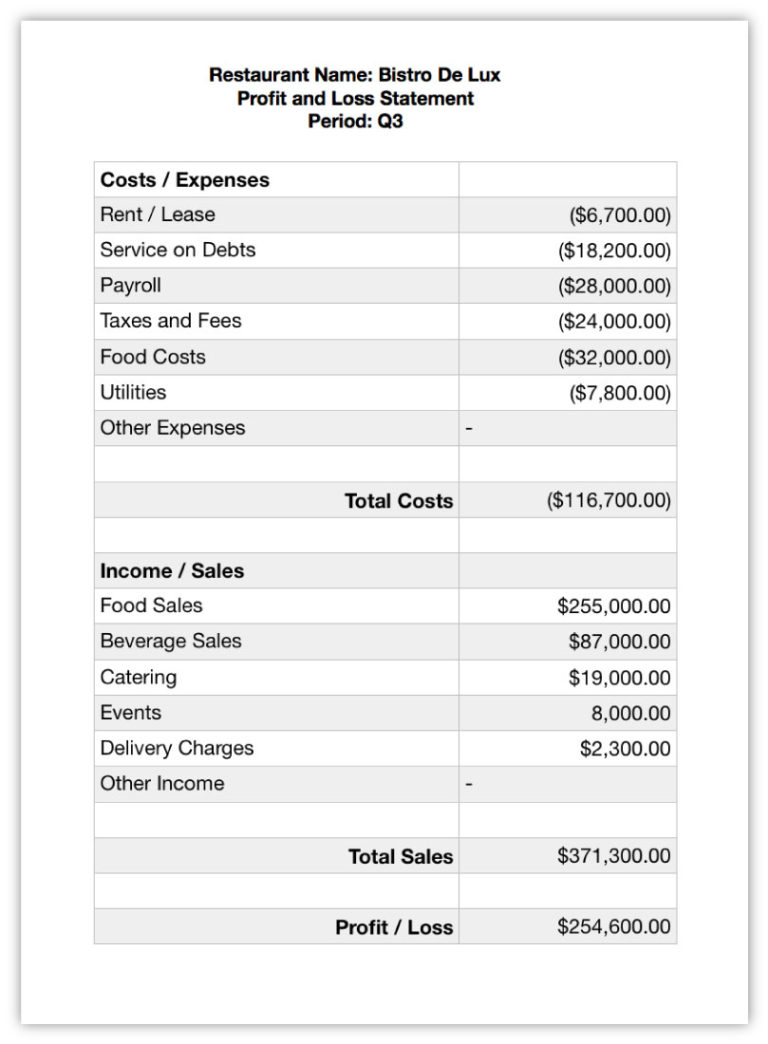

At its most basic level, a p&l reflects costs that are subtracted from sales. A profit and loss statement (or income statement) is a monetary statement that lists the sales, costs, and expenses of your business in a set period of time. No business can be run without numbers.

Lp (“arkhouse”) that it has nominated nine individuals to stand for election to the macy’s, inc. Image sourced from sage.com here are some other useful things you can do with a p/l statement. The most important of these is the p&l.

The profit and loss statement (p&l) 2. This figure serves as a benchmark for restaurant owners and operators, helping them evaluate their own profit margins and gauge their performance against industry standards. Three of the reports that will include the data you need for an audit are the profit and loss statement, balance sheet, and statement of cash flow.