Cool Info About Relationship Between Profit And Loss Balance Sheet

Remember that the retained earnings account reflects all income the firm has earned since its inception less any dividends paid out to shareholders.

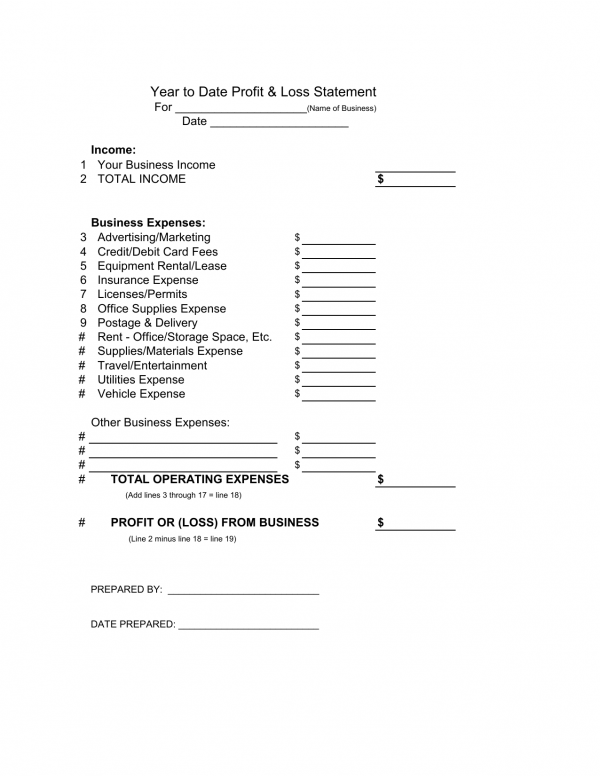

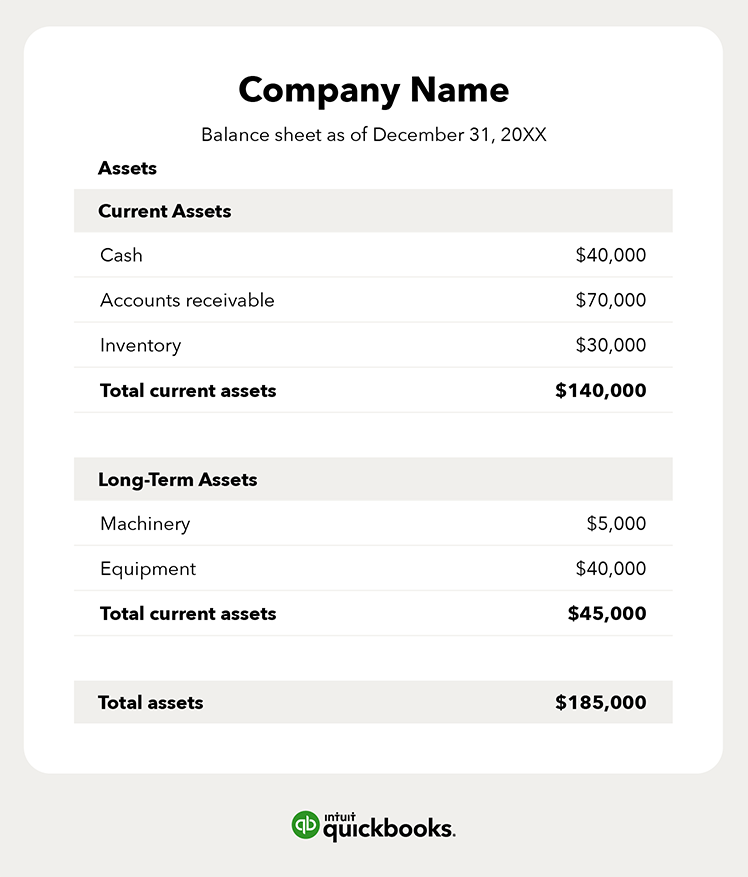

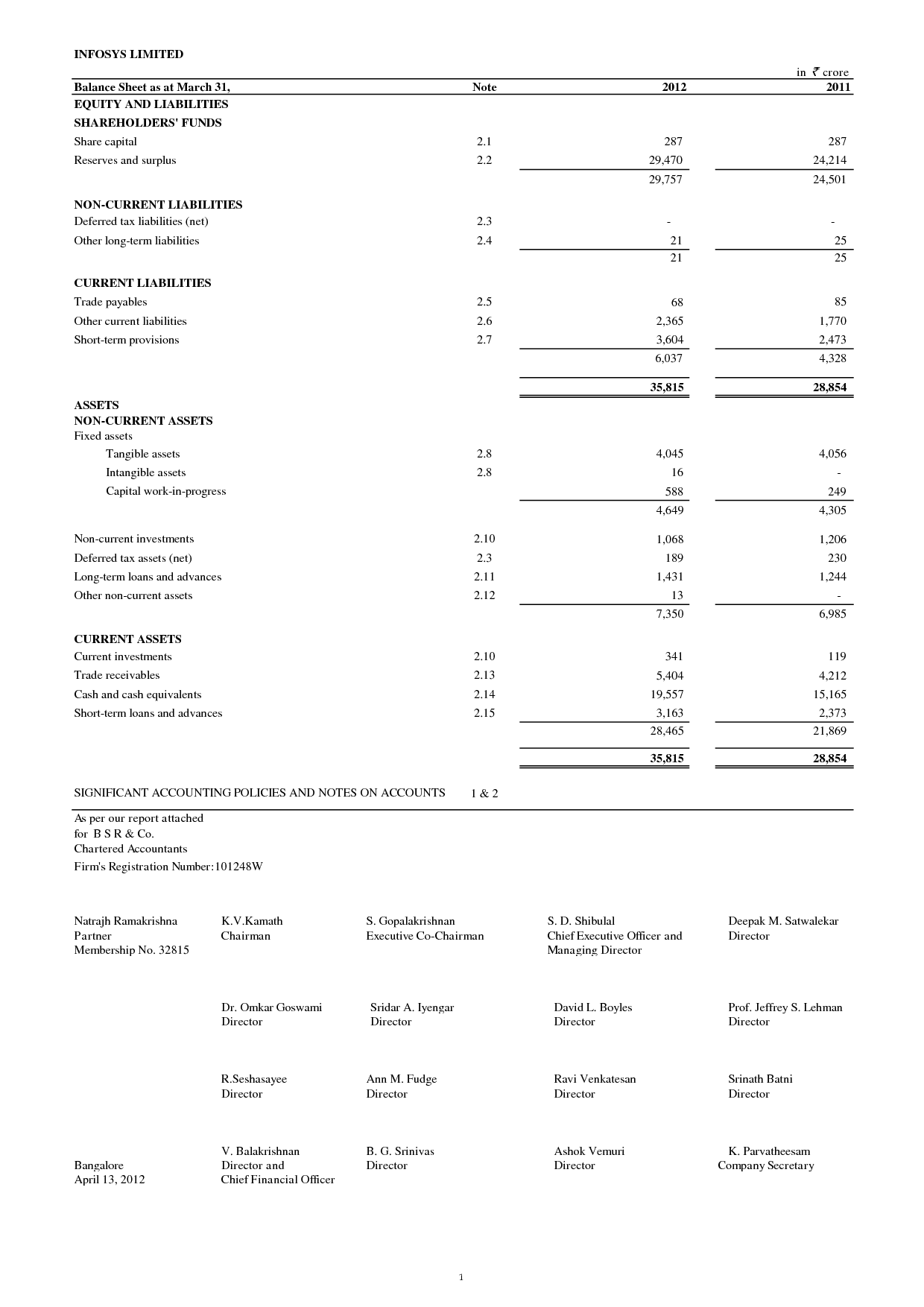

Relationship between profit and loss and balance sheet. The profit and loss account and the balance sheet are two of the most important financial reports companies and investors rely on. A balance sheet reports your assets/liabilities at a point in time. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

Balance sheet and profit & loss account are actually prepared as an equivalent part of the company’s financial reporting process, which plays a significant role in helping shareholders like investors, creditors, and management to actually measure the company’s profitability and stability from various perspectives. Sales revenue > cash and debtors cost of goods sold expense < stock operating expenses > cash operating expenses < prepaid expenses operating expenses > creditors operating expenses > accrued expenses. Profit and loss statement these are some of the key differences between balance sheets and profit and loss statements:

Balance sheet vs. A balance sheet is a statement that discloses the financial position of its assets, liabilities and capital on a specific date. Relationship between income statement and balance sheet.

Understanding the relationship between trial balance, p&l, and balance sheet reports is essential for effective financial management. Income statement, or profit and loss statement, is directly linked to balance sheet, cash flow statement and statement of changes in equity. A profit and loss account is an account that shows the revenue and expenses of the firm from business operations during a financial year.

A p&l statement provides information about whether a company can. The balance sheet gives a snapshot of the company’s financial standing at a certain point in time. The relationship between balance sheets and profit and loss accounts the profit and loss account summarises a business’s trading transactions, such as income, sales, and expenditures, for a given period, and shows the resulting overall profit or loss.

The other two are the balance sheet and the cash flow statement. Analysts view the assets minus liabilities as the book value or equity of the firm. Despite their common origins, there are key differences between the two that must be noted when preparing or analyzing them—in this article, we’ll list them all.

Essentially, the balance sheet and p&l statement are partners in the financial world. The purpose of the p&l. The three financial statements are:

When experts prepare them a key difference between these two documents is that financial experts typically prepare them at different points in the business cycle. That might be today, or it might be at the end of your business’s accounting year. This is outlined by every enterprise, a partnership enterprise or sole proprietorship firm.

The increase or decrease in net assets of an entity arising from the profit or loss reported in the income statement is incorporated in the balances reported in the balance sheet at the period end. A profit and loss account (p&l) reports the true financial position of the business, i.e. Between in commerce balance sheet vs profit loss account balance sheet vs profit & loss account a balance sheet is a precise representation of the assets, equity and liabilities of the entity.

A profit and loss (p&l) statement is one of the three types of financial statements prepared by companies. Changes in current assets and current liabilities on the balance sheet are related to revenues and expenses on the income statement but need to be adjusted on the cash flow statement to reflect the actual amount of cash received or spent by the business. The income statement illustrates the profitability of a company under accrual accounting rules.