Top Notch Tips About Retained Earnings On Trial Balance

Determine beginning retained earnings balance add current.

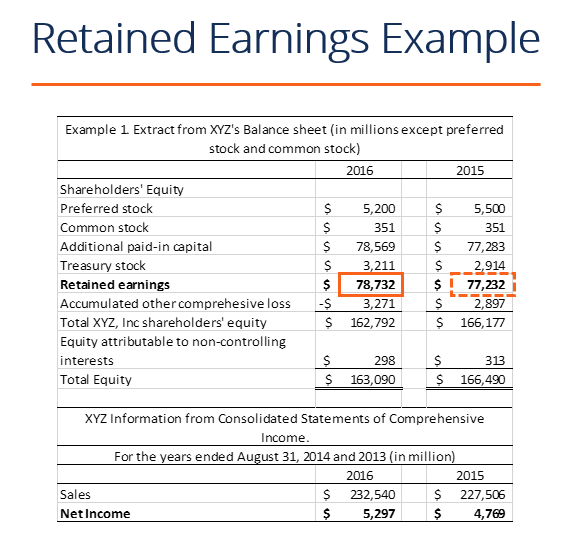

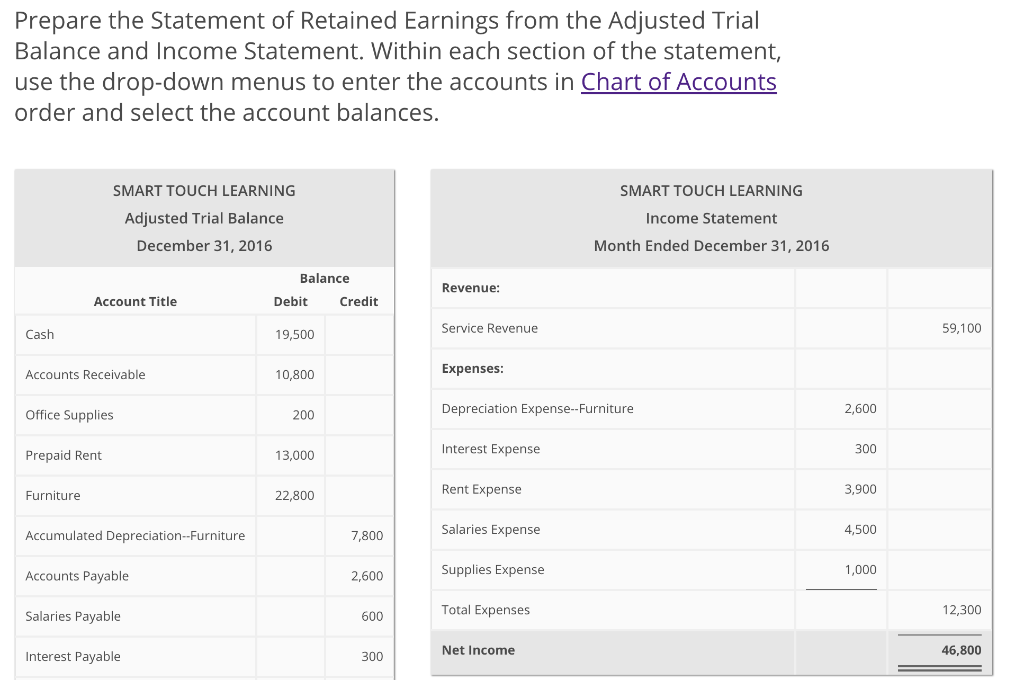

Retained earnings on trial balance. Retained earnings refer to the residual net income or profit after tax which is not distributed as dividends to the shareholders but is reinvested in the business. We need to do the closing entries to make them match and. Beginning re (2015) = $18,861.

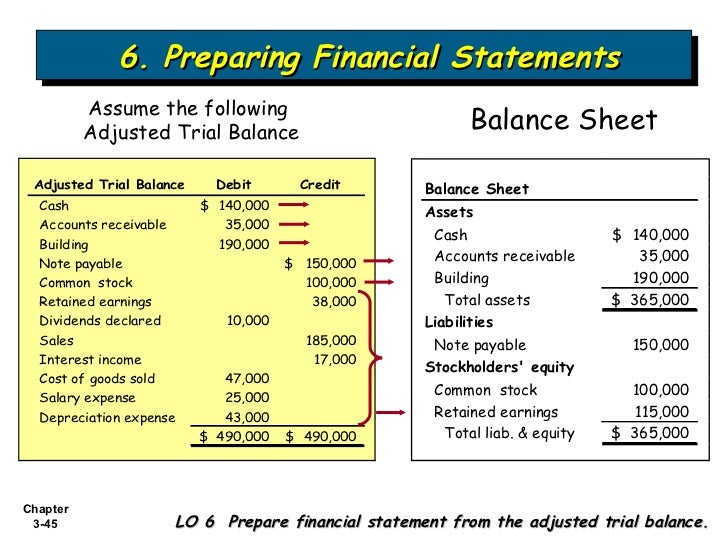

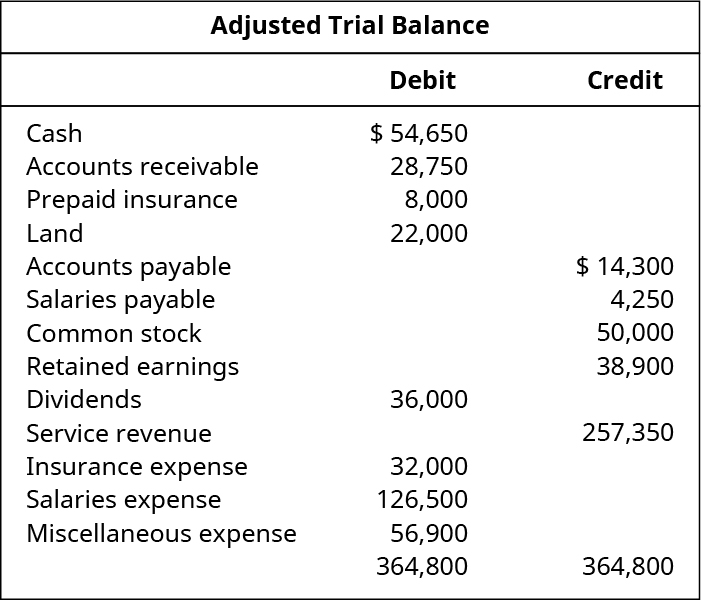

The accounts reflected on a trial balance are related. Typically, retained earnings are judged based on their relationship to a company’s total assets. A trial balance is a list of all accounts in the general ledger that have nonzero balances.

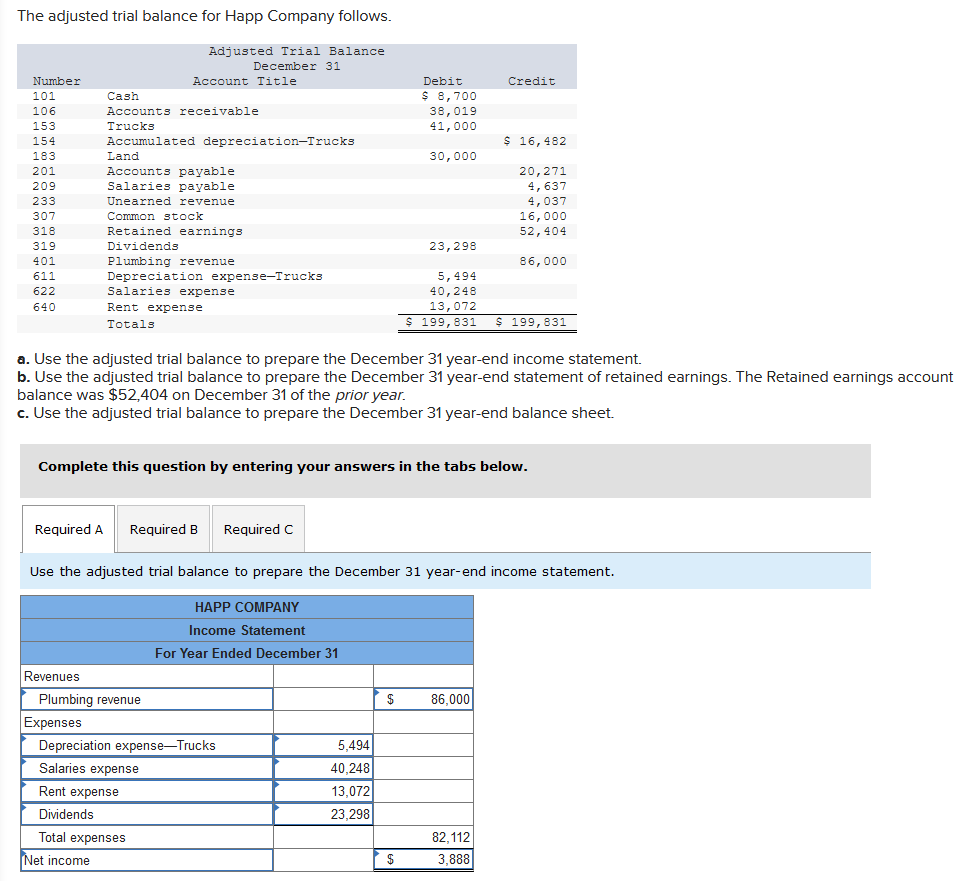

On the statement of retained earnings, we reported the ending balance of retained earnings to be $15,190. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. In general, the trial balance will give the accumulation of all the previous retained earnings that the company has made in the past, up to the start of the financial.

Notice that the retained earnings balance of $7,680 on the adjusted trial balance does not represent the ending retained earnings balance because the account has not yet. Hi, the retained earnings value appearing on the tb is different than the bl. Preparing an unadjusted trial balance is the fourth step in the accounting cycle.

Select summarize retained earnings values, the report shows the sales income ledger account balance of $500 for the current month, $200 in the beginning balance column,. Unlike previous trial balances, the retained earnings figure is included, which was obtained through the closing process. Trial balance and retained earnings.

To calculate retained earnings, the beginning retained earnings balance is added to the net income or loss and then dividend payouts are subtracted. The statement of retained earnings will include beginning retained earnings, any net income (loss) (found on the income statement), and dividends. The trial balance serves as a foundational report in the accounting process, providing a snapshot of all account balances at a given point in time, including retained earnings.

Remember that when we toss dividends, $1,450, into the pot, our retained earnings decreases, so we’ll subtract to get the amount that’s left in the pot:

![[Solved] pls help asap! Dawson Hair Stylists' adjusted](https://media.cheggcdn.com/study/390/390b3201-aa27-45d0-9258-30ca5ef8a073/image)