Brilliant Info About Saas Financial Statements

Sapiens international corporation, (nasdaq and tase:

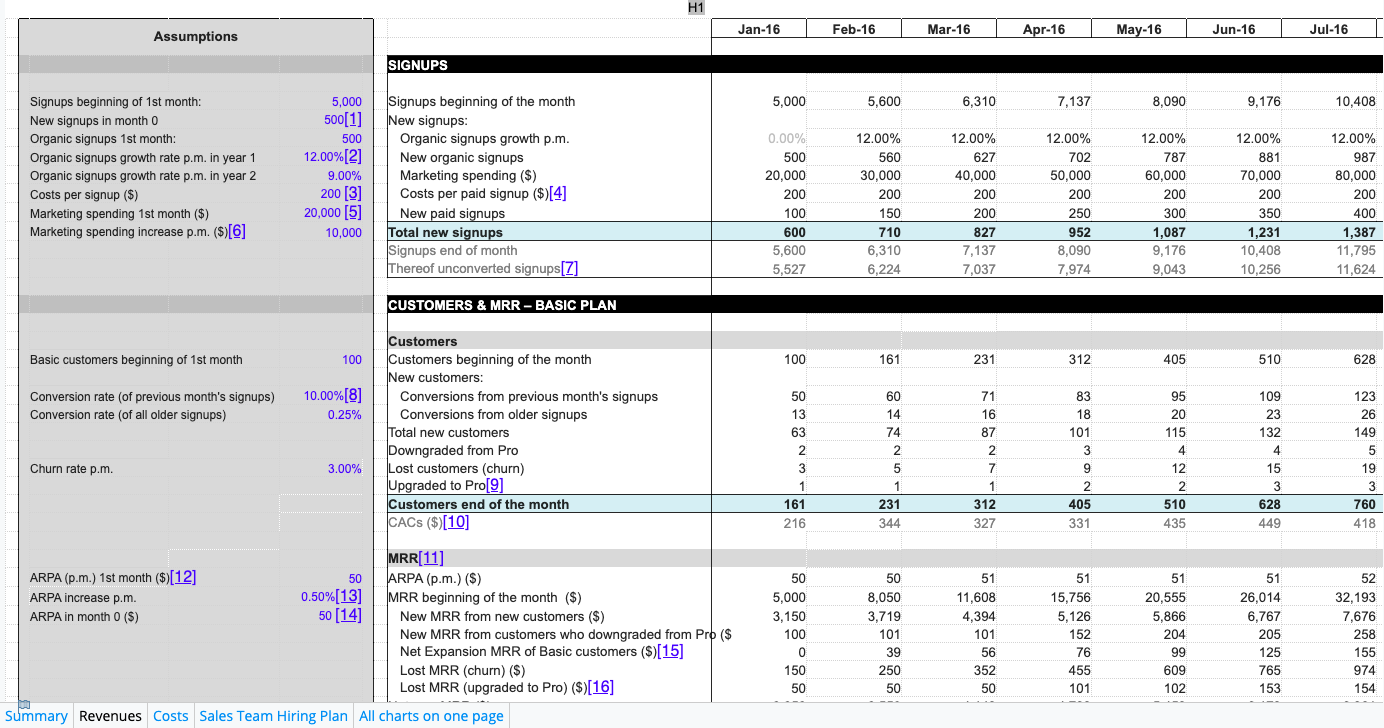

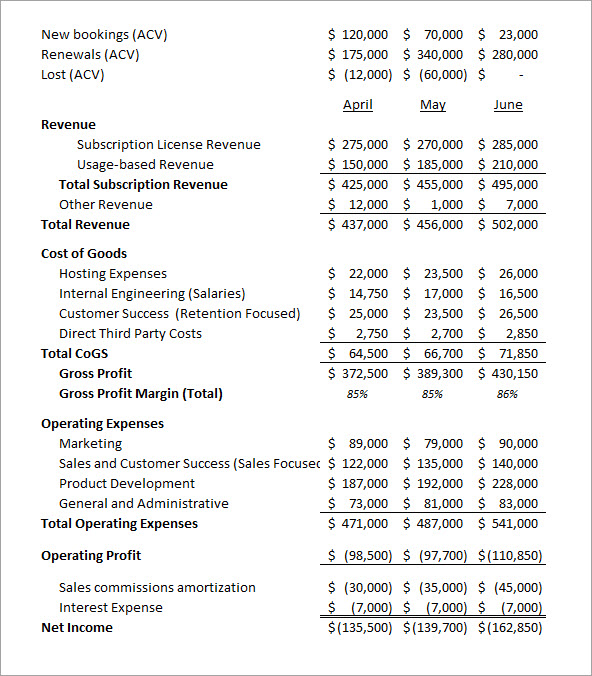

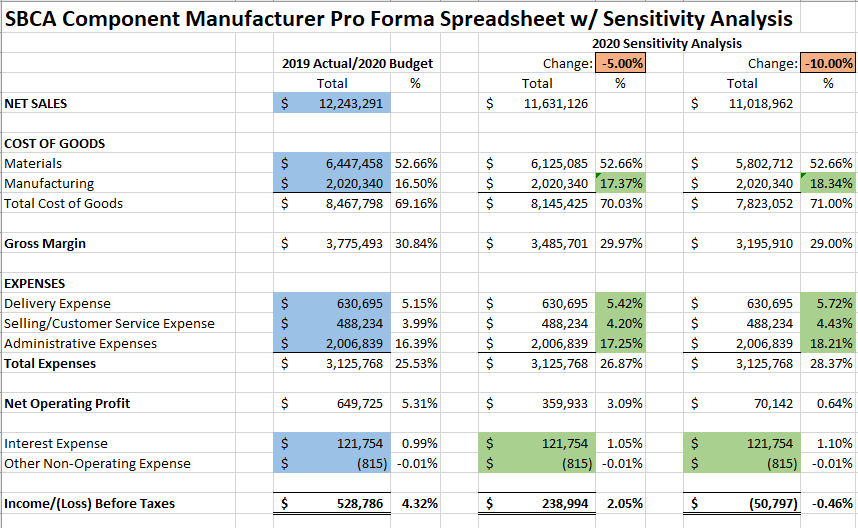

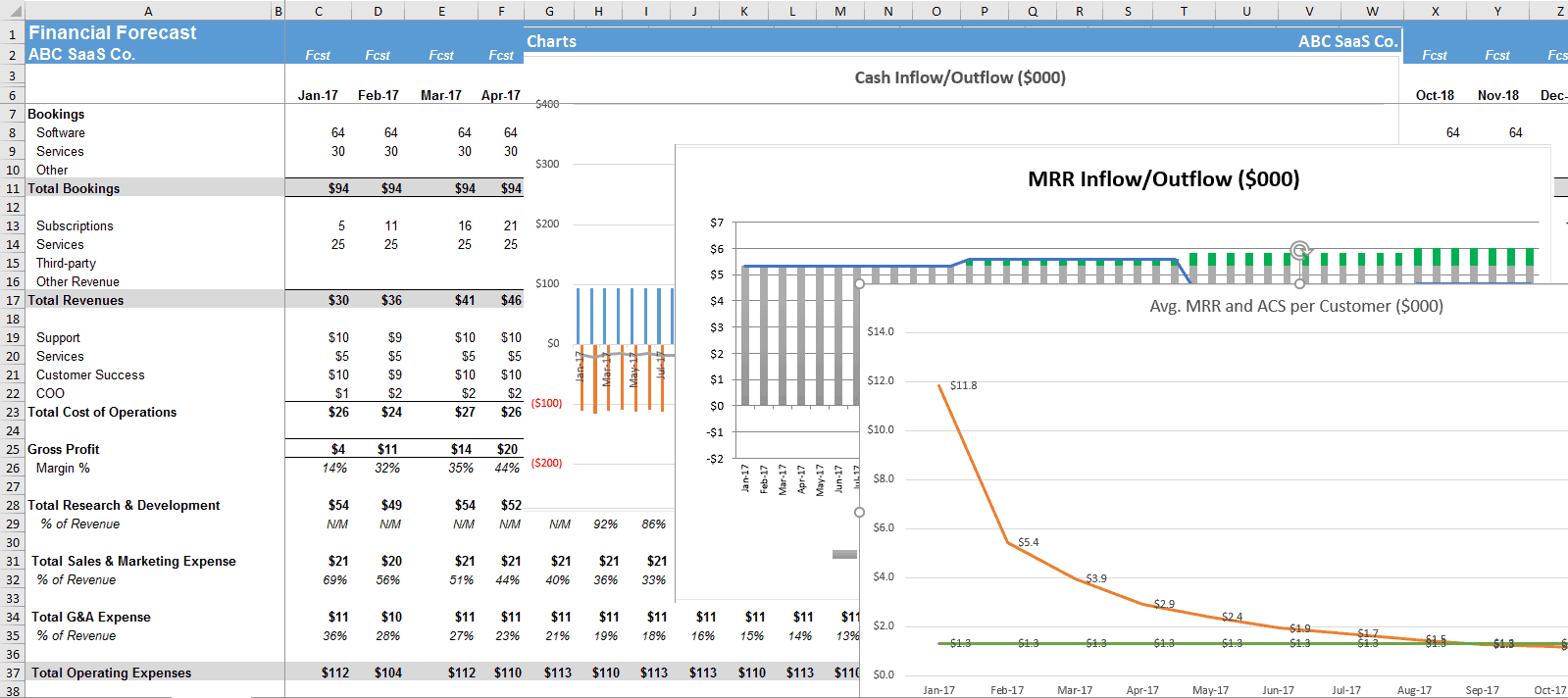

Saas financial statements. Most importantly, you can use this financial instrument to make future projections and hypotheses. The saas p&l is a foundational pillar of saas financial management. Balance sheet the balance sheet provides a snapshot of the company’s financial position at a specific point in time.

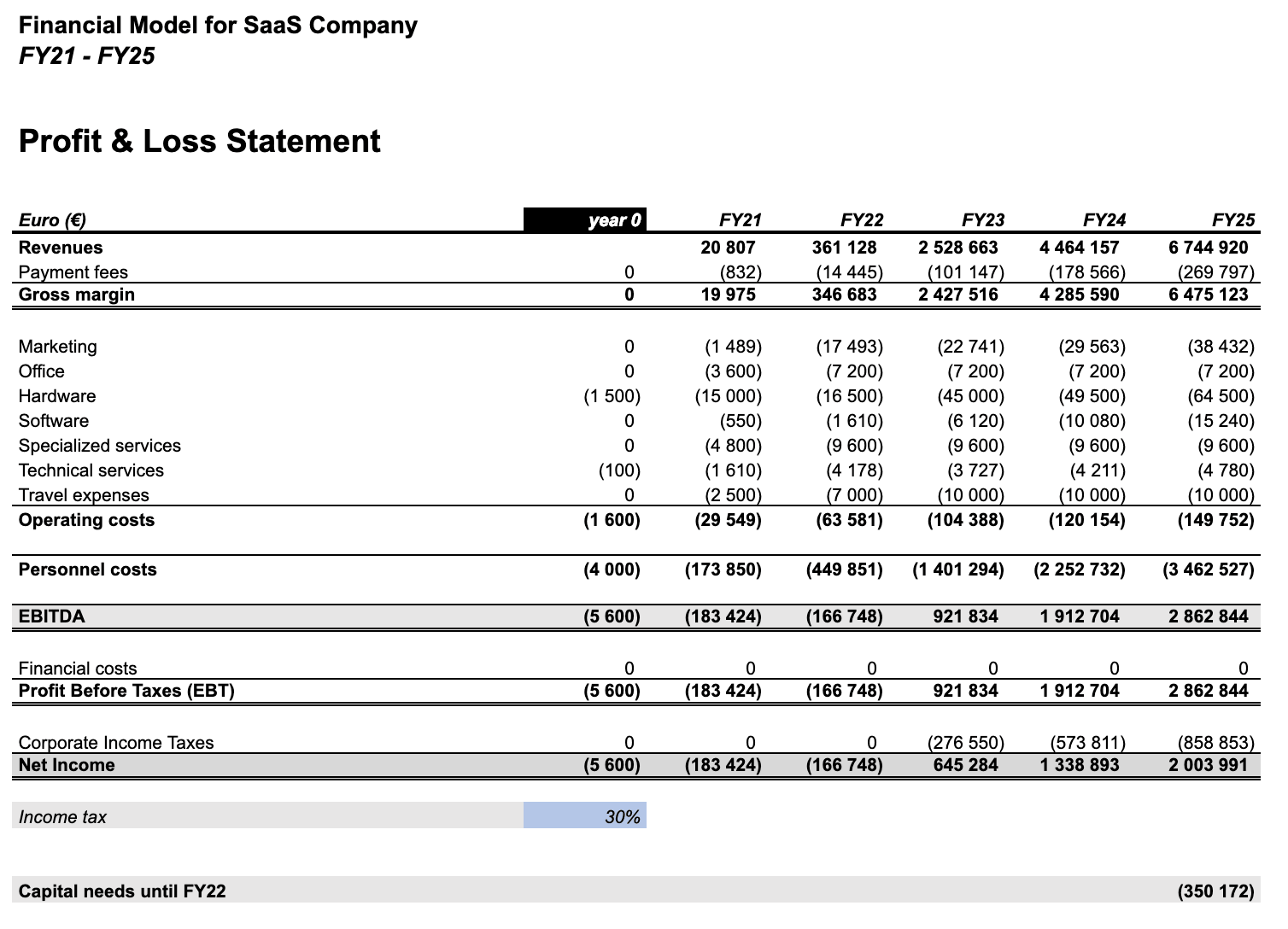

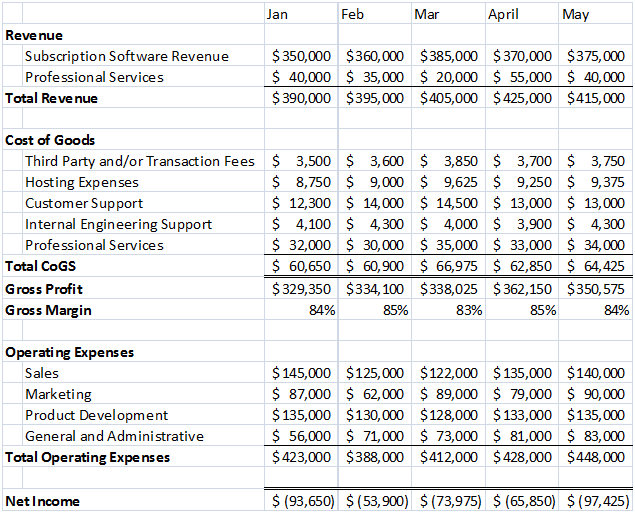

Income statement the income statement, also known as the profit and loss statement, shows a company's revenue and expenses over a specific period, typically a quarter or a year. Spns), a leading global provider of software solutions for the insurance industry, today announced that bhsf, a uk profit for good health and. Then, as sort of a practical exercise, we will review saas company financial reports and highlight the specific financial profile associated with these businesses.

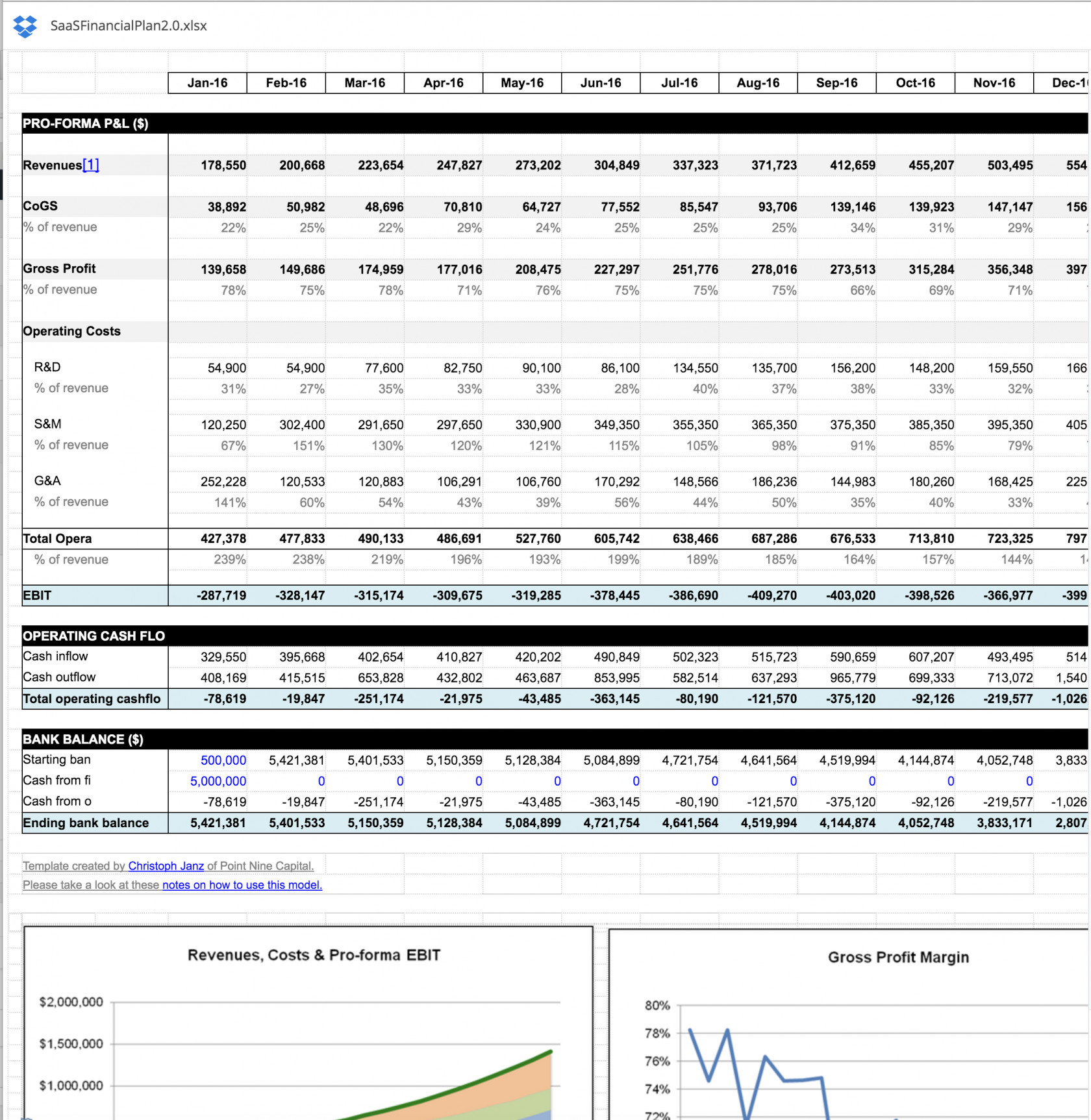

However, for saas companies, the most important one to understand and analyze is the income statement. Understanding how to prepare and analyze these statements in line with gaap is a fundamental aspect of saas accounting, providing valuable insights into the. This is a standard saas income statement (aka p&l).

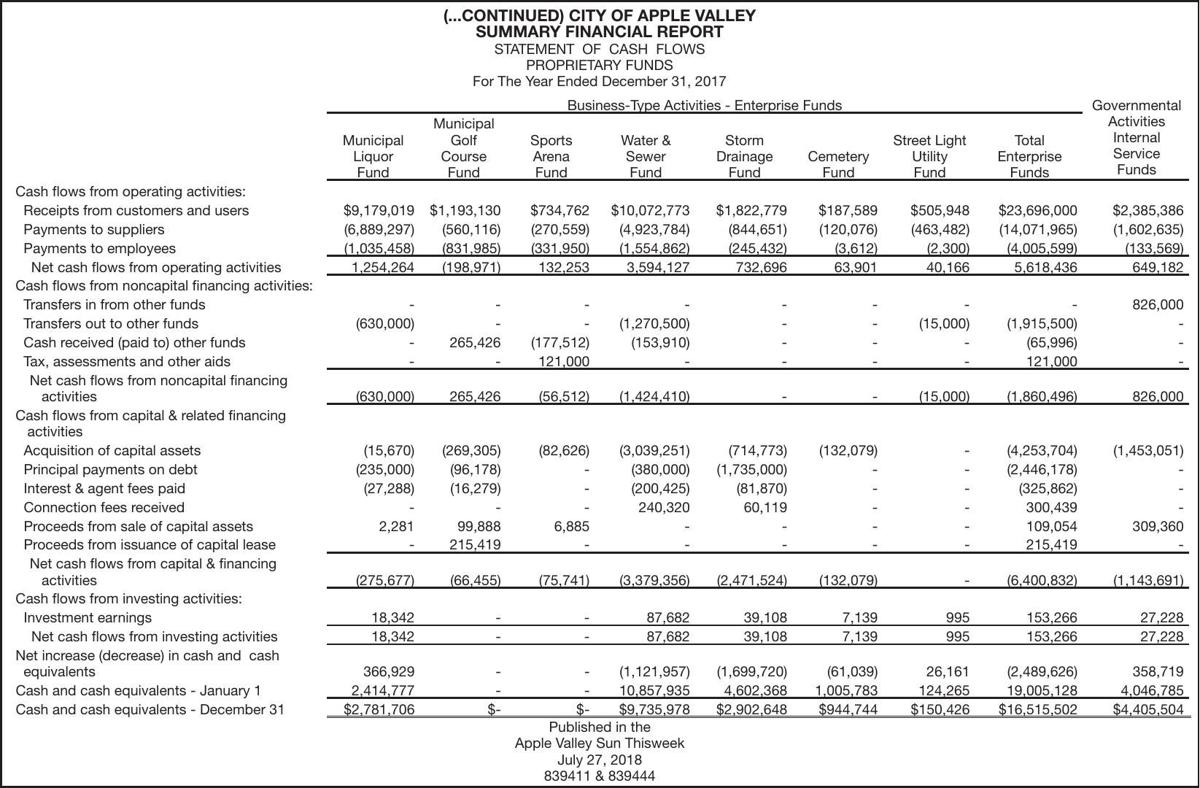

Recurring revenue (mrr and arr) 2. At its simplest, accounting is the recording, reporting, and analysis of the financial data for a business. Saas financial statements are formal reports that present the financial performance, position, and cash flows of a saas company, including the income statement, balance sheet, and cash flow statement, typically prepared in.

Not always commonly defined and reported don’t always translate into revenue and cash (failed implementation) These include the following documents: The income statement, the balance sheet, and the cash flow statement.

Once your inputs are complete, you can review your saas p&l summary. Fisy innovation plan by remi berthier 2. In the saas world, these financial statements take on nuanced complexities due to the recurring revenue model, deferred revenues, and the capitalization of certain expenses.

The three financial statements that every company must prepare are the income statement, balance sheet, and the statement of cash flows. These statements are critical, as they show your company’s financial health. Our saas balance sheet template on the other hand simply shows your financial position at a specific point in time.

When looking at growth, bookings are important, however: $1 to $3 million $3 to $10 million over $10 million the income statement a gaap income statement is the best source for understanding growth and burn: By analyzing the income statement, saas companies can make informed decisions about pricing, marketing, and investment in the business.

Their financial statements will also have very different metrics and ratios than other online business types. Gaap standards specify that three financial statements must be completed in each financial period. A complete guide to saas accounting table of contents:

Not only do they protect against unforeseen expenses and revenue drops, but they can also be a powerful tool for enticing lenders to invest in your business. Introduction types of accounting gaap financial statements revenue recognition for saas introduction to saas accounting in recent years with the surge of the saas economy, accounting practices have evolved too. To create a reliable and accurate saas financial model, follow these steps: