Beautiful Tips About Fair Value Through Other Comprehensive Income

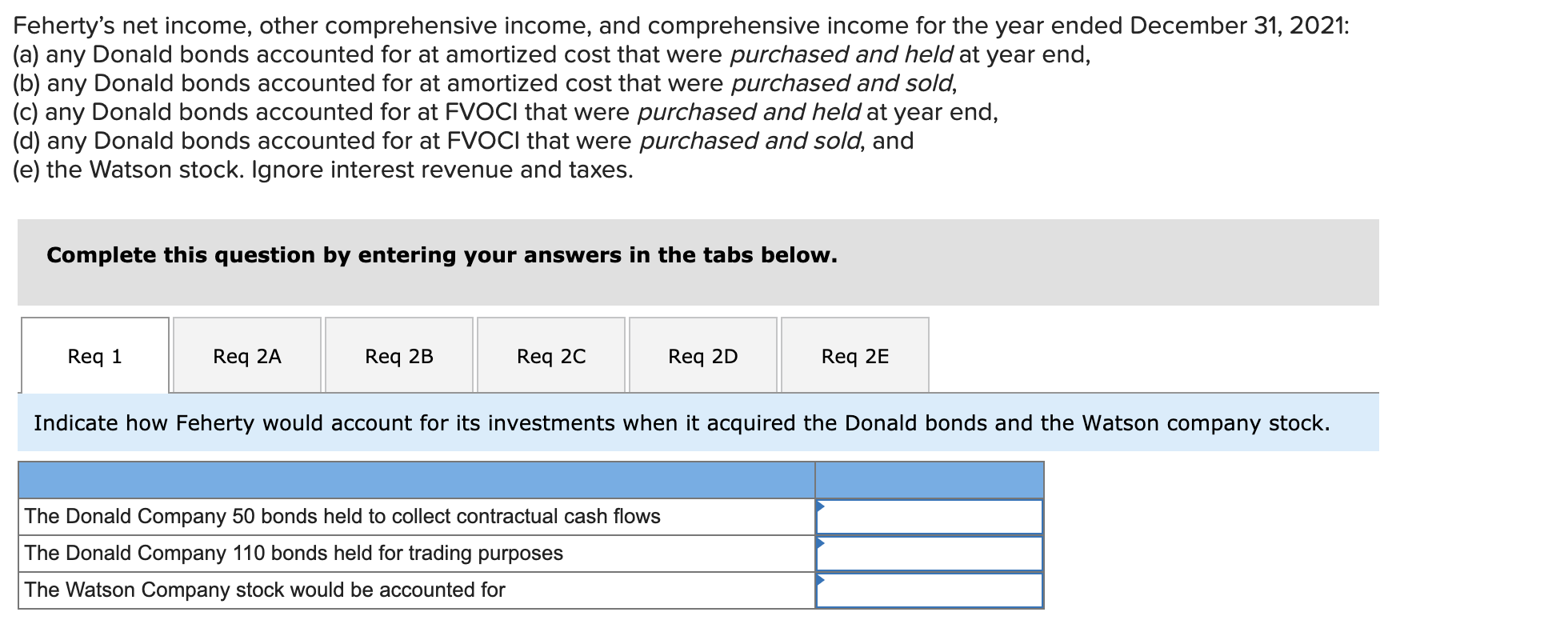

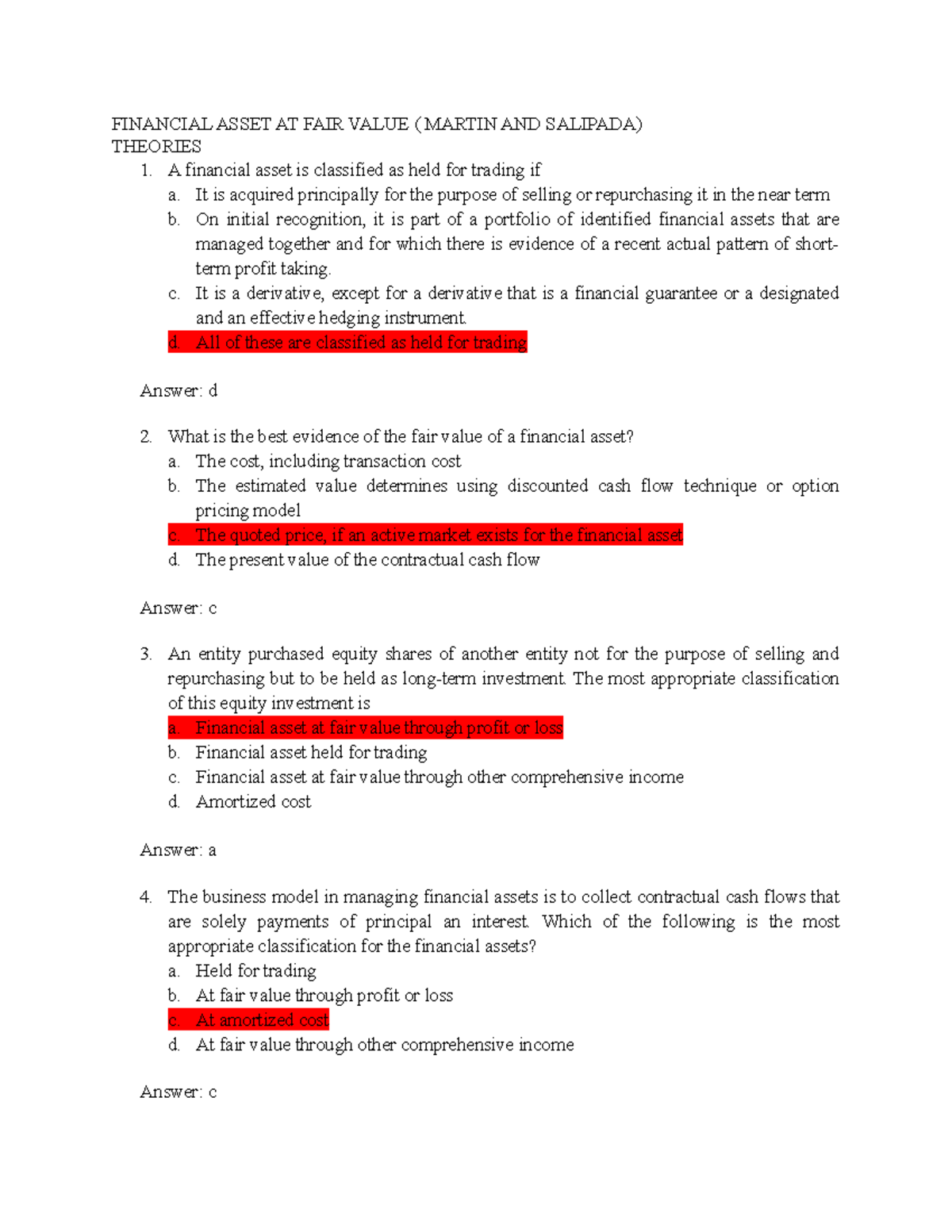

Amortised cost, fair value through other comprehensive income (‘fvoci’) and fair value through profit or loss.

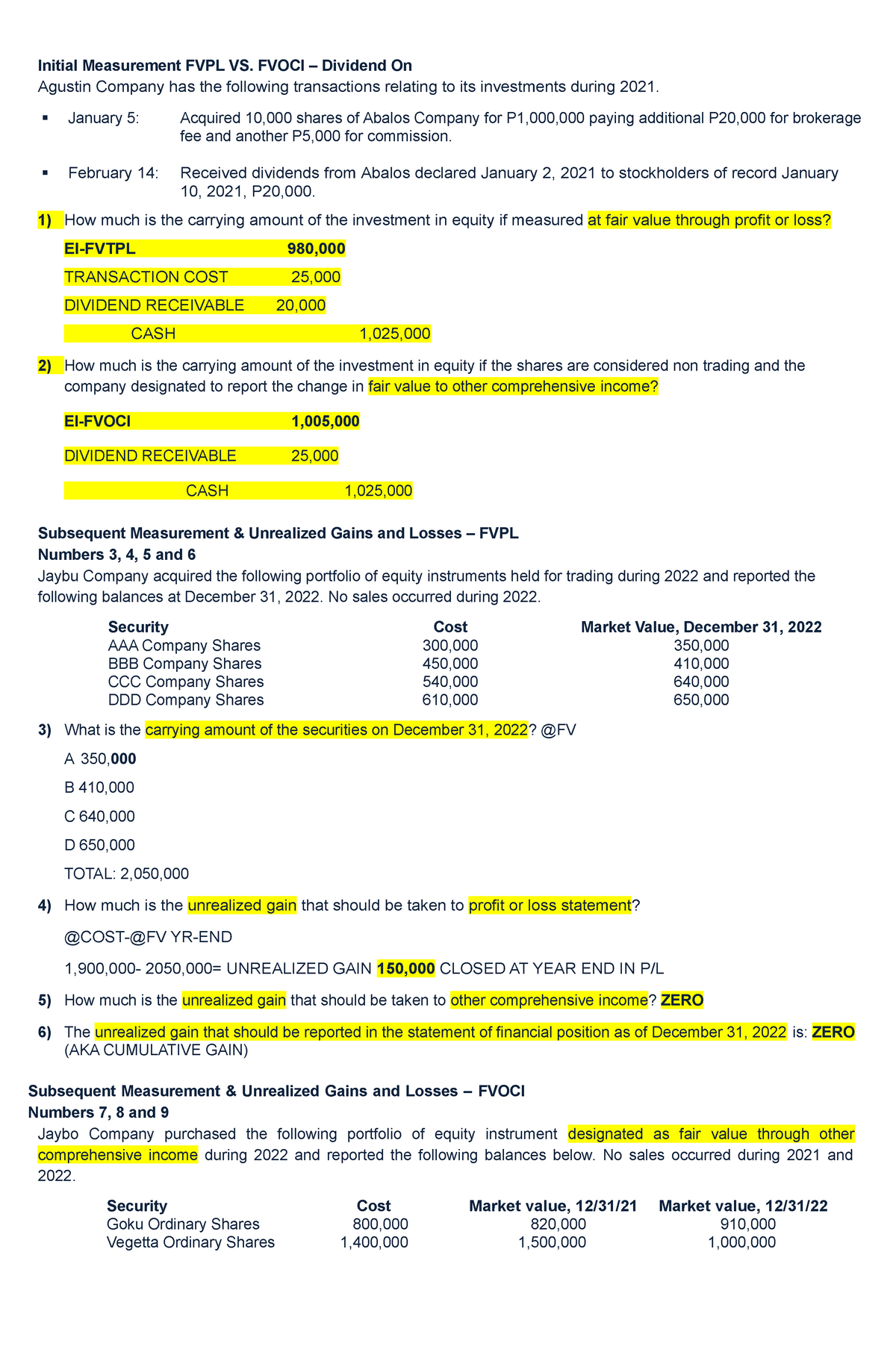

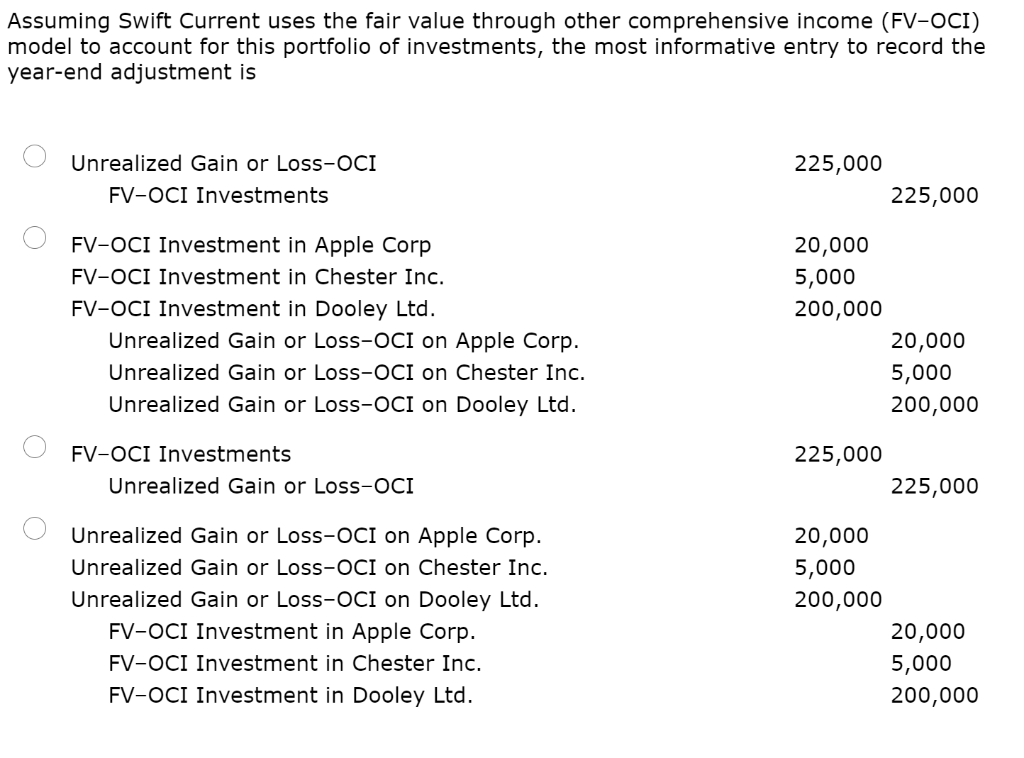

Fair value through other comprehensive income. Fvoci (fair value through other comprehensive income) approach introduced by ifrs 9 provides a more accurate and transparent picture of an entity’s financial performance. An alternative approach is known as electing financial assets as fair value through other comprehensive income (fvoci) which is allowable under ifrs 9 for some asset. And to present the portion attributable to changes.

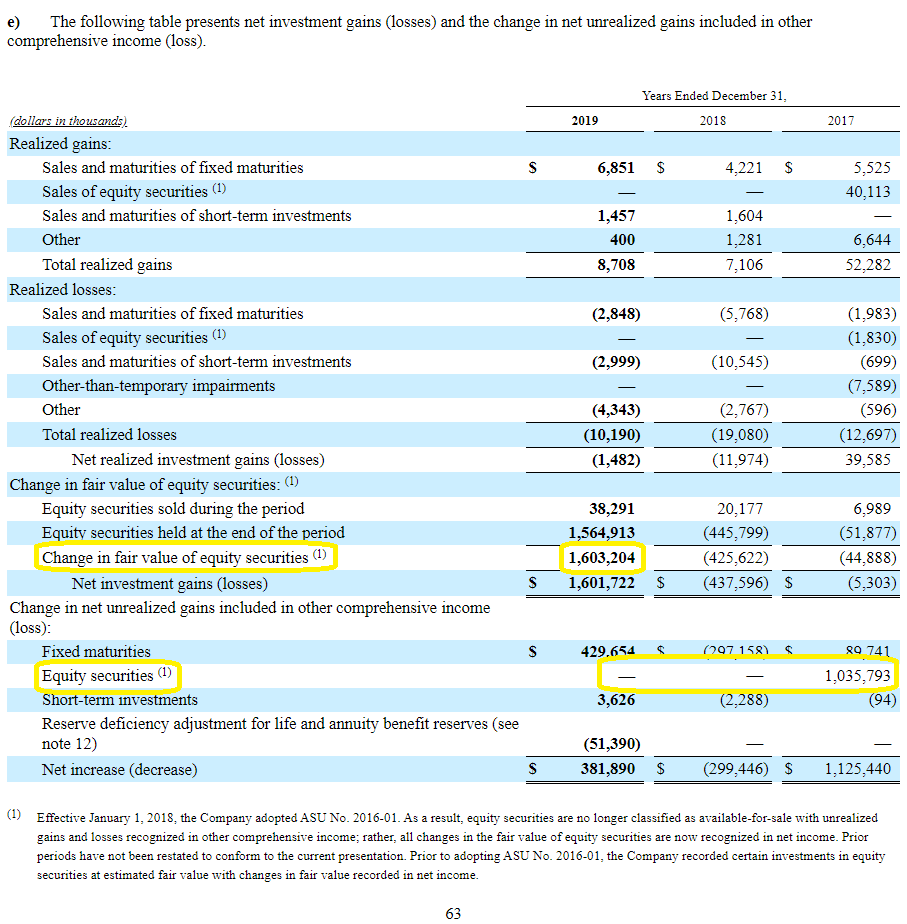

Fair value through other comprehensive income category for certain debt instruments. The fvtoci classification is mandatory for certain debt instrument. Fair value movements are usually recognised in profit or loss, however, in some cases, they are recognised in other comprehensive income (oci) and classified as being at fair.

Instruments will be classified either at amortised cost, the newly established measurement category fair value through other comprehensive income (fvoci) or fair value. Ifrs 9 has three classification categories for debt instruments: Liabilities designated under the fair value option, an entity would be required to present the total fair value change in profit or loss;

Addressing a narrow range of application questions and by introducing a ‘fair value through other comprehensive income’ measurement category for particular simple debt. It includes requirements for recognition and.

Fair value through other comprehensive income (fvoci) is one of the three classification categories for financial assets under ifrs 9 that is applicable to particular. Fair value through other comprehensive income—financial assets are classified and measured at fair value through other comprehensive income if they are held in a business model whose objective is achieved by both collecting contractual cash flows. When an equity instrument is classified at fair value through other comprehensive income under ifrs 9, all the fair value changes are recognised in oci (other than.

It also contains a new impairment model which will result in earlier recognition of losses. Ifrs 9 financial instruments issued in 2014 is the iasb's replacement of ias 39 financial instruments: It stands for fair value through other comprehensive income;

Fair value through other comprehensive income (fvoci) using fvoci, the alternative elected treatment, transaction costs must be capitalised as part of. Or fair value through profit or loss (fvtpl).