Underrated Ideas Of Info About Income Tax Expense Cash Flow Statement

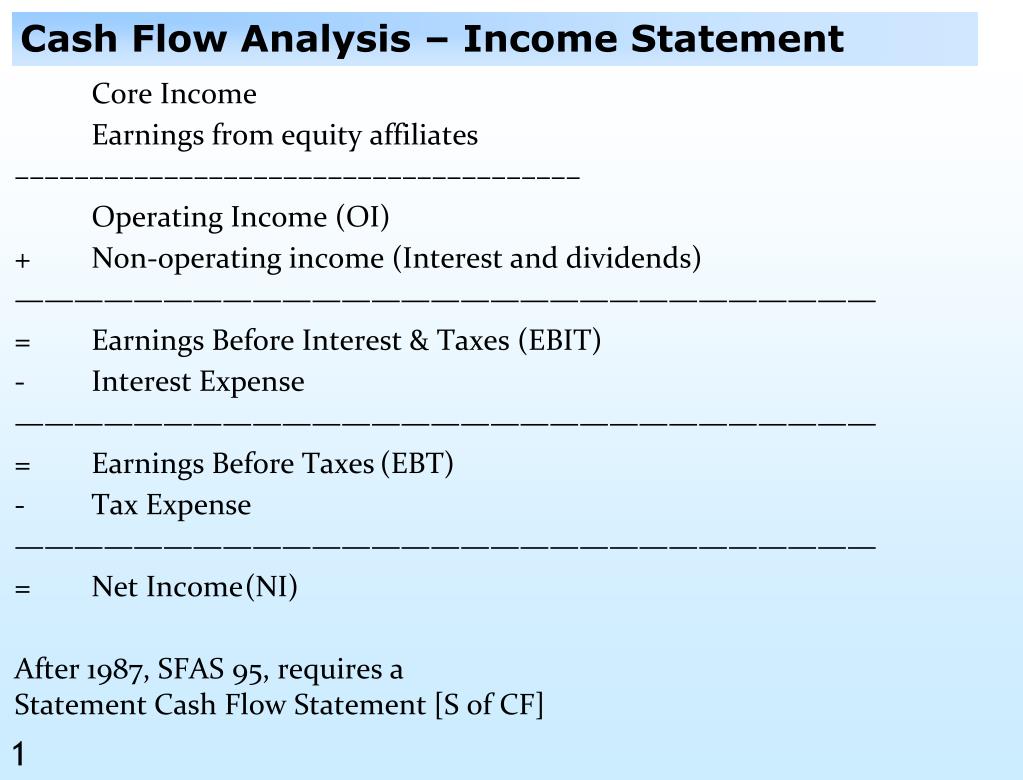

The tax paid in the year can be calculated by taking the opening balance of tax payable in the statement of financial position, adding the tax.

Income tax expense cash flow statement. Also, for statements of cash flows, only use the actual amount of tax paid or received. By analyzing the operating cash flow equation, a business can determine how tax is. Keeping that in mind, managing cash flow is top priority for any business.

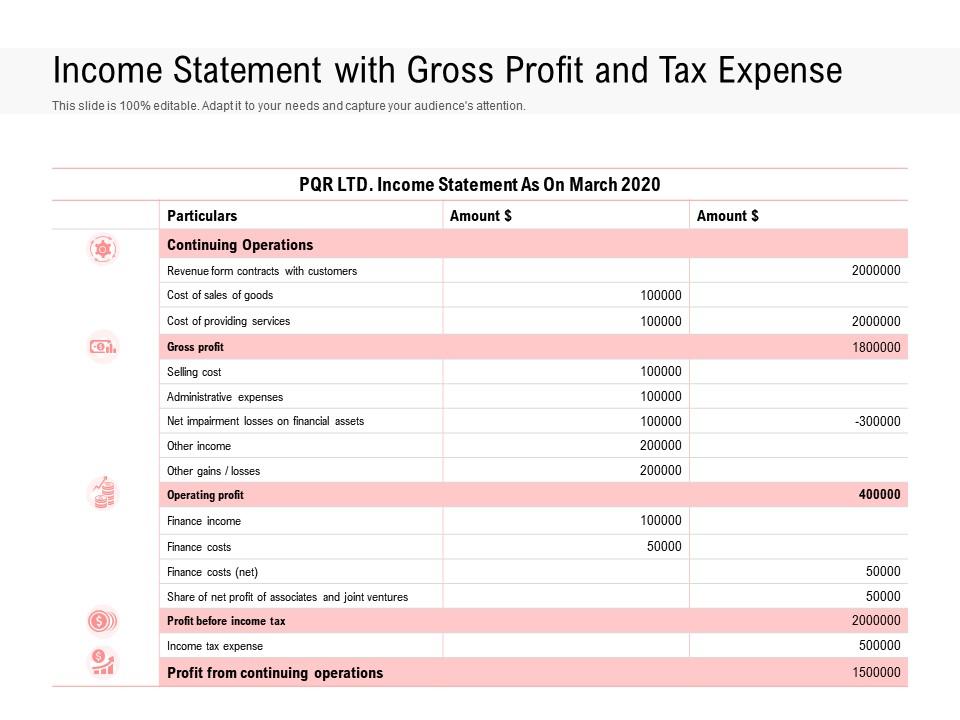

Typically, a business calculates its taxes due by multiplying the tax rate by the amount of taxable income made by the business. Revenue minus expenses equals profit or loss. Depreciation is a financial accounting method used to allocate the cost of tangible assets over t.

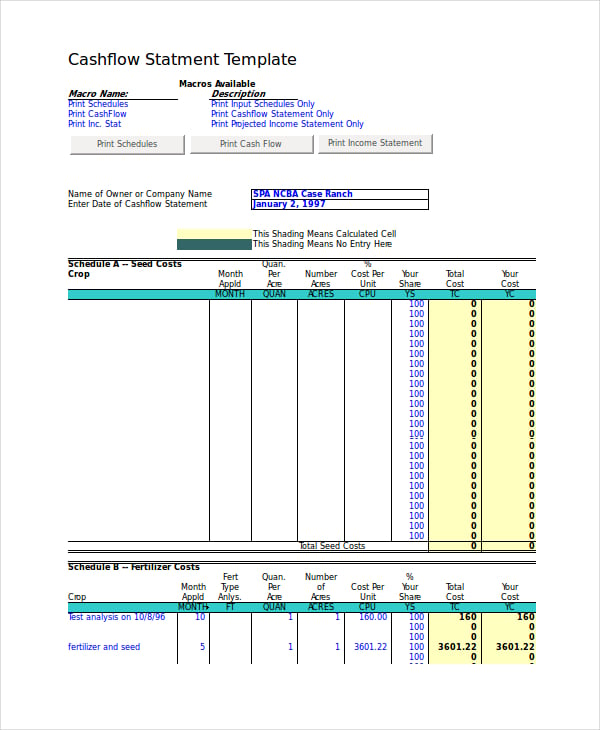

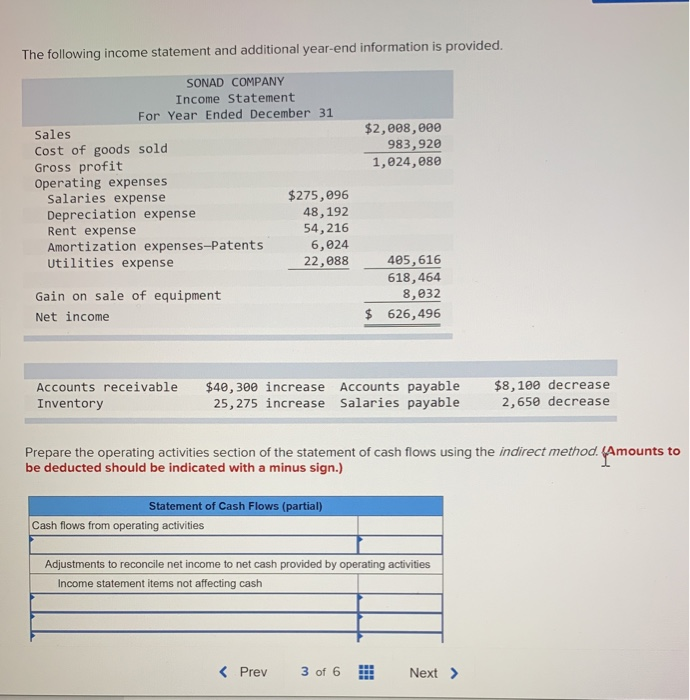

A cash flow statement is generally divided into three main parts: Begin with net income from the income statement. The second step is to analyze the net changes in the balance sheet accounts that we discussed earlier.

Add back noncash expenses, such as depreciation, amortization, and depletion. A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. An income statement might use the cash basis or the accrual basis.

Taxes appear in some form in all three of the major financial statements: An income statement is another name for a profit and loss statement (p&l). The income statement is a useful way to see how a company makes money and how it spends it.

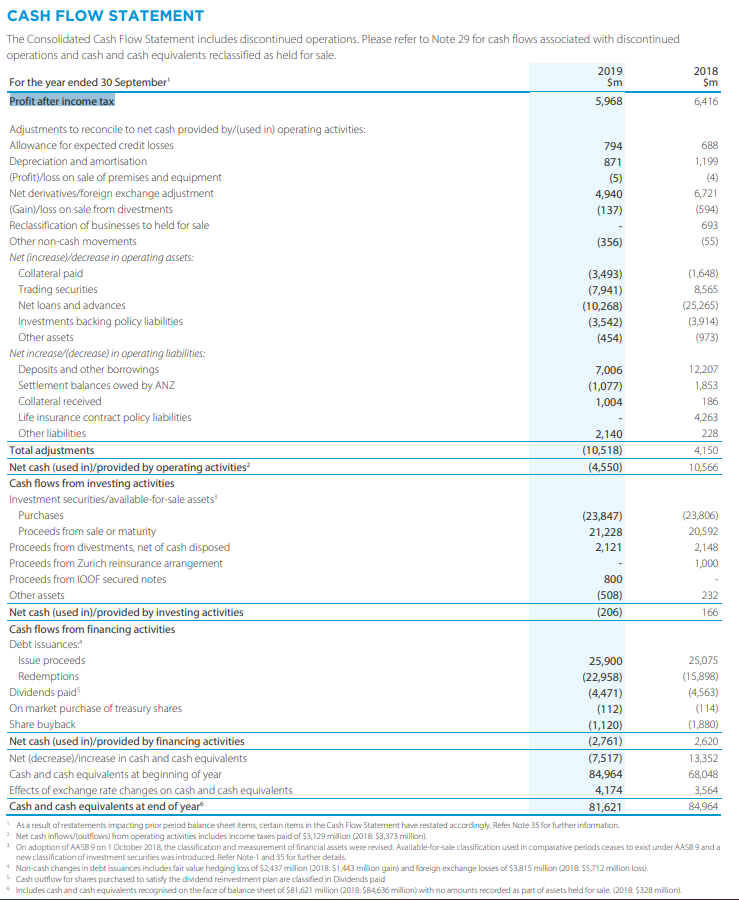

The cfs highlights a company's cash management, including how well it generates. Operating activities investing activities financing activities operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses. Cash payments or refunds of income taxes, unless specifically associated with financing or investing.

So, the company would have $85,000 of operating cash flow. It can be assumed for many cases that the tax paid will be the tax payable from the prior accounting period. Cash flow from operating activities is.

Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. But, that's easier said than done. In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of the reporting standards established under.

Income from operations of $652 million; It is relevant to the fa (financial accounting) and fr (financial reporting) exams. Dividends received (dividends paid are reported in the financing section) cash paid income taxes;

After all, cash is king (or queen!). The cash flow statement (cfs), along with the income statement and balance sheet, represent the three core financial statements. The article will explain how to calculate cash flows and where those cash flows are presented in the statement of cash flows.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)