Underrated Ideas Of Tips About Account Receivable Debit Or Credit In Trial Balance

Is accounts receivable debit or credit on trial balance?

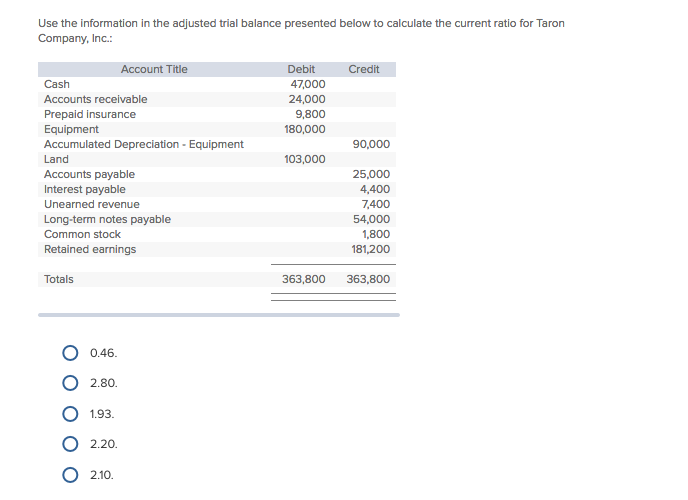

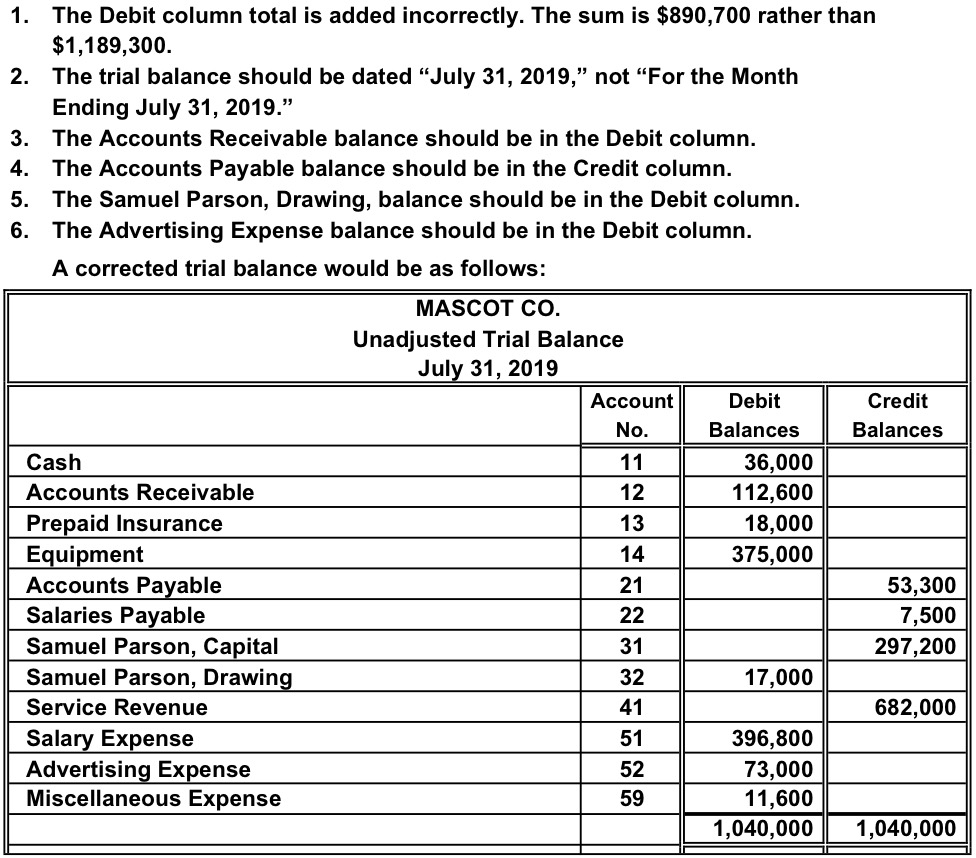

Account receivable debit or credit in trial balance. A trial balance is a list of the balances of all of a business's general ledger accounts. If the total of all debit values equals the total of all credit values, then the accounts are correct—at least as far as the trial balance can tell. Example of a credit balance in accounts receivable;

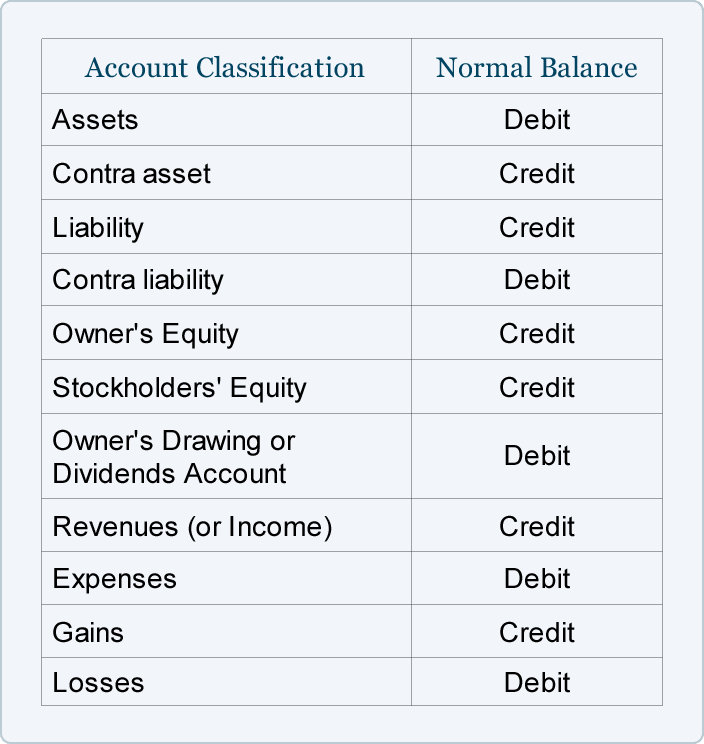

Accounts receivable is an asset on the left side of the accounting equation and is normally a debit balance. Example tb at 31 december 2021 using balances; Accounts receivable is money owed to a business by its customers and is recorded as an asset on the balance sheet.

A trial balance is a worksheet with two columns, one for debits and one for credits, that ensures a company’s bookkeeping is mathematically correct. Does accounts receivable have a debit or credit balance? The account names are listed as arranged in the ledger and the balances are placed either on the debit or credit column.

Can you also have a “debit balance”? It is a statement prepared at a certain period to check the arithmetic accuracy of the accounts (i.e., whether they are mathematically correct and balanced). However, there are times when credit balances occur in accounts receivable, such that your ar account has more money than it should.

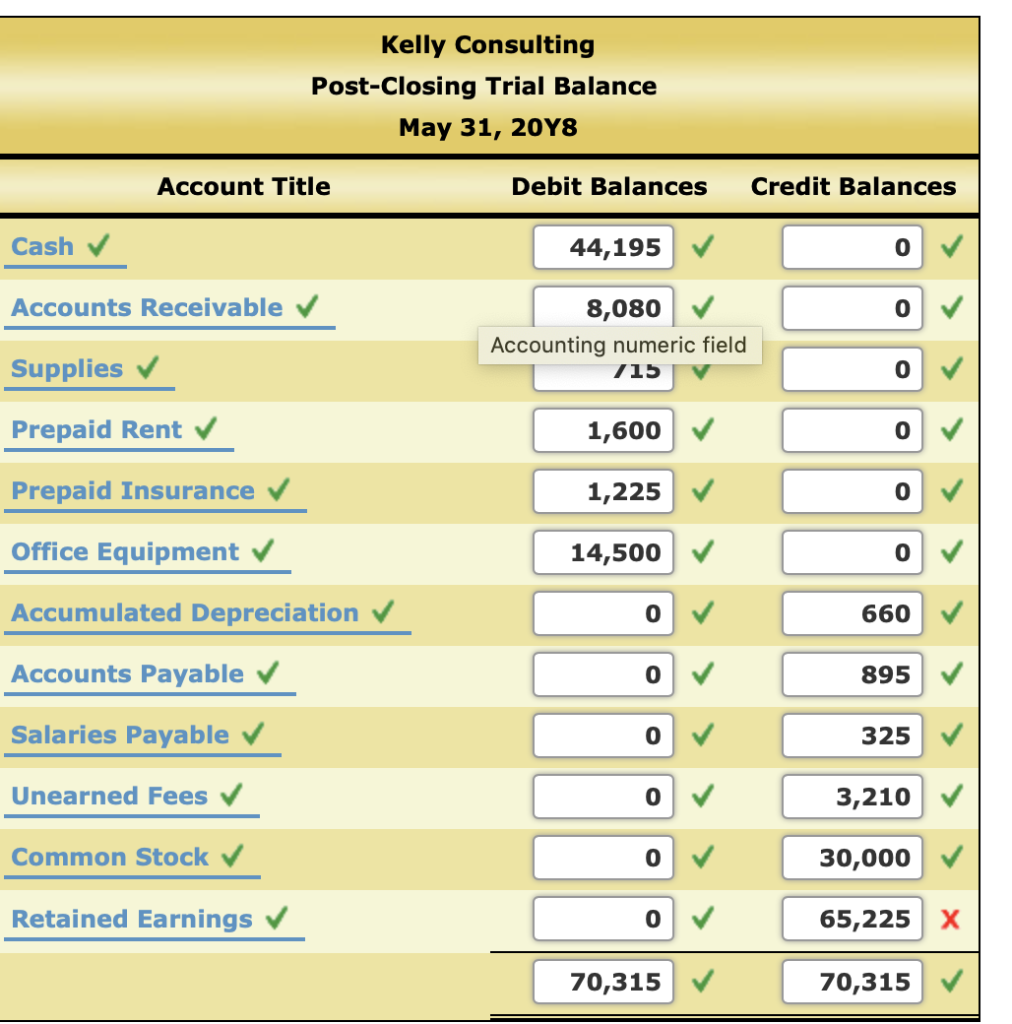

The goal is to confirm that the sum of all debits equals the sum of all credits and identify whether any entries have been recorded in the wrong account. An accounts receivable trial balance is a financial report listing individual customer credits and debits, ensuring the total matches the general ledger. Each account should include an account number, description of the account, and its final debit/credit balance.

In simpler terms, it's the tracking of who owes you what. Your general ledger will show your total accounts receivable balance, but to dig into outstanding payments by individual customers, you’ll usually need to refer to the accounts receivable subsidiary ledger. Applying a debit or credit to your accounts receivable is a simple process.

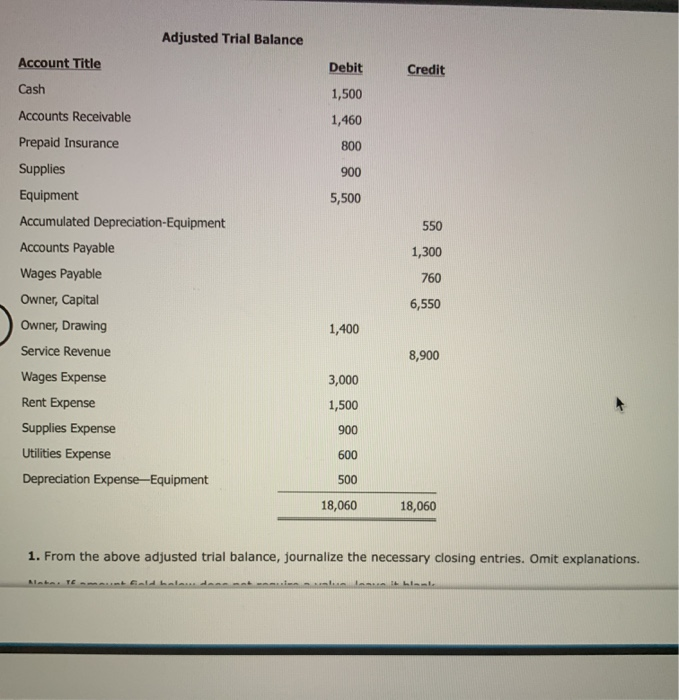

By maintaining a precise record, businesses can effectively manage cash flow. Accounts payable normal balance: Journalize adjusting entries using information provided for.

Accounts payable is a liability on the right side of the accounting equation and is normally a credit balance. In your trial balance, you’ll record this as a debit in your accounts receivable and credit in your cash account. On a balance sheet, accounts receivable are said to be an asset.

In trial balance, accounts receivables are shown with the actual amount receivable from the third party. Managing your accounts receivable credit balance policy; In addition, it should state the final date of the accounting period for which the report is.

From 1 april until the customer pays, you have an account receivable. For credits, subtract the amount from the right side of the ledger (the credit column). This can happen for a variety of reasons, including: