Supreme Info About Cash Flow On Balance Sheet

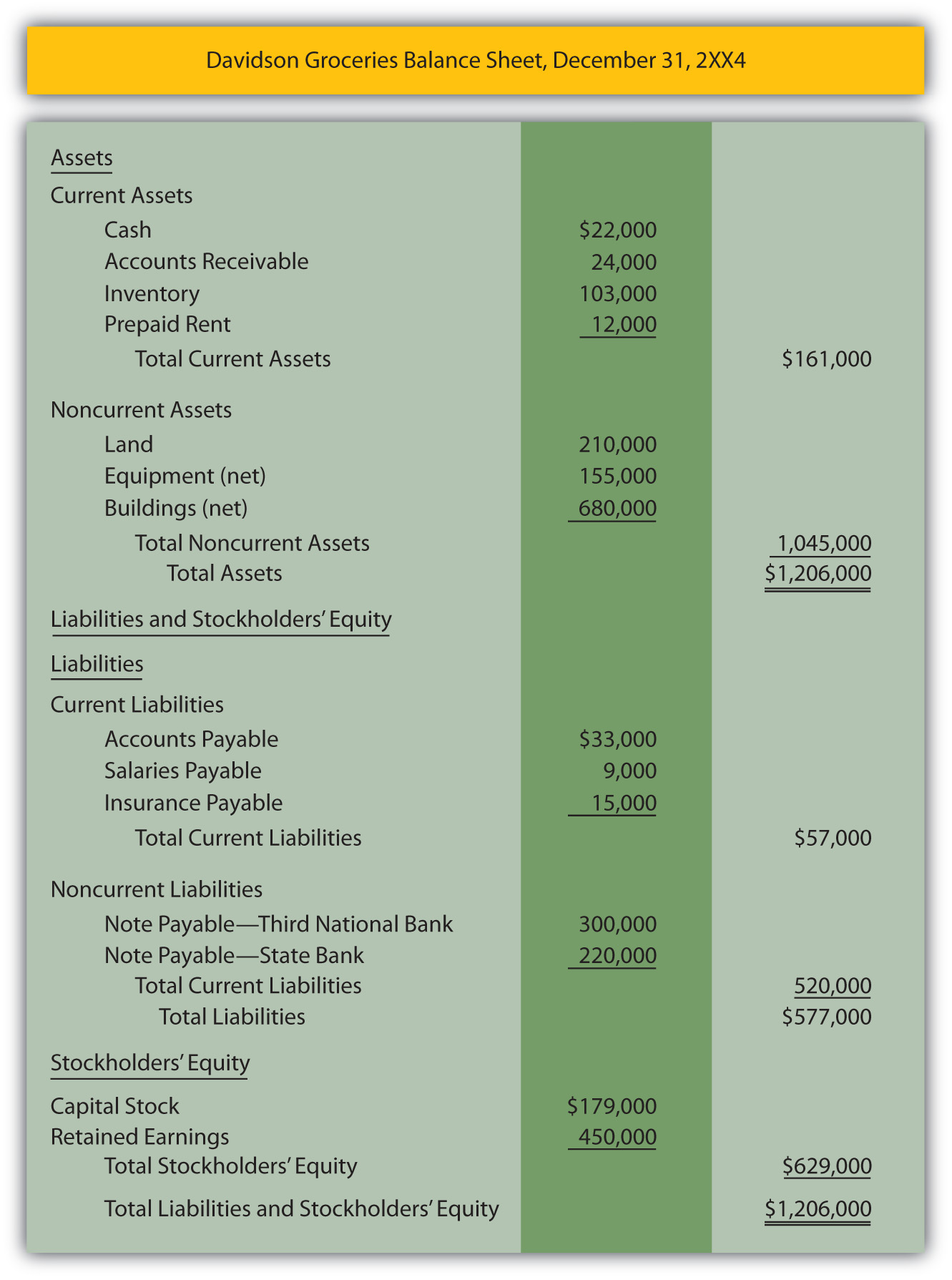

The balance sheet on the other hand, is a snapshot showing what the business owns and owes at a single moment in time, i.e.

Cash flow on balance sheet. It’s evident that the cash flow statement and balance sheet offer two very different purposes as it relates to financial reporting. Cash flow statements are one of the three fundamental financial statements financial leaders use. With this balance sheet template, you can assess the financial standing of a business by examining assets, liabilities, and equity.

What is a cash flow statement? This article will provide a quick overview of the. These offer an inside look at a company.

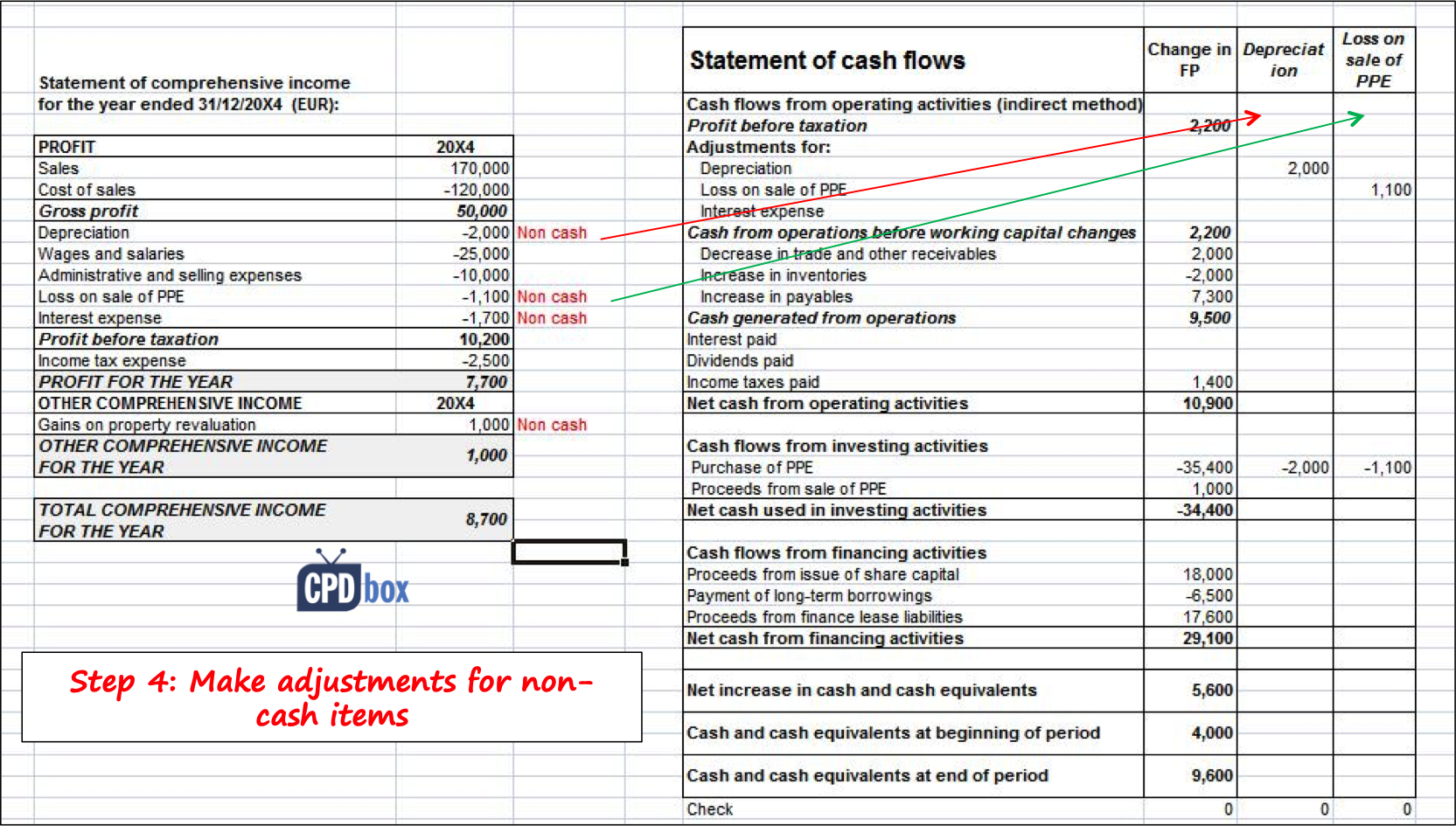

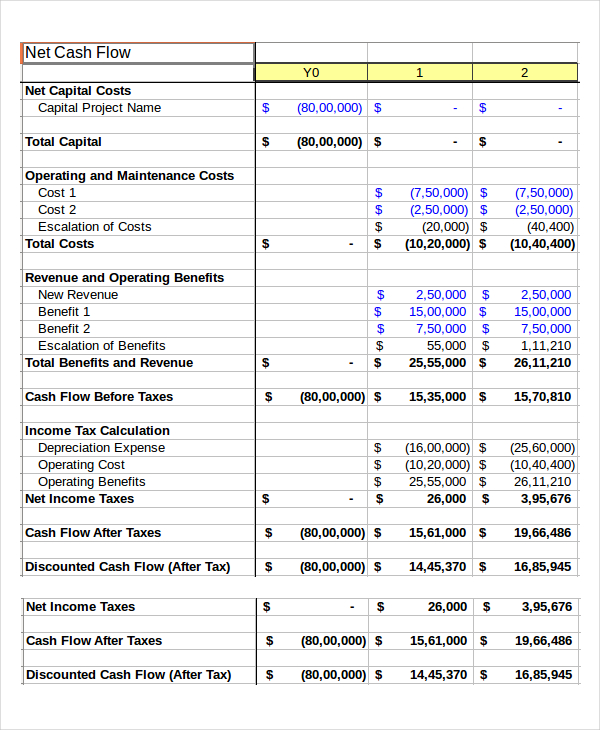

Cash flow statement vs balance sheet vs profit and loss account the profit and loss account, like the cash flow statement, shows changes in accounts over a set period of time. The income statement, balance sheet, and statement of cash flows are required financial statements. The cfs measures how well a.

Begin with net income from the income statement. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. Lastly, at the bottom of all financial statements is a sentence that informs the reader to read the notes to the financial statements.

Key highlights since the income statement and balance sheet are based on accrual accounting, those financials don’t directly measure what happens to cash over a period. It tells you what value your. Pp&e, depreciation, and capex depreciation and other capitalized expenses on the income statement need to be added back to net income to calculate the cash flow from operations.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. Ias 7 cash flow statements replaced ias 7 statement of changes in financial position (issued in october 1977). While this is likely due to.

In other words, the balance sheet shows the assets and liabilities that result, in part, from the. But, both can be used to assess the company’s financial health and help with future planning. The cash flow statement (cfs), along with the income statement and balance sheet, represent the three core financial statements.

A cash flow statement tells you how much cash is entering and leaving your business in a given period. In the full statement, we can see that clear lake has net cash flow of $20,000. In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of the reporting standards established under.

Assuming the statement was prepared correctly, the sum should equal the ending cash balance on the balance sheet. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business. The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period.

The cash flow and balance sheet can be linked by looking at balance sheet movements. The cash flow statement is an important financial statement issued by a company, along with the balance sheet and income statement. The income statement and statement of cash flows also provide valuable context for assessing a company's finances, as do any notes or addenda in an earnings report that might refer back to the.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)