Breathtaking Tips About Meaning Of Cash Outflow

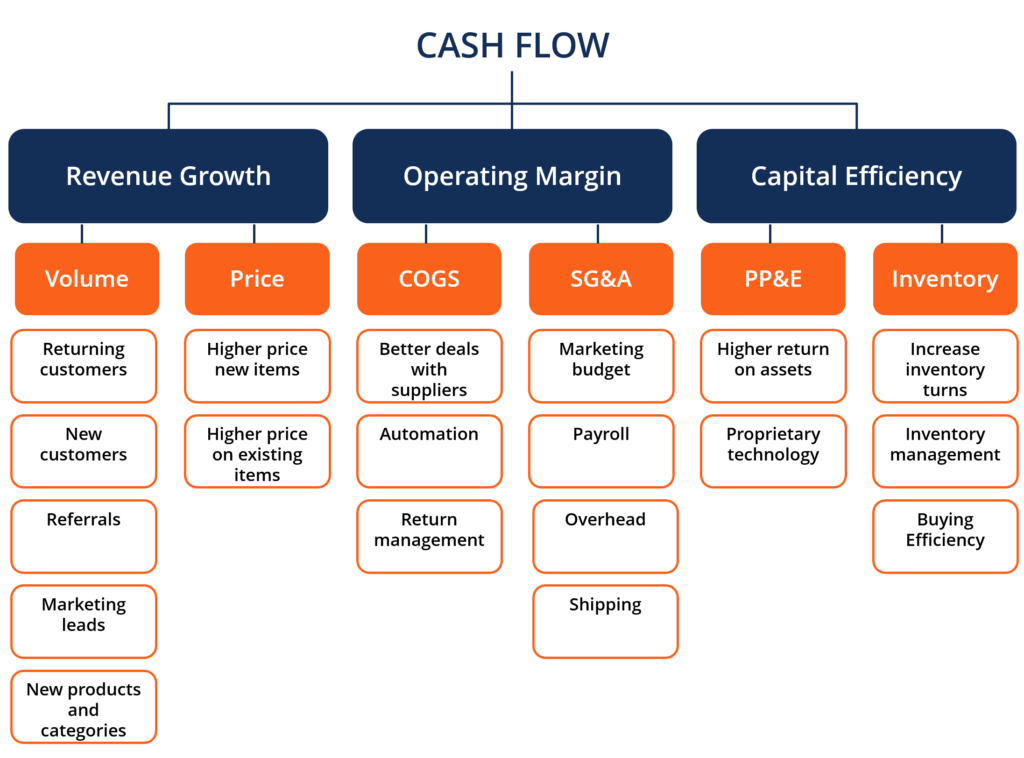

Cash inflow is the money going into a business which could be from sales, investments, or financing.

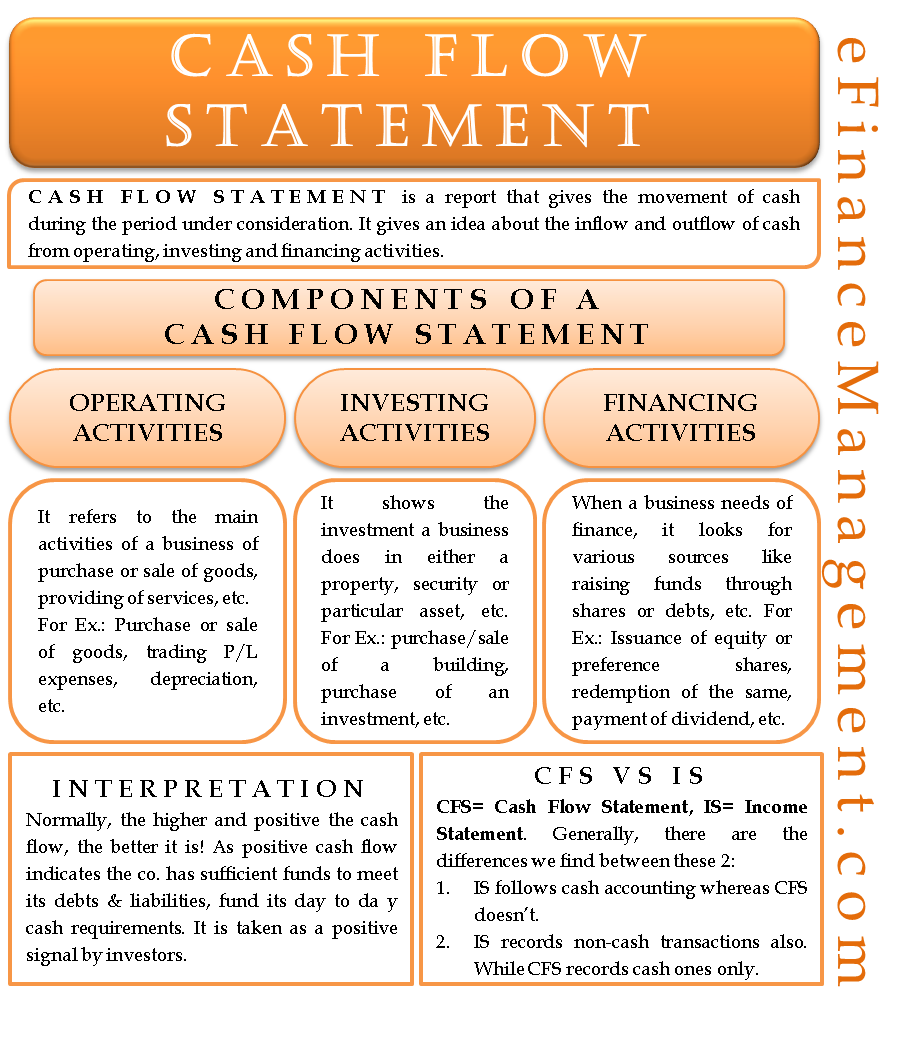

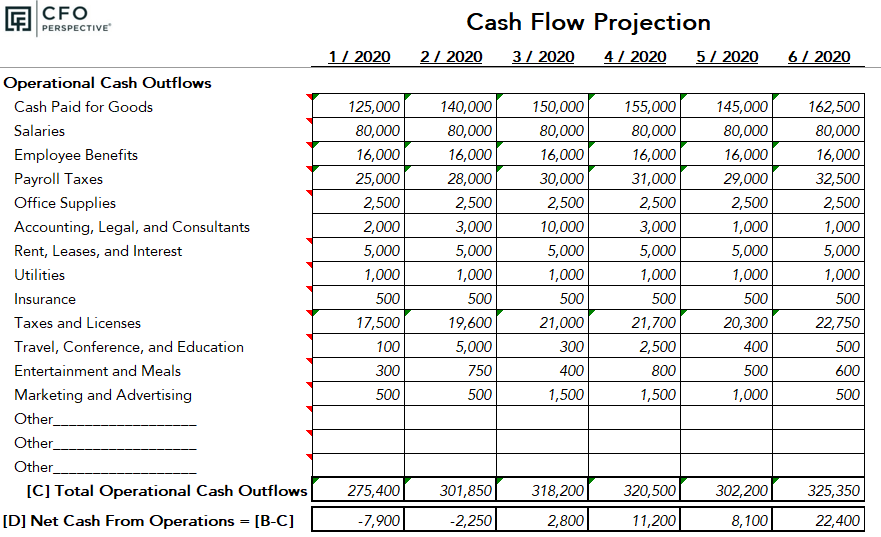

Meaning of cash outflow. Cash outflow is the amount of cash that a business disburses. Contents definition in a sentence, an outflow is a movement of cash out of a bank account that may or may not occur at the same time as the associated cost. The cash flow statement makes adjustments to the information recorded on your income statement, so you see your net cash flow—the precise amount of cash you.

Cash outflow refers to the amount that a business disburses or the expenditure incurred by a company during the financial year, which means that it is the. Objectives of cash flow statement. Cash inflow adds money to a firm by increasing its income.

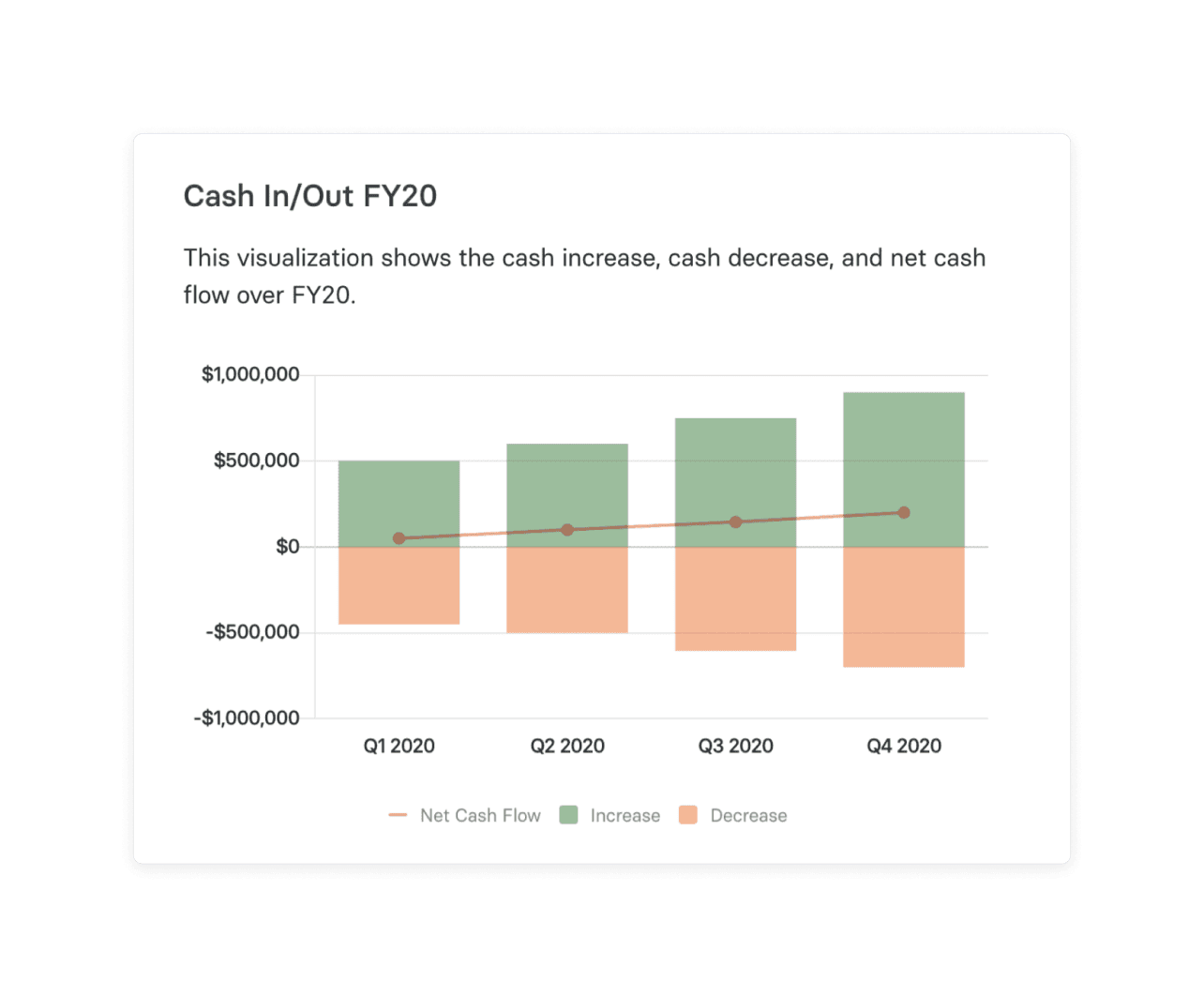

Operating cash flow indicates whether a. Depreciation is a financial accounting method used to allocate the cost of tangible assets over t. Cash inflow is the cash you’re bringing into your business, while cash outflow is the money that’s being distributed by your business.

Operating cash flow (ocf) is a measure of the amount of cash generated by a company's normal business operations. Obvious examples of cash outflow as experienced by a wide range of businesses include. This includes all money your company makes and spends.

Cash outflow is money leaving the business due to any form of expenses, debts, or liabilities. The reasons for these cash payments fall into one of the following. What is cash outflow?

The key to improving your cash flow with regard to cash outflows is to delay all outflows of cash as long as you possibly can while still meeting all your outflow. Companies undertake many measures to reduce outflows as they increase expenses and. It’s the opposite of cash outflow, which is the money leaving the business.

Here, cash leaves the company. The meaning of cash flow statement or statement of cash flows can be defined as ‘cash flow statements exhibit the flow of incoming and outgoing cash. Cash flow refers to the inflow and outflow of cash and cash equivalents.

A cash outflow statement refers to the expenses that a company pays or owes. In simple terms, the term cash outflow describes any money leaving a business. Learning how to calculate and analyze the two saas financial metrics will enable you to make.

The most common cash outflow items found on. Inflows and outflows affect a firm’s profitability. Cash outflow is referred to as the process of movement of cash outside the business, which is due to the various liabilities that a business has during its course of operations.

Net cash flow = cash flow from operating activities cash flow from operating activities cash flow from operations is the first of the three parts of the cash flow statement that. Examples of cash outflow include salary.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

-1.png)